Blog > What Is Cash Burn? Calculating and Controlling Your Spending

What Is Cash Burn? Calculating and Controlling Your Spending

For startups and growing businesses, keeping a close eye on spending is crucial. While hitting revenue milestones is important, how quickly cash flows out of a business can reveal just as much about its financial health. This makes it imperative for companies to understand their cash burn rate.

This article will explore cash burn, the difference between gross and net burn, and strategies for managing spending effectively.

What is cash burn?

Cash burn is the rate at which a company uses its cash reserves to cover expenses. When a business isn’t making enough money to pay its costs, it relies on these reserves to pay for things like rent, salaries, and operating costs. This is common in startups and fast-growing companies, often spending more on growth than they earn in revenue.

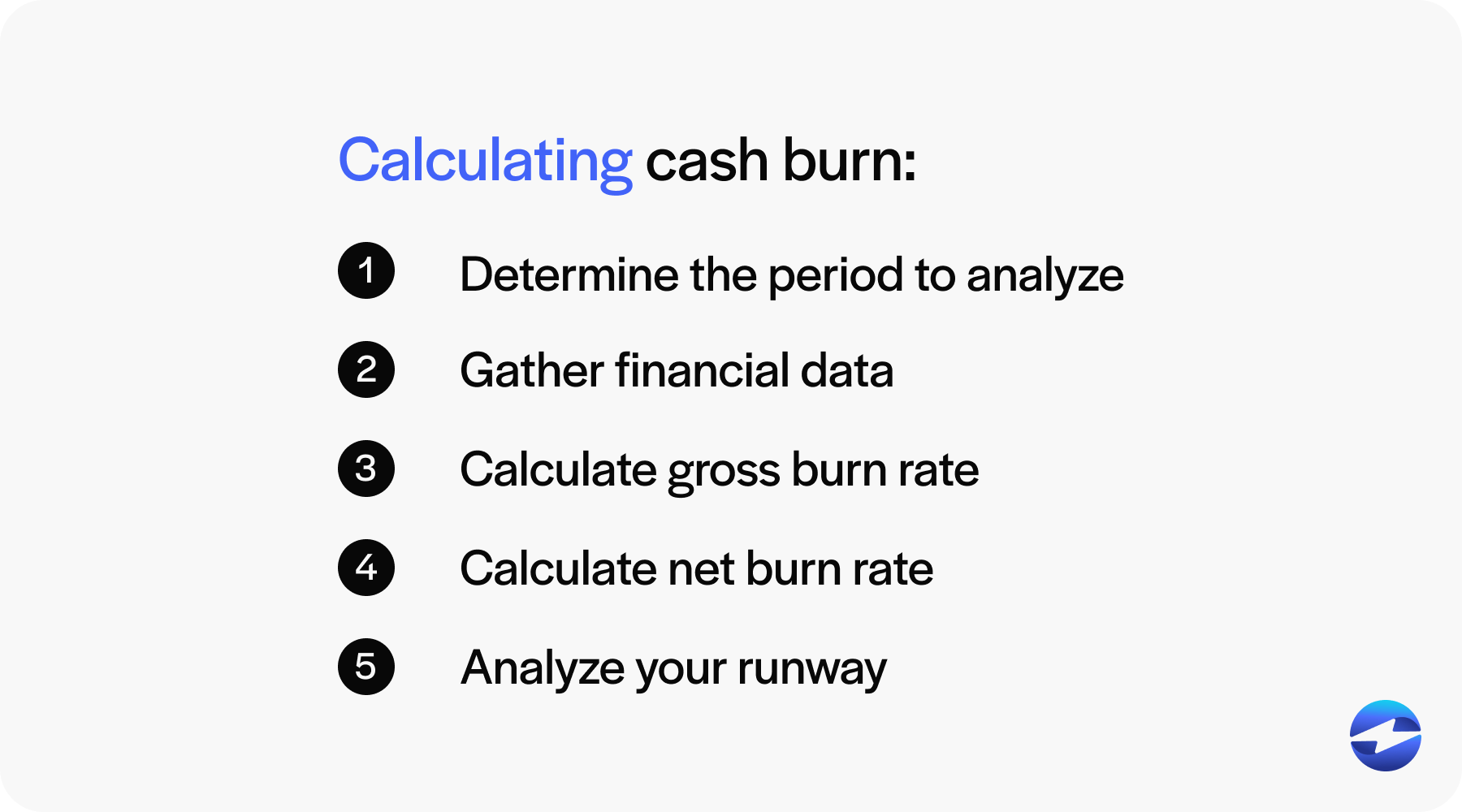

To calculate cash burn, use the following steps:

- Determine the period to analyze: Decide the period you want to calculate.

- Gather financial data: Collect the following data for the selected period:

- Total operating expenses: This includes payroll, rent, utilities, marketing, and any other outflows.

- Total cash inflows (revenue): The amount of money generated from sales, investments, or other income.

- Calculate gross burn rate: Gross burn rate shows how much cash your company spends monthly (without considering revenue).

- Calculate net burn rate: Net burn rate accounts for revenue and shows the actual cash loss per month.

- Analyze your runway: Calculate your runway to understand how long your cash reserves will last.

Forecasting your business’s cash burn rate is crucial as this metric provides a picture of your business’s economic stability.

Why is forecasting cash burn important?

Forecasting cash burn is essential for business survival because it allows companies to plan their finances effectively and avoid negative cash flow.

By predicting how quickly your business will deplete its cash reserves, you can make informed decisions that support long-term stability.

Accurate forecasting helps with budget planning by anticipating future spending and allocating funds wisely. It ensures financial security by confirming enough cash to cover day-to-day operations. Additionally, it supports strategic decision-making, such as determining the right time to invest in resources or expand operations.

Forecasting also provides clarity on cash runway, helping businesses understand how long their reserves will last at their current spending rate. By staying on top of cash burn predictions, businesses can avoid financial surprises and focus on sustainable growth.

To calculate cash burn, you’ll first need to familiarize yourself with gross burn and cash burn.

