Blog > The State of Payment Automation in 2026: Why 1 in 3 Businesses Still Waste a Work Week Each Month on Payment Tasks

The State of Payment Automation in 2026: Why 1 in 3 Businesses Still Waste a Work Week Each Month on Payment Tasks

Nearly 1 in 3 companies have teams spending more than 30 hours per month on manual payment tasks.

Think about that. A full work week every single month spent on invoicing, entering payment data, and chasing co llections. Not building customer relationships. Not developing strategy. Not growing the business. Just moving data around.

The benefits of automation are obvious. So, why are businesses still stuck? We surveyed 820 CEOs, CFOs, and finance leaders to find out. What we learned had less to do with technology and more to do with outdated assumptions.

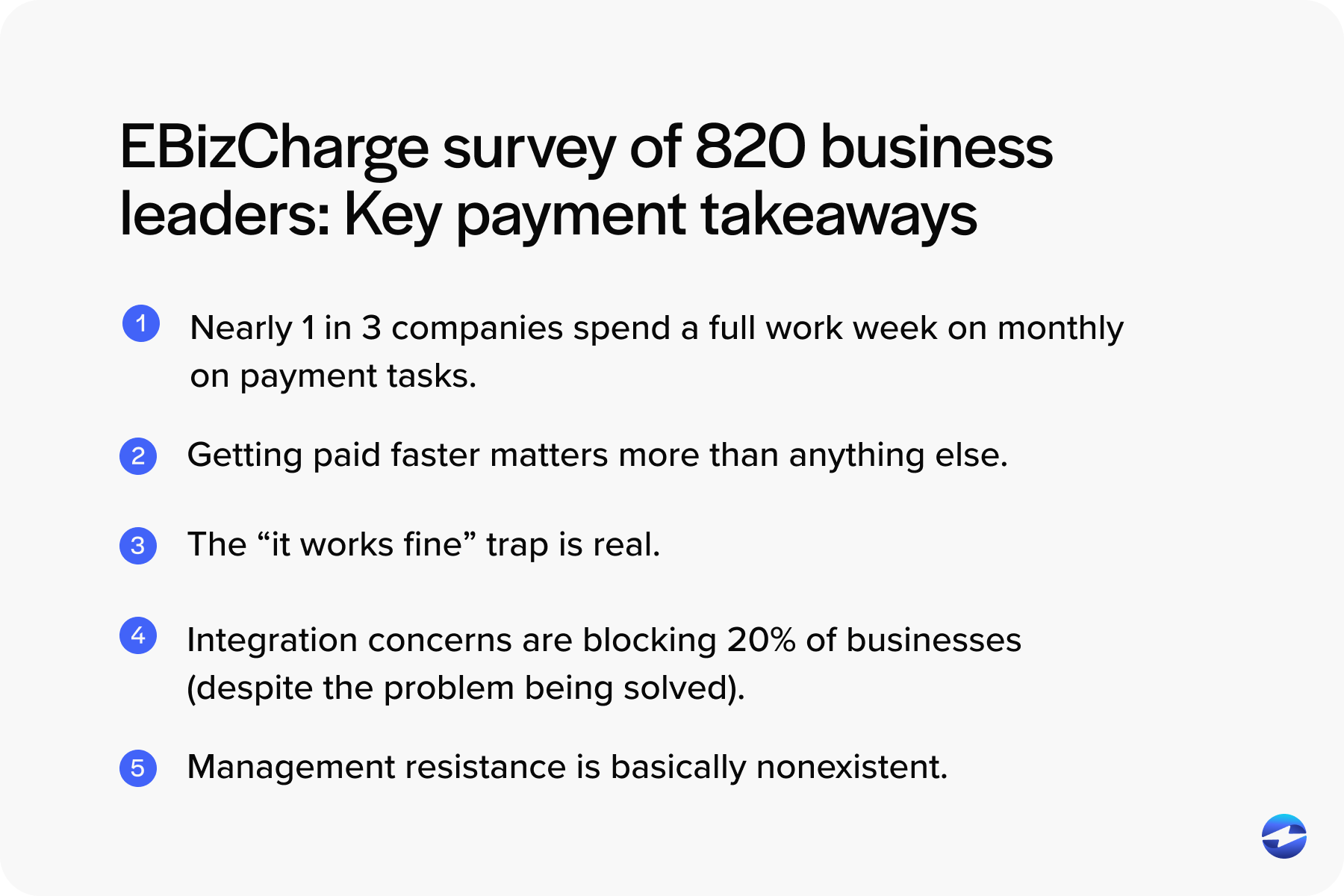

Five Key Findings

Here are the highlights that stood out:

- Nearly 1 in 3 companies spend a full work week monthly on payment tasks. 29% of respondents reported their teams spending 31+ hours per month on manual invoicing, payment entry, and collections.

