Blog > What Receipts Should I Save For Taxes? And For How Long?

What Receipts Should I Save For Taxes? And For How Long?

Tax season is often stressful and time-consuming for businesses, but it doesn’t have to be. Creating a simple system for organizing your physical receipts can eliminate the last-minute scramble and simplify quarterly and end-of-year tax management.

This article will delve into the significance of receipt management and provide insights into strategies and best practices to alleviate the stress of taxes for your company.

What are business tax receipts?

Business tax receipts document all expenditures associated with professional responsibilities or activities and can be used for tax deductions or write-offs.

Business tax receipts can be for expenses related to office supplies, meals with clients, digital software subscriptions, online purchases, and even credit card processing fees.

Business receipts that don’t qualify as write-offs should also be tracked to incorporate them into a final expense report.

In addition to tax receipts, the IRS requires businesses to keep records for supportive documents, including sales slips, paid bills, invoices, deposit slips, canceled checks, and more.

Implementing a proactive management system will help your business efficiently handle these receipts and supporting documents to reduce stress and better prepare you financially or in the event of an IRS audit.

Tax receipts not only help your business track its expenses, but they also play a critical role in maintaining updated financial records.

The importance of business tax receipts and recordkeeping

While taxes may be the first thing that comes to mind when storing receipts for expenses, these records also provide valuable insights into your daily operations and finances.

Thus, keeping receipts should be a standard practice to track departmental expenses and enhance your overall financial strategy.

Saving receipts for recordkeeping is essential for:

- IRS Compliance: The IRS requires accurate reporting of all income and expenses and supporting documents in case of an audit.

- Deductions: Deductions can significantly lower your business’s taxable income but can only be approved if valid receipts are provided.

- Financial transparency: Organized and accurate records promote financial transparency and keep your business and its stakeholders and investors informed on your company’s financial standing.

- Growth and strategy: Recordkeeping helps you categorize expenses and make informed decisions about budget allocation, cost-cutting, and growth strategies.

In addition to the importance of recordkeeping, businesses must understand how long they should save receipts for taxes.

Do I need to keep all my receipts for taxes?

If you’re wondering if you need to save receipts for purchases under $75, in most cases, the answer is no.

Most businesses only keep receipts over $75 because the time it takes to track every little expense may be disproportionate to the benefits, and the administrative burden would be overwhelming. Minor expenses can still be accounted for but aren’t required.

There are IRS exceptions to the $75 receipt rule, such as keeping receipts for all travel-related costs and employee expenses, even if they’re below that amount. If you’re unsure which receipts to save, refer to the IRS Publication 463 to determine what expenses to track and record.

You should also be aware of IRS receipt requirements on how long to store business receipts.

How long should I keep receipts?

Understanding IRS business expense receipt requirements also means knowing how long to save tax documents and receipts.

