Blog > Times Interest Earned Ratio Explained

Times Interest Earned Ratio Explained

Navigating the labyrinth of financial metrics can be daunting, but helpful formulas like the times interest earned (TIE) ratio help companies navigate their expenses.

It’s essential for companies to understand the TIE ratio, its importance, and how to use this calculation, as it illuminates a company’s fiscal fortitude against obligations.

What is the times interest earned (TIE) ratio?

The times interest earned ratio (TIE ratio), also known as the interest coverage ratio, is a financial metric that helps gauge a company’s ability to meet its debt obligations.

The TIE ratio reflects how often a company’s operating income can cover its annual interest expense and is a critical indicator of financial health.

Put simply, the TIE ratio measures a company’s cushion for paying interest on its debt and assures lenders and investors that it generates sufficient cash flow for debt repayments.

Why is the TIE ratio important?

The TIE ratio is an essential tool for businesses to use to predict their future financial stability and incorporate into their operational strategies.

A company that consistently boasts a high TIE ratio is seen as financially healthy, as it has a steady stream of income to cover its debt obligations. This consistent earnings history makes it a more attractive investment and a safer bet for lenders.

The TIE ratio also informs stakeholders whether a company can afford to take on more debt. Firms that demonstrate a solid ability to cover their periodic debt payments and have a high coverage ratio may be better positioned to increase their financial leverage safely.

On the other hand, a company with a lower TIE ratio may need to consider measures to improve its cash flow or reduce debt repayments. This can involve restructuring debt, optimizing business operations to cut costs, or finding ways to increase income.

Investors and analysts use this ratio, along with a range of other financial ratios, to paint a broader picture of a company’s current and future economic health. It’s a vital component of a company’s financial statements, allowing for more informed decisions. This ratio provides a tangible metric for stakeholders to measure and compare the business’s ability to honor its debt obligations over time.

