Blog > What is a Doubtful Account?

What is a Doubtful Account?

Every business has to deal with its share of issues, especially when collecting and managing invoices. While there are strategies to prevent and mitigate late payments and financial discrepancies, no merchant is immune to a doubtful account.

A doubtful account, also known as a doubtful debt, refers to an account receivable or invoice with the potential to become a bad debt in the future.

What causes a doubtful account?

When it comes to doubtful accounts, not every situation is the same — doubtful accounts can be caused by many different scenarios.

Some of the most common causes of doubtful accounts include consumer disputes, insufficient funds, and miscommunications between businesses and their customers.

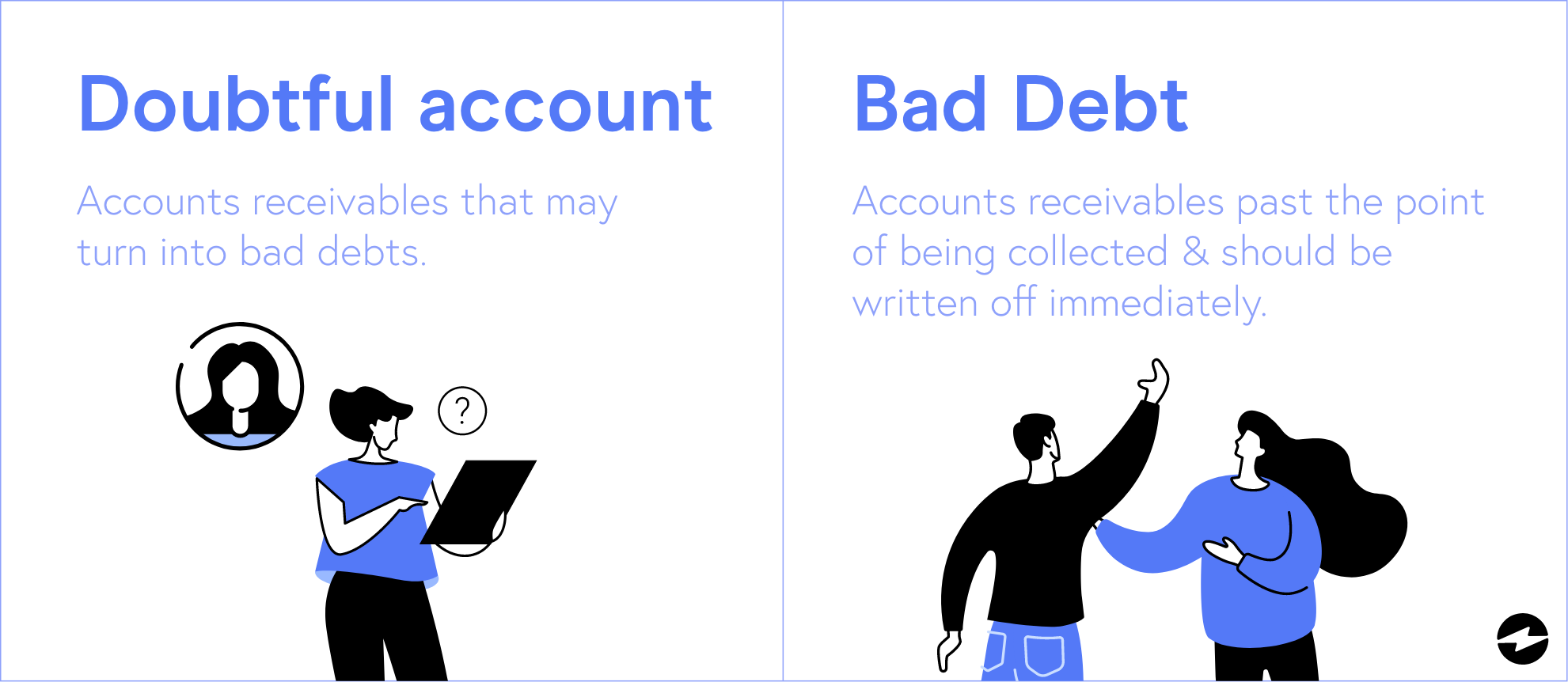

What’s the difference between a doubtful account and a bad debt?

It’s crucial for merchants to know the difference between a doubtful account and a bad debt, so that they don’t confuse the two and lose out on collecting an invoice.

Doubtful accounts or doubtful debts are accounts receivables that may turn into bad debts, whereas bad debts are past the point of being collected and should be written off immediately.

The importance of tracking and creating an allowance for doubtful accounts

Since doubtful accounts can lead to bad debts which can negatively affect your business and its cash flow, it’s important to monitor and track these accounts.

Merchants can actively track doubtful debts by creating an allowance for doubtful accounts (ADA) which is recorded on a balance sheet that consists of your company’s assets, liabilities, and equity.

The allowance for doubtful accounts on the balance sheet is the total amount of unpaid invoices or debt subtracted from accounts receivable, and is listed as a deduction below the accounts receivable line item. This deduction is categorized as a contra asset because it decreases your accounts receivable.

Once an allowance for doubtful accounts is established, businesses can best estimate the number of invoices that will go unpaid which enables them to anticipate bad debt losses and make more informed financial decisions moving forward.

How merchants can calculate their doubtful accounts

Merchants can take advantage of several methods to calculate and predict doubtful accounts which will help them better manage invoice collections and their overall finances.

Each doubtful account calculation method provides valuable insights into consumer activity, high-risk behavior, and more, allowing businesses to alter their collection approach and financial operations to yield the greatest return.