- Getting paid faster matters more than anything else. Roughly 40% of respondents said their top priority was getting paid faster by customers, not reducing costs or saving time. Among those concerned about integration complexity, 53% still cited faster payments as their top need.

- The “it works fine” trap is real. Roughly 22% of respondents said their current process works fine but when we looked at the data more closely, we found that 36% of this group spends six or more hours per month on manual payment tasks. Some teams even spend over 75 hours collectively monthly.

- Integration concerns are blocking 20% of businesses (despite the problem being solved). The number one technical barrier is connectivity to existing software, despite modern embedded payment solutions that offer native integrations to over 100+ ERP and other top business platforms. What used to require six months and a systems integrator, now takes two weeks with a pre-built connector.

- Management resistance ranked lowest among barriers. Only 2% of respondents said management doesn’t view automation as important.

Survey Methodology

We surveyed 820 business leaders in Q4 of 2025 and asked four questions about payment automation. All respondents were actively evaluating payment automation solutions.

Geographic and market context: Respondents were primarily from North American Business-to-business (B2B) companies across manufacturing, distribution, professional services, and technology sectors. Company sizes ranged from mid-market businesses ($10M-$500M annual revenue) to smaller high-growth companies.

Response rates: All 820 respondents completed the first two questions about their role and monthly hours spent on payment tasks (100% completion rate).

Questions three and four about automation benefits and barriers received 746 responses (91% completion rate).

Why this sample matters: These are decision-makers who likely approve budgets, evaluate vendors, and sign contracts, not random survey takers or junior staff members. This data includes firsthand insights into what’s blocking adoption at the decision-making level.

