Blog > Streamline NetSuite Billing: From Manual Processes to Full Automation

Streamline NetSuite Billing: From Manual Processes to Full Automation

Manual billing can be tedious, time-consuming, and full of errors. If your team is still logging into NetSuite to push invoices by hand or manually reconciling payments each month, you’re not alone. Many businesses start with manual billing processes because it’s what they know. But as the business grows, so does the pressure on finance teams to keep up. That’s where automation steps in.

This guide is built for finance teams, AR managers, and NetSuite admins who are ready to cut the busywork and get serious about streamlining their NetSuite billing operations. Whether you’re managing subscription revenue, B2B contracts, or recurring services, NetSuite billing automation can drastically reduce errors and speed up your cash cycle.

Understanding Manual Billing Workflows in NetSuite

Manual billing might seem manageable at first—until you start scaling. In a typical NetSuite environment, finance teams often juggle tasks like invoice creation, payment matching, and tracking down overdue payments. These processes often require spreadsheet exports, repeated data entry, and late-night reconciliation sessions.

Not only is this frustrating, but it also opens the door to human error. Incorrect invoice dates, duplicate charges, and missed renewals can snowball into cash flow delays or customer churn. If your team spends more time checking numbers than analyzing performance, it’s a strong sign that it may be time to consider automated billing.

Native NetSuite Tools for Billing Automation

NetSuite offers powerful tools to help you automate billing in NetSuite, starting with SuiteBilling and Advanced Revenue Management (ARM). These features allow you to set up flexible NetSuite billing schedules tied to contracts, subscriptions, or service timelines.

SuiteBilling supports different billing models, such as usage-based, fixed-rate, and milestone billing, while ARM handles revenue recognition rules in the background. With the right setup, invoices generate automatically based on your NetSuite billing schedule, reducing the need for human touchpoints.

You can also leverage SuiteFlow and saved searches to automate reminders, approvals, or next steps after a billing event. Together, these tools form a foundation for robust NetSuite advanced billing workflows.

Implementing Full Billing Automation

Moving to full automation doesn’t happen overnight, but a phased approach makes it doable. Start by reviewing your current processes and identifying where manual intervention is still needed.

Begin configuring templates for NetSuite automated invoicing, setting up triggers for when invoices should be created, whether it’s monthly, quarterly, or based on contract milestones. Ensure your billing rules account for edge cases like upgrades, proration, or usage-based changes.

It’s also essential to connect your billing logic with payment status updates. As payments come in, NetSuite should automatically mark invoices as paid and trigger follow-up workflows, keeping your accounts receivable (AR) ledger clean and accurate without extra effort.