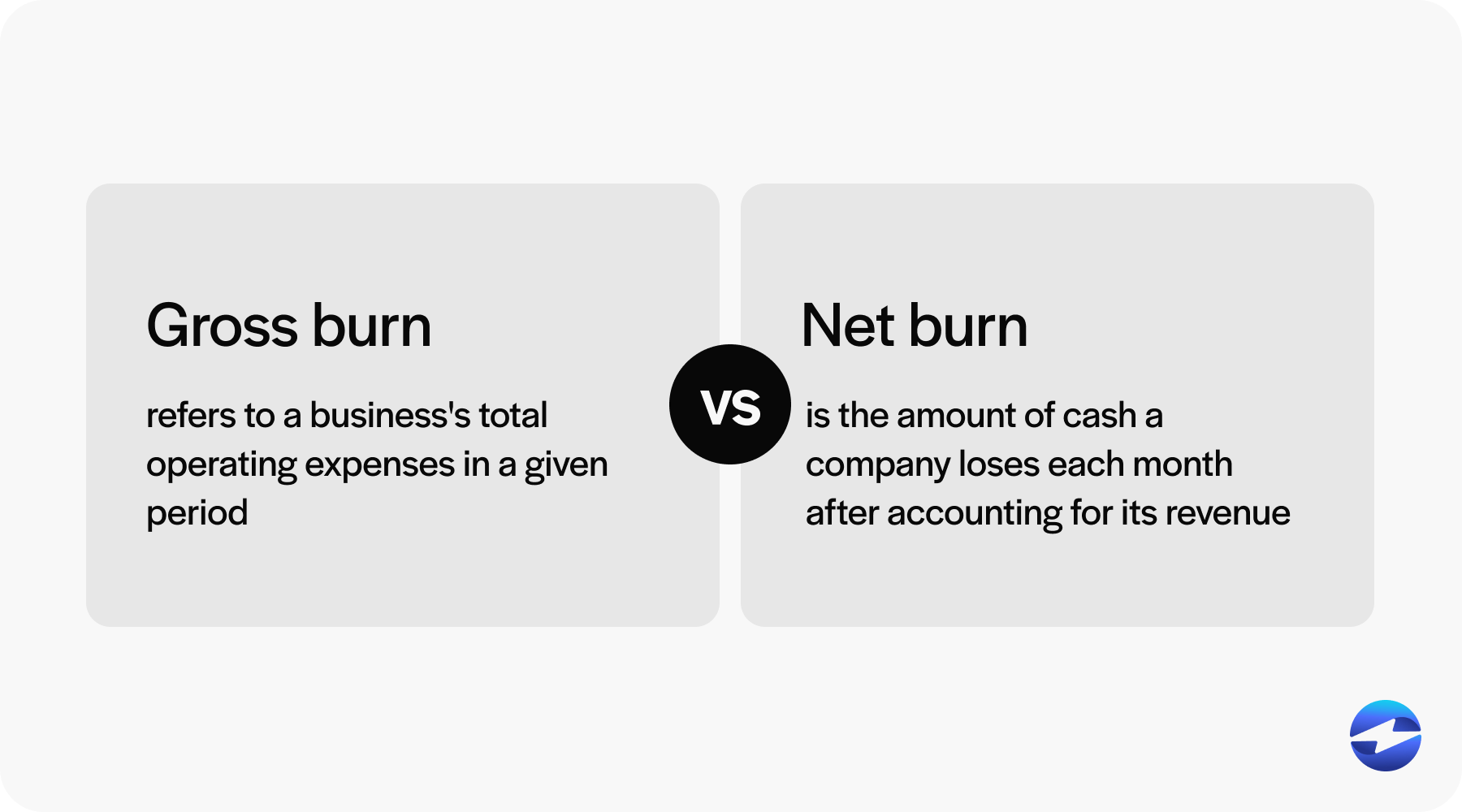

Gross burn vs net burn: What’s the difference?

Gross burn and net burn play key roles in understanding a company’s overall cash burn. Together, they offer a clear picture of how much money is being spent and how effectively revenue offsets those expenses.

Gross burn refers to a business’s total operating expenses in a given period, usually a month. This includes payroll, rent, utilities, and other operating expenses.

Net burn is the amount of cash a company loses each month after accounting for its revenue. It’s calculated by subtracting the monthly revenue from the gross burn.

Evaluating both metrics allows businesses to identify inefficiencies, assess their financial health, and make strategic adjustments to improve sustainability, making it crucial for businesses to understand how to calculate them.

Calculating gross and net burn

Understanding how to calculate gross and net burn rates is vital for financial planning, as these rates can help businesses better assess their financial health and plan their cash flow statements.

Here’s how to calculate gross burn rates and net burn rates:

