Blog > What is Marginal Revenue and How To Calculate It

What is Marginal Revenue and How To Calculate It

Understanding the financial intricacies of a business often hinges on concepts like marginal revenue, additional income generated from increasing product or service sales by one unit, which plays a critical role in decision-making.

Calculating marginal revenue can provide insights into pricing strategies, the viability of increasing production, and overall business performance. To fully grasp its significance, it’s vital to compare it with other financial formulas, such as average revenue and marginal costs, and recognize potential obstacles to improving it.

What is marginal revenue?

Marginal revenue (MR) refers to the additional revenue a company generates by selling one more unit of a product or service. This concept is critically analyzed in economics and business to assess the profitability of increasing production levels.

The best definition of marginal revenue is the money made from the sale of each additional unit of output.

As the volume of output increases, the marginal revenues can vary depending on several factors, such as the market price, customer demand, and competitive markets.

In perfectly competitive markets, the marginal revenue is equal to the market price since each additional unit of output is sold at a constant price. However, in markets that aren’t perfectly competitive, the price may decrease as more units are supplied, leading to a different marginal revenue figure for additional units sold.

Understanding marginal revenue is crucial because it’s closely linked to marginal costs and helps businesses decide how much to produce and at what price.

Factors that can impact marginal revenue

Since varying factors like market prices and demand can influence marginal revenue, it’s essential to understand the effect each of these factors has.

To better understand how different variables affect MR, refer to the table below:

| Factor | Influence on MR |

|---|---|

| Additional Units Sold | Directly increases MR |

| Market Price | MR equals market price in perfect competition |

| Marginal Costs | Can be subtracted from MR to calculate marginal profit |

| Production Costs | Does not directly affect MR, but influences profit |

| Customer Demand | High demand can increase MR with higher prices |

| Level of Output | Past certain point, MR can decrease if market is saturated |

With these factors in mind, the next section will help you calculate marginal revenue by plugging in a simple formula.

