Blog > What Is a Trial Balance and How Does It Work?

What Is a Trial Balance and How Does It Work?

A trial balance is a fundamental accounting tool designed to ensure the accuracy of financial records. It acts as a checkpoint, summarizing all ledger accounts at a given time to confirm that debits and credits are balanced. Without this critical step, businesses risk making decisions based on inaccurate data.

This guide will uncover the importance of a trial balance, how it works, and how it plays a key role in the accounting process.

What Is a Trial Balance?

A trial balance is a bookkeeping report that summarizes the balances of all general ledger accounts at a specific time. It’s a foundational tool in accounting, designed to verify the accuracy of the double-entry bookkeeping system by ensuring that the total debit balances equal the total credit balances.

This alignment confirms that the ledger entries are mathematically correct, though it doesn’t guarantee the absence of errors, such as misclassified transactions or omissions. The trial balance typically includes all accounts used in the ledger, such as assets, liabilities, equity, revenues, and expenses. It serves as a critical checkpoint before preparing financial statements, helping accountants identify and resolve discrepancies early in the accounting process.

Is a trial balance a credit or debit?

A trial balance is neither a credit nor a debit. Its primary purpose is to verify the accuracy of the bookkeeping process by ensuring that the total debits equal the total credits. The trial balance doesn’t represent a financial transaction or account but is instead a tool for reviewing and confirming the balance of debits and credits recorded in the ledger.

Trial Balance vs. General Ledger: What’s the difference?

The trial balance and the general ledger are essential accounting tools, yet they serve distinct purposes. The general ledger records all the business’s transactions, maintaining detailed account histories. On the other hand, the trial balance summarizes these accounts to confirm that total debits equal total credits. Understanding the difference between trial balance vs. general ledger is crucial for accurate financial reporting, as the trial balance ensures entries in the general ledger align correctly and reveal no discrepancies.

Now that you know what a trial balance is, you should familiarize yourself with its key characteristics.

Key Characteristics of a Trial Balance

Understanding the key characteristics of a trial balance provides valuable insights into how it functions as a checkpoint for financial integrity, aiding in the detection of errors and preparation for more comprehensive reports like the income statement and balance sheet. By examining its distinct attributes, businesses can better appreciate its role in maintaining transparent and reliable financial practices.

Here are a few key characteristics of a trial balance:

- List of Accounts: The trial balance includes all the accounts from the general ledger. This list ensures every account, whether active or dormant, is taken into consideration to provide a complete financial snapshot.

- Account Balances: Each account is displayed with its respective balance. These balances reflect the activity recorded over a specific period, serving as the foundation for accuracy when verifying financial statements.

- Debit and Credit Columns: The trial balance organizes accounts into two separate columns—one for debit balances and the other for credit balances. This layout helps differentiate transactions and simplifies the process of checking for errors.

- Equal Totals: A correctly prepared trial balance’s hallmark is that the debit column’s total matches the credit column. Equal totals indicate that ledger entries comply with the double-entry bookkeeping principle. If they don’t match, it’s a clear sign something needs to be corrected.

These characteristics not only ensure the accuracy of financial data but also streamline the preparation of formal financial statements. It’s also important to understand the trial balance format, as inputting the necessary information correctly is imperative for a smooth process.

