Blog > What Is a Pass-Through Fee? Pricing Models and Why They’re Charged

What Is a Pass-Through Fee? Pricing Models and Why They’re Charged

In the complex world of commerce, many financial terms are vital to understanding, as they can impact business operations.

Pass-through fees are included in these terms since they’re crucial in how companies structure their pricing models and can influence profitability, cash flow, and overall financial health.

What are pass-through fees?

A pass-through fee refers to the costs levied by card networks like Visa, MasterCard, and Discover. These fees are incurred by merchants for each transaction and are paid to the card-issuing banks as compensation for handling the credit risk and processing the payment.

Pass-through fees are essential for merchants since they directly impact overall credit card processing costs. The reasons for these charges include compensation for the risk undertaken by issuers, maintenance of payment networks, and provision of customer rewards programs associated with many types of credit cards.

There are multiple types of pass-through fees, each serving its own purpose.

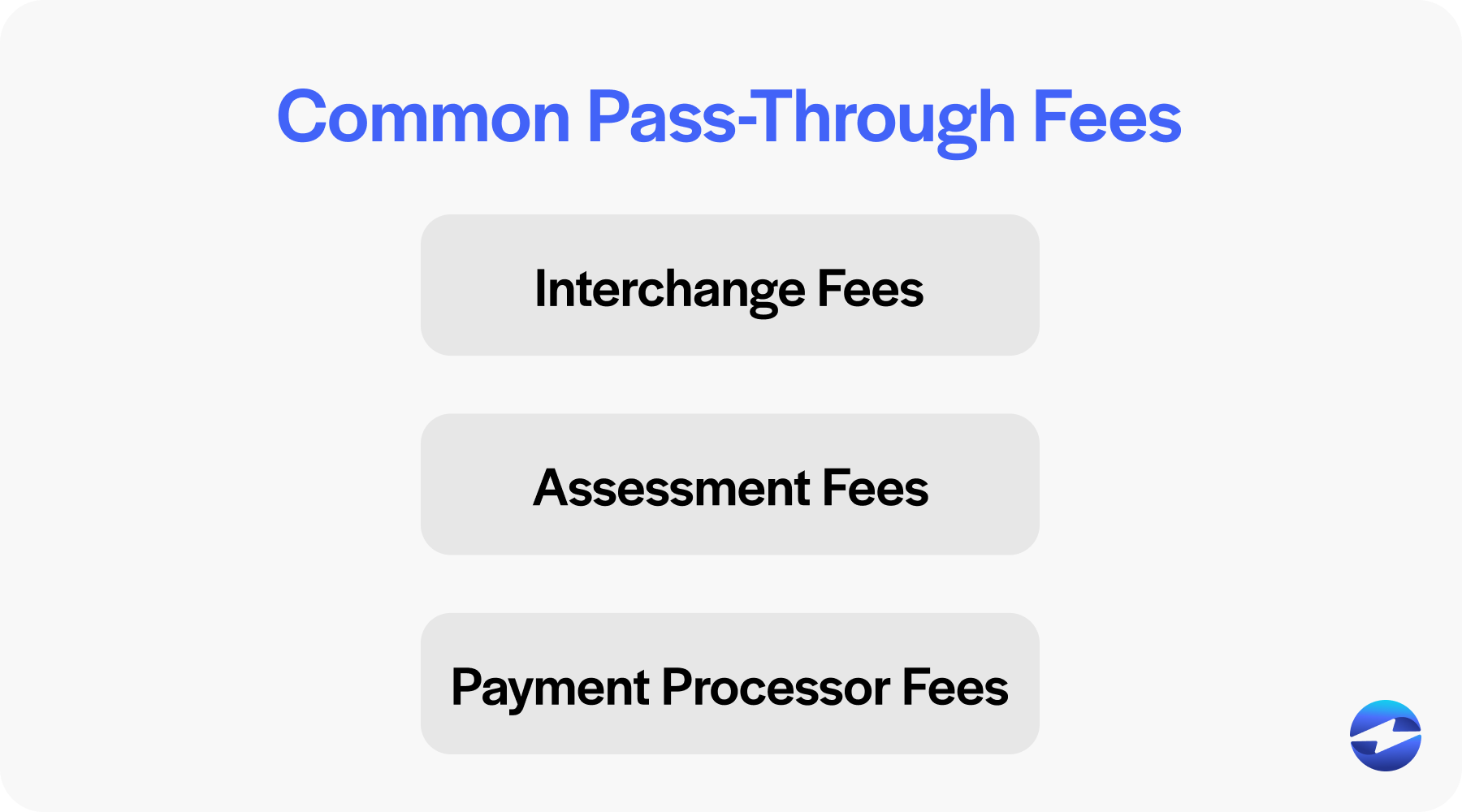

3 different types of pass-through fees

Understanding the various types of pass-through fees is crucial for any business that accepts credit card payments.

Here are three common pass-through fees to know:

- Interchange fees: Interchange fees represent a significant component of pass-through rates and are paid directly to the card-issuing banks. These fees are set by the card networks and vary based on several factors, including card type, transaction type, and sales volume. The intricacies of interchange rates are substantial, as each card network publishes detailed interchange rate tables, which are periodically updated to reflect current market conditions and costs.

- Assessment fees: Assessment fees are another variety of pass-through charges billed by the card networks. Unlike interchange fees that go to the card-issuing banks, assessment fees are paid to the card networks themselves. These fees are typically smaller, percentage-based charges applied to the merchant’s monthly sale volume that passes through the card network. They help the card networks cover operational costs, including maintaining and developing their payment infrastructures, facilitating secure and reliable credit card transactions worldwide.

- Payment processor fees: Payment processors are intermediaries that handle credit card transactions between merchants, card networks, and issuing banks. These processors charge merchant fees for their platforms and services, including transaction authorizations, settlement, and customer support. In addition to a markup over interchange fees, processors may charge monthly fees, PCI compliance fees, and terminal lease fees. Costs can vary by processor and transaction types and volumes.

