Blog > Understanding Cash Flow: Problems and Solutions

Understanding Cash Flow: Problems and Solutions

Cash flow is crucial for any business, yet many companies find themselves drowning in financial uncertainty. Therefore, understanding cash flow management is essential for maintaining financial health and ensuring long-term success.

This article will explore the intricacies of cash flow, common issues that arise, and practical strategies to navigate these challenges, equipping your business with the knowledge needed to safeguard its financial future.

What is cash flow management?

Cash flow management is the process of monitoring, analyzing, and optimizing the movement of money in and out of a business.

With proper cash flow management, a company can ensure it has enough cash to cover its expenses, such as payroll, rent, and supplier payments, while maintaining sufficient reserves for unexpected costs of investment opportunities.

Effective cash flow management includes tracking cash inflows (sales revenue, loans, etc.) and outflows (operating expenses, debt repayments, etc.).

By forecasting future cash needs, managing payment schedules, and identifying potential shortfalls, businesses can maintain financial stability, avoid liquidity issues, and support sustainable growth.

Since cash flow problems can lead to financial instability, it’s crucial to identify the causes of these problems and find solutions before they lead to any significant damage.

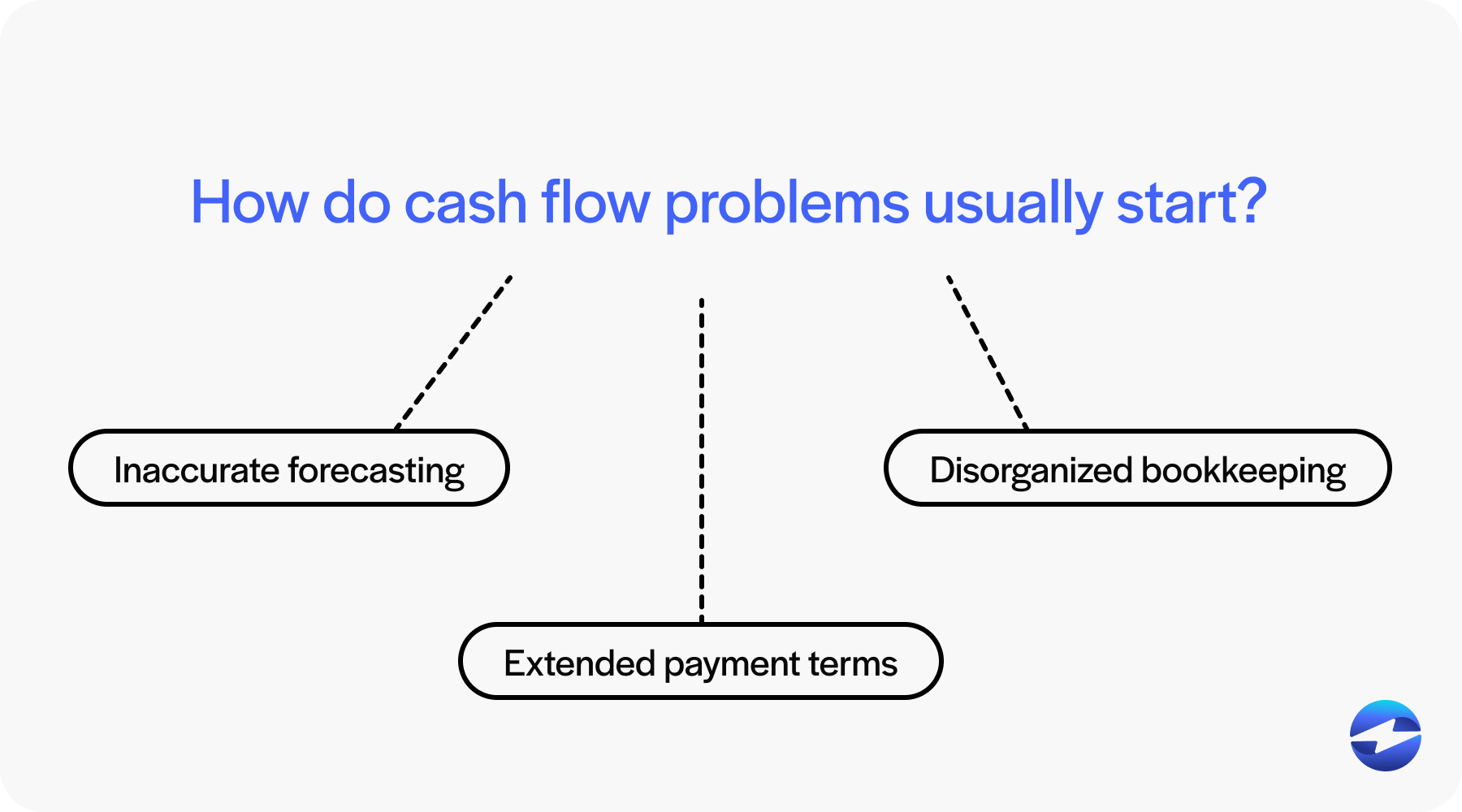

How do cash flow problems usually start?

Cash flow problems often start when a business spends more than it earns, which can be due to several factors.

Inaccurate forecasting, extended payment terms, and disorganized bookkeeping are significant contributors to cash flow problems.

Inaccurate forecasting undermines a business’s ability to plan effectively, as overestimating revenues or underestimating expenses can create a false sense of financial security, leading to overspending or insufficient preparation for lean periods.

Extended payment terms, while often offered to attract or retain clients, can delay the inflow of cash needed to cover operational costs, creating a misalignment between incoming and outgoing funds. This problem is exacerbated when customers delay payments beyond agreed terms, leaving the business struggling to meet its obligations.

Meanwhile, disorganized bookkeeping compounds these issues by obscuring the true financial picture, making it challenging to track overdue payments, assess cash reserves, or identify potential problems before they escalate.

These factors can domino into other problems with cash flow that strain liquidity and diminish a business’s ability to operate efficiently.

