Blog > What Is A Merchant Payment Gateway?

What Is A Merchant Payment Gateway?

If your business accepts credit card payments, you probably use a merchant payment gateway to process them. But what exactly is a payment gateway?

Simply put, a merchant payment gateway is cloud-based credit card processing software.

A payment gateway facilitates communication between the different entities in a credit card transaction. This includes the merchant’s bank, the card-issuing bank, the credit card network, and all parties in between. It functions as the engine under the hood, doing all of the hidden back-end work of processing credit cards. The processes of a payment gateway ensure that everything runs smoothly and the merchant receives the funds into their account.

A credit card transaction begins when the customer swipes their card or supplies their information to the merchant. The merchant enters this information into their system. It passes through the payment gateway and then on to several different entities. For the card to receive approval, the gateway must send a message to the credit card network and the card-issuing bank, and then back to the merchant. And that’s just the first step in the process!

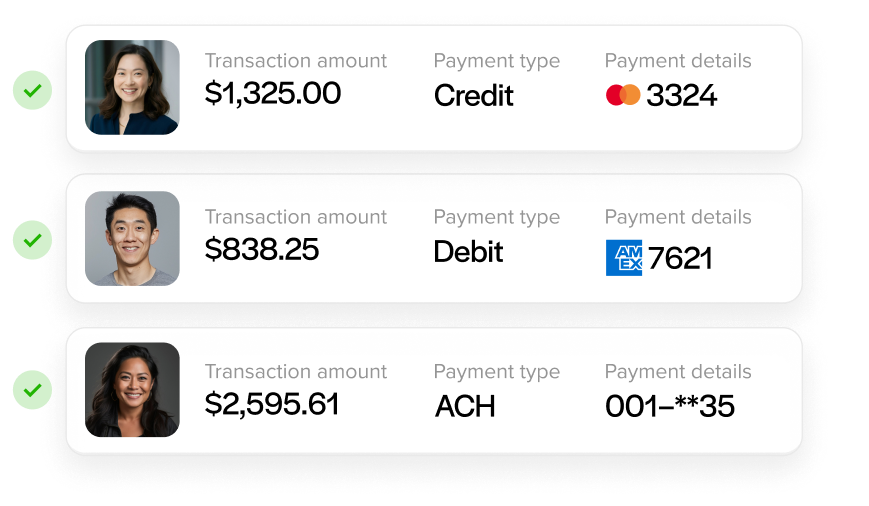

Payment gateways do more than ferry messages between entities in the transaction process. Oftentimes, they feature useful tools and integrations to help merchants save time and money.

Some payment gateways have built-in virtual terminals, allowing merchants to accept credit card payments directly within the payment gateway. And some payment gateways integrate into accounting (also called ERP, or Enterprise Resource Planning) software and eCommerce shopping carts, acting as the back-end processing software.

A payment gateway integrated into an ERP allows merchants to run and accept credit card payments within the native environment of their ERP. An eCommerce integration powers online shopping carts that can accept credit cards.

When choosing a merchant payment gateway, you should consider several features.

Support

If you own a business that accepts credit card payments, you want a payment gateway provider that offers 24/7 support. Accepting credit card payments can pose risks—a card may be declined, or a customer may issue a chargeback, for instance. Having the support you need at the time you need it will keep your business running smoothly.

Security

Handling credit card information carries serious responsibility. Businesses don’t want to be held liable for breaches or compromised data. Look for a payment gateway provider that adheres to strict PCI compliance standards and takes steps to safely store customer data. Encryption and tokenization are best practices that can set payment gateway providers apart. Don’t let lackadaisical security come back to haunt you. Invest in a provider that uses the latest technology to protect customer information.

Savings

Not all payment gateway providers offer the same pricing plans. Some providers utilize level 3 processing in order to cut interchange rates and slash fees, while flat rate pricing ensures that merchants won’t lose money to transaction fees. Bottom line: read the fine print, check the pricing, and make sure you choose to partner with a provider who will truly add value to your business.

Reporting

Finally, look for a payment gateway that gives you comprehensive and flexible reporting tools. These will allow you to better manage your credit card transactions. You’ll be able to drill down, better understand the data, and make changes to enhance your future profitability.

Merchant payment gateways streamline the credit card payment process. Find a payment gateway provider you can partner with, and you’ll be empowered with tools and features that save time and money.