These fees can significantly affect sales profitability, especially for small to medium enterprises with thinner margins.

Who charges pass-through fees?

Pass-through fees are typically charged by credit card processors to merchants as a direct reimbursement for the costs imposed on the processors by credit card networks such as Visa, MasterCard, and Discover, as well as interchange fees by issuing banks.

Pass-through charges are generally non-negotiable since they’re set by the card networks and depend on various factors such as card type, transaction type, and card sales volume.

Merchants agree to these fees as part of their contract with the processor. It’s important to note that while credit card processors collect these fees, they don’t retain them. Instead, they forward them to the appropriate card networks and financial institutions.

Pass-through fees can vary significantly between transactions, making it challenging for businesses to accurately forecast their credit card processing costs.

Pass-through fee pricing models

Several pass-through pricing models are available, each with its own set of advantages and disadvantages, tailored to the needs of diverse business types.

Getting familiar with these models can help merchants make informed decisions that align with their financial goals, lead to greater transparency in processing fees, and lower costs.

Interchange-plus

Interchange-plus pricing offers a clear structure where the credit card processor passes the card networks’ interchange rates and a fixed markup to the merchant.

Many favor the interchange-plus pricing model for its transparency since it separates the pass-through costs and the processor’s fee, allowing merchants to see precisely what they’re being charged for each transaction.

This model is often recommended for merchants with higher transaction volumes or those who prefer a detailed breakdown of charges.

Flat rate

In contrast to the interchange-plus model, the flat rate pricing model simplifies the process by charging a single fixed percentage or fee for each transaction, regardless of card type or transaction details.

The flat rate pricing structure can be beneficial for small businesses or those with lower transaction volumes that prefer fixed costs.

While this model offers simplicity and ease of understanding, it may not provide the lowest rates compared to pricing structures more tailored to the actual cost of transaction processing.

Tiered rate

The tiered rate pricing model categorizes transactions into different tiers based on various criteria, such as card type, transaction method, and risk level.

The three tiers typically associated with tiered pricing include qualified, mid-qualified, and non-qualified rates.

