Blog > The Evolution of Accounting: Past, Present and Future

The Evolution of Accounting: Past, Present and Future

The evolution of accounting dates back thousands of years. Although the principles still remain the same, technology has drastically altered the way merchants handle the accounting process. Cloud computing and accounting software programs now allow businesses to take what was once a 20-hour process and complete it in 15 minutes.

Let’s take a look at how technology has changed accounting over time.

15th Century

In the 15th century, Italian mathematician Luca Pacioli first established the “language of business.” Historians now regard him as the father of modern bookkeeping.

He found that merchants used books of debits and credits to keep track of what they spent and what they owed. These early methods of bookkeeping helped merchants maintain financial records and manage their business’ productivity.

Although the application has changed since then, the fundamentals remain vastly similar.

19th Century

The first accounting organization was established in New York in 1887, solidifying the status of accounting as a profession. It later became the American Institute of Certified Public Accountants. Before this, accountants typically served only a single client. The advent of the organization enabled accountants to start serving multiple individuals and businesses.

20th Century

Computer technology revolutionized accounting, as bookkeeping no longer had to be done with paper and pencil.

In 1978, a spreadsheet program known as VisiCalc helped streamline the accounting process. VisiCalc ran on an Apple II computer and allowed for digital data entry. Before this, changing a single number would force accountants to recalculate the entire spreadsheet. With VisiCalc, you could change a single number and it would automatically update all relevant cell information.

IBM launched Lotus 1-2-3 in 1983, an updated version of VisiCalc. Lotus is recognized as the first integrated software solution. It offered database functionality, graphical charts, and the ability to handle spreadsheet calculations.

In 1985, Windows introduced Microsoft Excel, which replaced Lotus as the standard for spreadsheets. Excel allows accountants to prepare financial statements, reconcile accounts, manage cash flow statements, and more.

QuickBooks, now the most popular accounting program in the U.S., was released as a day-to-day bookkeeping software for small businesses in 1998. While 80% of bookkeepers currently use QuickBooks, its security was initially questioned by professional accountants. They claimed it did not meet traditional accounting standards.

21st Century

In 2000, QuickBooks updated its software to include audit trials, double entries, and other security-enhancing items. It also developed components that catered to specific industries. QuickBooks made it easier for small businesses to manage finances, record transactions, pay bills, and complete reporting.

Technology has improved the speed and security of the accounting process. Today, computers can process information faster and more efficiently than humans, and automatically update reports and balances.

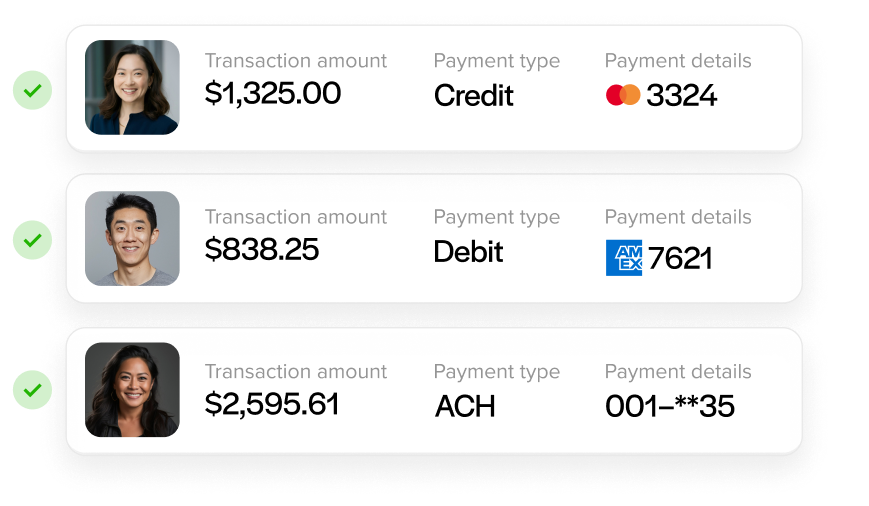

With the help of tokenization, the accounting process today is extremely secure. Tokenization converts credit card information into a unique token, decipherable only with the proper payment card tokenization system. Completely different from the original credit card information, the token acts as the key for all future transactions. Hackers cannot unlock the vault that houses credit card data without this key. Even if they managed to, the information would be indecipherable.

Mobile banking also allows businesses to process transactions from a mobile phone or tablet with the help of a software application.

The Future of Accounting

Businesses now have the option to use cloud-based accounting. Cloud-based accounting is software that runs on servers, allowing you to access data from anywhere you have an Internet connection. It protects businesses from system administration costs and server failures. For most companies, moving to the Cloud reduces IT expenses by 30% to 70%.

Technology has simplified the accounting process. Integrations now streamline data entry, improve accuracy, and reduce the margin of error.

With integrations, businesses can link their accounting software to a payment processor. This simplifies payment acceptance and allows businesses to run transactions directly within their existing accounting software.

The continued evolution of accounting will allow for greater software integration, increased efficiency, and faster data entry for businesses across the globe.