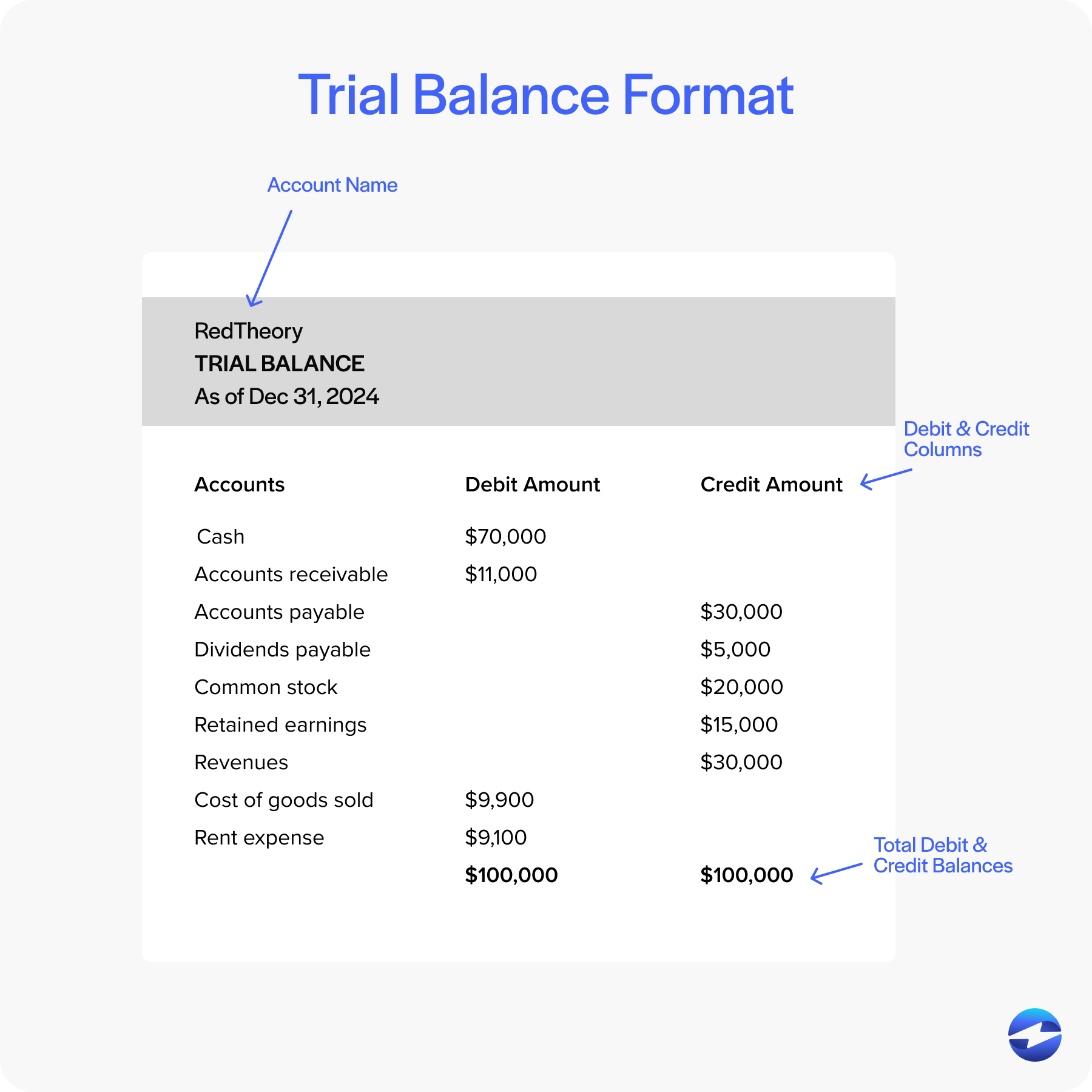

The Trial Balance Format

The trial balance format is structured to ensure clarity and consistency when reviewing financial data. Each component serves a distinct purpose in organizing and verifying account information.

Here’s what the format includes:

- Serial Number: A unique number is assigned to each entry for identification and easy reference.

- Account Name: The name of the account listed in the general ledger, providing clear identification.

- Debit Column: Displays the balances of accounts with debit totals.

- Credit Column: Reflects the balances of accounts with credit totals.

- Total Debit and Credit Balances: Summarizes and confirms that the total debits equal the total credits, ensuring correctness.

It’s also important to understand the rules governing trial balances, as they serve as the pillars of accuracy.