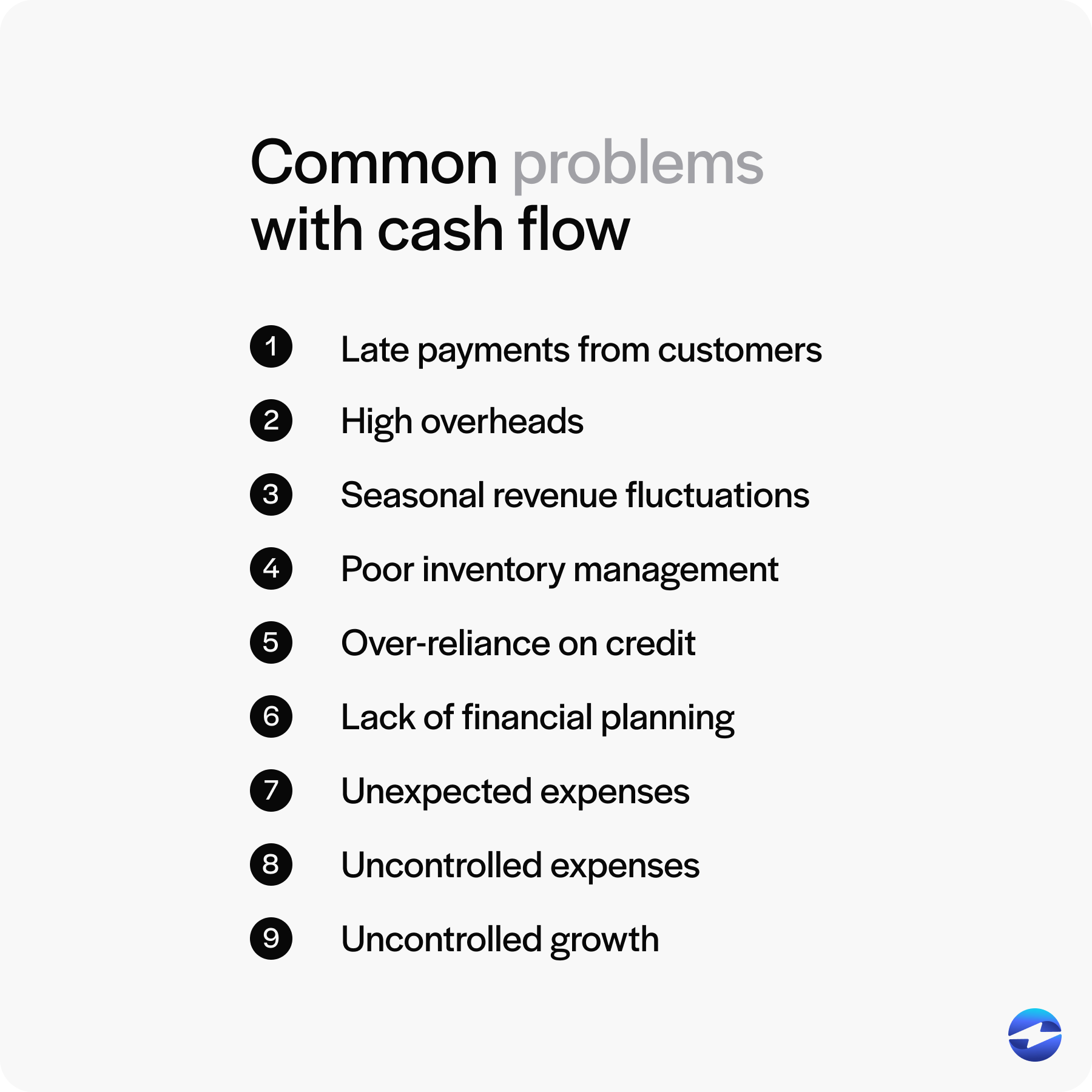

9 common problems with cash flow

Understanding common cash flow problems is vital to the success of any company, regardless of the industry.

Cash flow issues can impact your ability to pay bills, invest in growth, and sustain operations. By knowing these issues, you can prepare better and find solutions.

Here are nine common problems with cash flow to familiarize yourself with:

- Late payments from customers: Late payments are a common cash flow problem. When invoices remain unpaid, your cash inflows slow down. This can make it difficult to meet your business expenses on time.

- High overheads: High overhead costs, including rent and salaries, can hurt cash flow. When these costs are higher than expected, they eat into profits. This leaves less money available for other financial needs.

- Seasonal revenue fluctuations: Seasonal revenue fluctuations can lead to cash flow challenges. Businesses with sales peaking in certain months may struggle during off-seasons. Managing cash flows during these periods is crucial to stay solvent year-round.

- Poor inventory management: Poor inventory management can disrupt cash flow. Holding too much stock ties up cash that could be used elsewhere. Conversely, too little stock can lead to missed sales opportunities.

- Over-reliance on credit: Over-reliance on credit is risky for cash flow. While credit can cover immediate expenses, high interest rates and repayments can drain your cash reserves over time.

- Lack of financial planning: A lack of financial planning often results in cash flow problems. Without planning, it’s hard to predict cash inflows and outflows and can lead to surprises that hinder your financial stability.

- Unexpected expenses: Unexpected expenses can create sudden cash flow issues. Equipment failures or urgent repairs can require immediate spending, which strains cash reserves and leads to negative cash flow.

- Uncontrolled expenses: Uncontrolled expenses can quickly deplete cash resources. Regularly reviewing business expenses helps prevent unnecessary costs from spiraling out of control.

- Uncontrolled growth: Rapid expansion may sound appealing but often requires significant capital. When growth outpaces financial resources, it can lead to cash shortages.

