Blog > What are Returned Check Fees: Definitions, Costs, and Prevention Strategies

What are Returned Check Fees: Definitions, Costs, and Prevention Strategies

Unexpected expenses and insufficient funds can result in returned checks, leading to hefty fees and significant financial challenges. The repercussions of such incidents extend beyond monetary losses to one’s economic reputation and legal ramifications.

Therefore, businesses should understand the costs associated with returned checks to optimize their financial planning.

What is a returned check fee?

A returned check fee, often known as a bounced check fee or nonsufficient funds (NSF) fee, is a charge imposed by a financial institution when a check can’t be processed due to insufficient funds in the associated account.

The cost of a returned check fee varies amongst banks, credit unions, and other entities but typically ranges from $25 to $35. This fee covers the direct costs of processing a failed payment, including the bank’s administrative and overhead costs. The receiver of the check can also charge the check writer additional fees for the inconvenience and potential indirect expenses, such as delayed payment.

Preventing returned check fees is crucial for maintaining a healthy credit score and avoiding additional bank fees or credit report issues. One effective prevention strategy is to monitor account balances and set up overdraft protection closely. Opting for online bank services or direct deposit can also reduce the likelihood of insufficient funds.

Understanding the various costs associated with returned check fees and their impact on financial health is essential.

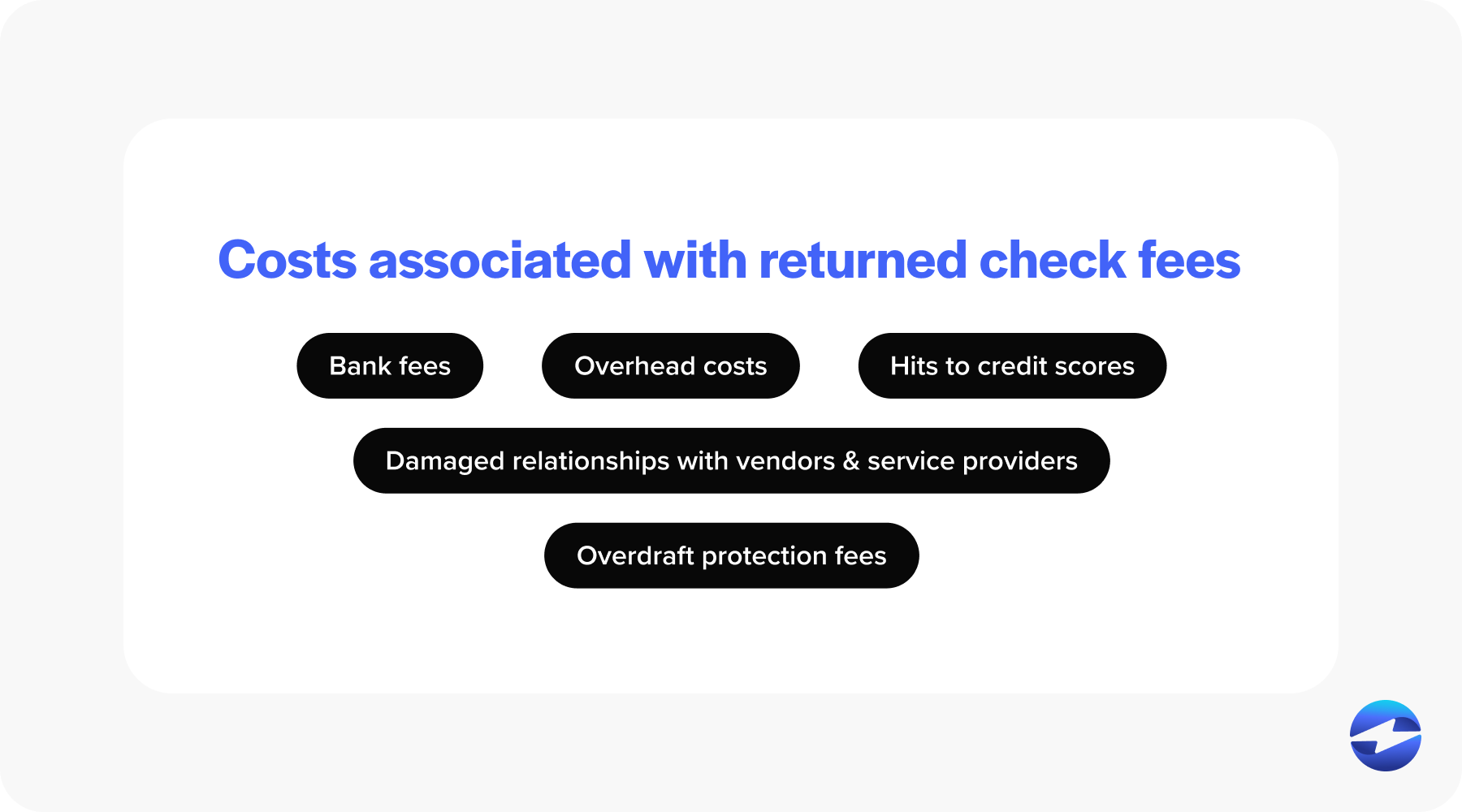

Costs associated with returned check fees

Recipients may incur significant direct costs, sometimes even higher than the original fee, to cover the administrative expenses of handling a returned check. These costs can include bank fees and overhead costs, such as time needed for employees to resolve the issue.

Indirect costs may also arise, such as potential hits to credit scores and relationships with vendors or service providers, including health care providers or behavioral health services.

