Blog > The Benefits of AI in Accounting

The Benefits of AI in Accounting

Artificial intelligence (AI) has steadily emerged as a transformative powerhouse, revolutionizing the accounting field by automating mundane tasks and enhancing decision-making capabilities. Although some fear this new tool may replace human accountants, its true potential lies in blending machine precision with human insight.

This article will explore AI’s role in modern accounting and offer practical insights on integrating this technology into existing systems for optimal benefits.

Understanding accounting practices

Accounting practices involve managing and recording businesses’ financial transactions. These practices provide transparency into your company’s financial position and ensure accurate financial reporting.

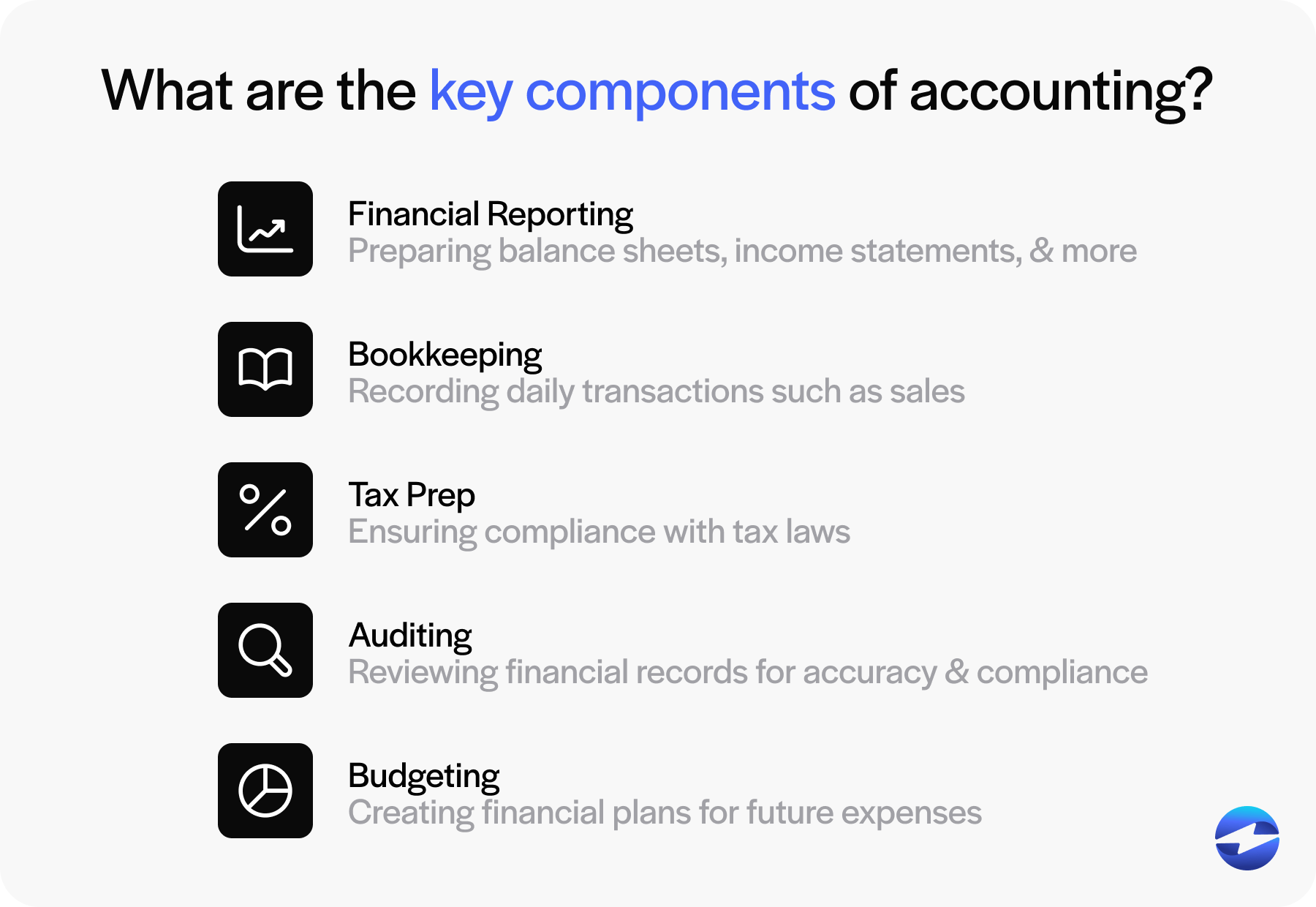

Here are five key components of accounting practices include:

- Financial reporting: Involves preparing balance sheets, income statements, and cash flow statements.