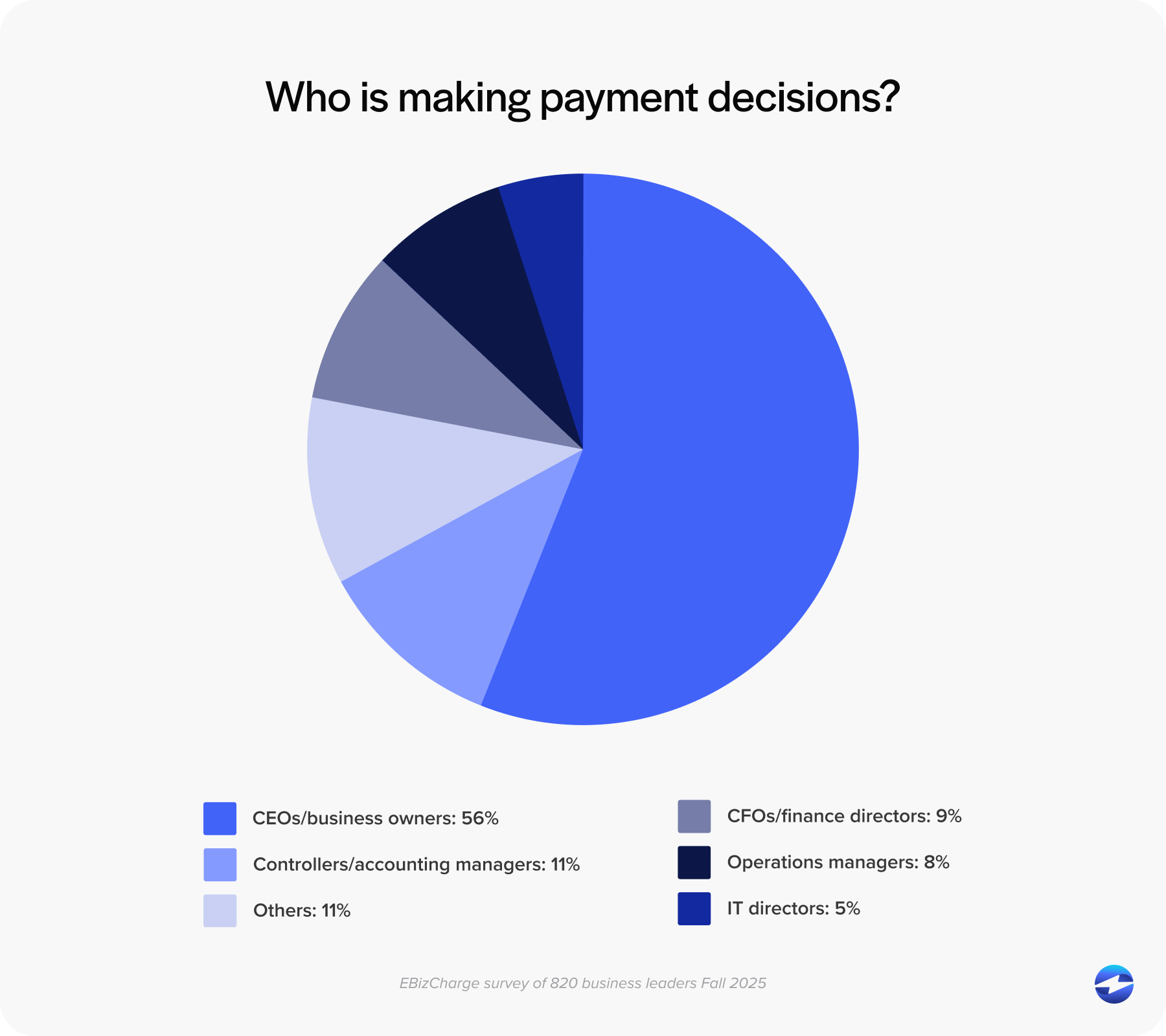

Who’s Making Payment Decisions These Days?

Here’s something that caught our attention: More than half of the people evaluating payment automation are CEOs and business owners.

Role breakdown:

- 56% were CEOs or business owners

- 11% were controllers or accounting managers

- 9% were CFOs or finance directors

- 8% were operations managers

- 5% were IT directors

- 11% held other roles including ERP/accounting administrators, accounts receivable (AR) specialists, chief technology officers, treasurers, and financial systems managers

457 CEOs and business owners responded to this survey. That’s a significant shift from even five years ago when payment processing was largely managed by finance departments. Now it’s landing on the executive desk.

Why CEOs Are Getting Involved

When payments move to the C-suite agenda, it’s likely because they touch three critical areas: cash flow, customer experience, and operational efficiency. It’s no longer only about making the back office run smoother.

Here’s the uncomfortable part: Nearly 1 in 3 companies have teams spending 30+ hours per month on manual payment tasks. That’s nearly a full work week every month that could be redirected to growth, strategy, or customer service. Instead, it’s consumed by invoicing, payment entry, and chasing collections.

What This Tells Us

Leadership likely recognizes that payment operations directly impact the business and see the time drain. They just haven’t found the right solution yet.

With some teams spending 50, 75, or even 100+ hours, manual payment operations are no longer a back-office problem. Instead, they’re likely leading to organizational efficiency crises that CEOs and other executives will need to solve.

The Time (and Money) Being Wasted

Roughly 62% of businesses spend six or more hours per month on payment tasks such as manual invoicing, entering payment information into systems, reconciling bank statements, and following up on late payments.

Here’s the full breakdown:

- 38% spend 0-5 hours monthly (businesses that have already automated)

- 28% spend 6-15 hours (one to two days every month)

- 18% spend 31-50 hours (nearly a full-time employee)

- 4% spend 51-75 hours

- 7% spend more than 75 hours (some teams have multiple people spending their entire day just processing payments)

- 5% selected other

The Divide Between Automated and Manual Operations

The contrast across all respondents is striking. While 38% of companies automate their processes to ensure a minimal time investment, nearly 30% still dedicate the equivalent of a full-time employee (or more) solely to managing payment operations.