While cash flow problems can result from many different circumstances, there are solutions for these problems.

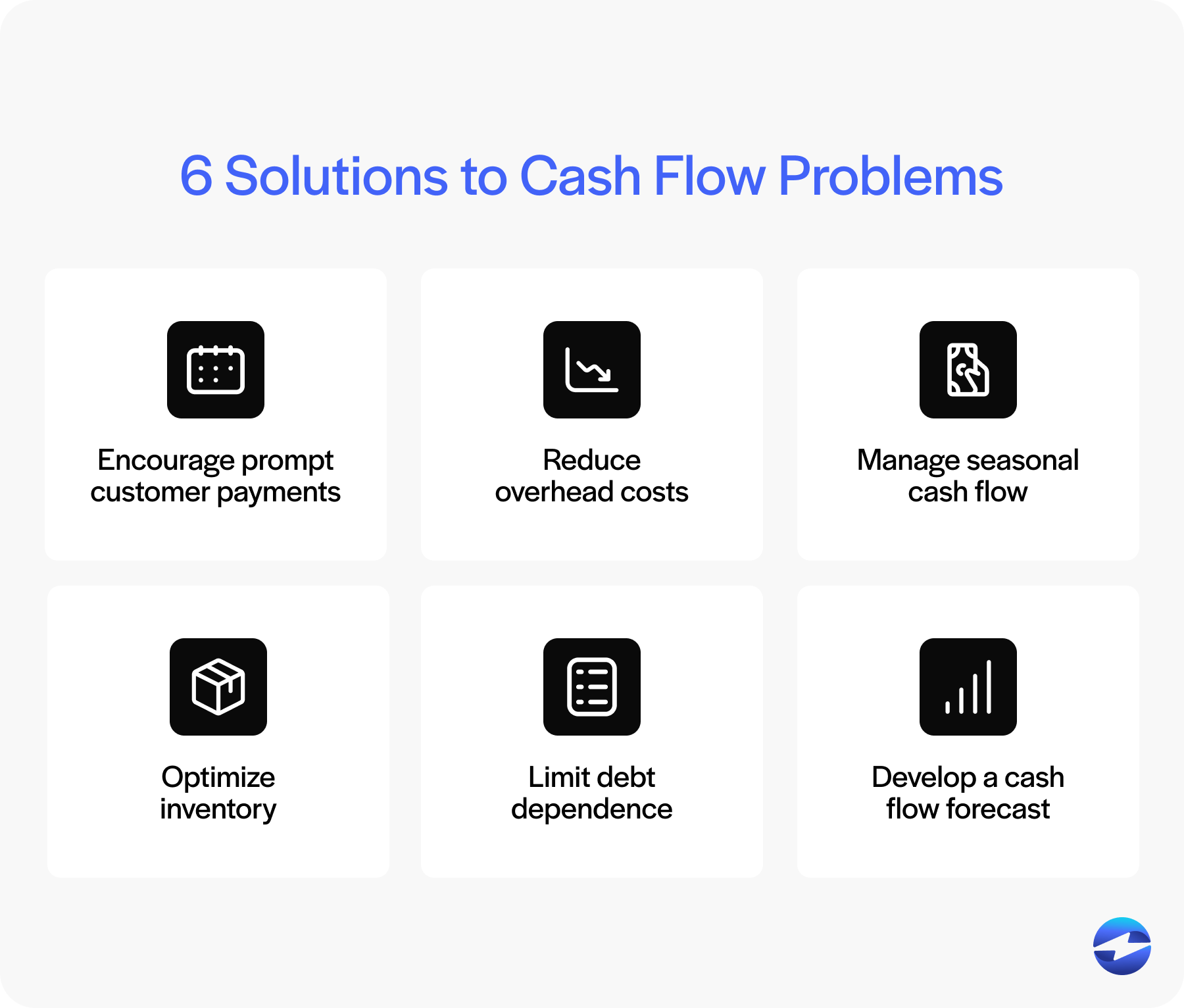

6 solutions to cash flow problems

It can be challenging to keep up with expenses without positive cash flow, making awareness of solutions to cash flow problems essential to prevent these financial issues and improve operations.