- Bookkeeping: Records daily transactions such as sales, purchases, and payments.

- Tax prep: Ensures compliance with tax laws.

- Auditing: Reviews financial records for accuracy and compliance.

- Budgeting: Helps create financial plans for future expenses.

Common accounting principles include the double-entry system, which records debits and credits to maintain balanced financial accounts, and accrual accounting, which records revenues and expenses when they’re incurred rather than when cash is exchanged.

Accounting practices include preparing financial statements, reconciling bank statements, and managing accounts receivable (AR) and payable (AP). These practices are fundamental for making informed decisions, tracking business performance, and ensuring transparency. They also play a crucial role in risk management, maintaining financial health, and guiding strategic decision-making.

A solid understanding of these practices enables businesses to establish accurate and efficient financial processes.

Will AI replace accountants?

Artificial intelligence is an intelligence system that can automatically perform tasks such as learning, reasoning, problem-solving, and decision-making without manual intervention.

AI systems use algorithms and data to recognize patterns, automate processes, and improve over time without explicit human intelligence.

While AI can enhance efficiency and provide intelligence in accounting, it won’t replace accounts entirely.

AI-powered tools can provide numerous benefits that streamline accounting practices, saving accountants time and energy. However, human judgement is still a crucial element of accounting.

Accountants are needed for strategic decision-making and assessing potential risks. AI currently lacks the ability to fully understand complex scenarios or apply empathy in client services. Therefore, accounting will continue to require a human touch where personal judgement is involved.

Although the landscape of this emerging tool is still under speculation, it will most likely serve as a useful tool to streamline more tedious tasks.

That said, it’s important to understand what AI can bring to the table.

10 benefits of AI in accounting

AI and accounting offer a powerful dynamic, offering multiple benefits that reshape financial operations.

Understanding these benefits is crucial for accountants and firms looking to stay ahead in a competitive environment.

1. Automation of repetitive tasks

AI significantly improves efficiency by automating repetitive tasks that would otherwise consume valuable time and resources. This includes data entry, invoice processing, bank reconciliations, and payroll management, which can be completed seamlessly with AI-driven software.

Automation reduces manual work and allows accountants to focus on strategic decision-making, financial planning, and advisory services.

2. Improved accuracy

Another significant advantage of AI is its ability to improve accuracy. Manual bookkeeping is prone to human error, but AI eliminates many of these risks by ensuring that calculations, financial entries, and data processing are performed without mistakes.

AI systems apply built-in validation checks and automated data processing to maintain high levels of precision, reducing the likelihood of costly discrepancies and ensuring financial records remain reliable.

3. Fraud detection and risk management

Fraud detection and risk management are also significantly enhanced through AI-powered systems. AI continuously monitors financial transactions, identifying irregularities and flagging potentially fraudulent activities.

By analyzing patterns and anomalies, AI can detect suspicious behavior, such as duplicate payments or unauthorized account access. This proactive fraud prevention helps businesses safeguard their financial assets and reduces the risk of financial misconduct.

4. Faster data processing

The ability to process large volumes of financial data at exceptional speeds is another area where AI excels. Traditional accounting methods often take time to analyze financial information and generate reports, but AI can process data in real-time.

This rapid data processing allows businesses to make informed decisions faster, proactively respond to financial challenges, and streamline forecasting more efficiently.

5. Enhanced financial analysis

AI’s impact extends beyond automation and speed by also enhancing financial analyses. AI-driven tools can identify trends, evaluate key performance indicators (KPIs), and generate predictive insights based on historical data.

By leveraging AI’s financial analysis, businesses can improve forecasting, optimize budgeting strategies, and make data-driven decisions that lead to sustainable growth.

6. Cost reduction

Cost reduction is another key benefit of AI accounting practices. By automating tasks that previously required extensive manual effort, businesses can reduce labor costs while also minimizing the financial impact of human errors.

Additionally, AI-driven solutions optimize resource allocation, allowing companies to operate more efficiently without the need for constant hiring or increased administrative expenses.

7. Better compliance and auditing

Compliance and auditing also become more manageable with AI. AI-powered software continuously monitors financial transactions to ensure adherence to regulatory requirements and accounting standards.

AI identifies potential compliance risks in real-time, helping businesses avoid legal penalties and prepare for audits with accurate, well-organized financial records.

