Blog > The True Cost of Processing Fees: What 650 Decision-Makers Revealed

The True Cost of Processing Fees: What 650 Decision-Makers Revealed

We all know payment processing fees are a cost of doing business. Without them, you’d be limited to cash, checks, and wire transfers. Good luck explaining that to your customers.

The combination of smartphones, high-speed internet, and secure payment technology has made digital payments not only convenient but expected. According to a recent J.D. Power survey, 65% of small businesses’ annual sales revenue in 2025 was processed by merchant services providers – up 3% from the prior year. That growth isn’t surprising since most companies can’t handle payment processing complexity on their own.

Most businesses naturally turn to merchant service providers to handle all the requirements of accepting multiple payment methods. In exchange, the provider collects a processing fee meant to recoup transaction costs.

The question is: what’s all this convenience actually costing?

Survey Methodology and Key Findings

To understand the real impact of payment processing fees on businesses, we surveyed 650 people actively evaluating payment processing solutions that likely had decision-making authority in their organizations.

We asked four straightforward questions:

- What percentage of your revenue goes toward payment processing fees?

- Do you pass credit card processing fees to your customers?

- Have you noticed customers changing payment methods to avoid fees? (For those who answered yes to previous question.)

- Do you avoid using credit cards when there’s a surcharge?

