Blog > Understanding The 3 Core Principles of Accounting

Understanding The 3 Core Principles of Accounting

Accounting can often seem complex, yet at its core lies a set of fundamental principles that guide these financial operations. Understanding these principles not only clarifies financial transactions but also enhances decision-making in personal and business matters.

This article will explore the three golden rules of accounting and answer frequently asked questions about accounting practices.

What is accounting?

Accounting is a systematic process of recording, classifying, summarizing, and interpreting financial data. It involves the detailed and comprehensive recording of transactions and the preparation of various financial statements that are critical for decision-making.

At its core, accounting is like a language companies use to communicate their financial health to stakeholders, including investors, creditors, and regulatory agencies.

With accounting, business owners and managers can track their revenues and expenses, assess their financial position, and adjust their operations as needed. Therefore, it plays a pivotal role in any business’s financial management and strategic planning, aiming for profitability and long-term sustainability.

The financial records maintained through accounting are fundamental to producing accurate financial reports such as the income statement, cash flow statement, and balance sheet.

With the proper accounting practices in place, businesses can ensure compliance with accounting standards and regulatory requirements, such as generally accepted accounting principles (GAAP), International Financial Reporting Standards (IFRS), tax regulations, and more.

The following section will explain the three golden rules of accounting that serve as a framework to record and interpret financial transactions accurately.