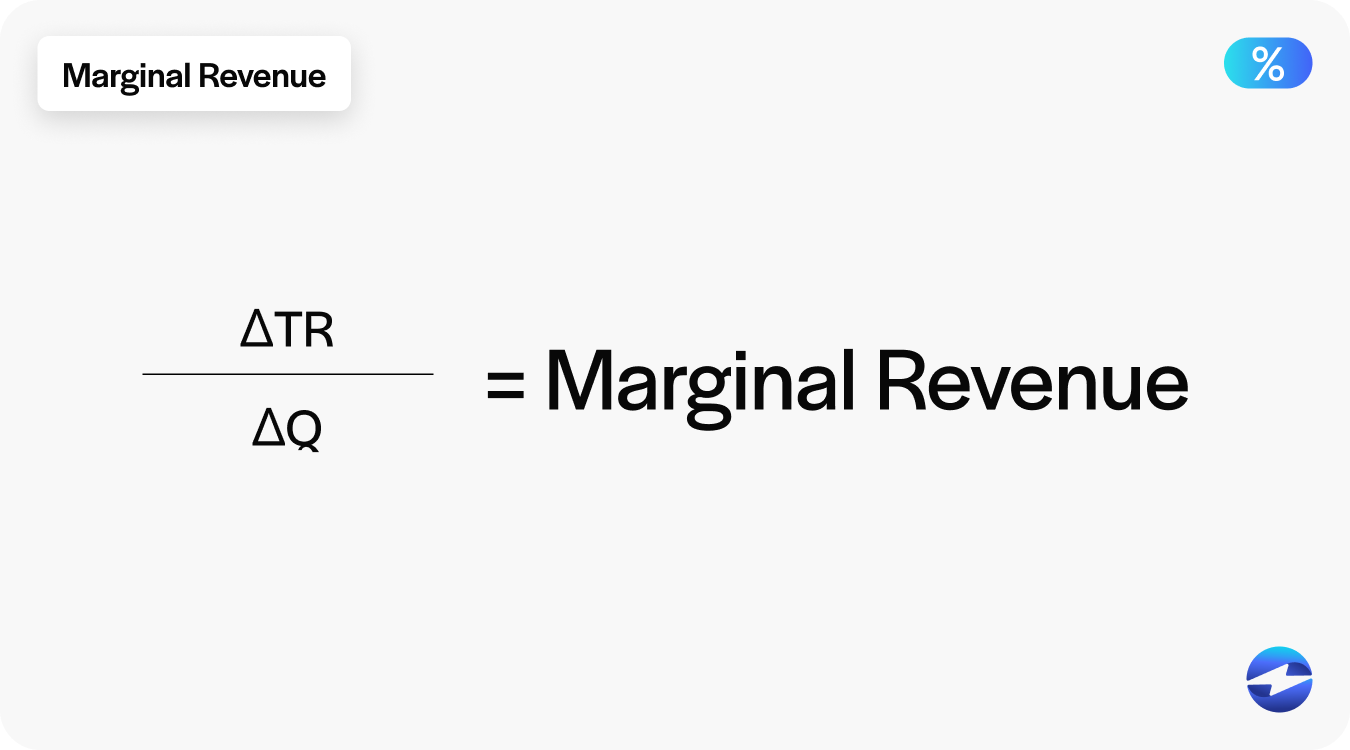

How is marginal revenue calculated?

Marginal revenue is calculated by dividing the change in total revenue by the change in the quantity of goods sold.

Merchants can calculate this revenue using the marginal revenue formula here:

Marginal Revenue (MR) = ΔTR / ΔQ

Δ = change

TR = total revenue

Q = quantity

ΔTR represents the change in total revenue, and ΔQ represents the change in quantity sold (i.e., the number of additional units sold). Simply put, it’s the increase in revenue that results from the sale of one extra unit of a product or service.

For example, if selling an additional item increases total revenue from $100 to $110, then the marginal revenue generated by selling that additional item would be $10:

MR = ($110 – $100) / (1 extra unit) MR = $10 / 1 MR = $10

This calculation demonstrates the additional profit generated by selling an extra unit and assumes that all other factors, such as production costs and market conditions, remain constant.

The importance of tracking marginal revenue

Tracking marginal revenue is vital since analyzing trends associated with these figures can help businesses determine the most profitable production levels and adjust their pricing strategies accordingly.

Regularly reviewing marginal revenue can also help you anticipate how changes in market demands or the cost of production will influence revenue increases. In competitive markets, where market demands often drive the selling price, companies need to know whether producing additional units will be beneficial or result in losses. Marginal revenue can signal when to stop further production, as continuing to make it past a certain point can lead to diminishing returns, where additional units can decrease the average revenue and potentially the overall profit.

Overall, routine assessments of marginal revenue are essential to maintain efficiency, optimize production costs, and develop robust pricing strategies that maximize profitability for your company.

Marginal revenue vs different financial formulas

Marginal revenue differs from other financial formulas that assess various aspects of a company’s performance and decision-making process, as it specifically evaluates the extra revenue that results from adding a single product unit.

Below, you’ll see how marginal revenue compares to average, total, and marginal costs.

Marginal revenue vs. average revenue

MR and average revenue (AR) are related but measure different outputs. MR measures the revenue increase from selling one additional unit. In contrast, AR averages the income earned per unit of output sold by dividing total revenue by the number of units sold.

You’ll see the average revenue formula here:

AR = Total Revenue / Quantity Sold

In perfect competition, MR equals the selling price and, therefore, also matches the AR. In imperfect competitive markets, AR can remain constant as output increases, but MR may decrease due to the price needing to be lowered to sell each extra unit.

Marginal revenue vs. total revenue

While MR considers the revenue change from selling one extra unit, total revenue (TR) reflects the entire amount of income a company generates from the sales of its goods. TR is calculated by multiplying the number of units sold by the selling price of the product.