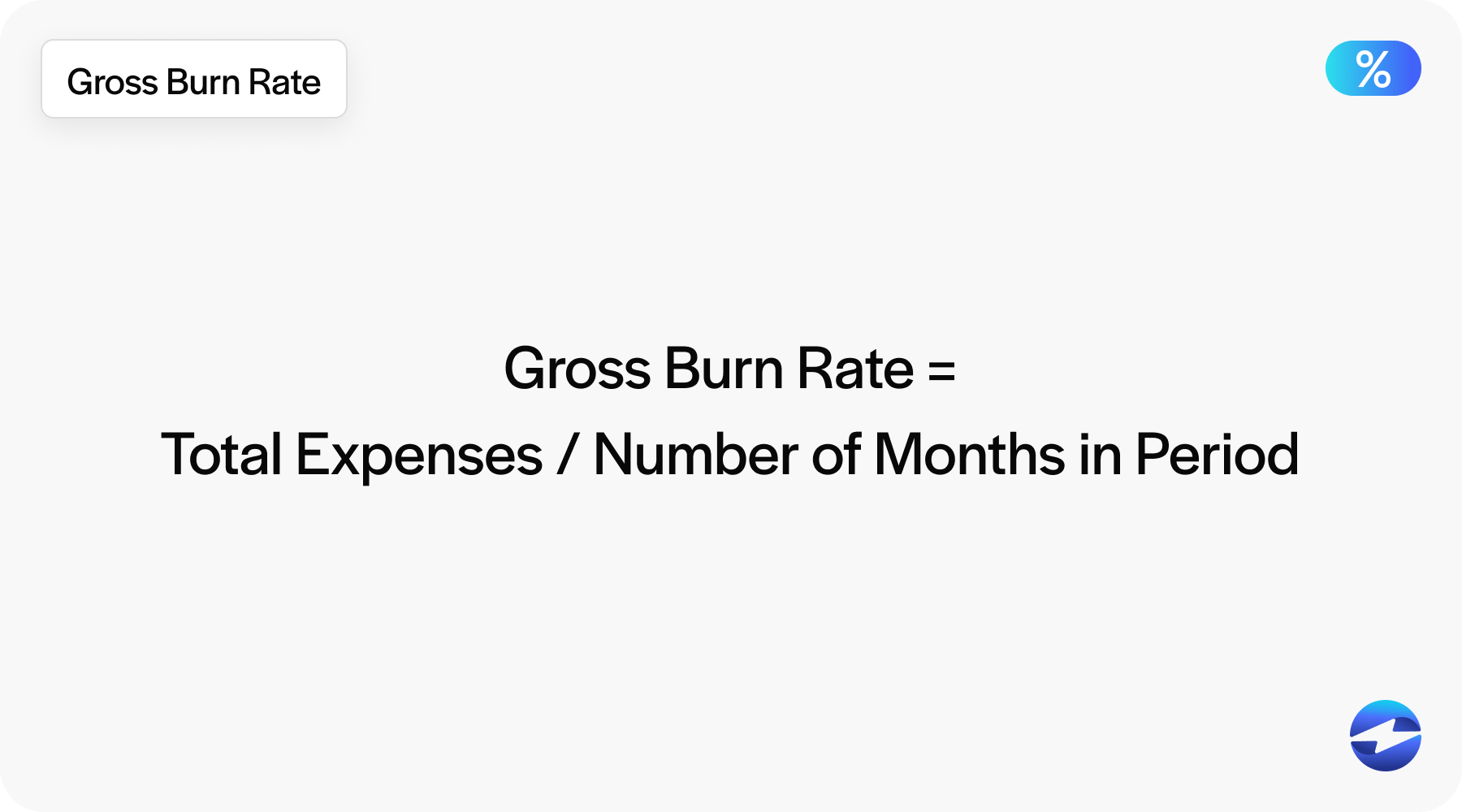

Gross burn rate

To calculate the gross burn rate, divide your total expenses by the number of months in the period you’re analyzing.

For example, if your business spends $100,000 monthly on expenses, your gross burn rate is $100,000 monthly.

This metric helps you understand how quickly your business spends cash before factoring in revenue, providing insights into your cash flow and financial runway.