Automated auditing also streamlines the review process, making regulatory compliance easier and reducing the administrative burden of audits.

8. Natural language processing (NLP) for reporting

Natural Language Processing (NLP) further enhances AI accounting by making financial reporting more accessible. AI-powered NLP systems can transform complex financial data into clear, comprehensive language, allowing non-accounting professionals to understand key financial insights.

These tools also enable businesses to automatically generate reports, summarize performance trends, and retrieve financial data through voice or text-based queries, making financial analysis more user-friendly and efficient.

9. Personalized financial advice

Beyond operational improvements, AI offers personalized financial advice by analyzing a company’s financial health and suggesting tailored recommendations.

AI-driven advisory tools can help businesses identify cost-saving opportunities, optimize tax strategies, and develop investment plans based on real-time financial data. This level of personalization ensures that decisions are well-informed and aligned with business objectives.

10. Scalability and integration

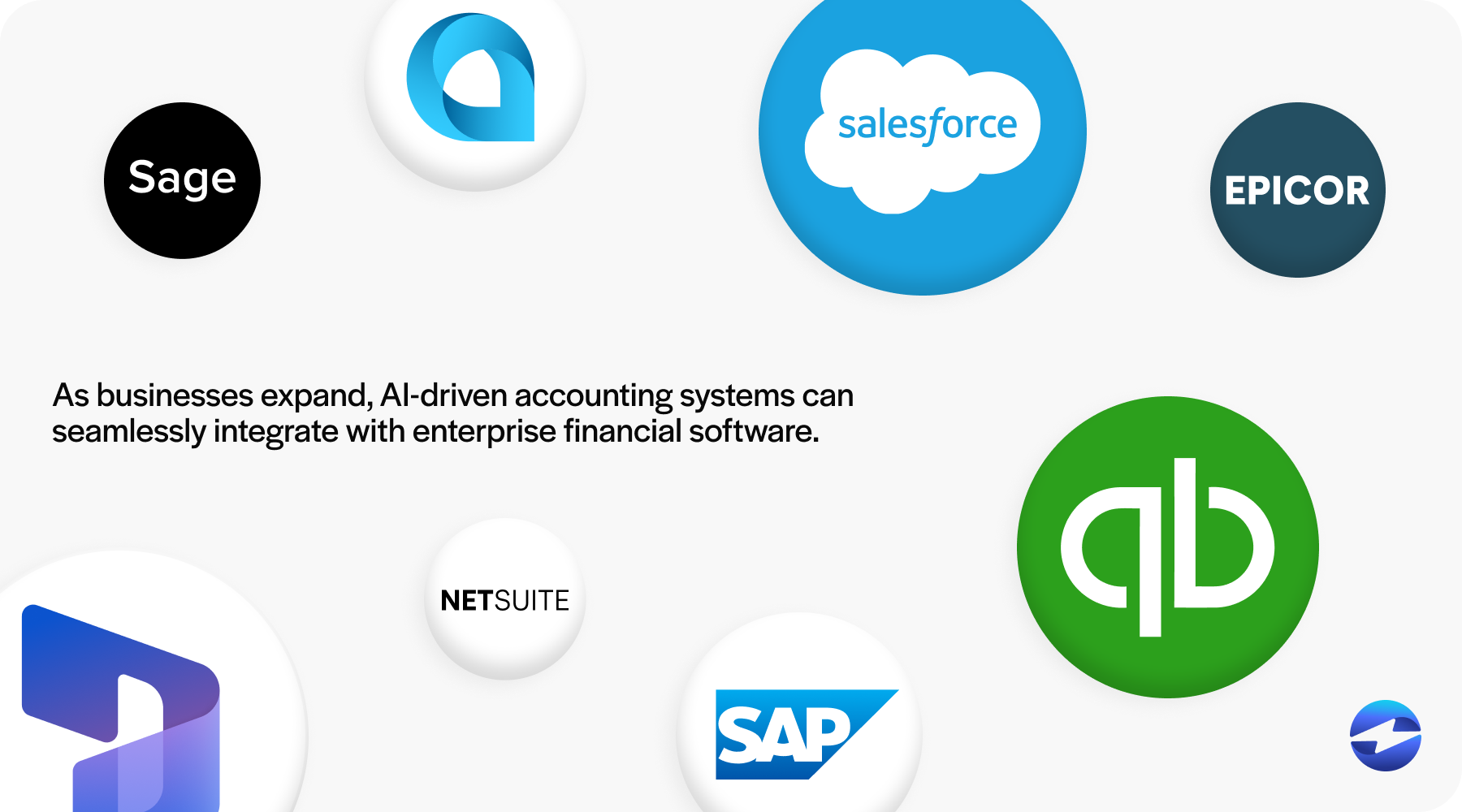

One of the most valuable aspects of AI in accounting is its scalability. AI solutions are designed to adapt to a company’s growth, handling increasing transaction volumes and evolving regulatory requirements without disrupting operations.