You’ll see the total revenue formula here:

Total Revenue = Price * Quantity

TR typically grows as production increases, but MR dictates the growth rate. If MR is positive, each additional item sold increases TR. When MR becomes negative, TR decreases with further sales, indicating diminished profitability in selling additional units.

Marginal revenue vs. marginal cost

Comparing MR to marginal cost (MC) is vital in determining the profitability of producing and selling additional goods. MC represents the increase in total cost when one additional output unit is produced, not sold.

Calculating MC involves looking at additional expenses for materials, labor, and other factors affecting the production of an extra unit, not its sale.

You’ll see the marginal cost formula here:

MC = ΔTC / ΔQ

Informed decisions about output levels require analyzing both MR and MC. A company can maximize its profit by producing up to the point where MR equals MC. Producing more leads beyond this point can equate to higher costs than the additional revenue would cover, eroding profit margins.

With this understanding, you can utilize these financial formulas with various strategies to find the best ways to improve your company’s marginal revenue.

5 ways to improve your company’s marginal revenue

Improving your company’s marginal revenue is key to maximizing profitability and ensuring long-term growth. By implementing strategic changes in pricing, production, and customer acquisition, businesses can boost the additional revenue generated from each new sale. Here are five effective ways to enhance your company’s marginal revenue and drive financial success.

Here are five strategies that can help boost your additional revenue:

- Optimize your pricing strategy

- Implement dynamic pricing

- Increase product differentiation

- Enhance product bundling or upselling

- Expand into new markets

1. Optimize your pricing strategy

To optimize your pricing strategy, consider analyzing customer demand and marginal costs. Adjusting product prices to reflect the value perceived by customers can lead to an increase in revenue for each additional item sold.

It’s also essential to align pricing with the cost of production to ensure that marginal profit remains positive. Regularly reviewing market demands and competitive pricing can help determine the ideal selling price that maximizes MR without sacrificing sales volume.

One often overlooked cost is payment processing. Solutions like EBizCharge offer credit card processing for QuickBooks and payment processing for NetSuite, helping businesses reduce processing overhead and protect their margins on every additional unit sold.

2. Implement dynamic pricing

Dynamic pricing involves real-time adjusting based on market conditions, customer demand, and inventory levels.

By using this pricing strategy, companies can capitalize on changes in market demands and adjust prices for their products or services to match peak times and slow periods.

For example, airlines and hotels use dynamic pricing to adjust the cost of their services based on real-time demand, availability, and other factors such as seasonality or special events. An airline may increase ticket prices as the number of available seats on a flight decreases or during peak travel times. Similarly, hotels raise room rates when occupancy levels are high or during major local events. This strategy allows them to maximize revenue by charging more when demand is high and less when demand is lower, ensuring that they fill seats or rooms while optimizing overall profitability.

Overall, dynamic pricing helps capture additional profit from a willing market and maintain a competitive advantage.

3. Increase product differentiation

Product differentiation enables a company to increase its market power and potentially charge higher prices for its extra units sold.

Adding unique features, improving quality, or innovating new uses for a product can justify an increase in the unit price, thus potentially boosting MR. Differentiation strategy helps explain a higher product price and reduces the elasticity of demand, ensuring that customer demand is less sensitive to price changes.

4. Enhance product bundling or upselling

Product bundling and upselling strategies involve offering complimentary products or upgrades that enhance the value received by the customer.

By creating bundles or encouraging customers to purchase a premium version, companies can increase the average revenue per transaction, increasing MR. This approach helps businesses extract higher value from their customer base and promotes an increase in revenue without a proportionate increase in production costs.

5. Expand into new markets

Entering new geographical or demographic markets can lead to selling additional units without necessarily impacting the existing product’s selling price or market price.

By reaching new customer segments or entering less saturated markets, companies can experience potential revenue increases from fresh sources of demand. Depending on product type and company resources, expansion can occur physically or through digital channels.