Three common methods merchants can use to calculate their doubtful accounts include:

- Historical percentage method

- Accounts receivable (AR) aging method

- Customer risk classification method

How to calculate doubtful accounts using the historical percentage method

Businesses can calculate and predict future doubtful accounts using a historical percentage of credit sales or total accounts receivable collected.

Merchants can use the historical percentage method by reviewing their collection data to determine their total AR or credit sales for a given time period and the average percentage of invoices that were written off during that period.

The percentage of uncollected sales can be applied to each period’s credit sales as a debit to the bad debt expense account and a credit to allowance for doubtful accounts.

Example: If 2% of your sales were uncollectible, set aside 2% of your sales in your allowance for doubtful accounts. If you have $100,000 in accounts receivable, your allowance for doubtful accounts will be $2,000 ($100,000 x 2%).

Every business has to deal with its share of issues, especially when collecting and managing invoices. While there are strategies to prevent and mitigate late payments and financial discrepancies, no merchant is immune to a doubtful account.

A doubtful account, also known as a doubtful debt, refers to an account receivable or invoice with the potential to become a bad debt in the future.

What causes a doubtful account?

When it comes to doubtful accounts, not every situation is the same — doubtful accounts can be caused by many different scenarios.

Some of the most common causes of doubtful accounts include consumer disputes, insufficient funds, and miscommunications between businesses and their customers.

What’s the difference between a doubtful account and a bad debt?

It’s crucial for merchants to know the difference between a doubtful account and a bad debt, so that they don’t confuse the two and lose out on collecting an invoice.

Doubtful accounts or doubtful debts are accounts receivables that may turn into bad debts, whereas bad debts are past the point of being collected and should be written off immediately.

The importance of tracking and creating an allowance for doubtful accounts

Since doubtful accounts can lead to bad debts which can negatively affect your business and its cash flow, it’s important to monitor and track these accounts.

Merchants can actively track doubtful debts by creating an allowance for doubtful accounts (ADA) which is recorded on a balance sheet that consists of your company’s assets, liabilities, and equity.

The allowance for doubtful accounts on the balance sheet is the total amount of unpaid invoices or debt subtracted from accounts receivable, and is listed as a deduction below the accounts receivable line item. This deduction is categorized as a contra asset because it decreases your accounts receivable.

Once an allowance for doubtful accounts is established, businesses can best estimate the number of invoices that will go unpaid which enables them to anticipate bad debt losses and make more informed financial decisions moving forward.

How merchants can calculate their doubtful accounts

Merchants can take advantage of several methods to calculate and predict doubtful accounts which will help them better manage invoice collections and their overall finances.

Each doubtful account calculation method provides valuable insights into consumer activity, high-risk behavior, and more, allowing businesses to alter their collection approach and financial operations to yield the greatest return.

Three common methods merchants can use to calculate their doubtful accounts include:

- Historical percentage method

- Accounts receivable (AR) aging method

- Customer risk classification method

How to calculate doubtful accounts using the historical percentage method

Businesses can calculate and predict future doubtful accounts using a historical percentage of credit sales or total accounts receivable collected.

Merchants can use the historical percentage method by reviewing their collection data to determine their total AR or credit sales for a given time period and the average percentage of invoices that were written off during that period.

The percentage of uncollected sales can be applied to each period’s credit sales as a debit to the bad debt expense account and a credit to allowance for doubtful accounts.

Example: If 2% of your sales were uncollectible, set aside 2% of your sales in your allowance for doubtful accounts. If you have $100,000 in accounts receivable, your allowance for doubtful accounts will be $2,000 ($100,000 x 2%).

How to calculate doubtful accounts using the accounts receivable aging method

Another way merchants can estimate doubtful accounts is by using the accounts receivable aging method.

The AR aging method works by grouping outstanding customer invoices by date range — the amount of time invoices have been past due. Merchants can then assign a specific percentage for each group based on the number of invoices that will likely go uncollected.

The accounts receivable aging method is best suited for bigger businesses with more customers and multiple credit cycles.

Example: Your business has 5% of accounts receivable invoices that are 31-60 days past due. In this group, your invoices total $5,000 ($5,000 x 5% = $250). You also have 3% of invoices less than 30 days past due, and your invoices total $7,000 ($7,000 x 3% = $210). Your estimate of doubtful accounts for both AR aging periods would total $460 ($250 + $210).

How to calculate doubtful accounts using the customer risk classification method

Lastly, merchants can calculate doubtful accounts using the customer risk classification method.

Instead of assigning a percentage to each aging group like in the previous method, the customer risk classification method assigns each customer a percentage or risk score by assessing their payment collection history and calculating the percentage of invoices they’re likely to not pay.

After estimating their doubtful accounts, businesses can then segment these customers into risk categories based on their scores (I.e. low-risk, high-risk) and handle them accordingly.

How can doubtful accounts affect your accounts receivable?

Doubtful accounts are a crucial part of every company’s accounts receivable process because they can significantly impact your cash flow and overall monetary success.

If not efficiently monitored and addressed, doubtful accounts will likely become uncollectible invoices that convert into bad debts. These debts will add up and put a strain on your working capital which can lead to a lot of financial turmoil for your business over time.

Merchants can automate their accounts receivable to reduce doubtful accounts

Luckily, merchants can optimize their payment collections and reduce their doubtful accounts that can lead to bad debts by automating their accounts receivable process.

Finding a reliable payment software provider to efficiently automate your accounts receivable collections will be highly beneficial for your business, as it provides real-time reporting tools and analytics that will help you actively identify, track, and mitigate doubtful accounts.