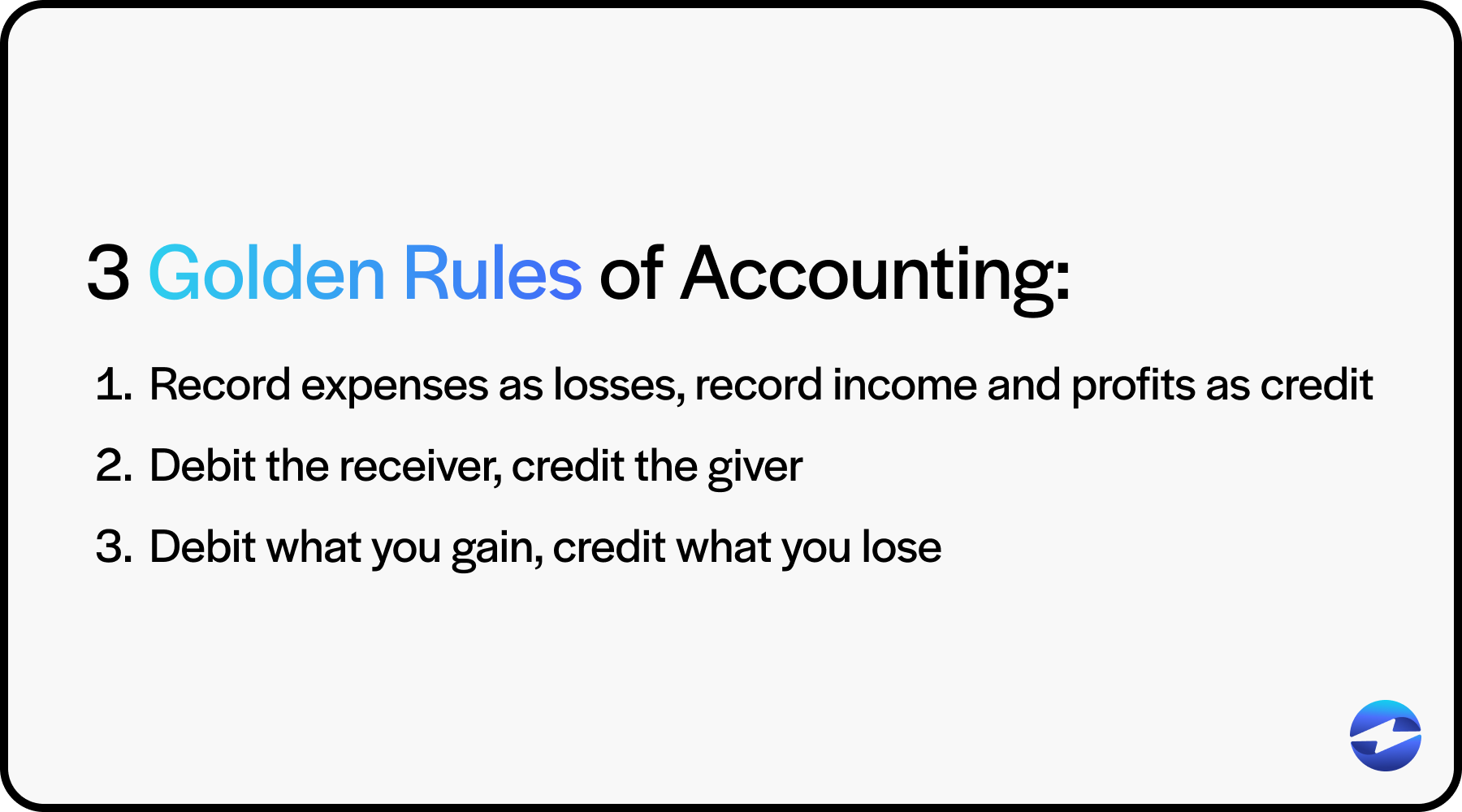

The 3 golden rules of accounting

Accounting is grounded in a set of three fundamental concepts and principles that ensure consistency, clarity, and comparability of financial statements.

The three golden rules of accounting are:

- Record expenses as losses, record income and profits as credit

- Debit the receiver, credit the giver

- Debit what you gain, credit what you lose

These 3 golden rules of accounting facilitate a uniform approach to recording financial events and enhance the accuracy and transparency of financial reporting.

1. Record expenses as losses, record income and profits as credits

The record expenses as losses, record income and profits as credits rule focuses on nominal accounts, which deal with a company’s revenues, expenses, gains, and losses.

Whenever a business incurs an expense, such as paying salaries or purchasing supplies, it’s recorded as a debit. Conversely, any income or gains, like revenue from sales, are recorded as credits. This rule helps businesses keep a clear record of all inflows and outflows, ensuring that financial performance is properly reflected in the accounts.

2. Debit the receiver, credit the giver

The debit the receiver, credit the giver rule applies to personal accounts involving individuals or entities in transactions. This rule adheres to the principles of the double-entry system, which requires that for every transaction, there must be equal and opposite entries to ensure balance.

The foundation of the double-entry system consists of the simple premise that every transaction has two sides: debit and credit. Essentially, whenever a business receives something of value, such as cash or services, the receiver is debited. The party providing or giving the value is credited.

This rule is essential for tracking transactions between parties, such as loans, payments, or transfers, ensuring clarity about who owes or owns what.

3. Debit what you gain, credit what you lose

The debit what you gain, credit what you lose rule pertains to real accounts, which include assets like cash, inventory, or property.

When a business gains an asset, such as buying inventory or acquiring property, it’s recorded as a debit. When an asset is used up or leaves the business, such as when inventory is sold or cash is paid out, it’s credited.

This rule ensures that businesses can track their assets properly, so the balance sheet accurately reflects what the company owns and owes at any given time.