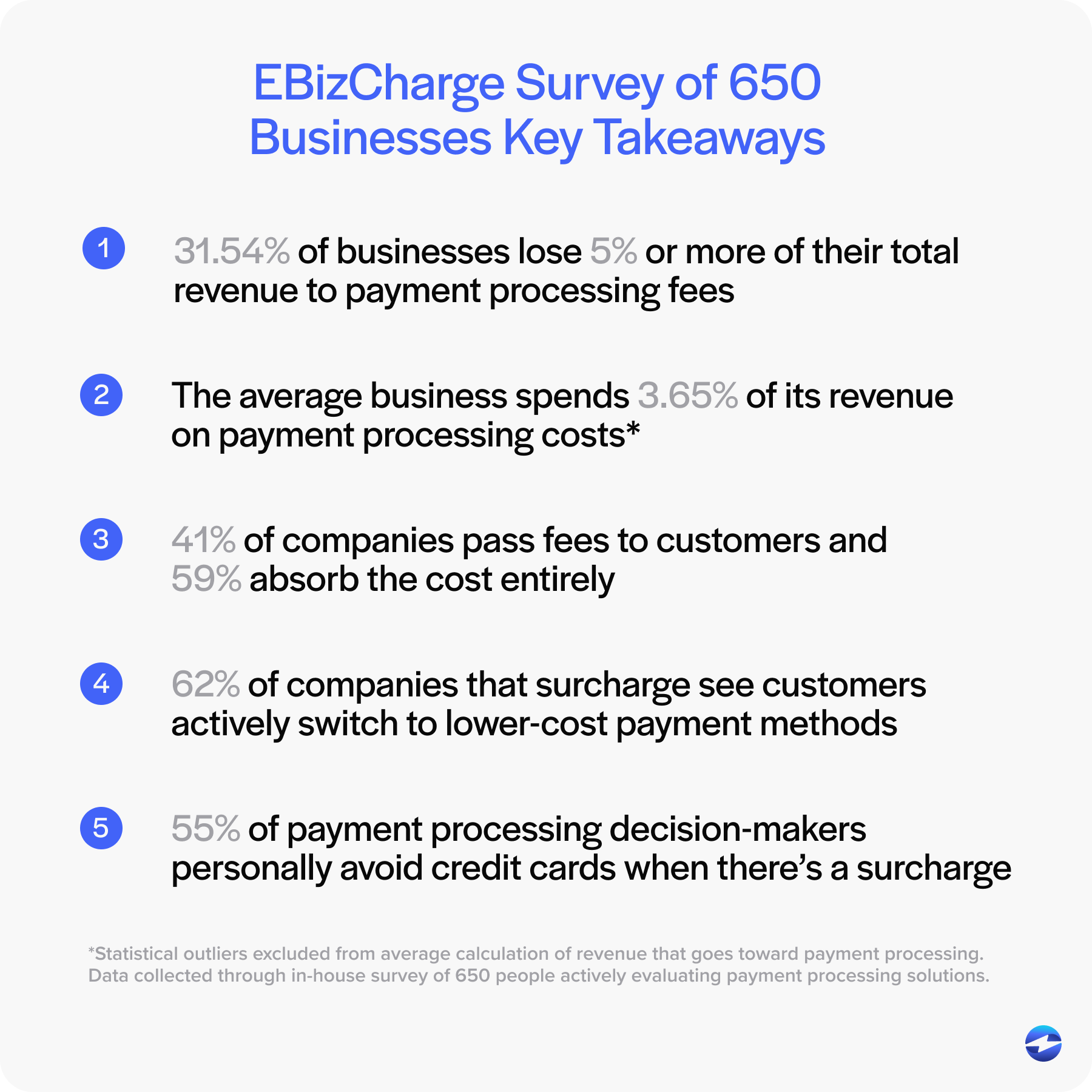

Key Takeaways:

- Nearly 1 in 3 businesses (31.54%) lose 5% or more of their total revenue to payment processing fees