Quickly solving cash flow problems can allow your business to avoid profitability dips, which can harm your growth initiatives and overall stability.

Thankfully, you can implement these six solutions to mitigate and address cash flow concerns:

- Encourage prompt customer payments: Encouraging prompt payments can boost cash inflows. Offer payment discounts for early payments. Send invoices promptly and follow up on unpaid invoices. Online payment systems can also make it easy for customers to pay on time.

- Reduce overhead costs: Cutting unnecessary business expenses can help with high overhead costs. Look at your current costs and find areas to reduce them. Consider energy-saving options or negotiate better rates for utilities. Lowering costs can improve cash flow and increase profit margins.

- Manage seasonal cash flow: Many businesses face seasonal fluctuations. These affect cash flow during different times of the year. Creating a cash reserve during peak seasons can help manage lean periods. Adjusting business operations to match the season can also prevent cash flow challenges.

- Optimize inventory: Since excess inventory can tie up cash that can otherwise be used for other high-priority expenditures, optimizing inventory by understanding customer demands will be helpful. Use inventory management tools to reduce overstocking. Efficient management ensures cash inflows stay steady without unnecessary cash outflows.

- Limit debt dependence: Relying too much on business loans can lead to problems. While a short-term loan can help in emergencies, too much debt is risky. Extra cash spent on interest payments can affect cash flow, so aim to manage available resources and use lines of credit wisely.

