Blog > The 5 Most Common Accounting Problems (and How to Solve Them)

The 5 Most Common Accounting Problems (and How to Solve Them)

Your accounting process may be more difficult than it needs to be. Many people still enter credit card information and process payments manually. Cloud-based servers can help store sensitive credit card data more securely.

By 2018, at least 30% of workloads were moved to the cloud to keep credit card data more secure than locally installed accounting software. The benefits of integrating accounting software with cloud-based solutions include increased security and a boost in efficiency for businesses.

Small Business Digest reported that 91% of small to medium business owners with integrated payment systems reduced back-office expenses by at least 21%.

Here are 5 accounting problems that can hinder productivity for your business, along with solutions for more productive results:

- Poor Security

- Lack of Efficiency

- Non-Compliance

- Challenging Software

- Lack of Features

Let’s get into it!

Problem: Poor security

Solution: Use cloud-based software

Only 39% of merchants use cloud-based accounting software.

Customers trust businesses with sensitive credit card information. In order to avoid fraud, it’s important to store this data in a secure vault. However, many businesses fall short in this department. Some merchants put data at risk by keeping sensitive credit card information in spreadsheets, on printed paper, or on post-it notes.

Instead, data should be stored in a secure, cloud-based vault.

By finding a virtual payment gateway that offers cloud-based solutions, merchants can gain enhanced data security levels for sensitive information. Many virtual payment gateways use a process called tokenization to protect customer data from unwanted eyes and store it on a secure, PCI-compliant server.

Problem: Lack of efficiency

Solution: Integrate your software

Less than 50% of merchants currently use integrated software.

The accounting process can be extremely tedious. In order to process payments, merchants must go through a time-consuming multi-step process. First, a merchant must log into a physical terminal and manually enter credit card information, including card number, expiration date, billing address, and shipping address. Then, they must create an invoice, write a purchase order, and process a transaction. After an approval code is received, they must go back into their accounting system and create a cash receipt.

An integration can streamline this process and save businesses valuable time and money.

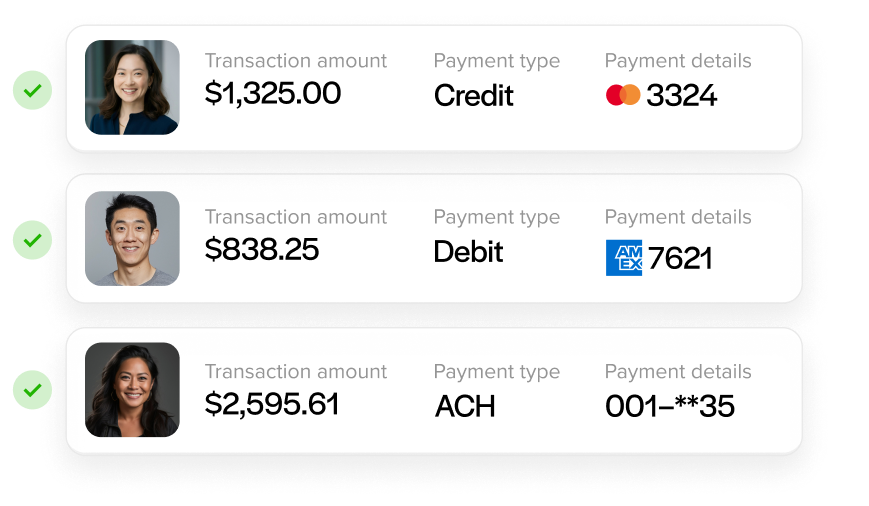

By using a payment integration with their accounting software, merchants can accept credit card payments directly within their accounting software. Credit card information can be updated with the click of a button, and payments can be automatically posted with invoices and emailed to customers for immediate payment.

Problem: Non-compliance

Solution: Stay up to date with security requirements

61% of merchants’ businesses are not PCI compliant.

If businesses accept credit card payments, they must be PCI compliant. PCI compliance is a set of security standards that protects credit card information. Non-compliance puts sensitive data at a much higher risk of fraud, and can result in heavy business fines of up to $100,000 per month.

To ensure your business maintains PCI compliance and steers away from accounting problems, find a payment gateway that meets all of the PCI DSS specifications. In order to become PCI compliant, merchants must complete a yearly self-assessment questionnaire and pass a quarterly PCI security scan. A payment gateway can help your business meet these required security measures.

Problem: Challenging software

Solution: Update your software

27% of businesses use accounting software that is more than 11 years old.

Outdated software not only makes accounting more difficult, it also jeopardizes security. Are you still manually entering credit card information into your accounting software? Do you use several different systems to complete your accounting tasks? Many companies use older software and firmware that don’t offer the same protection as the most current versions.

Updating to the most current software ensures that your sensitive credit card information is being protected at the highest security level possible. Integrations allow for enhanced speed and productivity while reducing the risk of accounting errors that can occur with outdated software.

Problem: Lack of features

Solution: Find a feature-rich payment gateway

The convenience of a payment gateway encourages customers to pay faster, cutting down on invoice turnaround time by an average of 50%.

Traditional accounting software offers limited features at an expensive price, and many require you to update to the latest version in order to gain full functionality. In addition, many software providers don’t offer the reporting tools and security features that some payment gateways can provide.

A feature-rich payment gateway that integrates to your software can provide a host of features that make credit card processing faster and more efficient. With a payment gateway, you can securely store sensitive data, access unlimited transaction history, create customized reports, and reduce processing costs.

Accounting problems don’t have to rule your business. Cloud-based software helps store sensitive credit card location in a safe place, and an integrated payment solution can help maximize security and increase efficiency for your business.