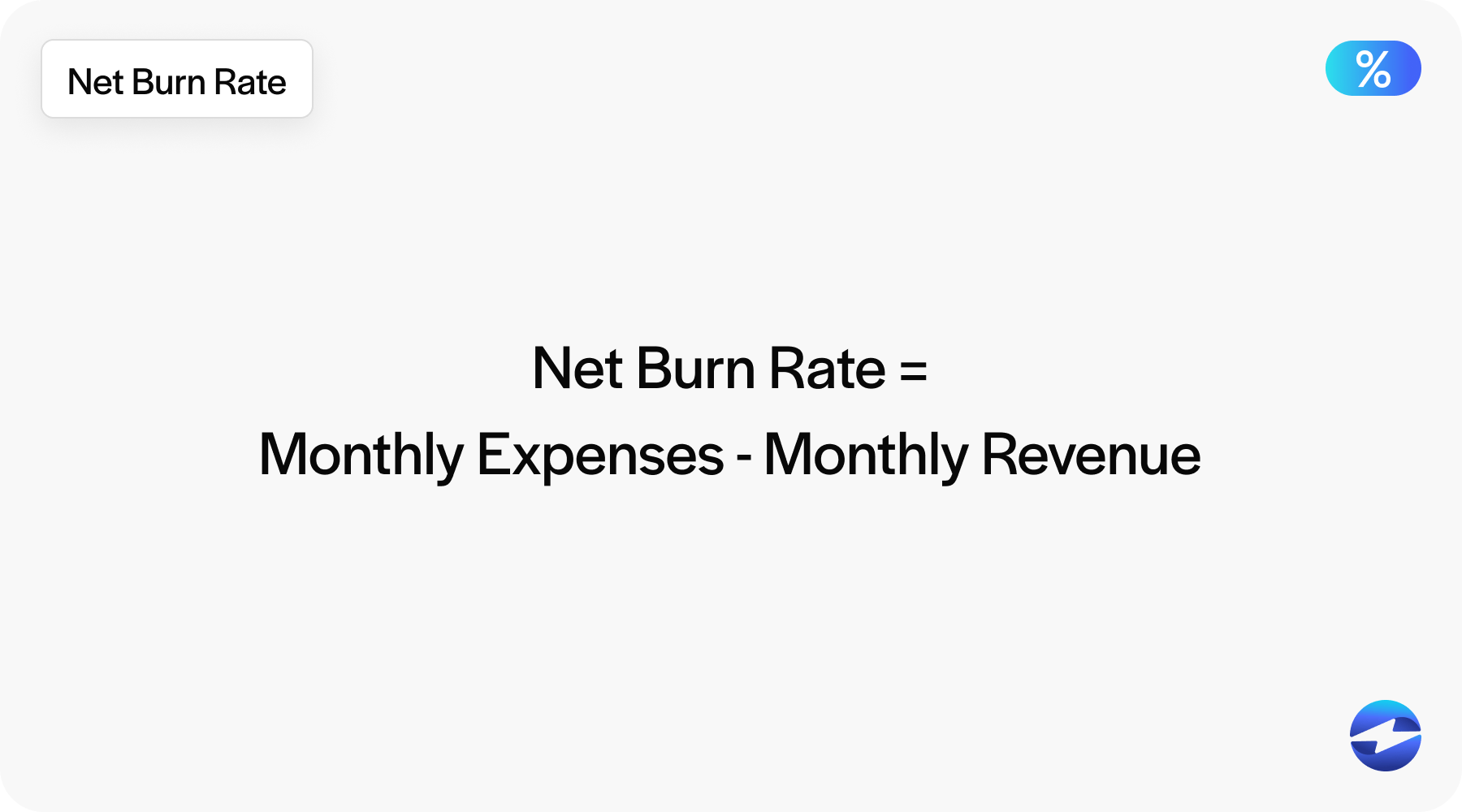

Net burn rate

To calculate the net burn rate, subtract your monthly revenue from your monthly expenses. The result represents how much cash your business is losing each month.

For example, if your business spends $100,000 monthly and generates $60,000 in revenue, your net burn rate is $40,000 monthly. This metric provides a clearer picture of how quickly your cash reserves are depleting, considering both expenses and income.

Regularly calculating these rates can improve operational efficiency and financial decisions, enhancing a company’s overall cost structure.

In addition to these calculations, knowing how to calculate runway is essential.