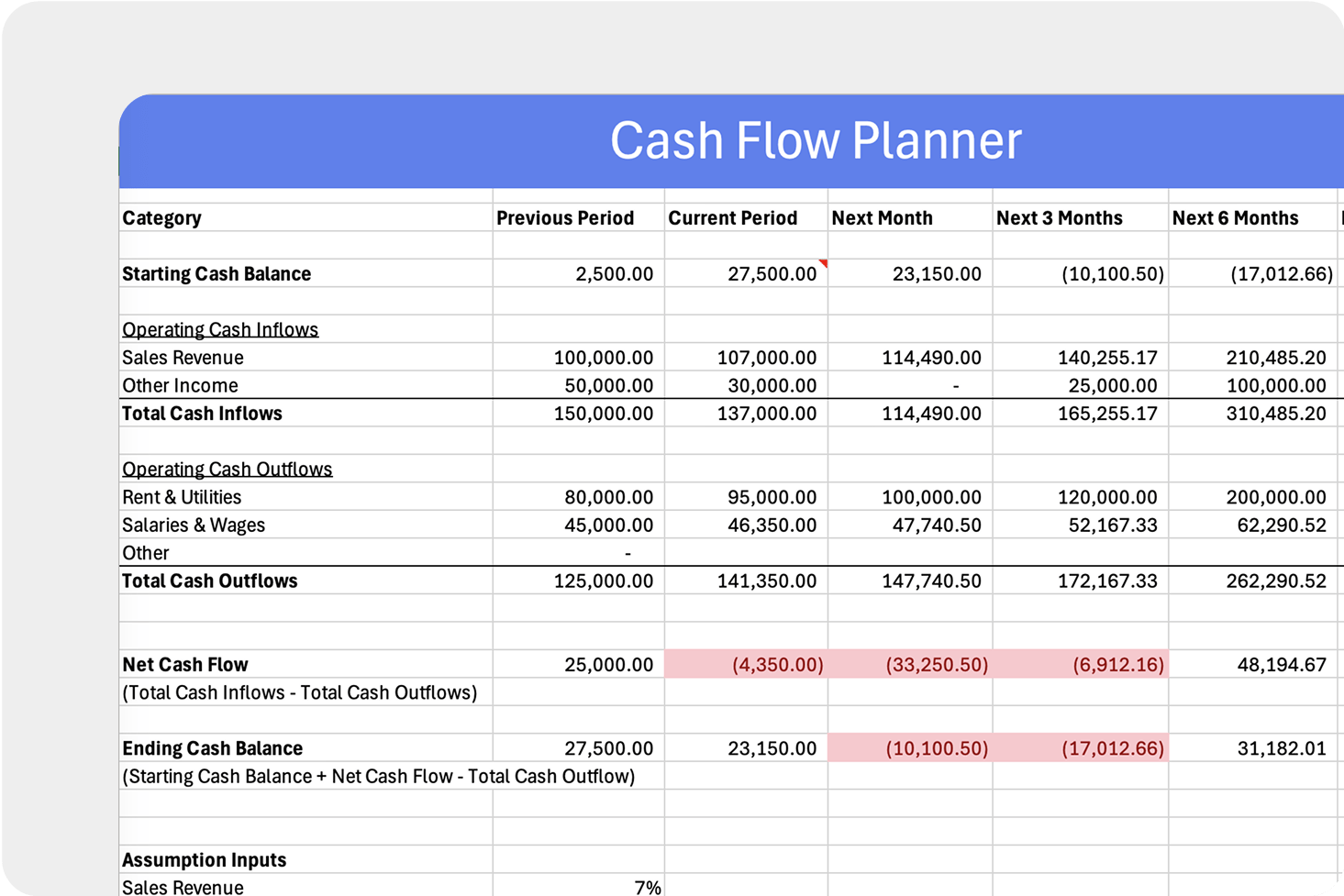

- Develop a cash flow forecast: Creating a cash flow forecast allows you to plan for the future. Cash flow predictions and forecasting can help you prepare for potential issues. Proper planning lets you make informed decisions to ensure your business has enough cash reserves for unexpected expenses. Your company can also use cash flow statements to analyze and improve its financial health.

By implementing these solutions, businesses can position themselves for sustained growth and long-term success.

It’s also important to know the differences between cash flow and budget, as these two financial components can be confused.