Times interest earned (TIE) formula

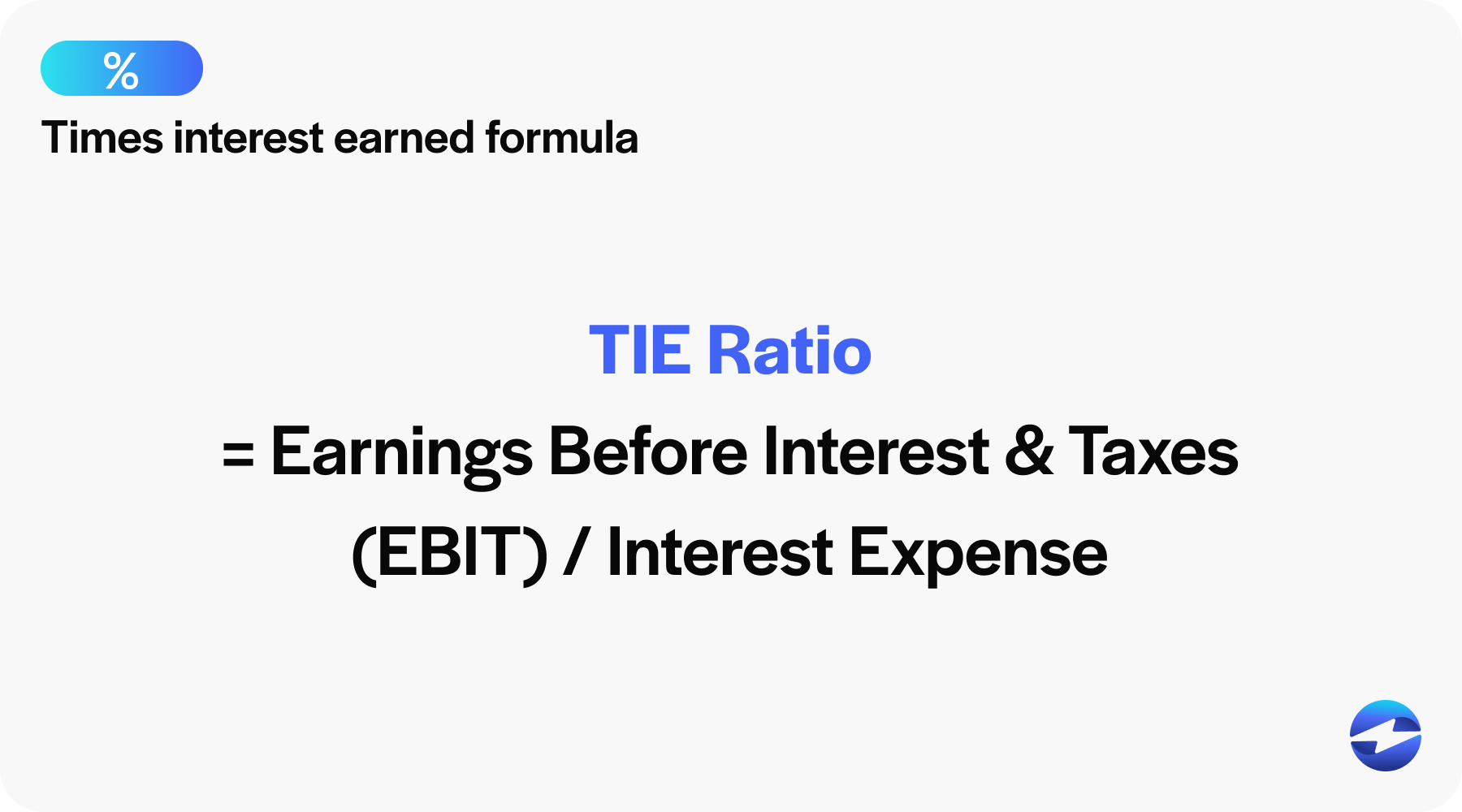

The times interest earned (TIE) formula is a straightforward calculation that assesses a company’s ability to cover its interest expenses with its earnings.

The TIE formula is as follows:

TIE ratio = Earnings Before Interest and Taxes (EBIT) / Interest Expense

Accurate figures from the income statements are vital to ensuring the calculation reflects the correct financial picture.

Earnings Before Interest and Taxes represent a company’s income from its primary business operations. This excludes costs associated with taxes and interest, making them a pure indicator of profitability.

Interest Expense is the total cost a company incurs in a specific time frame (usually annually) for its accrued debt.

By examining these numbers, the TIE ratio formula offers a quantifiable look at how many times a company can pay its interest, emphasizing its solvency.