- The average business spends 3.65% of its revenue on payment processing costs*

- Only 41% of companies pass fees to customers and 59% absorb the cost entirely

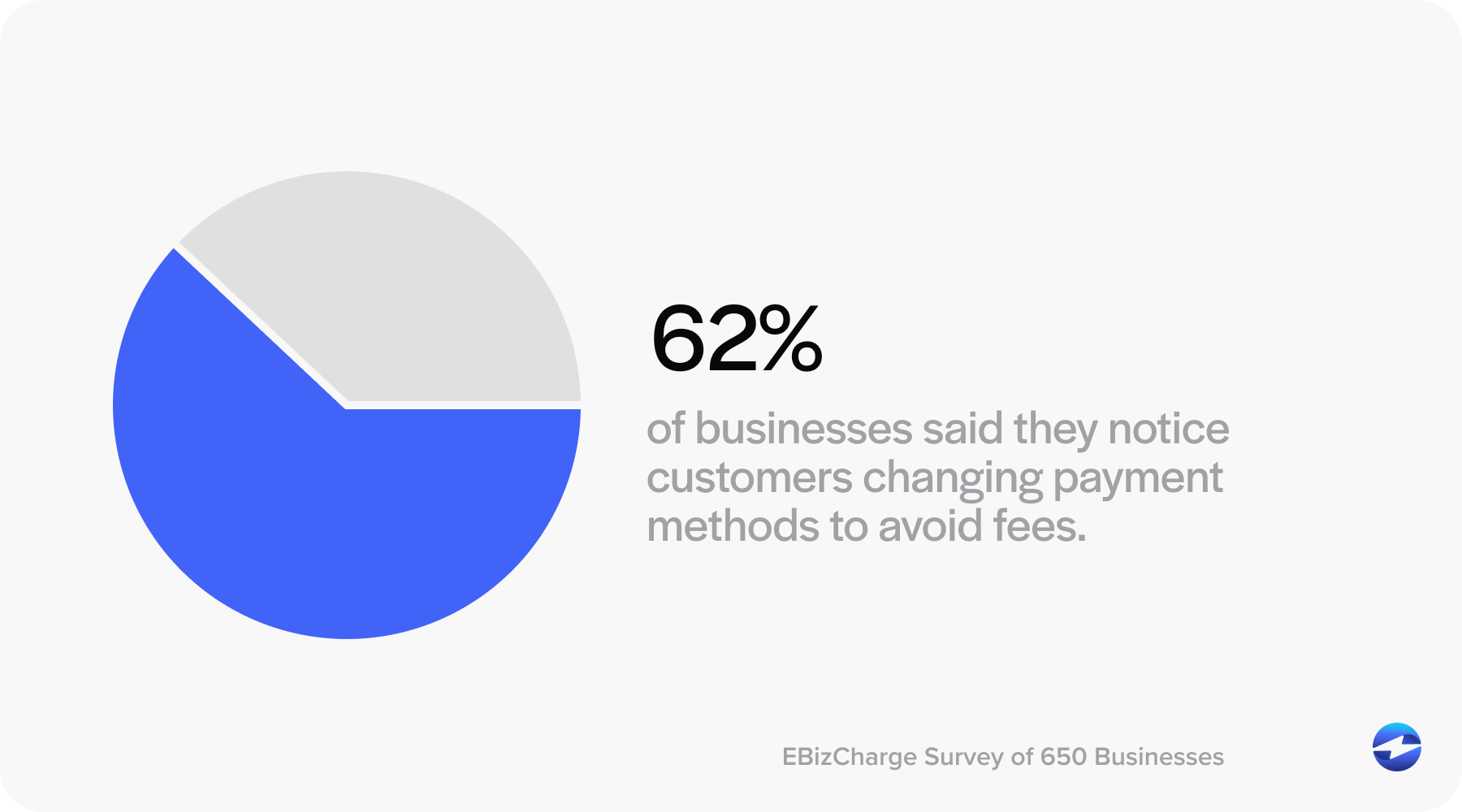

- 62% of companies that surcharge see customers actively switch to lower-cost payment methods