As businesses expand, AI accounting systems can seamlessly integrate with enterprise financial software, ensuring that financial management remains efficient, accurate, and compliant at every stage of growth.

AI technology continues to evolve, making its role in accounting increasingly vital to maintain efficient business operations and adapt strategies to keep up with the evolving financial landscape.

AI’s role in accounting

AI has already transformed modern accounting, integrating into multiple facets of accounting practices.

Here are five examples of how AI is currently used in various accounting practices:

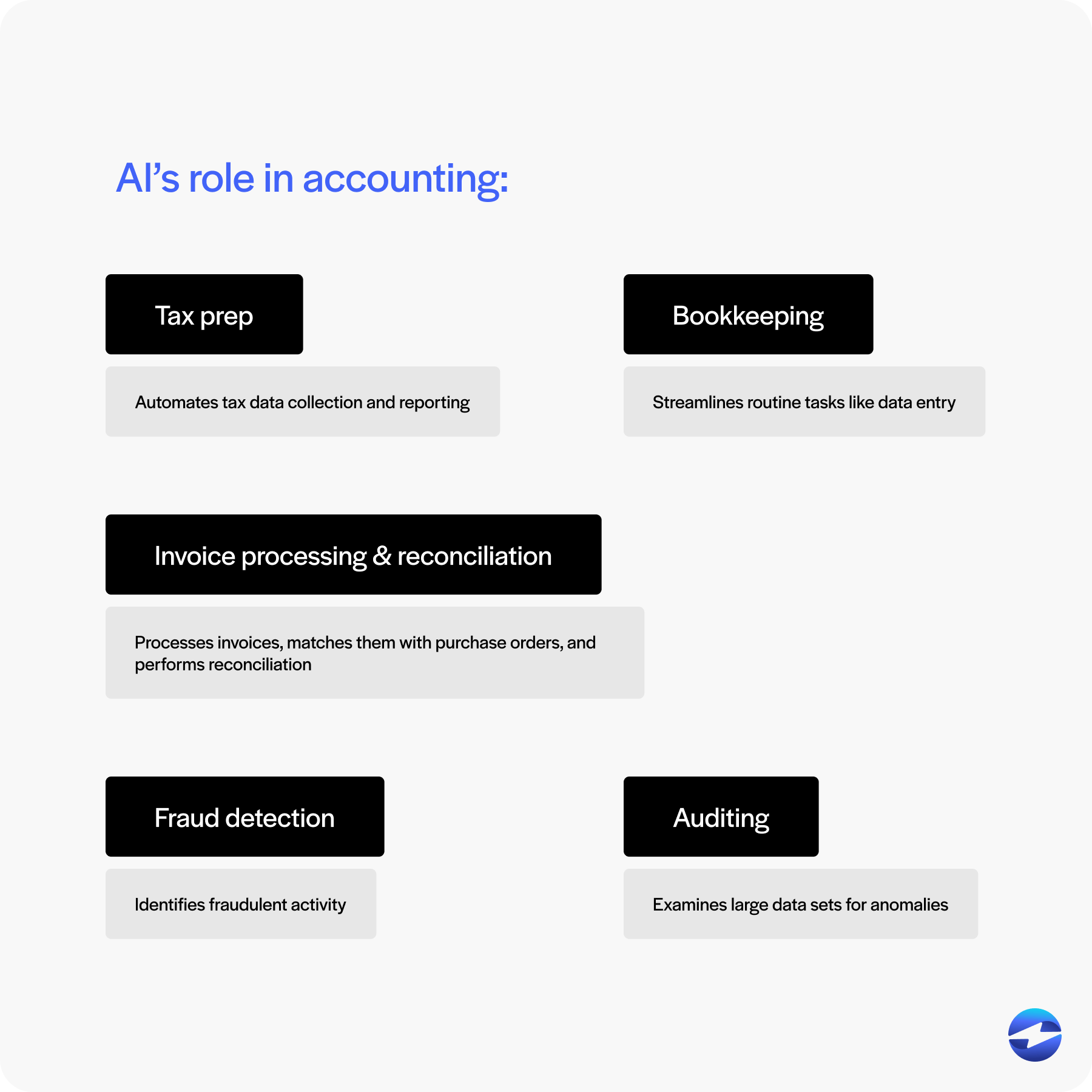

- Tax prep: AI automates tax data collection and reporting, ensuring compliance and reducing human errors.’