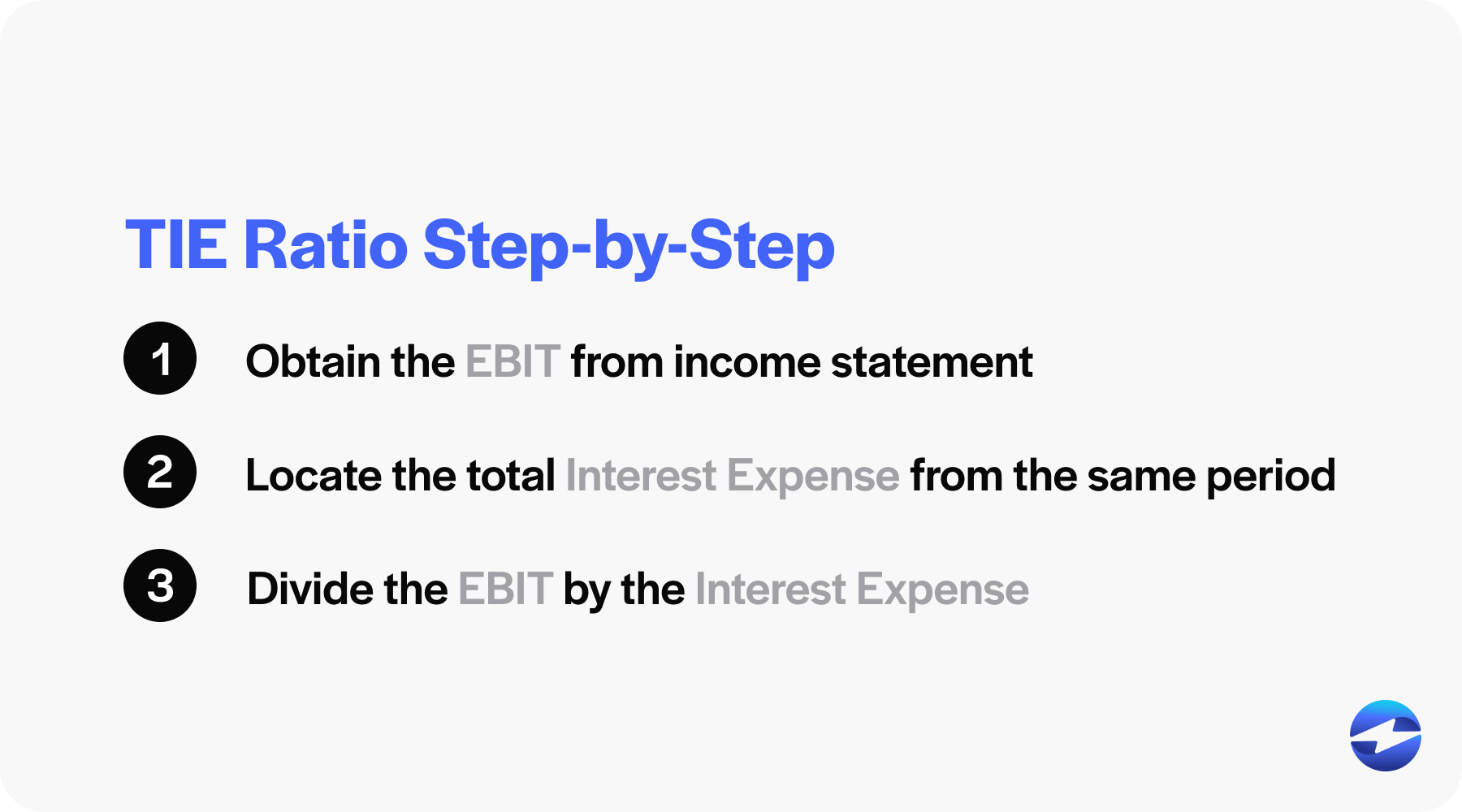

How to calculate TIE

Calculating the TIE ratio is a straightforward process. Here’s how to do it:

- Obtain the company’s EBIT from its income statements. This is typically listed as a distinct line item.

- Locate the total Interest Expense over the same period, which is also reported on the income statements.

- Divide the EBIT by the Interest Expense to determine the TIE ratio.

The following section provides examples highlighting different scenarios you may encounter when calculating TIE ratios for your business.

Examples of the TIE ratio

Example 1

Company A has an EBIT of $200,000 and an annual Interest Expense of $40,000. Using the TIE formula:

$200,000 / $40,000 yields a TIE ratio of 5

This demonstrates that Company A can cover its interest obligations five times with its earnings.

Example 2

Company B has an EBIT of $150,000 with the same Interest Expense of $40,000. Using the TIE formula:

$150,000 / $40,000) yields a TIE ratio of 3.75

While Company B can still cover its interest, it has a smaller margin of safety than Company A.

Example 3

Company C (a start-up) may have a lower EBIT of $60,000 and an Interest Expense of $30,000. Using the TIE formula:

$60,000 / $30,000 yields a TIE ratio of 2

With such a ratio, potential investors might exercise caution, given the company’s limited ability to withstand financial turbulence while meeting its debt obligations.

While the TIE ratio can vary widely among industries and sectors, it directly reflects a company’s financial leverage and capacity for managing debt in relation to its earnings.