This means some businesses are set up to run payments in the background, consuming minimal time. Whereas other teams are spending 30, 50, or even 75+ hours a month, processing payments manually.

Think about what an organization could accomplish with an extra 30 hours per month. This time could go toward customer service, business development, or strategic finance work instead of manual data entry.

What Manual Payment Processing Actually Costs

Let’s put dollar figures on the cost of manual processing.

Conservative scenario (6-15 hours/month): If your team spends roughly 6-15 hours monthly on payment tasks at a fully loaded cost of $75 per hour, that’s $450 to $1,125 per month. Annually, that’s between $5,400 and $13,500 just in labor costs.

Mid-volume scenario (31-50 hours/month): For businesses in this range, we’re talking $18,600 to $30,000 annually at typical accounting staff rates of $50 per hour.

High-value time scenario: If your finance director or controller is involved at $100+ per hour, those 31-50 hours monthly become $37,200 to $60,000 in annual opportunity cost.

These numbers don’t include error correction costs, customer friction from delayed invoices, or the impact on cash flow when payments take longer to process. This is only the direct labor cost of entering invoices, posting payments, and reconciling accounts.

The real cost is what you’re not doing with that time, such as the strategic planning that may get pushed aside or the growth initiatives you miss because due to reconciling last week’s payments.