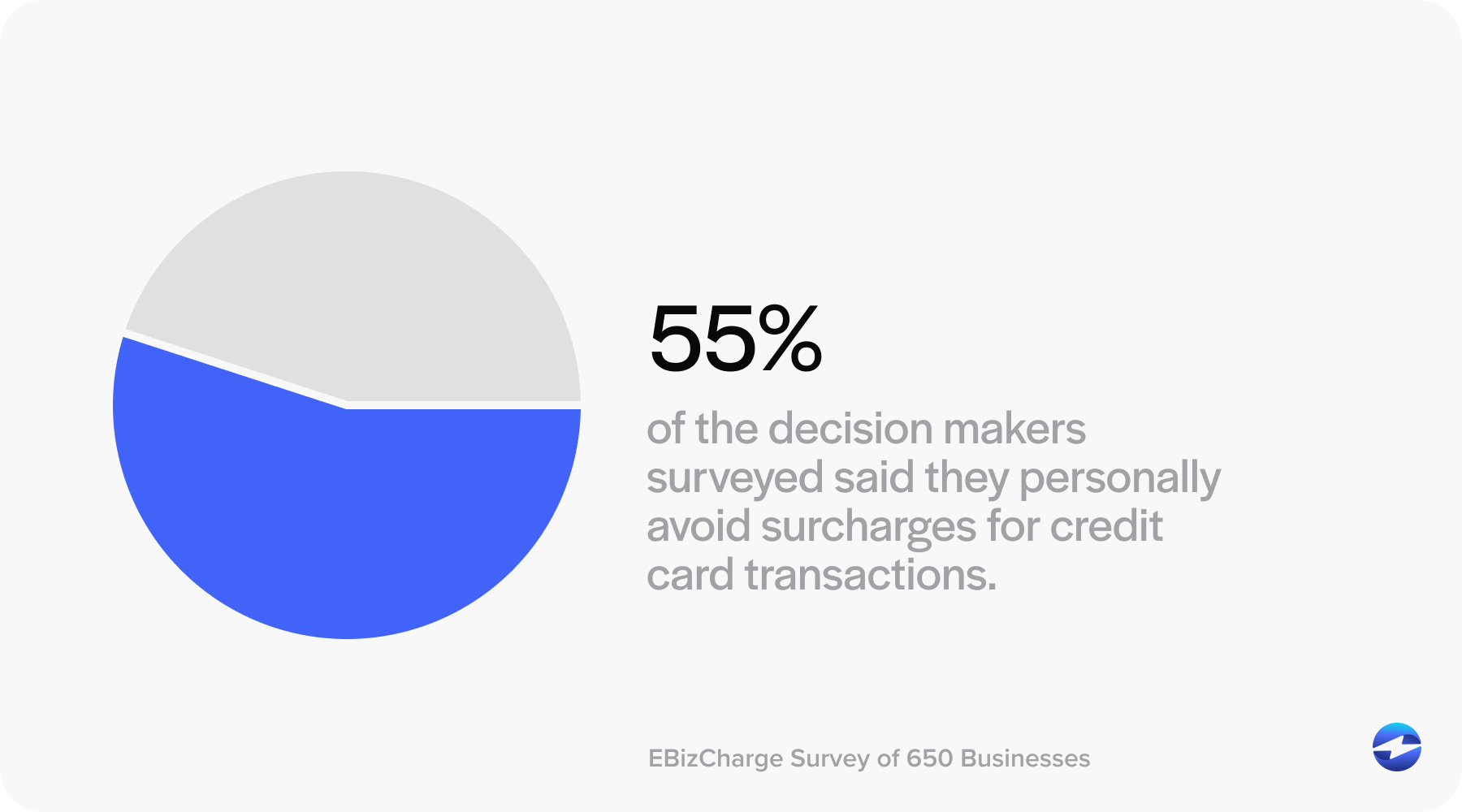

- 55% of payment processing decision-makers personally avoid credit cards when there’s a surcharge

*Statistical outliers excluded from the average calculation of revenue that goes toward payment processing

Payment processing keeps businesses running smoothly by letting customers pay how they want. However, the costs are adding up, and fees are starting to shape how people choose to pay. Here’s what really stood out.

The Processing Fee Burden is Real: Average Cost is 3.65% of Revenue

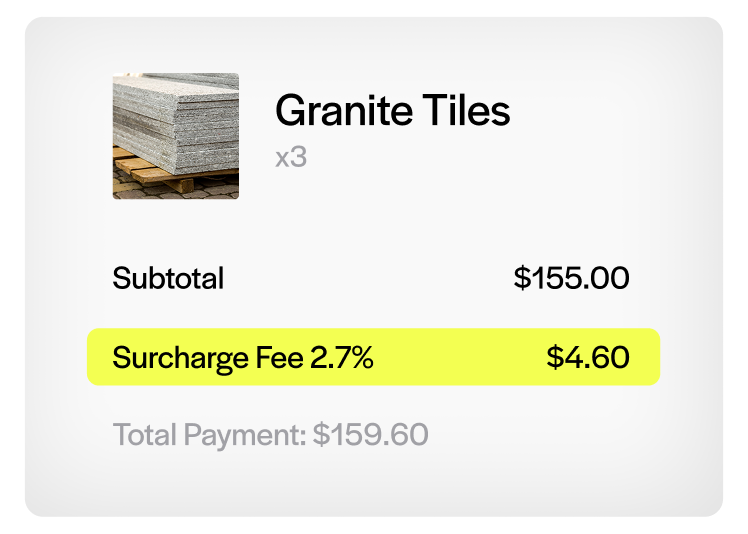

The average business in our survey spends 3.65% of its total revenue on payment processing fees.

Now, 3.65% may not sound catastrophic, but let’s think about it. If your company brings in $2 million annually, you’re spending over $73,000 to accept payments. For a $10 million company, that’s more than $365,000 annually! That’s enough to hire several full-time employees or make significant technology investments.

While 3.65% was the average, nearly a third of respondents (31.54%) are paying 5% or more of their revenue in processing fees. Imagine explaining to your board that 5 cents (or more) of every dollar coming through the door disappears before you even start calculating other operating expenses.

For many B2B companies, especially those operating on thin margins, this represents a significant chunk of what would otherwise be profit. If you’re in manufacturing, distribution, or professional services with average margins of 5-15%, payment processing fees could eat up half your net profit or more.

