Blog > What is Cash on Delivery (COD)?

What is Cash on Delivery (COD)?

Cash on delivery (COD) is a method of collecting payment when the buyer pays for a good or service at the exact time of delivery rather than before. This is also known as a COD payment for the buyer and it can take many different forms such as cash, check, or electronic payment. All of these payment methods affect a company’s accounting department and are generally better for the company since they receive faster payment from the buyer as long as the goods are delivered on time. Not only are the COD payment methods better for the company, but gives customers with a bad history of credit an abundance of cash-based options to pay for the products or services that they desire. All of the benefits and possible pitfalls of cash on delivery will be discussed in the following sections of this article.

Understanding How Cash on Delivery Works

Cash on delivery can be integrated into any organization as a payment method which allows customers to pay for their goods and services at the exact time of delivery. A COD transaction takes on many different shapes and can affect a company’s accounting in different ways.

When a COD customer orders a product (either online or via phone), they will choose cash on delivery as their method of payment. Once the order arrives, the customer will pay the invoice on site, generally, to the shipping company delivering the goods for the supplier. Even though cash on delivery customers aren’t paying for the goods or services on credit, that doesn’t suggest suppliers won’t have to create invoices for COD customers. The invoice makes it easier for accountants to organize their records between customers that pay on credit and customers that use the COD method of payment.

Cash on Delivery in Application

In the B2B (business-to-business) world, it would be beneficial for retail companies to use the cash on delivery payment method to pay for large deliveries from wholesalers to ensure all the products arrive before the payment is made.

In the day-to-day lives of consumers, we are constantly making a payment on delivery. Some of the more apparent examples of COD as consumers include ordering takeout food, going to the dry cleaner, and buying clothes at a retail store.

Payment Methods used for COD

There are many methods of accepting payment on delivery (or COD), COD payments can include checks, credit cards, cash, or electronic payment. When customers choose to pay by cash, checks, or other offline methods, suppliers have a significantly more difficult time processing those payments and recording it in their accounting ERP systems.