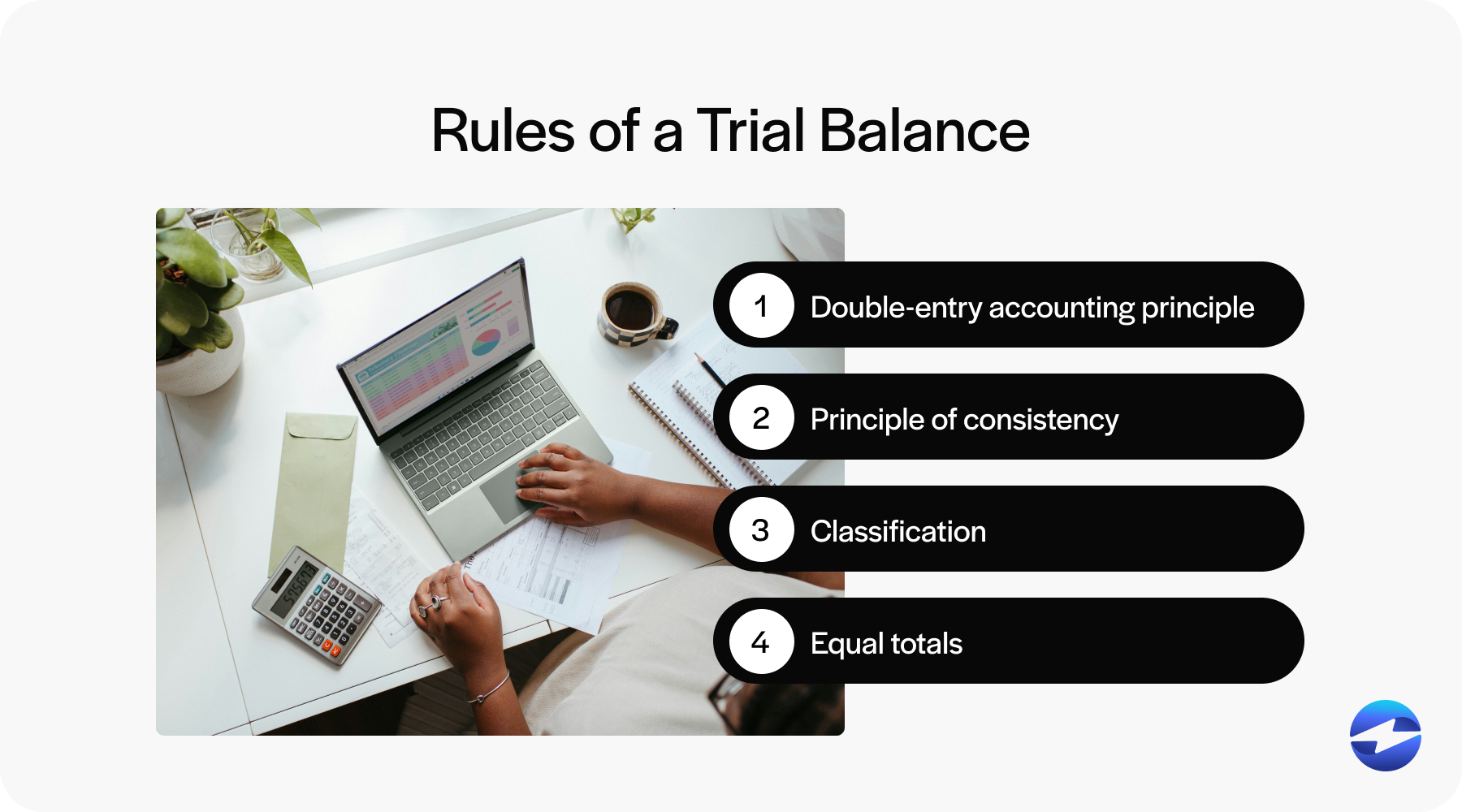

The Rules of a Trial Balance

A trial balance is governed by a set of fundamental rules that ensure precision and alignment in financial records. These rules are vital for maintaining order and consistency in accounting practices, forming the backbone of accurate reporting.

- Double-Entry Accounting Principle: A trial balance follows the double-entry bookkeeping system, where each financial transaction is recorded as both a debit and a credit. This principle ensures that every entry balances out and maintains accuracy across accounts.

- Principle of Consistency: Consistent recording methods must be applied to prepare a trial balance. Any deviation in accounting practices can lead to errors and disrupt the accuracy of the final output.

- Classification: All accounts must be properly categorized under appropriate headings, such as assets, liabilities, or equity. Correct classification helps create a clear, structured trial balance that’s easy to interpret.