- Bookkeeping: AI streamlines routine tasks like data entry, allowing accounting professionals to focus on more complex issues.

- Invoice processing and reconciliation: AI-powered tools can swiftly process invoices, match them with purchase orders, and perform reconciliation, reducing manual tasks and errors.

- Fraud detection: AI helps identify fraudulent activity by analyzing patterns and flagging suspicious transactions, enhancing risk management.

- Auditing: AI assists in auditing by examining large data sets for anomalies, ensuring thorough and accurate audits.

As businesses continue to adopt AI-driven solutions, accounting processes will become more efficient, accurate, and data-driven, shaping the future of financial management.

If you’re looking to implement AI into your own accounting processes, the following section will provide a brief explanation of how to get started.

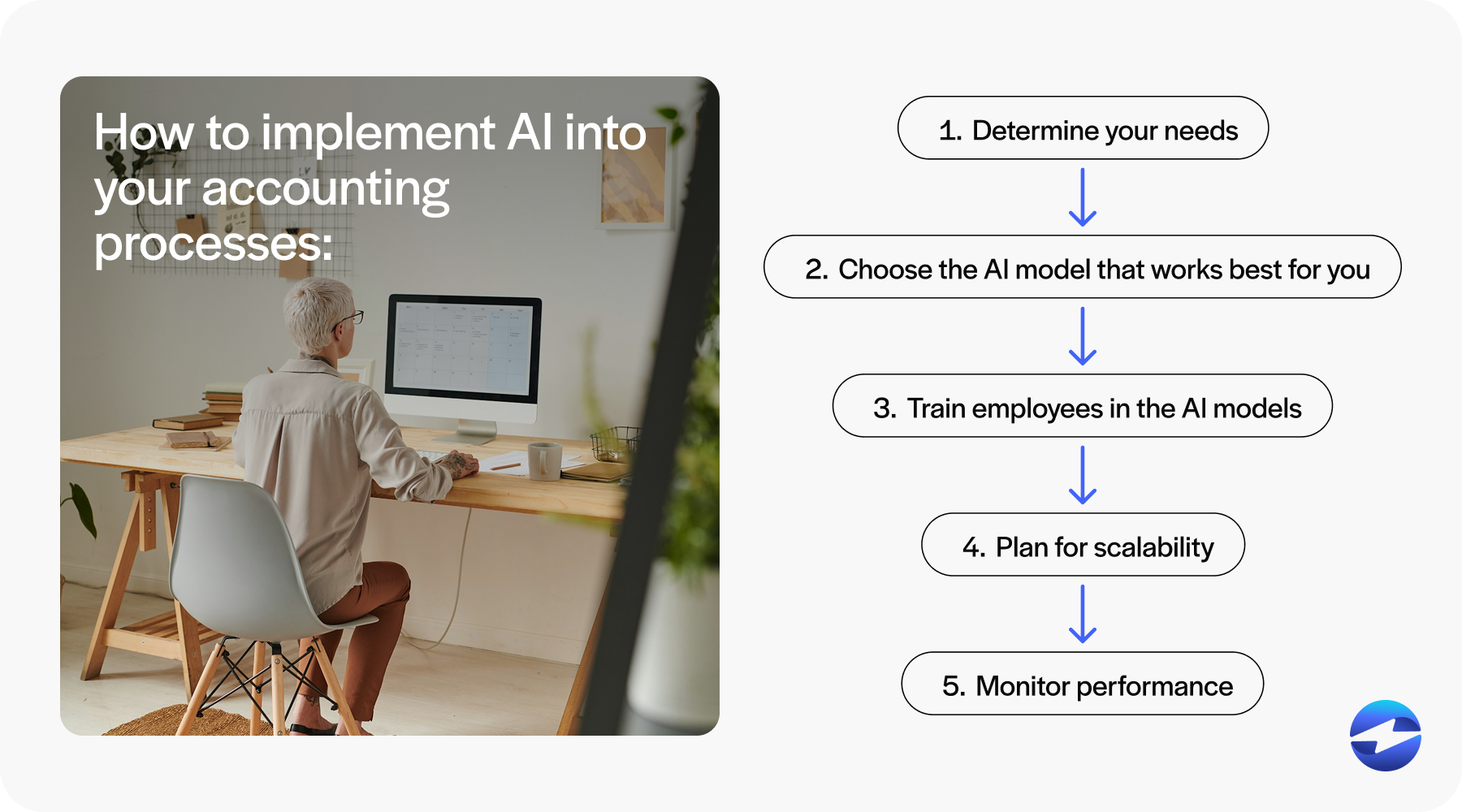

How to implement AI into your accounting processes

Successful AI integration requires careful planning and execution. From identifying your specific business needs to selecting the right AI model and training employees, each step plays a crucial role in ensuring AI solutions deliver meaningful results.