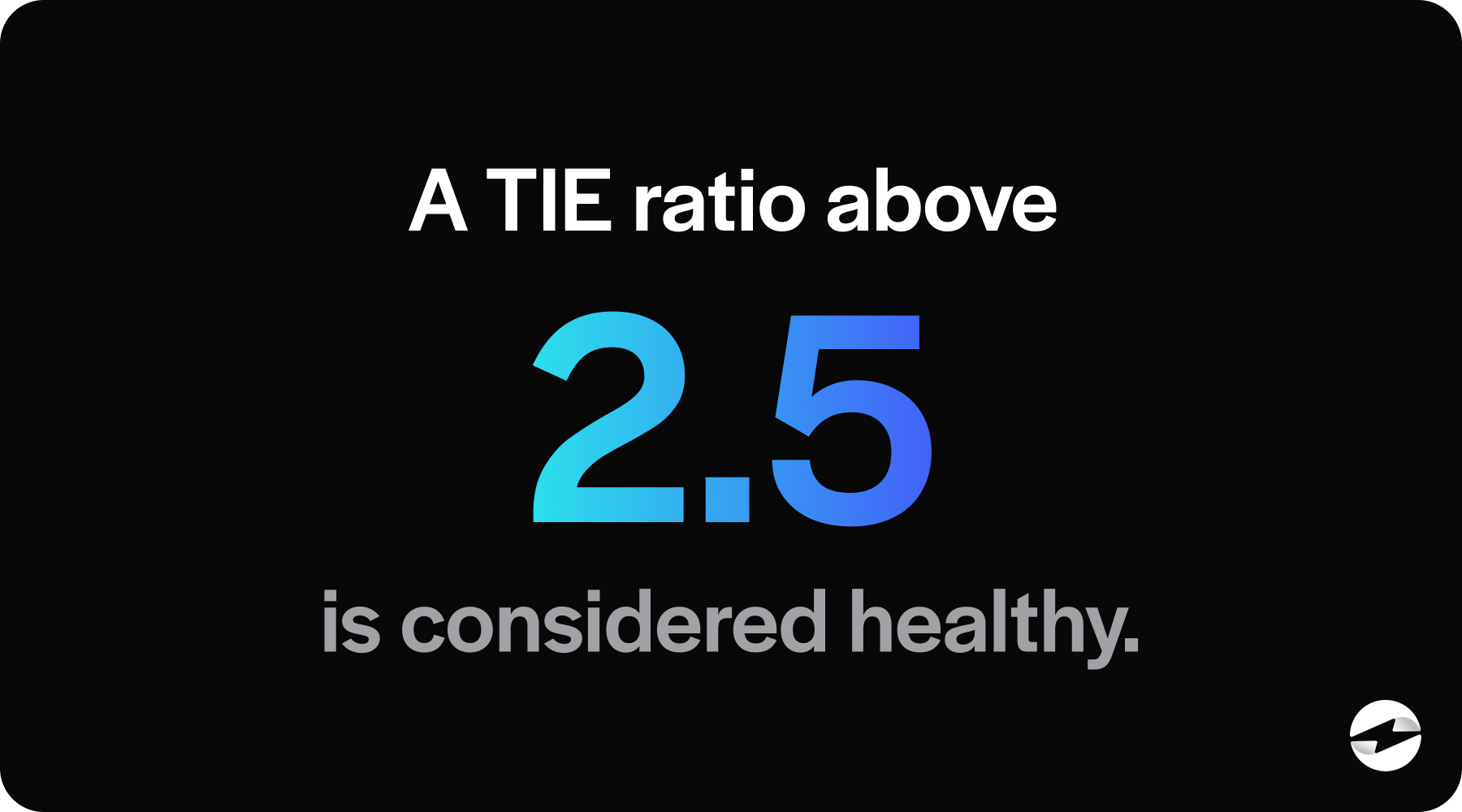

What’s considered a good TIE ratio?

Determining what constitutes a good TIE Ratio largely hinges on the industry and economic conditions.

Generally, a TIE ratio above 2.5 is considered healthy, signifying that a company’s earnings are sufficient to cover its interest expenses by at least 2.5 times. This can indicate solid financial health and a lower risk of default on debt obligations.

However, the benchmark can vary since certain capital-intensive industries may have norms lower than 2.5 due to their substantial debt loads for funding operations.

Investors and creditors often prefer a higher TIE ratio, which suggests consistent earnings and an acceptable risk level when extending capital through debt offerings.