On the other hand, prevention costs include fees for services like overdraft protection plans that can prevent the check from bouncing. While these services can save the check writer from NSF fees, they come with their own costs.

For example, overdraft protection fees can range from $10 to $35 per transfer, depending on the financial institution. Some banks also charge a monthly maintenance fee for overdraft protection services, which can be around $5 to $10. Despite these costs, overdraft protection can save money in the long run by avoiding the higher fees associated with returned checks.

A prevention strategy to avoid these fees can include monitoring account balances closely, setting up direct deposits, and maintaining sufficient funds before issuing a check.

Alongside the costs of returned checks, additional consequences should be considered.

Consequences of writing a bad check

Writing a bad check where funds are unavailable in the bank account can trigger several adverse outcomes.

The most immediate repercussion is the returned check fee imposed by the financial institution. Not only does the check writer face this financial penalty, but also the chance of strained relationships with merchants and financial providers.

Repeatedly issuing checks with insufficient funds may lead to the person’s bank account being closed.

Financial penalties

Issuing a check without sufficient funds leads to direct financial penalties in the form of bank fees. It can also involve additional charges from the recipient’s bank.

The average cost for nonsufficient funds can range broadly, typically around $25 for each bad check. Bounced checks may also lead to more significant overhead for businesses seeking to recover funds and manage the administrative burden.

While bounced checks aren’t directly reported to credit bureaus, continued financial mismanagement reflected in nonsufficient funds incidents can indirectly affect a check writer’s credit score. Banks may report the account holder to a consumer reporting agency that tracks banking histories or debts may be turned over to collection agencies. In that case, it will likely be reported and can negatively impact a person’s credit score.