The following five steps will help you implement AI in your accounting operations.

1. Determine your needs

The first step in implementing AI into your accounting processes is determining your business’s specific needs. Start by identifying areas where automation can make the most significant impact.

Are you looking to reduce manual tasks like data entry, or is your goal to enhance fraud detection? Consider factors like the size of your business, the complexity of your financial processes, and the desired outcomes from using AI.

Knowing your needs allows you to focus on the right tools and solutions, minimizing unnecessary expenses and ensuring the AI implementation is both effective and efficient.

2. Choose the AI model that works best for you

Once you’ve determined your needs, the next step is selecting an AI model that suits your business. Different AI models offer various capabilities, so choosing one that aligns with your goals is crucial.

For instance, if you focus on invoice processing, you may opt for models specializing in natural language processing. On the other hand, if predictive financial analysis is your priority, machine learning models will likely be more appropriate.

Evaluate each model based on factors like scalability, ease of integration, and potential return on investment. Choosing the right AI model ensures that your accounting tasks are streamlined and that the AI delivers a measurable impact on your operations.

3. Train employees in AI models

Your employees will need to understand how to use the AI tools and how these tools fit into the broader accounting processes. This training empowers them to leverage AI capabilities fully for more efficiency.

Businesses can start by offering training sessions that explain the basics of AI and its benefits in accounting, then move on to more detailed training that covers the specific AI models your business uses.

Training sessions should include practical, hands-on experiences that allow employees to interact with AI systems, ensuring a deep understanding of their functions.

4. Plan for scalability

As your business grows, your AI systems should expand to handle increased workloads and more complex data. Scalability ensures that your investment in AI continues to provide value over time, adapting to changing business demands.

Ensure the AI solutions you choose can evolve with your needs, offering flexibility to add new features or integrate with other systems.

By prioritizing scalability, you ensure your accounting processes remain efficient and robust, regardless of business size. This forward-thinking approach also positions your company to quickly adopt future trends in AI technology.

5. Monitor performance

Regular assessments help identify areas where AI systems perform well and where improvements are needed. You can accomplish this by setting metrics to evaluate AI’s impact on efficiency, cost savings, and error reduction.

Routine performance reviews allow you to tweak processes, ensuring AI tools continue to align with business goals. Monitoring helps identify potential risks early, safeguarding against issues like data inaccuracies or system malfunctions.

By keeping an eye on AI performance, you maximize the benefits of artificial intelligence, ensuring it remains a valuable asset in your accounting toolkit.

Integrating AI into your accounting processes isn’t a one-time effort but an ongoing strategy that requires continuous evaluation and adaptation. By determining your business’s needs, selecting the right AI model, training employees, planning for scalability, and regularly monitoring performance, your company can successfully leverage AI to streamline financial operations.

As a newly emerged tool, AI faces high levels of scrutiny. That said, the future of AI in accounting looks promising.

The future of artificial intelligence in accounting

The future of artificial intelligence in accounting is promising, as it will enable accountants and AI systems to work together for improved efficiency and accuracy.

AI will handle repetitive tasks such as invoice processing and financial reporting, freeing accountants to focus on higher-value activities like strategic decision-making and risk management. This will significantly reduce human errors and enhance the accuracy of financial records.

In addition to automating routine tasks, AI-powered tools will improve fraud detection by analyzing transaction patterns and identifying potential risks in real-time. This will allow businesses to strengthen their financial security while enabling accountants to devote more time to client services and advisory roles.

AI will also play a crucial role in financial data analyses, providing real-time insights that support informed decision-making. Despite AI’s efficient data processing capabilities, human intervention will remain essential for interpreting complex financial scenarios and making strategic choices.

As it evolves, accounting AI and accountants will likely compliment each other by streamlining workflows, enhancing financial security, and improving business decision-making, creating a more dynamic and effective financial management process that balances automation with professional expertise.