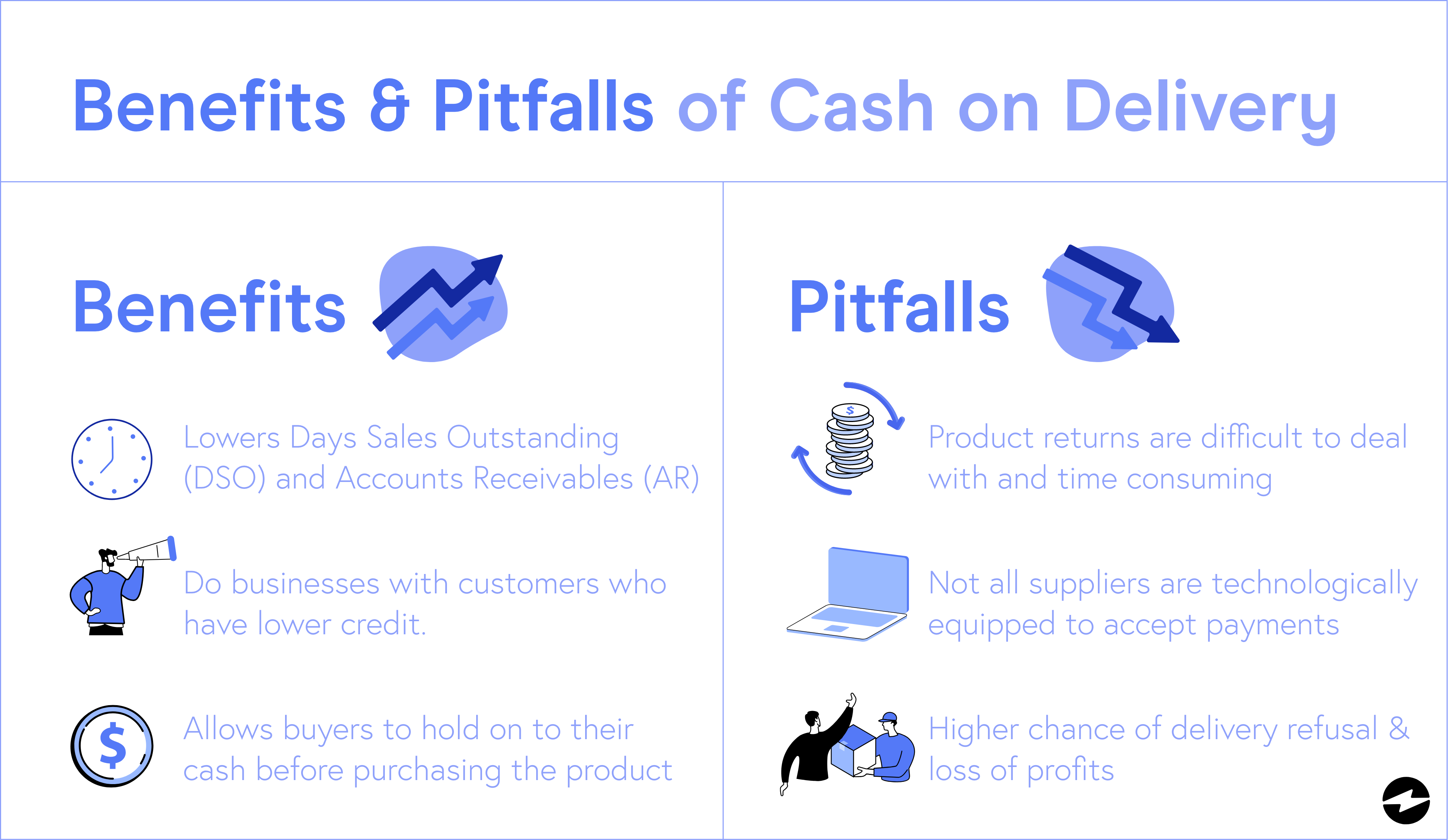

Benefits and Pitfalls of Cash on Delivery

Benefits of Cash on Delivery

For many businesses, accepting in-person cash on delivery secures the immediate payment of goods and services. This is beneficial for companies because it lowers their Days Sales Outstanding (DSO) which leads to an increase of cash flow. Lowering your DSO and accounts receivable (AR) gives your company greater cash flow and allows you to invest in new ventures.

Another benefit of COD is that it allows suppliers to do business with customers who have lower credit. Because the customer has to pay for the goods or services in-person and at the time of delivery, there’s no risk that the customer fails to pay the invoice. This same benefit for suppliers is also great for the customer. It opens the opportunity for customers with bad credit to pay for goods and services in person and not have to worry about the company denying them a transaction.

Finally, COD allows buyers to hold on to their cash before committing to purchasing the product and paying upfront. While this is a disadvantage for suppliers because of the risk of delivery refusal, buyers get the opportunity to see the product’s quality before officially making the purchase.

Pitfalls of Cash on Delivery

For buyers, returning products after the delivery has already been completed is often very difficult and time consuming to deal with. Even considering the difficulty and time associated with returning a product, many suppliers may refuse to accept the return under any circumstances.

Another pitfall for buyers who need to purchase goods or services with COD is that not all suppliers are technologically equipped to accept payments electronically in person. This leaves consumers with poor credit scores left to keep searching for suppliers that do allow cash on delivery payments.

Because cash on delivery for suppliers relies heavily on offline payment methods such as cash and checks, accepting COD payments from your customers puts a huge strain on accounting teams. Entering in all of the offline payment methods requires a significant amount of manual labor which creates an environment where mistakes could be made much easier than when payment methods are electronically accepted.

Finally, with cash on delivery orders, there’s a much greater chance of delivery refusal. The risk is even greater for suppliers delivering perishable goods such as food and drinks. When perishable goods spoil or get damaged, the supplier loses money on the goods and the customer receives their money back. This loss of profits on delivery refusal is a major pitfall of cash on delivery orders and should be considered when determining how your company should accept payments.

An Alternative to Using Cash on Delivery

While cash on delivery is beneficial if you want to increase your immediate cash flow and lower your accounts receivables, there are other alternatives that also have your company get paid on time and with a multitude of payment methods. Here is an alternative to using COD:

EBizCharge is a payment processing company and an alternative to using the cash on delivery payment method. EBizCharge uses a combination of 7 different payment methods to accept credit card payments from their customers making it easy for their customers to find ways to pay for the products or services they love. These methods include email pay, customer payment portal, EMV payments, recurring billing, mobile payments, text-to-pay, and virtual terminals. All of these payment methods can be integrated with your company’s accounting ERP software, making it easy for your accounting team to manage all of your company’s finances.