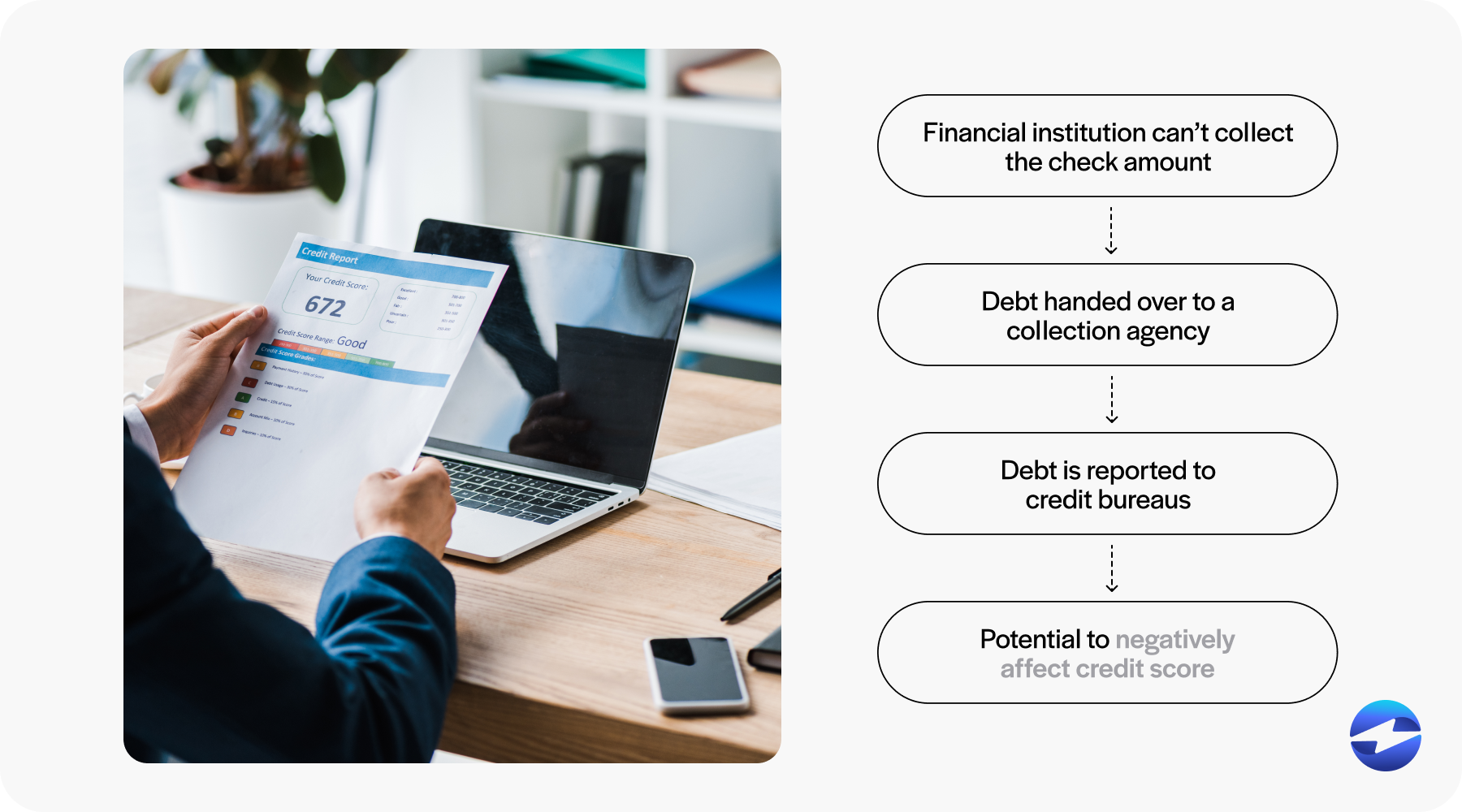

Potential impact on credit score

While NSF fees aren’t directly reported to credit bureaus, the consequences of a bounced check can lead to bad scores.

Suppose a financial institution can’t collect the check amount after it’s returned. The debt may be handed over to a collection agency. Once a debt is in collections, it’s typically reported to credit bureaus. This derogatory mark can stay on a credit report for up to seven years, negatively affecting the credit score.

Furthermore, continuous overdrafts associated with bounced checks may lead a bank to close a checking account. The closure can indirectly affect credit scores if reported and when opening new bank accounts in the future.

Legal aspects and consumer rights

Writing a bad check can have legal consequences in some instances. Depending on the check amount and other factors, individuals can face misdemeanors or felony charges in some states.

That said, consumers have rights that protect them from abusive collection practices, are entitled to dispute errors, and can seek legal advice. Individuals must be aware of their rights and the consequences of financial carelessness.