What Businesses Actually Want

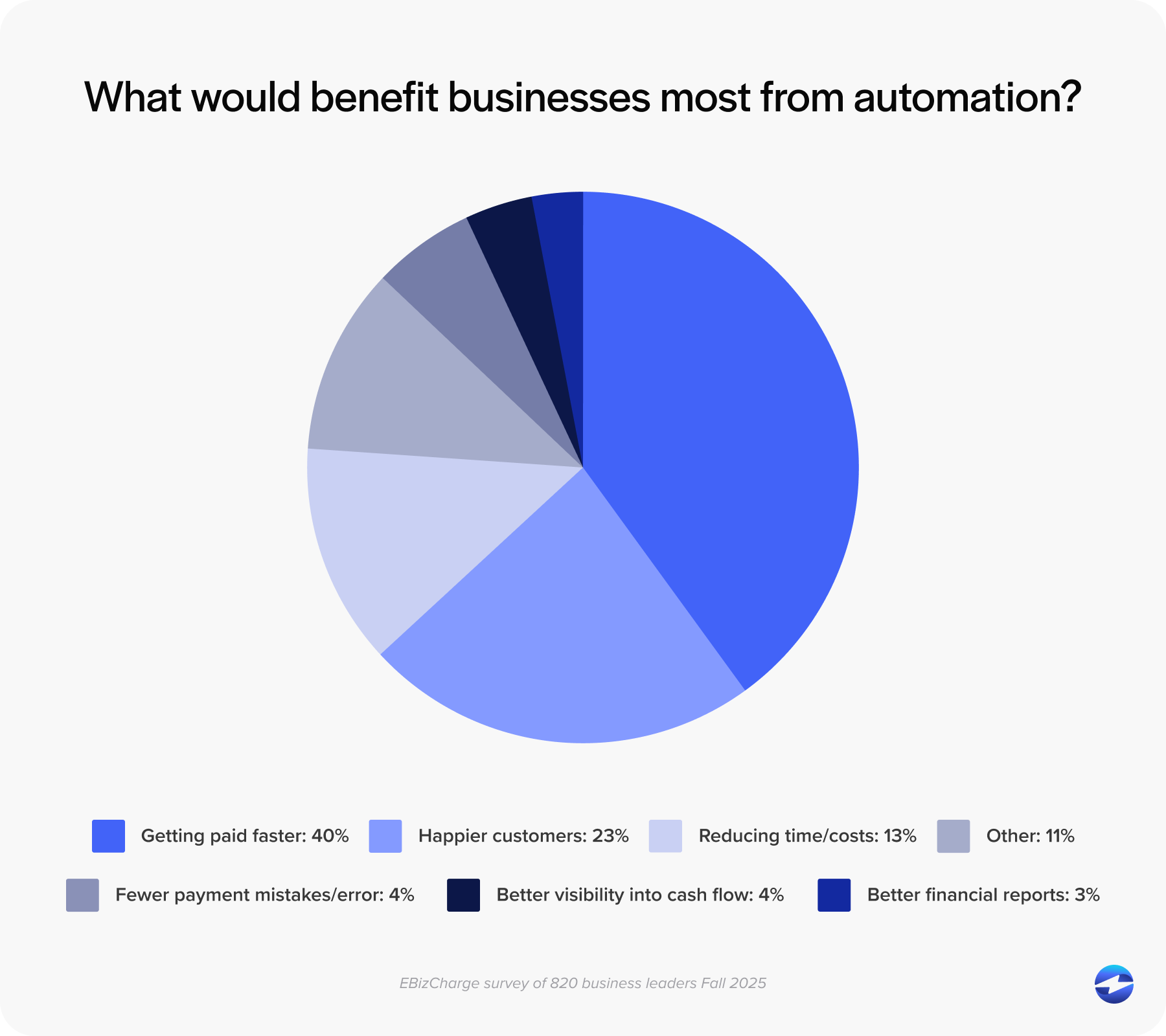

When we asked what would benefit them most from automation, 40% of companies said their top priority was getting paid faster by customers.

Nearly twice as many business executives and professionals value cash flow velocity over cutting costs (which came in third at 13%).

Here’s a breakdown of what finance leaders value most:

- 40% said getting paid faster by customers

- 23% said happier customers

- 13% said reducing staff time and costs

- 11% said other

- 6% said fewer payment mistakes and errors

- 4% said better visibility into cash flow

- 3% said better financial reports

Customer experience came in second at 23%. Making it easier for customers to pay isn’t typically considered a finance priority, but nearly a quarter of respondents recognized it as a customer retention strategy.

When you add it up, 63% of businesses prioritize either customer-facing benefits (getting paid faster, happier customers) or financial positioning over operational efficiency, challenging how payment automation is usually marketed.

Most vendors lead with time-saving and cost-saving benefits, but the data shows companies care more about getting paid faster and keeping customers happy.

Why These Priorities Matter

Cash flow velocity is king. Getting paid faster isn’t only about convenience. It’s about having the working capital to take on new projects, invest in growth, or make payroll without stress.

When typical B2B terms are Net 30, but customers pay between day 45 and day 60, that extended timeline ties up important capital. When we broke down the data, 41% of CEOs and 40% of CFOs prioritize getting paid faster over anything else.

In addition to cash flow, the overall customer experience was also heavily valued by business leaders.

Customer experience is a revenue strategy. Nearly 1 in 4 businesses said making it easier for customers to pay is their top benefit. As customer expectations continue to evolve, many want multiple payment options, online payment portals, and instant confirmation.

When you make it easier to pay, customers are more likely to pay on time, relationships improve, and sales cycles have less friction.

The Surcharging Surprise

Passing credit card fees to customers wasn’t listed as a potential benefit of automation, but multiple respondents mentioned surcharging when selecting ‘Other’ as their top priority.

Numerous business leaders wrote in answers that included:

- “Pass on credit card fees to customers”

- “Less manual work adding processing fees”

- “Surcharging”

The responses kept coming.

Nowadays, many businesses want to accept card payments without foregoing some of their revenue. While only 11% selected ‘Other’ as their top priority, the fact that surcharging emerged organically across multiple responses suggests it’s a hidden concern that deserves more attention from payment vendors.

At 2.5-3.5% per transaction, processing fees can add up fast. However, manually adding surcharges has may be too complex for many companies.

What’s Actually Stopping Businesses

Despite many businesses likely recognizing the time drain of manual operations and how automation can help, the question still remains: why aren’t they moving forward?