- Equal Totals: The sum of debit balances must always equal the sum of credit balances in a trial balance. This equality acts as a checkpoint to highlight potential errors and maintain overall integrity in the financial data.

Now that you understand the rules of a trial balance, it’s important to remember that this accounting tool comes with pros as well as cons.

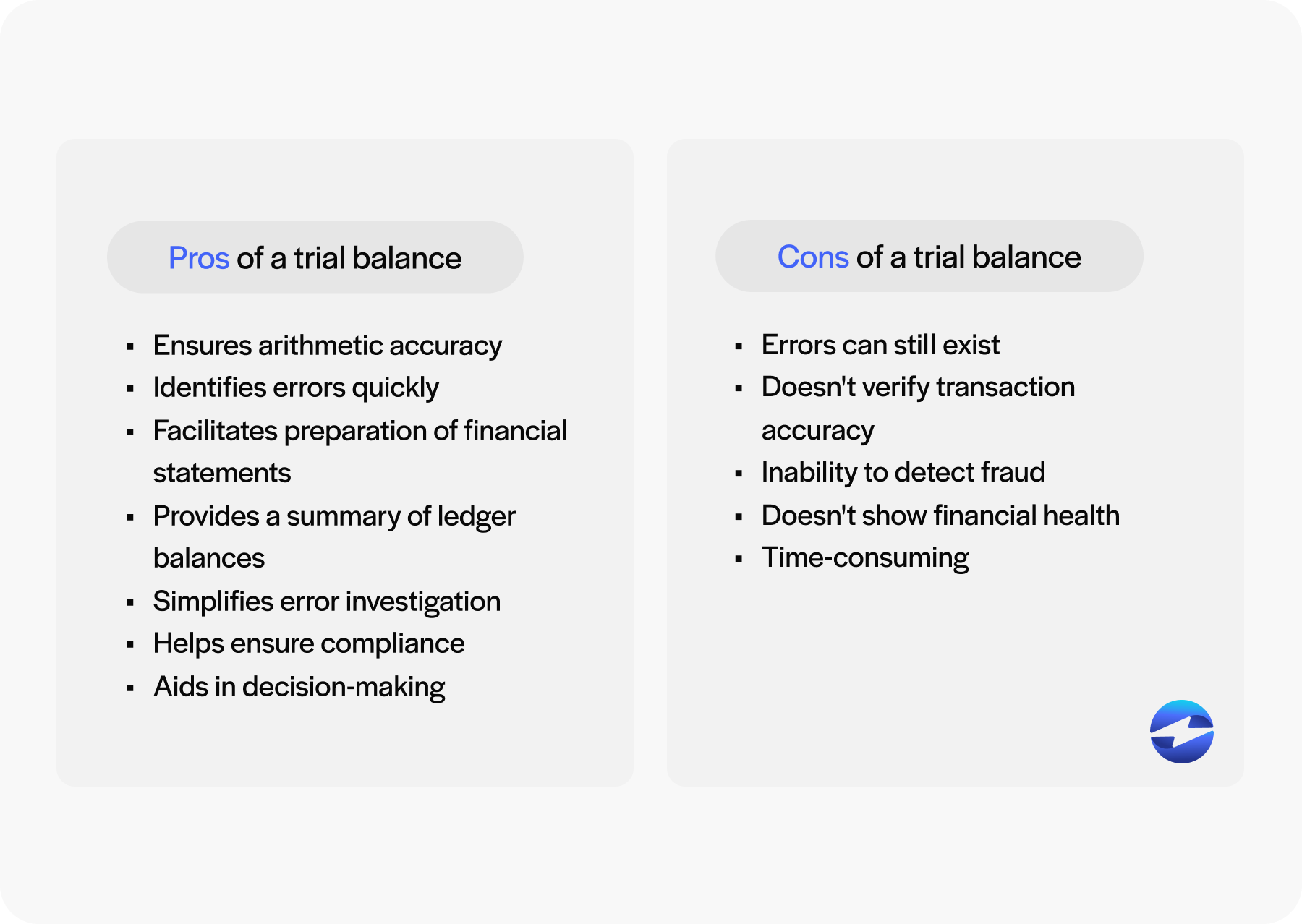

The Pros and Cons of a Trial Balance

While the trial balance is a cornerstone of accurate bookkeeping, it does have its limitations. Understanding the pros and cons of a trial balance is essential for businesses to leverage their strengths while being mindful of their shortcomings.