By implementing these strategies, businesses can focus on achieving a marginal revenue curve that leads to long-term growth and profitability. It’s crucial to monitor the effects of each strategy on MR and MC to ensure the optimal output level is achieved for sustained profit maximization.

While these are essential tips for improving your marginal revenue, increasing marginal revenue comes with some difficulties.

The difficulties of increasing marginal revenue

Although increasing marginal revenue is a common goal for companies looking to expand their business and profits, it can pose significant challenges as they scale operations.

The very nature of marginal revenues means they tend to decrease as production and sales increase, particularly in less-than-perfectly competitive markets. To maintain or increase MR over time, you may need to invest heavily in marketing or innovation, which involves additional costs and risks.

When a company initially increases production, it may experience substantial revenue gains. However, the additional income generated by selling extra units typically diminishes as output increases.

Marginal revenue can diminish due to saturated markets that may need more demand to keep up with increased production, causing the selling price to drop. It can also result from increased product supplies that may diminish perceived value or production costs that can increase when scaling up. Lastly, legal or regulatory constraints can limit sales volumes or impose additional costs in some markets, impacting revenues.

To increase MR, businesses must also consider the market price, consumer demand, and competitive landscape. Balancing these elements while attempting to increase revenue can be time-consuming and complex. There are also external challenges to consider.

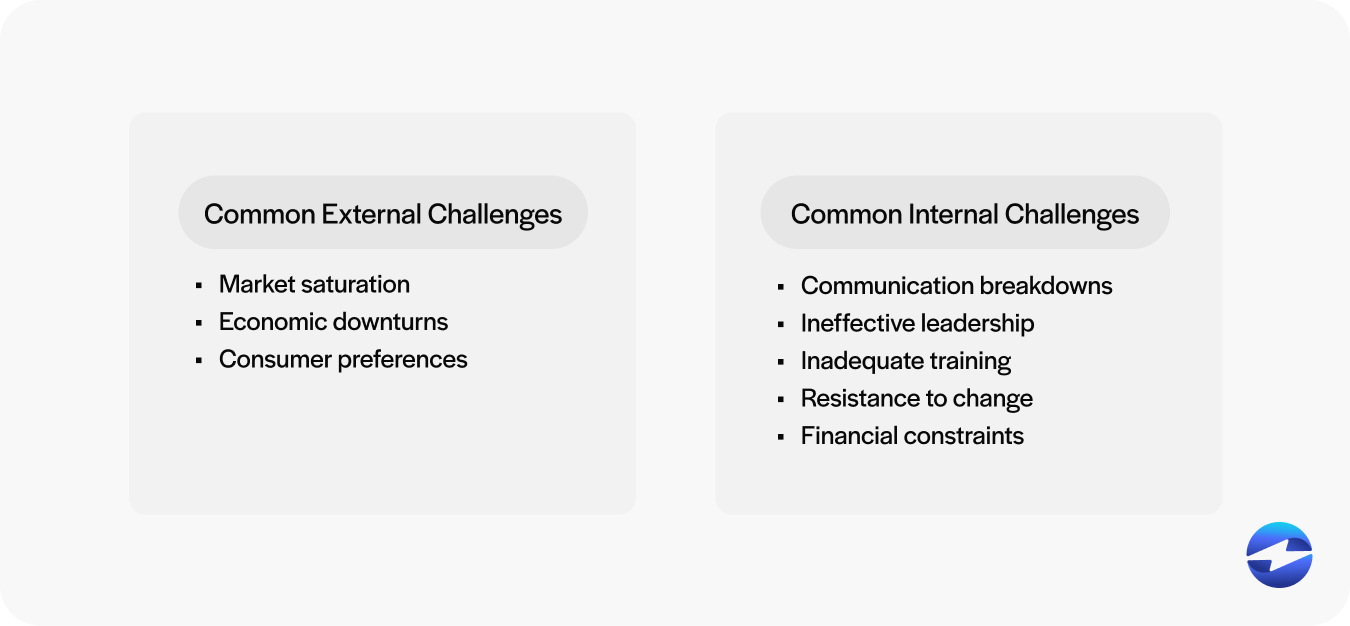

Common external challenges

Navigating the landscape of external factors is integral for businesses to maximize marginal revenues.