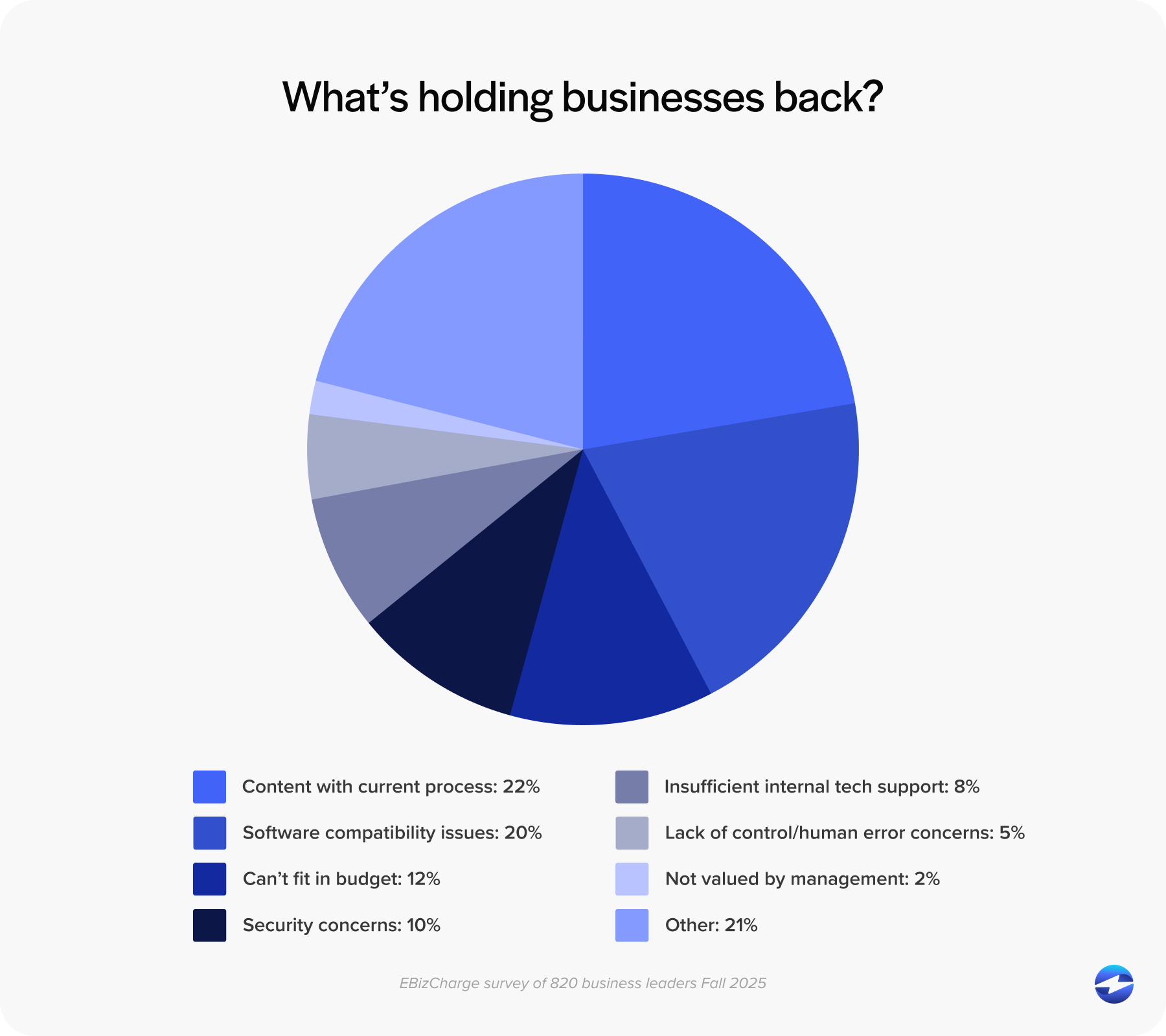

We asked respondents to identify their primary barrier to adopting payment automation. Here’s what they said:

- 22% – “Our current process works fine”

- 20% – “Too hard to connect with our current software”

- 12% – “Don’t have the budget right now”

- 10% – “Worried about security or compliance issues”

- 8% – “Don’t have the tech people to set it up”

- 5% – “Concerned we’ll lose control or make mistakes”

- 2% – “Management doesn’t see it as important”

- 21% – “Other”

Let’s look at each of these more closely.

The “It Works Fine” Trap

While 165 business leaders noted that their current process works fine, the time some are spending on manual payment operations may suggest otherwise.

Here’s what we found:

- 45% spend 0-5 hours monthly (it genuinely does work fine for them, they’ve likely automated)

- 29% spend 6-15 hours monthly (half a day to two days every month)

- 14% spend 31-50 hours monthly (a full work week)

- 2% spend 51-75 hours monthly

- 8% spend 75+ hours monthly (multiple team members or one very overwhelmed person)

- 2% selected “Other”

More than half of the “works fine” group spends six or more hours monthly on manual tasks. Some are even spending the equivalent of a full-time employee on payment operations, yet still claim their process works fine.