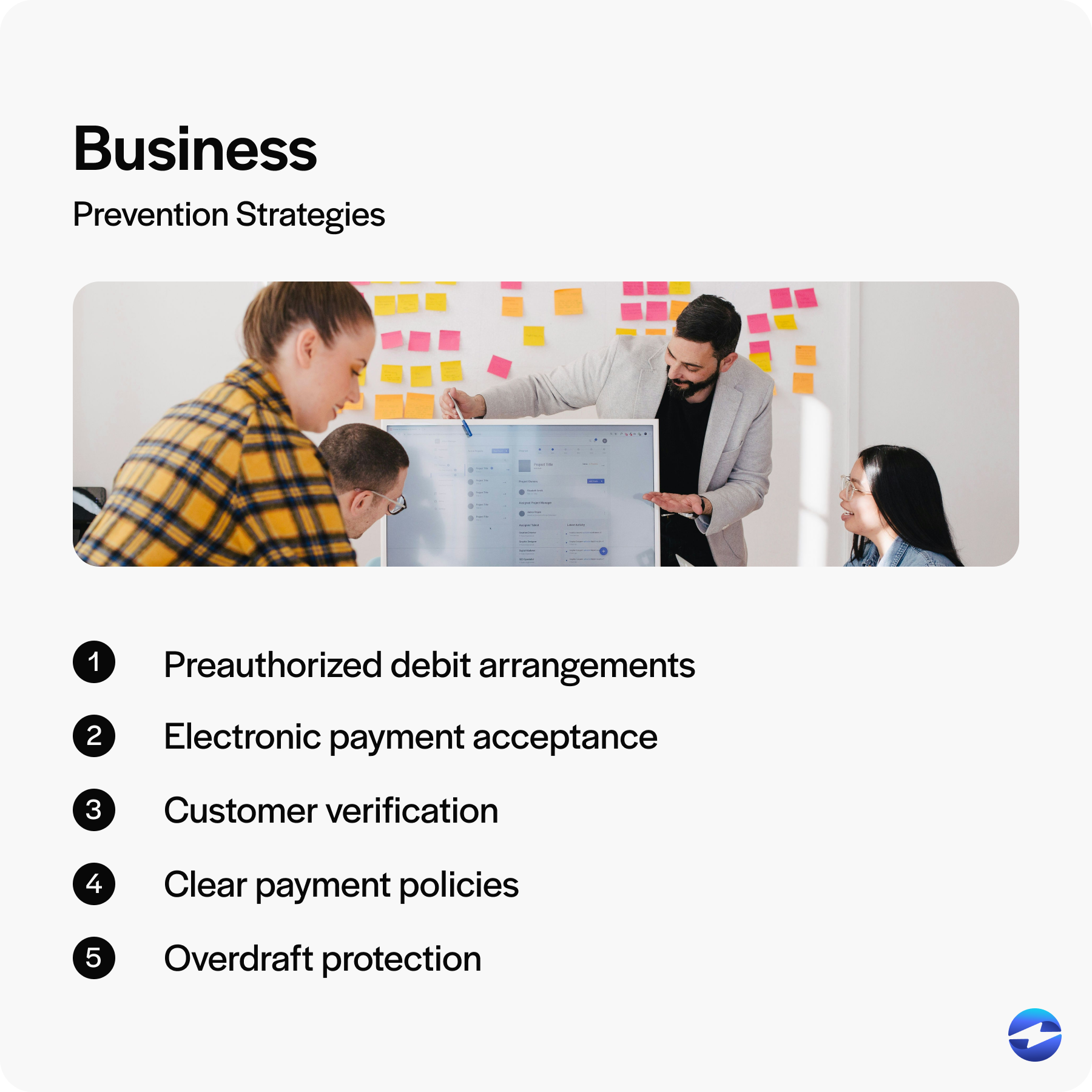

5 prevention strategies for businesses

Prevention strategies for businesses to avoid returned check fees involve a mix of proactive measures and financial tools.

Here are five returned check prevention strategies your business can implement:

- Preauthorized debit arrangements: Encouraging customers to set up automatic payments via direct deposit minimizes the likelihood of checks bouncing and, consequently, returned check fees.

- Electronic payment acceptance: Offering online payments or electronic funds transfers (EFTs) can reduce reliance on physical checks. This modernizes payment collection and reduces overhead costs related to check processing.

- Customer verification: Verification services can alert businesses that the check initiator’s account has sufficient funds before accepting a bad check, thus avoiding situations of insufficient funds.

- Clear payment policies: Implementing and communicating clear payment terms may deter customers from writing checks when funds aren’t available, reducing the incidence of bounced checks and associated fees.

- Overdraft protection: Businesses that issue checks can set up overdraft protection with their financial institution to prevent checks from bouncing, safeguard the business’s credit score, and prevent additional bank fees.

Connecting your payment solution to your accounting software makes the shift to electronic payments even more effective. A QuickBooks credit card integration lets businesses accept credit card and ACH payments directly within their accounting system, reducing the need for paper checks altogether. Manufacturers and distributors can take the same approach with payment processing for Epicor, which processes electronic payments within the ERP and eliminates the manual handling that comes with check-based collections. Both options help businesses move away from the risks and costs of returned checks while keeping their financial records accurate.

By adopting these strategies, companies can manage direct costs associated with returned checks, safeguard their financial stability, and ensure smoother transactions for their business and customers.