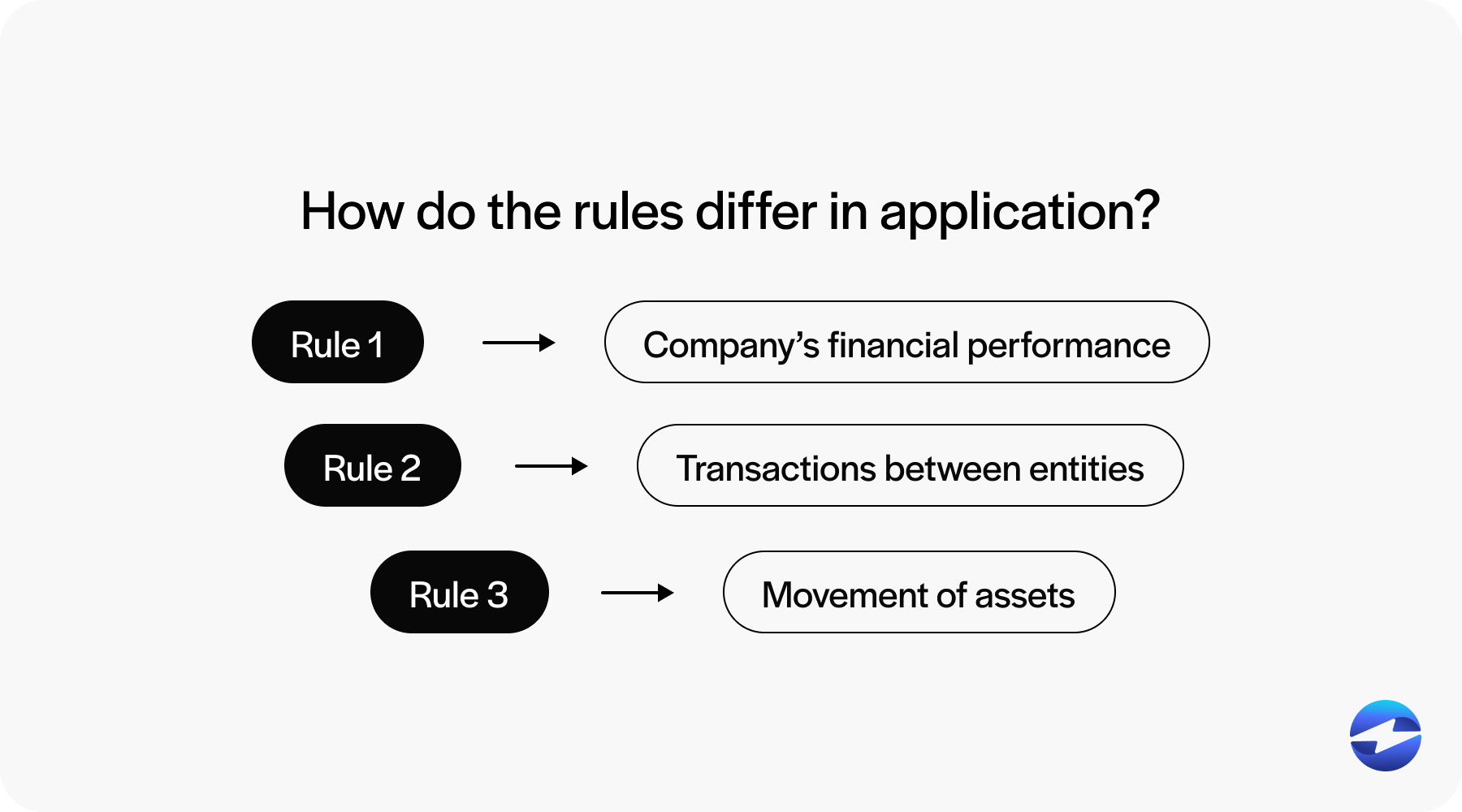

While all three rules operate within the double-entry system, they differ in their application.

The first rule deals with a company’s financial performance (expenses and revenues), the second tracks transactions between entities (personal accounts), and the third manages the movement of assets (real accounts). These differences ensure that businesses’ finances are correctly and consistently recorded.

The three core principles of accounting are to record all expenses and losses as debits and record all incomes and profits as credits, debit the receiving party and credit the giver, and debit what you gain and credit what you lose.

For a more streamlined approach to accounting, businesses can work with comprehensive payment solutions like EBizCharge.

Simplify your accounting processes with EBizCharge

EBizCharge is designed to simplify the accounting processes, enabling companies to enhance and streamline payment operations.

For example, small businesses can connect a QuickBooks payment gateway to automatically record every transaction as it happens, keeping debits and credits accurate without manual journal entries. Mid-market teams using Sage Intacct can achieve the same with Sage Intacct payment processing, which posts payments directly to the general ledger in real time. Both options help ensure your books stay aligned with the three golden rules from day one.

By seamlessly integrating with accounting software, this top-rated payment processing solution reduces manual data entry, minimizes errors, and enhances the transaction experience. Its user-friendly platform ensures fast and secure payment processing, which can lead to improved cash flow management.

Through features like tokenization and encryption, EBizCharge offers a high level of security, thereby ensuring the protection of sensitive financial data. Its ability to facilitate various payment methods also provides flexibility for both businesses and their customers. With comprehensive reporting tools, users can easily analyze financial data, improving business decisions and financial health.

EBizCharge simplifies accounting processes to enable businesses to focus on core activities while managing financial transactions, enhancing reporting accuracy, understanding their economic standing, and complying with accounting standards and principles.