When businesses are operating the same way for years, manual tasks can be normalized instead of evaluated for their actual costs, inefficiency, or obsolete practices.

The Integration Barrier That No Longer Exists

Incompatibility was another barrier expressed by respondents, as 151 people (20%) said the main thing stopping them is that it’s too hard to connect with their current software.

What required custom API development, six-month timelines, and expensive consultants in 2015, now takes two weeks with a pre-built connector. Modern embedded payment solutions typically come with native integrations to over 100 platforms like QuickBooks, Sage, Microsoft Dynamics NetSuite, Acumatica, SAP, Salesforce, and more. No custom development or systems integrator, just plug it in and go.

The data may point to businesses making decisions based on outdated assumptions about integration complexity.

Notably, 53% of people who cited integration concerns also said their top priority is getting paid faster. Despite business leaders’ frustrations with slow payments, many may be letting out-of-date practices, technological gaps, or their lack of awareness deter them from making a switch.

What Barely Registers as Barriers

Budget? Only 12%. That means 88% of businesses see clear return on investment (ROI) potential.

Security concerns? 10%. Modern processors are actually more secure than manual card entry. Security features like Payment Card Industry (PCI) Compliance, tokenization, and encryption all come standard.

Lack of tech resources? 8%. Modern solutions are vendor-led and designed for business users, not only developers.

Management resistance? 2%. Only 17 out of 746 respondents said leadership doesn’t see adopting payment automation as an important investment.

Traditional wisdom may suggest automation fails because leadership won’t buy in, but the data in this survey says the opposite.

Therefore, barriers may not be organizational, but rather technical misconceptions that haven’t kept pace with how modern integrations work.

What This All Means

Decision-makers are spending significant time on manual processes that can be automated. They’ve identified exactly what they want: faster payments, better customer experience, and operational efficiency.

Yet 42% remain stuck, with many citing barriers that may be influenced by outdated information or past experiences with older systems.

Many businesses that may benefit the most from automation may still be evaluating solutions based on older experiences or outdated expectations. Evolving payment tools have improved significantly, offering faster implementations and stronger security than previous generations of systems.

The “works fine” status quo is quietly costing thousands in monthly labor costs or time.

Moving Forward

Here’s what to do next, depending on which barrier resonates with you:

If your process “works fine”: Track your team’s actual hours this month. Calculate what that time costs at fully loaded labor rates. Ask yourself: Is “fine” the same as optimal?

If you’re concerned about integration: Ask vendors specifically if they have a native integration to your platform. You want pre-built, certified connectors with implementation timelines measured in weeks, not months.

If budget is your concern: Calculate what you’re spending now on manual processes. Start with finding the time spent and labor rates, plus cash flow impact from delayed payments. You may find you’re already spending more on inefficient practices than automating costs.

If you’re worried about security: Look for fully PCI-validated payment processors with advanced security measures that include tokenization, encryption, off-site data storage, and more. Compare their security to your current process of manually entering card numbers. Automation is almost always more secure.

There’s still a noticeable gap between what newer payment tools can do and what many businesses believe is achievable. Many teams may still believe automated solutions are faulty or incompatible with their infrastructure based on outdated information, rather than re-evaluating their current capabilities and evolving technology.

As businesses become more familiar with what’s possible, adopting automation becomes a natural next step.

See How EBizCharge Solves These Barriers

Want to see how your payment processes stack up? EBizCharge offers native integrations to 100+ ERP, accounting, CRM, and eCommerce platforms including QuickBooks, Sage, Microsoft Dynamics, NetSuite, Acumatica, SAP, Salesforce, and more.

The EBizCharge platform automates the full payment process by accepting customer payments, posting them to your ERP, and applying them to open invoices. The result is easier reconciliation, far less manual work, and faster cash flow.

Implementation is seamless with embedded payment software solutions that are designed to get you paid faster while making it easier for customers to make payments.

Schedule a free consultation call or demo today to see how EBizCharge can help.