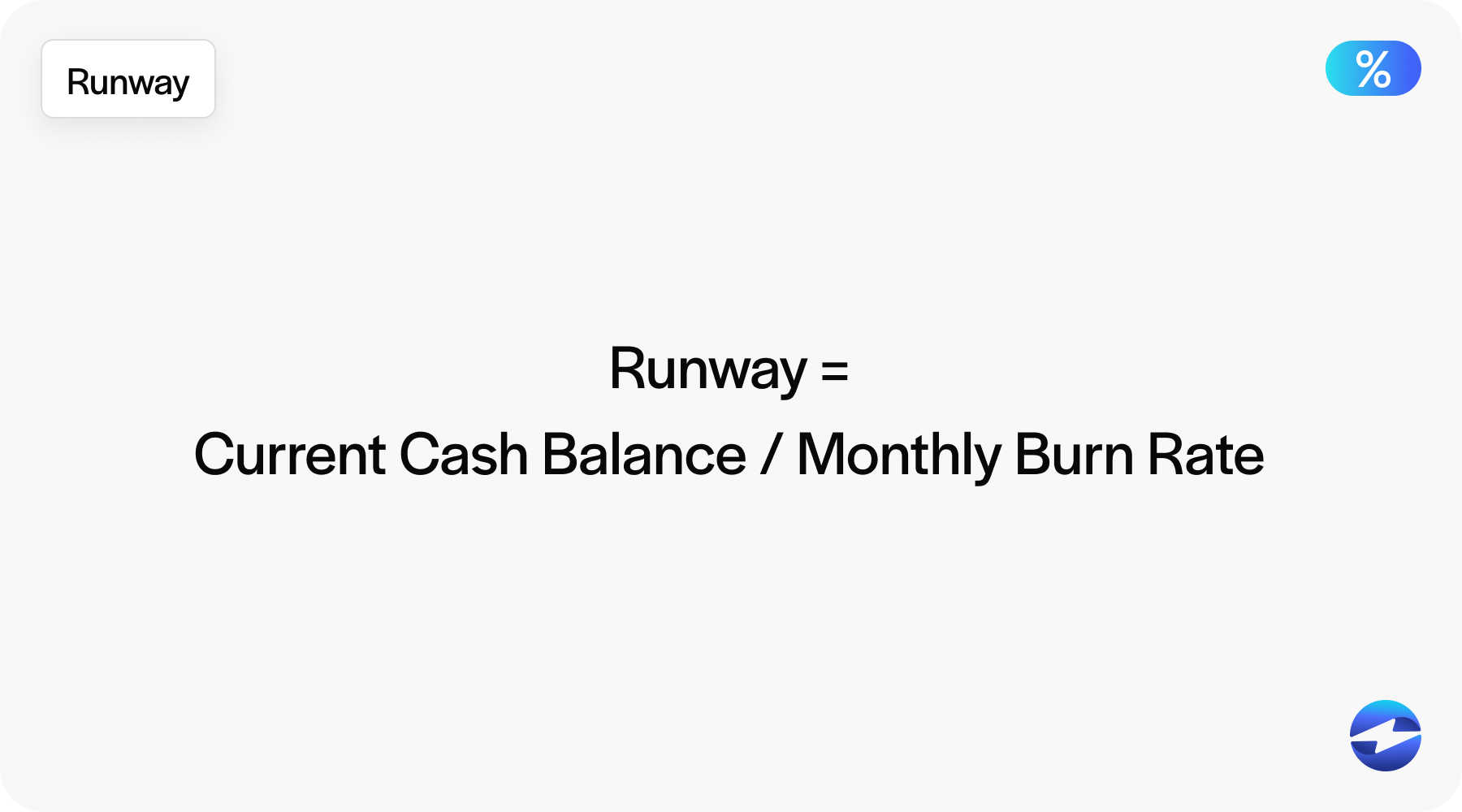

Calculating runway

Runway is the amount of time a business can operate before it runs out of cash – like measuring how far your car can go before running out of gas.