Having a payment processing company also lowers the risk of delivery refusal because the products or services are paid for before they arrive at the customer’s house. This speeds up the logistics process by saving the time of delivery drivers having to manage delivery refusals.

Merchants Can Lower their DSO with Cash on Delivery

Cash on delivery (COD) is an excellent payment method for companies that want to lower their DSO and bring in new customers that otherwise wouldn’t be able to make purchases from those companies. However, there are some major disadvantages of only accepting payments through cash on delivery. If the pitfalls discussed in this article are a dealbreaker for your company, your business could consider using a payment processing company, such as EBizCharge, to process all of your credit card payments and simplify your accounts receivables.

Benefits and Pitfalls of Cash on Delivery

Benefits of Cash on Delivery

For many businesses, accepting in-person cash on delivery secures the immediate payment of goods and services. This is beneficial for companies because it lowers their Days Sales Outstanding (DSO) which leads to an increase of cash flow. Lowering your DSO and accounts receivable (AR) gives your company greater cash flow and allows you to invest in new ventures.

Another benefit of COD is that it allows suppliers to do business with customers who have lower credit. Because the customer has to pay for the goods or services in-person and at the time of delivery, there’s no risk that the customer fails to pay the invoice. This same benefit for suppliers is also great for the customer. It opens the opportunity for customers with bad credit to pay for goods and services in person and not have to worry about the company denying them a transaction.

Finally, COD allows buyers to hold on to their cash before committing to purchasing the product and paying upfront. While this is a disadvantage for suppliers because of the risk of delivery refusal, buyers get the opportunity to see the product’s quality before officially making the purchase.

Pitfalls of Cash on Delivery

For buyers, returning products after the delivery has already been completed is often very difficult and time consuming to deal with. Even considering the difficulty and time associated with returning a product, many suppliers may refuse to accept the return under any circumstances.

Another pitfall for buyers who need to purchase goods or services with COD is that not all suppliers are technologically equipped to accept payments electronically in person. This leaves consumers with poor credit scores left to keep searching for suppliers that do allow cash on delivery payments.

Because cash on delivery for suppliers relies heavily on offline payment methods such as cash and checks, accepting COD payments from your customers puts a huge strain on accounting teams. Entering in all of the offline payment methods requires a significant amount of manual labor which creates an environment where mistakes could be made much easier than when payment methods are electronically accepted.

Finally, with cash on delivery orders, there’s a much greater chance of delivery refusal. The risk is even greater for suppliers delivering perishable goods such as food and drinks. When perishable goods spoil or get damaged, the supplier loses money on the goods and the customer receives their money back. This loss of profits on delivery refusal is a major pitfall of cash on delivery orders and should be considered when determining how your company should accept payments.

An Alternative to Using Cash on Delivery

While cash on delivery is beneficial if you want to increase your immediate cash flow and lower your accounts receivables, there are other alternatives that also have your company get paid on time and with a multitude of payment methods. Here is an alternative to using COD:

EBizCharge is a payment processing company and an alternative to using the cash on delivery payment method. EBizCharge uses a combination of 7 different payment methods to accept credit card payments from their customers making it easy for their customers to find ways to pay for the products or services they love. These methods include email pay, customer payment portal, EMV payments, recurring billing, mobile payments, text-to-pay, and virtual terminals. All of these payment methods can be integrated with your company’s accounting ERP software, making it easy for your accounting team to manage all of your company’s finances.

Having a payment processing company also lowers the risk of delivery refusal because the products or services are paid for before they arrive at the customer’s house. This speeds up the logistics process by saving the time of delivery drivers having to manage delivery refusals.

Merchants Can Lower their DSO with Cash on Delivery

Cash on delivery (COD) is an excellent payment method for companies that want to lower their DSO and bring in new customers that otherwise wouldn’t be able to make purchases from those companies. However, there are some major disadvantages of only accepting payments through cash on delivery. If the pitfalls discussed in this article are a dealbreaker for your company, your business could consider using a payment processing company, such as EBizCharge, to process all of your credit card payments and simplify your accounts receivables.