By highlighting both the advantages and limitations of a trial balance, businesses can better understand how to use it effectively.

Pros

- Ensures Arithmetic Accuracy: A trial balance confirms that all debit entries match the sum of all credit entries. This arithmetic check helps catch errors in ledger postings early in the process.

- Identifies Errors Quickly: By comparing the debit and credit columns, a trial balance sheet allows accountants to quickly spot inconsistencies. These discrepancies are red flags, pointing to areas that need further review.

- Facilitates Preparation of Financial Statements: A trial balance statement serves as the basis for creating key financial statements, such as the income statement and balance sheet. It organizes data to simplify the transition to these critical reports.

- Provides a Summary of Ledger Balances: A trial balance offers a clear snapshot of all account balances in one place. This summary is useful for reviewing overall financial activity and adjusting as needed.

- Simplifies Error Investigation: When errors are detected, a trial balance makes it easier to trace discrepancies back to their source. Its structured layout highlights where balances don’t match, narrowing the focus for troubleshooting.

- Helps Ensure Compliance: A trial balance helps businesses adhere to accounting standards and principles. This compliance is essential for maintaining trust and avoiding regulatory issues in financial reporting.

- Aids in Decision-Making: A trial balance statement provides an accurate foundation for evaluating financial health and making informed decisions. With reliable data, businesses can plan and allocate resources more effectively.

Cons

- Errors Can Still Exist Even if It Balances: While it ensures that debits equal credits, it does not guarantee the absence of errors on a trial balance statement. Mistakes like recording incorrect accounts or values can still be missed if they don’t disrupt the balance.

- Doesn’t Verify Transaction Accuracy: A trial balance focuses solely on numerical equality and does not check whether transactions were recorded correctly. Misclassifications or incorrect entries may not be detected through this process.

- Inability to Detect Fraud: A trial balance can’t uncover intentional manipulation or fraudulent activity. If fraudulent transactions are deliberately balanced, they’ll go unnoticed in the trial balance sheet.

- Doesn’t Show Financial Health: Though useful for accuracy checks, a trial balance does not provide insights into a business’s overall financial performance. It lacks the analytical depth to evaluate profit, losses, or cash flow.

- Time-Consuming: Preparing and reviewing a trial balance can be a lengthy process, especially for larger organizations. Ensuring accuracy requires meticulous attention to detail, which can delay broader accounting tasks.

From ensuring arithmetic accuracy and aiding in financial statement preparation to its inability to detect certain errors or fraud, a trial balance offers valuable insights but isn’t without flaws. Understanding both sides allows businesses to make more informed financial decisions with better accuracy.

Practical Applications of a Trial Balance

Here are just a few examples of how and when it’s helpful:

- Preparation of financial statements: A trial balance serves as the basis for creating financial statements, such as the income statement and balance sheet.

- Audit and compliance: Auditors often use trial balances to verify the accuracy of financial records and ensure compliance with accounting standards.

- Business decision-making: A trial balance provides an accurate snapshot of a business’s financial health, helping decision-makers plan and allocate resources effectively.

From streamlining financial statement preparation to aiding in audits and guiding strategic decisions, the trial balance proves its utility across multiple facets of accounting. By leveraging the trial balance effectively, businesses can build a strong foundation for sound financial management and long-term success.

A commitment to disciplined financial management

A trial balance is much more than an accounting formality; it’s a pivotal tool for fostering financial accountability and accuracy. By serving as both a diagnostic tool and a preparatory step, it empowers businesses to identify errors early, maintain compliance, and lay a strong foundation for financial reporting.

However, its true value lies in how it integrates into broader financial processes, bridging raw ledger data with actionable insights for decision-making. While it has its limitations, a well-maintained trial balance reflects a commitment to disciplined financial management, essential for navigating today’s dynamic business environment with confidence and precision.