Knowing your cash runway is vital for making informed financial decisions, as it can aid in future growth initiatives or potential cuts.

Here’s a quick breakdown of how to calculate cash runway:

- Cash balance: Start by determining your current cash balance, which is the total amount of cash your business has on hand.

- Monthly burn rate: Next, calculate average monthly expenses. Include operating costs like salaries, office space, and other operating expenses.

- Runway formula: Finally, use the runway formula:

Runway = Current cash balance / monthly burn rate

By knowing how much time you have before your cash reserves run out, you can take control of your financial strategy and avoid being caught off guard.

Managing expenses can be difficult for any business, but small to medium-sized businesses (SMBs) often feel this strain more than larger corporations. This makes managing cash burn imperative for SMBs.

10 tips for small to medium-sized businesses to manage cash burn

Managing cash burn is one of the biggest challenges small to medium-sized businesses face, especially in their early stages or during periods of rapid growth. Without proper oversight, expenses can quickly outpace revenue, leaving businesses in a precarious position.

Thankfully, SMBs can follow these 10 tips to manage their cash burn:

- Track your expenses closely: Regularly review your spending to understand where your money is going. Categorize expenses into essentials and non-essentials so you can identify areas to cut back if needed.

- Create a detailed budget: Develop a clear budget that outlines all expected income and expenses. Stick to it as much as possible but stay flexible to adjust for unexpected costs or changes in revenue.

- Negotiate with vendors: Reach out to suppliers and service providers to negotiate better terms or discounts. Even small savings can add up over time and help reduce cash outflow.

- Monitor cash flow regularly: Keep a close eye on your cash flow by updating projections frequently. This will help you anticipate shortfalls and plan for lean periods.

- Prioritize revenue-generating activities: Focus on initiatives that directly contribute to your bottom line. Avoid spending heavily on non-essential projections until your cash flow is stable.

- Extend payment terms: If possible, negotiate extended payment terms with vendors and creditors. This can help you hold onto cash longer and improve your financial flexibility.

- Leverage technology: Use accounting and financial management tools to automate tracking, generate reports, and gain insights into spending patterns.

- Build a cash reserve: Set aside a portion of your profits to create a safety net for unexpected expenses or periods of low revenue. A reserve can reduce stress and help you avoid taking on high-interest debt.

- Avoid over-hiring too soon: Be strategic with hiring decisions. Ensure your workforce aligns with current business needs and avoid taking on unnecessary payroll expenses during uncertain times.

- Seek professional guidance: Consult with a financial advisor or accountant specializing in SMBs, as they can provide valuable insights, help you optimize your cash flow, and identify areas for improvement.

By adopting strategic approaches to financial management, SMBs can reduce their cash burn and build a more resilient foundation for long-term success.

For efficient financial management, look for top-rated payment solutions that can streamline payment processes to optimize cash flow.

Optimizing cash flow with EBizCharge

EBizCharge provides payment processing software that helps merchants improve cash burn and extend their runway by streamlining payment processes and reducing operational costs.

EBizCharge provides robust payment technology and features, including faster payment processing, automated invoicing, and a secure customer payment portal that encourages quicker payments and invoice collections.

By offering competitive transaction fees and data optimization, EBizCharge can lower payment processing costs, freeing up funds for other needs.

EBizCharge offers over 100 seamless payment integrations into accounting, enterprise resource planning (ERP), eCommerce, and other business systems and detailed reporting tools. This gives merchants access to valuable insights and alleviates administrative burdens, allowing them to manage finances more efficiently and extend their financial runway.

With the top-rated EBizCharge payment processing platform, businesses can leverage a comprehensive suite of tools and features designed to optimize cash flow, minimize payment-related inefficiencies, and provide actionable insights into financial performance.