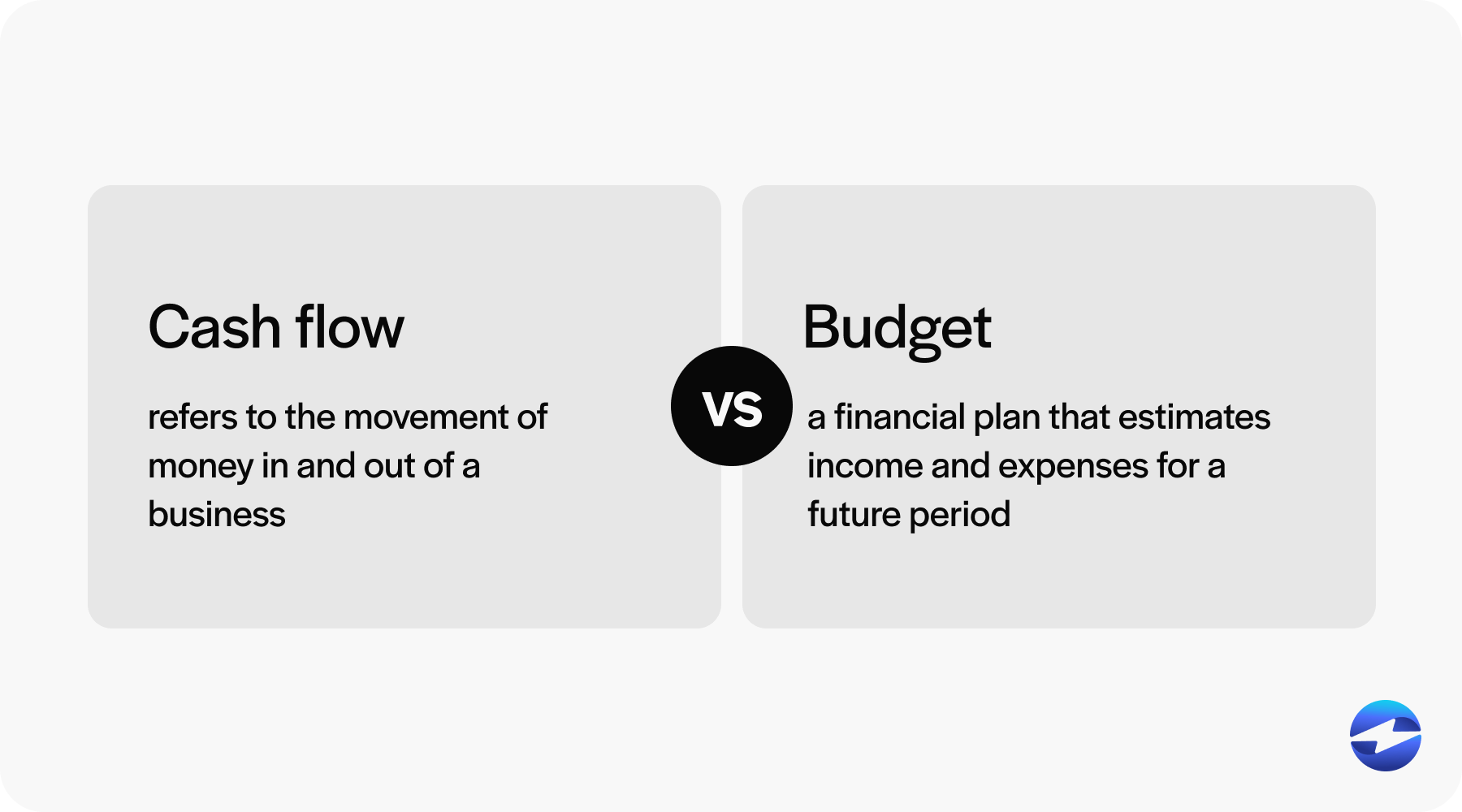

What’s the difference between cash flow and budget?

While both tools are integral to a business’s financial health, cash flow and budgets serve distinct purposes.

Cash flow refers to the movement of money in and out of a business. It’s about tracking income (cash inflows) versus expenditure (cash outflows) over a specific period. Cash flow is like a timeline of finances, showing when cash is available. It helps identify incoming revenue, like sales and loans, and outgoing costs, like business expenses.

In contrast, a budget is a financial plan that estimates income and expenses for a future period. A budget sets financial goals and guidelines to help businesses plan their spending and manage financial resources efficiently.

By using these tools in tandem, businesses can maintain financial stability, anticipate challenges, and align their operations with long-term objectives.

Working with top-rated payment solutions like EBizCharge can also improve cash flow management and simplify your payment collection process.

Take charge of your cash flow with EBizCharge

EBizCharge is a powerful tool that can enhance merchants’ cash flow by streamlining accounts receivable (AR) operations and integrating seamlessly with numerous enterprise resource planning (ERP), accounting, eCommerce, and other business systems.

The EBizCharge payment software reduces unpaid invoices and improves incoming revenue to mitigate late payments and avoid negative cash flow.

With features such as automated payment reminders, EBizCharge helps reduce overdue payments by prompting clients to settle their invoices on time. Its secure payment processing options protect against bad debt while offering diverse payment methods to encourage quicker settlements. These capabilities collectively create a positive cash flow environment, giving businesses greater control over their finances.

Merchants can leverage the powerful EBizCharge payment technology to reduce cash flow challenges, better manage unexpected expenses, maintain healthy cash reserves, and improve overall financial stability, paving the way for a healthier financial future.