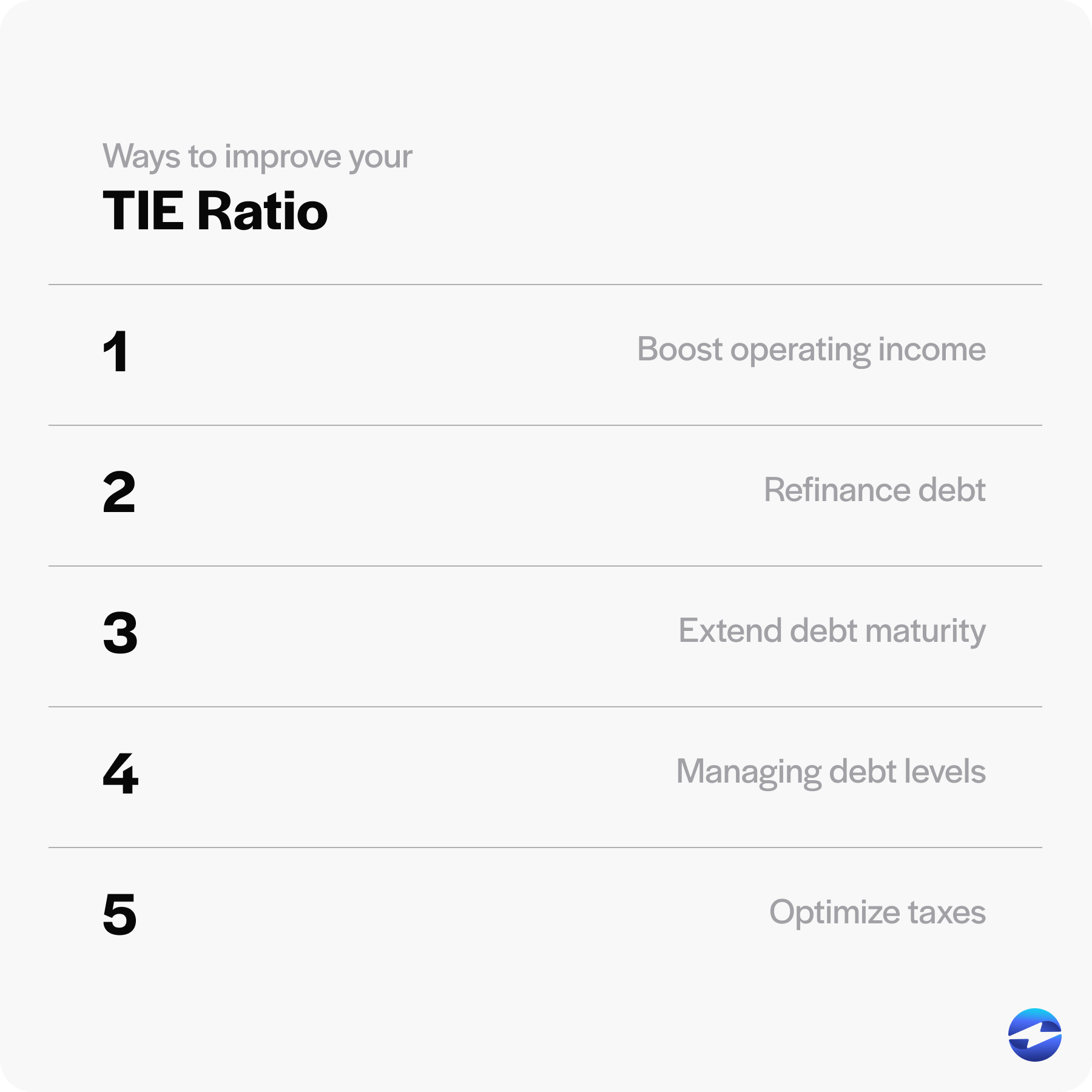

How can your company improve its TIE ratio?

Improving your company’s TIE ratio involves strategic measures to enhance earnings and manage debt effectively.

Here are strategies for increasing your TIE ratio:

- Boosting operating income: Increasing income before interest and taxes strengthens the numerator in the TIE ratio formula (operating income divided by interest expense). Focus on enhancing sales and minimizing costs to improve margins.

- Refinancing debt: Refinancing can lower interest rates on existing debt, reducing annual interest expense and potentially boosting the TIE ratio.

- Extending debt maturity: Prolonging the repayment period can lessen periodic debt payments, improving cash flow and the TIE ratio in the short term.

- Managing debt levels: Avoid taking on unnecessary additional debt. Prioritize using earnings or raising capital through equity rather than debt to fund operations or investments.

- Optimize taxes: Smart tax planning can increase current income, as reduced income taxes translate into higher earnings before interest and taxes.

Adopting these strategies can fortify a company’s TIE ratio, underlining its ability to leverage finances and ensure consistent revenue.

Making more informed decisions with TIE

The TIE ratio is a barometer of financial leverage and a tool for making informed decisions about handling outstanding debts and planning business operations over time.

Companies and investors must regularly scrutinize this ratio alongside other solvency ratios on income and financial statements to ensure a secure financial footing.