Qualified rates are the lowest fees, applied to standard, swiped debit and credit card transactions. Mid-qualified rates have higher costs for transactions such as keyed-in payments or some rewards cards. Lastly, non-qualified rates are the most expensive fees applied to high-risk transactions, international cards, or those failing to meet specific criteria.

Tiered pricing is especially advantageous for businesses with a mix of small and large transactions or those that serve a diverse customer base with different types of credit cards. This pricing model allows merchants to manage costs more predictably by categorizing transactions into different tiers based on factors such as card type, transaction method, and the associated risk level.

Tiered rates provide a middle ground between interchange-plus and flat rate pricing, offering some predictability while still accommodating different types of transactions. However, it can sometimes be less transparent and more complex to analyze, as categorizing transactions into tiers may not always be clear or consistent.

Subscription rate

The subscription rate pass-through fee pricing model is a financial arrangement used by credit card processors to charge businesses for the cost of processing credit card payments.

In this model, the payment processor charges businesses a fixed subscription fee, interchange rates, and network fees (or pass-through costs). These pass-through fees typically include interchange rates set by card networks like Visa and MasterCard, assessment fees, and other charges related to card types involved in transactions.

Subscription rates are designed to maintain transparency by billing merchants for the exact cost of each credit card transaction and a fee for the service.

Unlike tiered pricing models that categorize transactions into designated rate tiers, the subscription rate model separates the processor’s markup from interchange rates, allowing merchants to see what they’re paying for.

Understanding pass-through fee pricing models is essential before selecting a payment processor, as they can significantly impact businesses’ cash flow. Luckily, merchants can also implement best practices merchants to lower these costs.

7 best practices for lowering pass-through fees

Businesses can take proactive steps to minimize unnecessary expenses, improve financial efficiency, and protect their profit margins.

Here are seven best practices to help your business reduce pass-through fees:

- Negotiate better terms: Engage with your payment processor to negotiate lower pass-through costs. Providers may be willing to lower rates for businesses with high sales volumes.

- Opt for cost-plus pricing: Choosing a transparent pricing model like interchange-plus that separates pass-through fees from the processor’s markup can help you understand fees and potentially lower costs.

- Minimize card-not-present (CNP) transactions: Whenever possible, avoid transactions where the card isn’t physically present, as these often have higher rates due to the increased risk of fraud.

- Encourage debit over credit: Debit cards generally incur lower interchange rates than credit cards. Encourage customers to use debit cards by offering incentives or displaying signage.

- Batch transactions: Process transactions in batches to reduce the number of times they’re applied, especially for businesses with high transaction volumes.

- Update technology: Ensure your card processing technology is up to date to avoid additional fees for non-compliance or outdated transaction methods.

- Regularly review statements: Keep an eye on your merchant statements to catch any unexpected fees or increases in pass-through charges.

In addition to implementing these best practices to reduce pass-through fees, businesses can also work with trusted payment processors to ensure more reliable pricing models and transparent costs.

Reduce your payment processing fees with EBizCharge

EBizCharge differentiates itself from other payment processors by offering a range of services and pricing strategies designed to lower payment processing fees for businesses of all sizes.

EBizCharge’s proprietary technology optimizes transactions for the lowest possible interchange rates, particularly for B2B merchants who process transactions qualifying for Level 2 and Level 3 processing rates. EBizCharge also provides a flat-rate pricing model, which promotes transparency by eliminating hidden fees and unpredictable monthly bills.

EBizCharge seamlessly integrates with various ERP and accounting systems to streamline the payment collection process, thus reducing manual entry and associated errors which can lead to additional charges.

The EBizCharge payment software offers advanced security measures, including tokenization and encryption, to minimize the risk of fraud-related costs.

Additionally, EBizCharge provides excellent customer support and a user-friendly experience, potentially decreasing the need for costly technical support and system downtimes that could affect sales volume.

By focusing on these areas, EBizCharge aims to provide the most cost-effective solution for merchants that assists them in maintaining a competitive edge in today’s market.