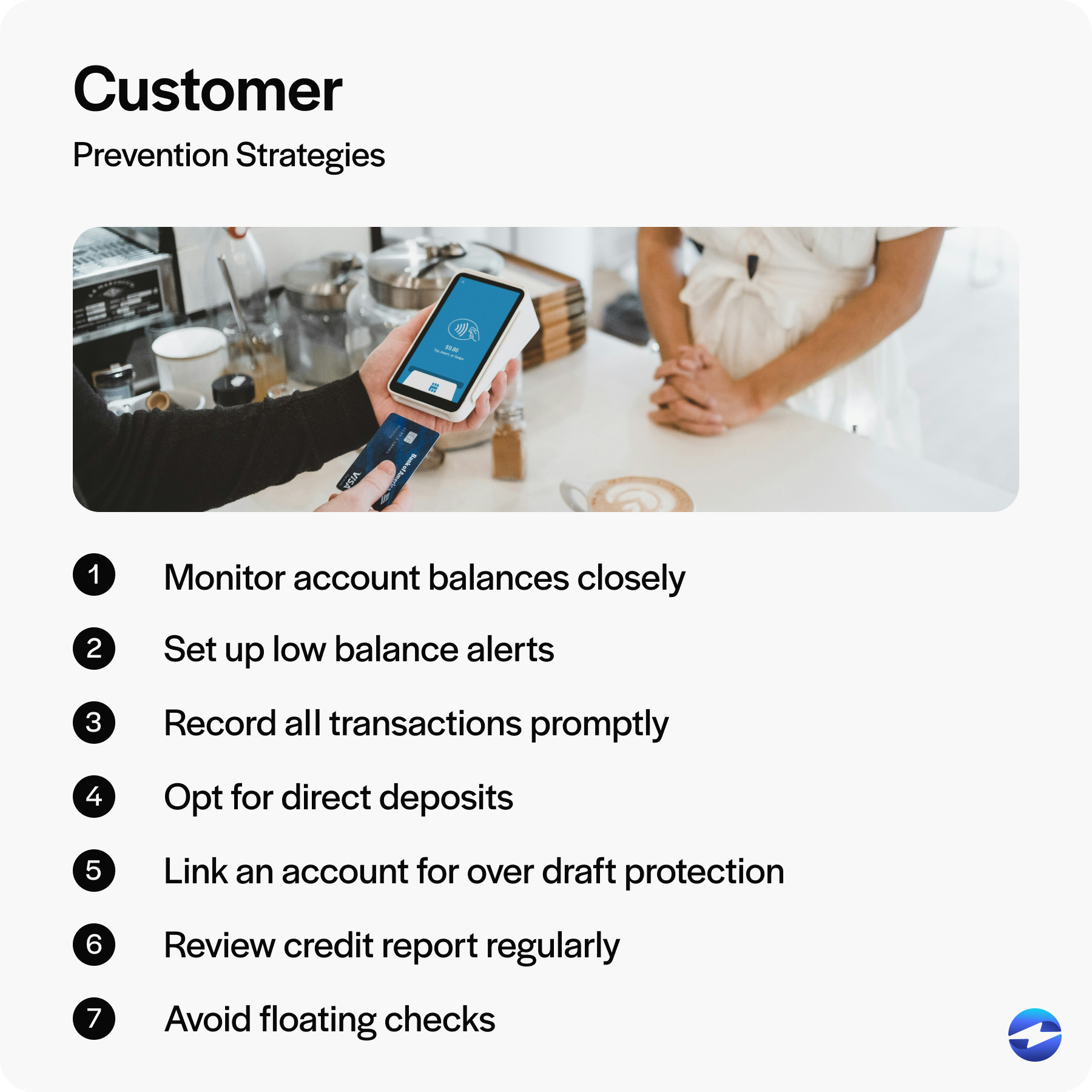

7 prevention strategies for consumers

Preventative measures are vital in avoiding the inconvenience and expense of returned check fees.

Here are seven strategies consumers can adopt to avoid returned checks:

- Monitor account balances closely to ensure sufficient funds are available before writing checks.

- Set up low balance alerts with your bank or credit union to receive notifications when your account drops to a certain amount.

- Record all transactions promptly. This includes checks, debit card purchases, and any automatic withdrawals.

- Opt for direct deposits from employers and other sources of income to ensure funds are promptly and securely deposited into accounts, thus reducing the risk of timing issues that can lead to insufficient funds.

- Link a savings account to your checking account for overdraft protection. Many financial institutions offer this service, which can transfer funds automatically if the checking account balance is too low.

- Review your credit report regularly for accuracy. Any issues with returned checks can negatively impact your credit score.

- Avoid floating checks. Writing a check hoping to deposit funds before it clears is risky and can lead to bounced checks and additional fees.

Implementing these strategies will reduce the likelihood of incurring returned check fees and help maintain financial health.

Minimize the risk of returned check fees

Managing returned check fees is essential for maintaining financial health and avoiding unexpected costs. These fees can accumulate, impacting both individuals and businesses significantly.

Understanding the causes and consequences of returned checks and implementing effective prevention strategies, such as monitoring account balances, setting up overdraft protection, and using electronic payment methods, can help minimize the risk of incurring these fees.