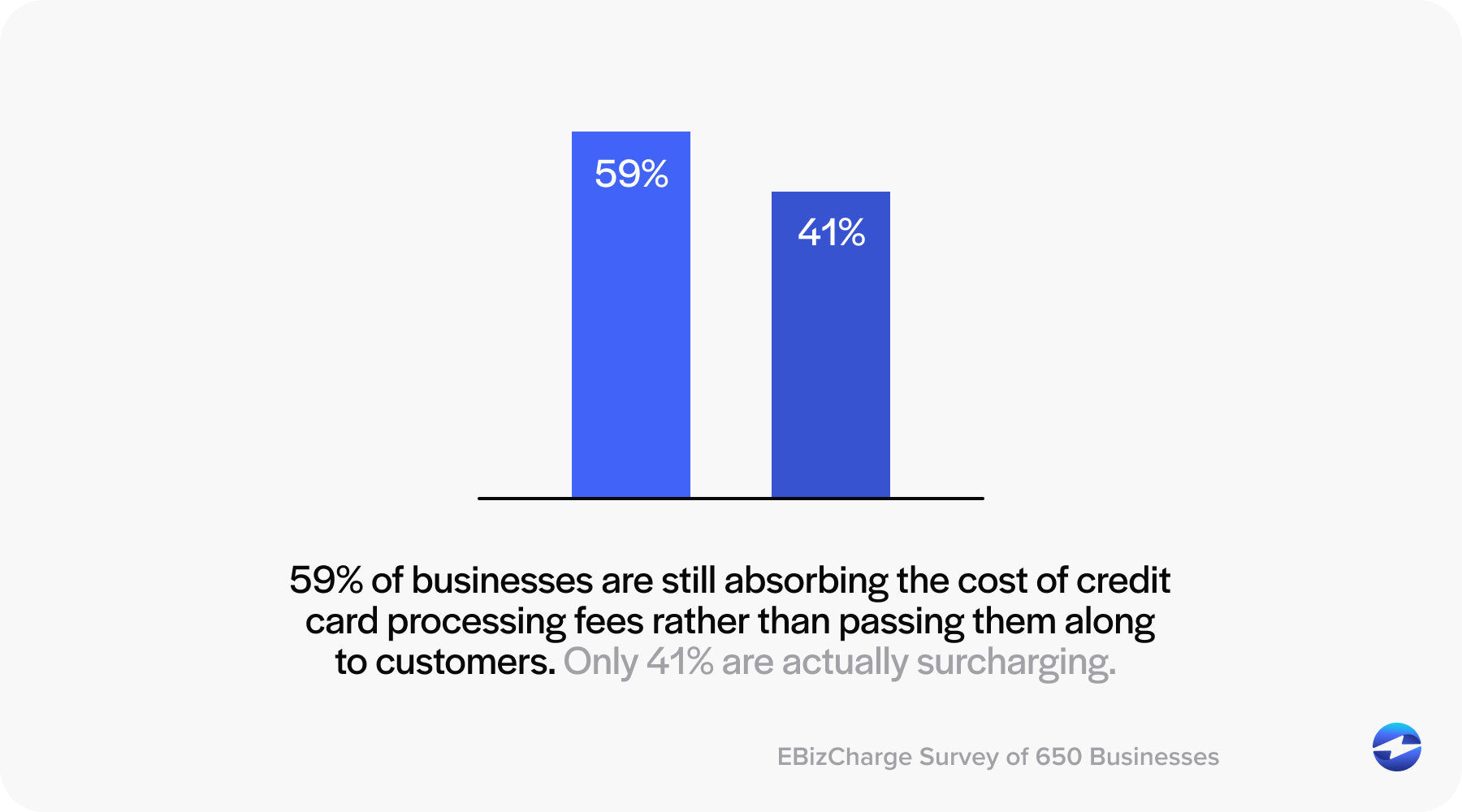

The Surcharging Split. Why 59% Still Absorb the Cost

Despite these hefty fees, 59% of businesses are still absorbing the cost of credit card processing fees rather than passing them along to customers. Only 41% are actually surcharging.

If you’re a CFO or billing manager staring at these processing fee line items every month, you’ve probably wondered why more companies aren’t just passing these costs along. The math seems simple, right?

Unfortunately, reality is more complicated than math. For many companies, customer relationships are everything. Adding unexpected processing fees can be like walking on eggshell when dealing with long-term contracts, repeat clients, and competitive bidding situations.

There’s also the complexity factor. Setting up surcharging properly isn’t just about adding a line item to your invoice. You need the right technology, proper disclosures, compliance with state regulations, and often integration with your existing accounting or ERP systems. For many IT managers, it’s one more thing to add to the never-ending implement and monitor list.

Then there’s competitive positioning. If your competitors aren’t surcharging, adding fees can put you at a disadvantage, even if your overall pricing is competitive. It’s often easier to build the cost of credit card fees into your base pricing than to explain additional fees after the fact.