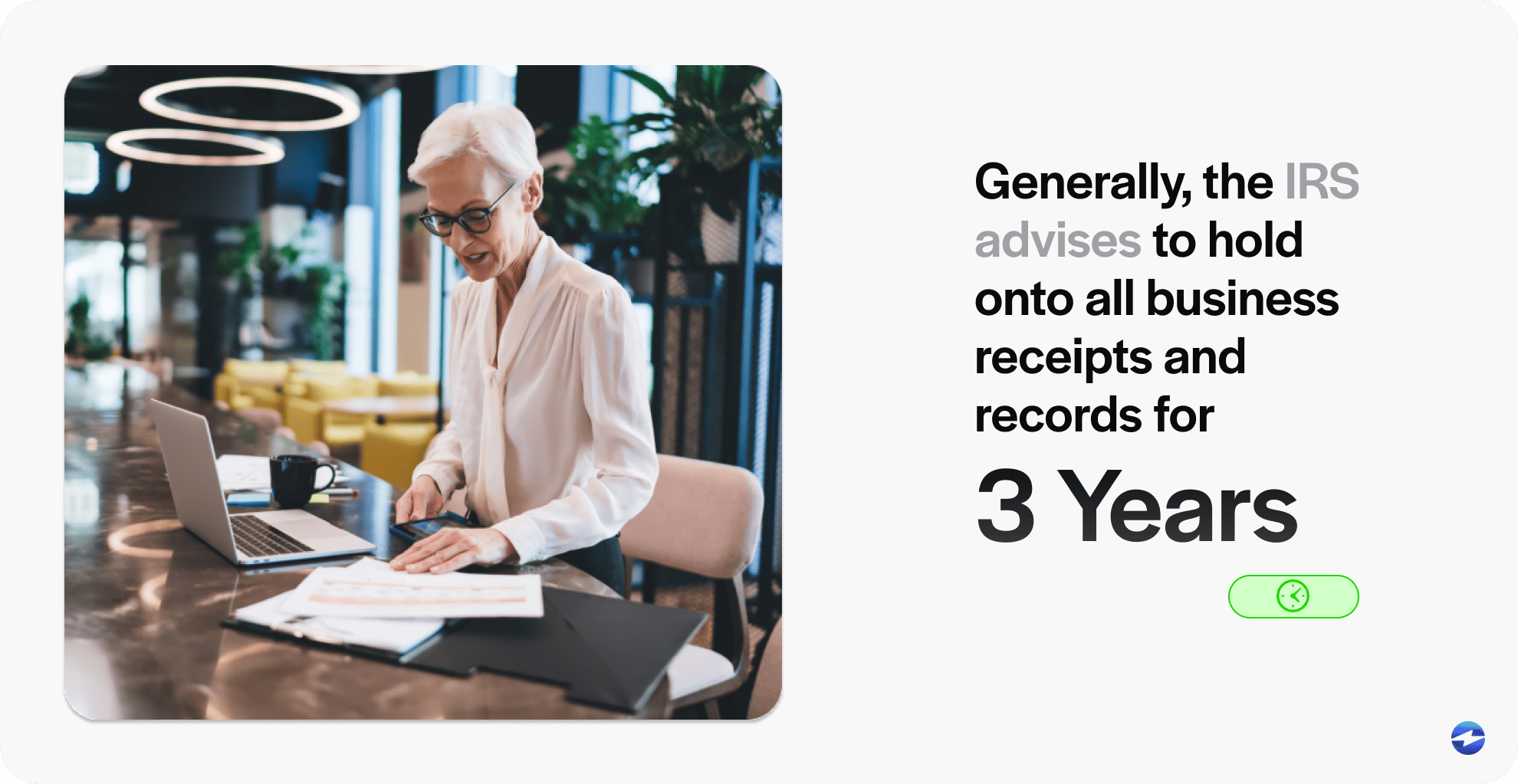

Generally, the IRS advises holding on to all receipts and records for 3 years. However, there are exceptions to this rule. Here are a few exemption examples:

- Certain states may require businesses to hold onto receipts for state tax purposes for over three years.

- If a business filed an insurance claim, it may need to provide related receipts for proof of purchase for claim items over three years old.

- Anytime a business can’t pay its taxes in full, it must save receipts for six years past the calendar year of partial payment.

Understanding these exemptions is imperative, as failure to produce the required records could pose significant problems during tax season. That said, there are ways to simplify your record collection and retention processes, alleviating unnecessary headaches down the road.

6 ways to simplify your tax management

While managing IRS receipts can be overwhelming, implementing an efficient system and the right strategies can ease the stress of taxes for your business.

To help with this, here are six tips to simplify your tax management process:

- Establish a receipt collection system

- Digitize your receipts

- Label and annotate your receipts

- Utilize receipt management apps

- Regularly review your receipts

- Consult tax professionals

1. Establish a receipt collection system

For businesses with a high volume of receipts to keep track of, it’s imperative to have a streamlined collection system. Not only will a streamlined system simplify tax reports, but it will also make reimbursement for expenses significantly easier.

An effective management system should include spending limits and qualified spending criteria, monthly expense report deadlines, a designated platform to upload and store IRS receipts and expense reports, and clear communication of expenses and what they entail.

An efficient storage system will allow you to find and access your receipts quickly and efficiently, and digitizing your receipts is a great way to accomplish this.

2. Digitize your receipts

Saving receipts for taxes can sometimes result in a disorganized mess. To avoid this, consider creating a process for digitally storing your receipts. This can be as simple as making a shared digital file with folders for each month and year.

For physical receipts, scanners are an excellent tool to keep in your arsenal. Scanning physical receipts allows you to minimize the number of paper cluttering your space.

Once complete, train your team to digitize all receipts as they come in or in monthly batches with their expense report.

3. Label and annotate your receipts

Once you’ve converted your physical receipts to digital files, you should label and annotate these receipts for taxes.

Sort receipts first by month and then by category. Your tax professional can advise on which categories you should be tracking.

Business tax receipt categories include office supplies, meal expenses, gas mileage, travel expenses, training and development, advertising, software subscriptions, employee incentives, etc.

With so many different receipts to keep track of, receipt management apps are also a great option to help with organization.

4. Utilize receipt management apps

Another way to streamline and simplify tax receipts is with a digital management app.

Most apps work similarly, so prioritize platforms that integrate with your existing CRM and accounting software. Some top receipt scanner apps include Zoho Expense, Shoeboxed, Neat, and more.

These systems also create automated reports and have advanced search functions for whenever you need receipts.

5. Regularly review your receipts

Once you’ve implemented an organized digital system, your business can begin analyzing its spending.

Reviewing your saved receipts for expenses before the end of the quarter, fiscal, or calendar year helps identify areas of opportunity. If your company has expense data from the past 12 months, you can compare month-to-month spending in each category.

If your company expenses have increased over time, it’s important to determine the reason. If the cause is unknown, the next step is figuring out why and implementing a plan for cost control.

Lastly, it may be wise for businesses to look to professionals to simplify their tax management system.

6. Consult tax professionals

If you’re unsure of what expenses and receipts to track or need extra help, your business should contact a tax professional.

Tax professionals can include in-house bookkeepers, accountants, CFOs, or external third parties. Nonetheless, these financial experts will advise on various best practices, including essential documents you should track.

With these tips to help you simplify your tax management efforts, you can ensure you have everything you need to prepare for tax season.

Master tax season with better tax receipt management

Effective management of business tax receipts is fundamental to maintaining financial stability and compliance with IRS receipt requirements.

Without a proper system for tracking receipts, discrepancies are sure to arise. Thankfully, the tips in this article provide a proactive approach to managing your financial outlook and can help your business develop a disciplined receipt management approach to conquer tax season and encourage more success and stability.