Here are three common external factors that drive these challenges:

- Market saturation: Market saturation occurs when a product has become so widespread that the influx of additional units doesn’t culminate in a notable revenue increase. At this stage, the market possesses an abundance of the product, causing a plateau or decrease in its selling price. Indicators of market saturation include an oversupply of a product, stagnant or declining sales volumes despite increased marketing efforts, a lower MR curve for additional items sold, and competitive markets that react with price cuts or product diversification.

- Economic downturns: Economic downturns can severely disrupt production levels and MR goals. The effects are usually widespread and can be seen in reduced consumer purchases (especially non-essential items), decreased average revenue across various sectors, new pricing strategies, and production cost adjustments.

- Consumer preferences: Consumer preferences can shift rapidly, leading to unpredictable product prices and revenue changes. Factors influencing consumer choices include new trends or fashions that result in product demand, innovations or new technologies, and shifts in socioeconomic factors that alter purchasing habits. Companies must monitor these trends to adjust product development and pricing strategies accordingly.

There are also various internal challenges to consider when navigating marginal revenue.

Common internal challenges

Businesses may also face internal challenges that can hinder revenue growth and efficiency.

Here are six common internal factors that drive these challenges:

- Communication breakdowns: Lack of communication can create a disconnect between teams and departments, leading to inefficiencies and errors.

- Ineffective leadership: Without solid leadership, your staff may be unmotivated, resulting in low productivity and high turnover.

- Resource allocation issues: Poor resource allocation can prevent projects from being completed on time and within budget.

- Inadequate training: Inadequate training can result in employees feeling ill-equipped to perform their duties, reducing the quality of work.

- Resistance to change: Businesses or employees who resist change can delay or sabotage innovation and adaptation efforts.

- Financial constraints: Financial limitations can hinder investments in new technologies or operations that can provide a competitive advantage for your company.

Promptly addressing these internal challenges enables businesses to maintain better operational effectiveness and financial health.

With the various challenges and factors in mind, businesses can decide whether producing the additional output unit will benefit their revenue.

Surviving the competitive landscape with marginal revenue

Marginal revenue is a valuable financial metric that helps businesses in competitive markets determine the profitability of producing additional units and make informed decisions regarding production levels and pricing strategies.

By consistently monitoring MR, identifying factors affecting your income, and implementing best practices to improve overall revenue, your company can fine-tune its approach to adapt to evolving markets and yield more long-term capital.

Frequently Asked Questions

What is the difference between marginal revenue and total revenue?

Total revenue is the overall money you make from all sales, while marginal revenue shows how much more you earn from selling one additional item.

What is the difference between marginal cost and marginal revenue?

The difference between marginal cost and marginal revenue is that marginal cost is the extra expense you incur to produce one more unit, while marginal revenue is the additional income you earn from selling that unit.

Is marginal revenue the same as price?

Marginal revenue isn’t always the same as price. In a perfectly competitive market, selling one more unit usually brings in the same amount as the price. But in less competitive markets, like a monopoly, marginal revenue tends to be lower than the price because you often have to drop the price to sell more units. So, while they can be equal in some cases, they’re usually different in less competitive situations.

- What is marginal revenue?

- Marginal Revenue Calculator

- The importance of tracking marginal revenue

- Marginal revenue vs different financial formulas

- 5 ways to improve your company’s marginal revenue

- The difficulties of increasing marginal revenue

- Surviving the competitive landscape with marginal revenue

- Frequently Asked Questions