How Customers React to Processing Fees: 62% Switch Payment Methods

For companies that are surcharging, we asked if they noticed customers changing payment methods to avoid fees? 62% said yes.

This result reveals critical insights into customer behavior. Nearly two-thirds of companies saw their customers actively switch to lower-cost payment methods when fees are transparent, which is actually good news if you think about it.

Nearly two-thirds of companies saw their customers actively switch to lower-cost payment methods when fees are transparent, which is actually good news if you think about it.

When customers see the cost of different payment methods, many may choose the cheaper option. Automated Clearing House (ACH) transfers, debit cards, checks, or other lower-cost methods become more attractive when the alternative is paying a surcharge fee.

When Decision-Makers Become Customers: 55% Avoid Surcharges

We also asked our survey respondents a personal question: Do you avoid using credit cards when there’s a surcharge? 55% said yes.

More than half of payment processing decision-makers actively avoid surcharges for credit card transactions when they’re the customer. As professionals, they understand why surcharging is necessary, but as consumers, they respond the same way their own customers do and seek alternatives when possible.

For billing managers and CFOs, this suggests that transparent credit card surcharging may help optimize your payment mix toward lower-cost methods. It also means ensuring lower-cost options are genuinely convenient for customers – there’s no point in steering customers away from using credit cards if other payment methods are slow.

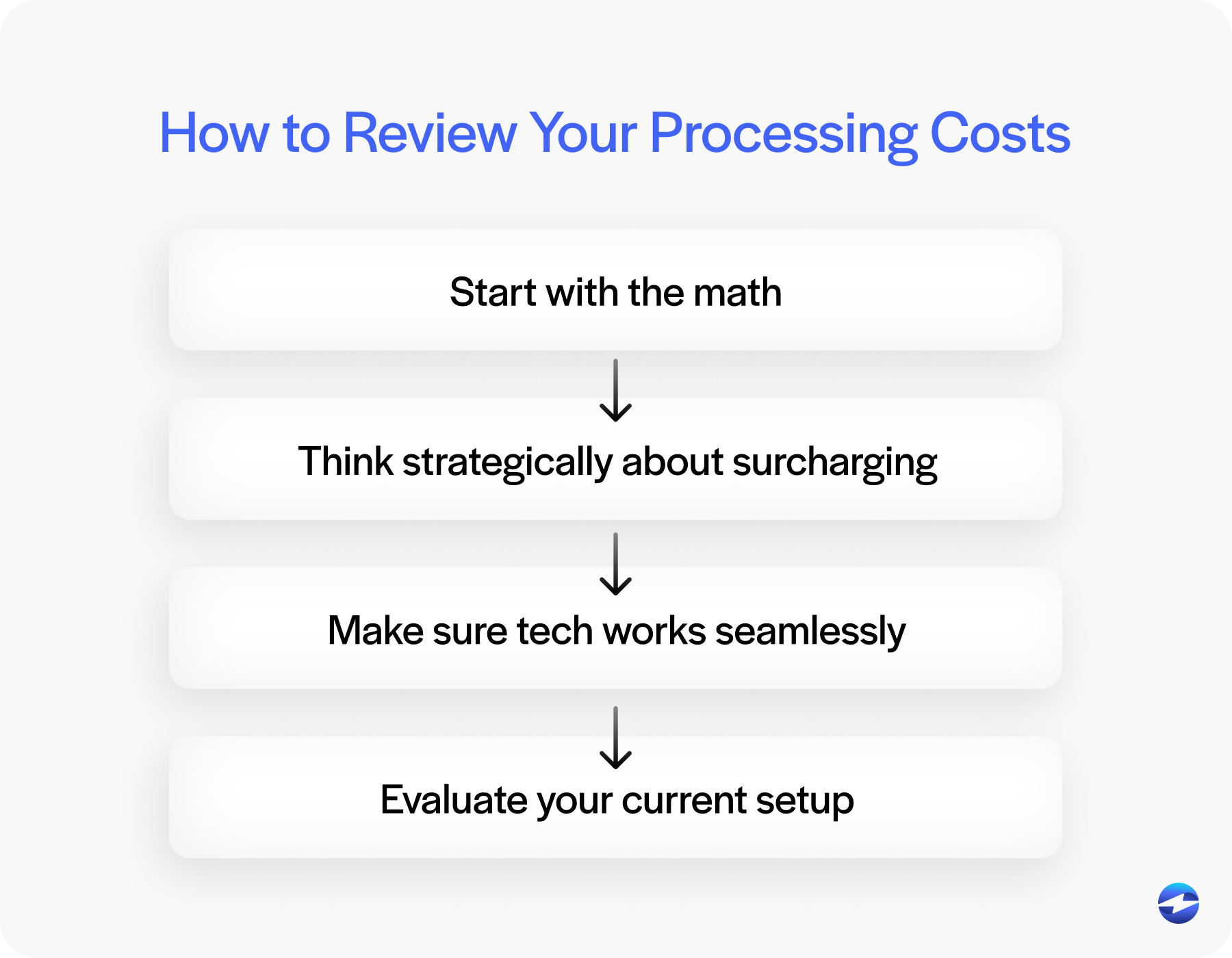

Strategic Implications for Payment Processing Leaders

If you’re responsible for managing payment processing costs and strategy for your company, here’s what this survey data means:

- Start with the math. Pull your statements and calculate what percentage of revenue goes to payment processing. Whether these calculations catch you off guard or were expected, there are usually ways to bring down costs with better rates, different processors, or optimizing payment methods.

- Think strategically about surcharging. It’s not just about recovering costs. If you’re in a trust-based business, transparency around processing fees may strengthen customer relationships. In price-sensitive markets, surcharges can put you at a disadvantage. Consider whether your customers value transparency or simply want the lowest invoice cost.

- Make sure the technology works seamlessly. If you implement surcharging, it needs to be automatic. Manual calculations create headaches for your team and confusion for customers. Your payment system should handle fee calculations, compliance, and posting without extra work for your accounting team.

- Evaluate your current setup. Can your current setup handle automated surcharging and integrate properly with your billing system? If not, you’ll need something more sophisticated. The last thing you want is surcharging to create more work than it saves in fees.

If you’re finding gaps in your current setup, integrated solutions can address most of these challenges simultaneously.

There’s a Better Way to Handle Processing Fees

Payment processing fees may be a bigger burden than many companies realize. Nearly a third of businesses are losing 5% or more of revenue to these costs. For most businesses, there’s room for improvement here.

Companies handling these expenses most effectively aren’t just negotiating better rates; they’re treating payment processing as an integrated part of their business operations.

EBizCharge integrates natively with over 100 accounting, enterprise resource planning (ERP), customer relationship management (CRM), and other top business systems, syncing payment processing into one cohesive platform. This means no more double data entry, lengthy reconciliation processes, or manual surcharge calculations.

The all-in-one EBizCharge payment software automatically handles compliance, applies appropriate fees where needed, and clearly communicates costs to customers without creating friction. You’re not only getting competitive processing rates but also eliminating the hidden costs.

Key EBizCharge Features

- Native integrations with 100+ accounting/ERP, CRM, and eCommerce systems

- Automated surcharging with built-in compliance and transparent customer communication

- Automatic reconciliation that eliminates manual data entry

- Advanced reporting for better cash flow visibility and cost analysis

- Multiple payment methods such as credit cards, ACH, and digital wallets

- Level II/III processing data for reduced interchange rates on B2B transactions

If you’re an IT manager, you’ll appreciate what doesn’t happen. No separate payment system to maintain. No custom code when your ERP gets updated. The EBizCharge integration is native, so it works with your existing workflows.

For CFOs and billing managers, EBizCharge changes how you view payment processing costs. Instead of another line item eating into margins, it becomes something that improves operations. Faster reconciliation, quicker payment collection, fewer failed transactions.

Simplify your payments today with EBizCharge

When businesses integrate EBizCharge into their workflow, they typically save on per-transaction fees, cut operational overhead, and gain real-time cash flow visibility.

Whether you’re looking for better rates, automated surcharging, payment method optimization, or operational efficiency improvements, the potential savings that EBizCharge provides are worth learning more about.

Ready to see how much you could save? Schedule a demo to learn how EBizCharge’s embedded payment solutions can reduce your processing costs and put money back into your business.