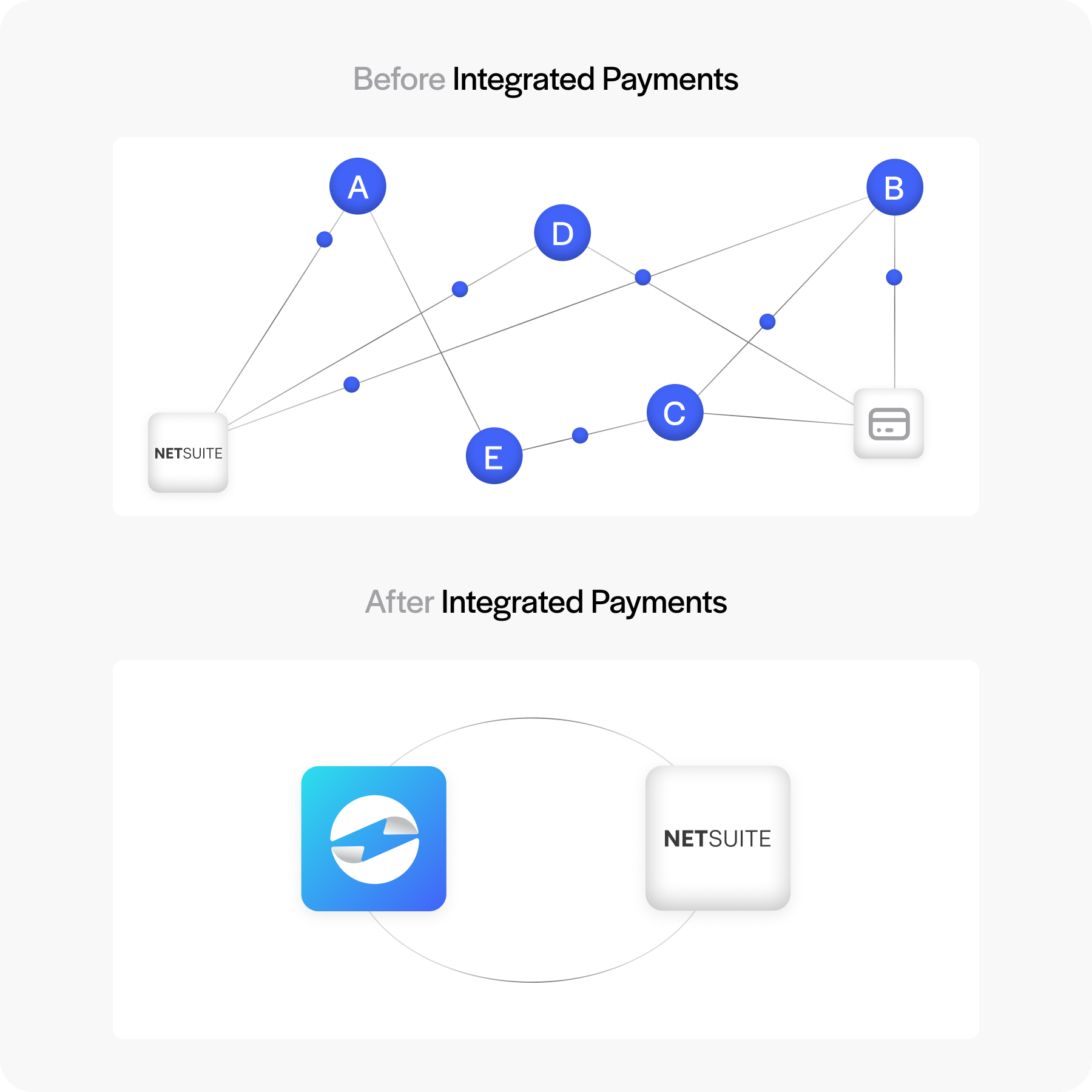

Optimizing Collections with Integrated Payments

Billing automation is just one side of the coin. While automating invoicing is critical, collecting payments efficiently is just as important, and is often where the most friction occurs in the billing cycle. Many teams still rely on disconnected systems or manual methods to chase payments, update records, or reconcile invoices, which can delay collections and increase errors.

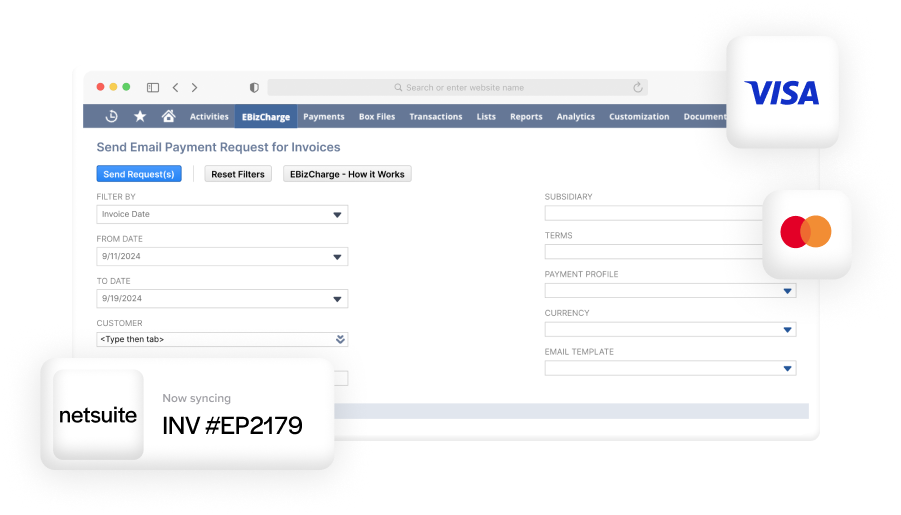

To fully streamline your AR process, you’ll want to integrate a payment processing solution that connects directly to your billing system. That’s where integrations like EBizCharge shine.

By embedding a payment processor directly into NetSuite, you can post payments in real-time, automate payment reminders, and give customers access to self-service portals. Whether you’re handling NetSuite credit card processing or ACH, the payment process becomes smoother for everyone involved.

Plus, with real-time data syncing, you eliminate the need for manual payment reconciliation—a massive win for busy finance teams.

EBizCharge Integration Advantages

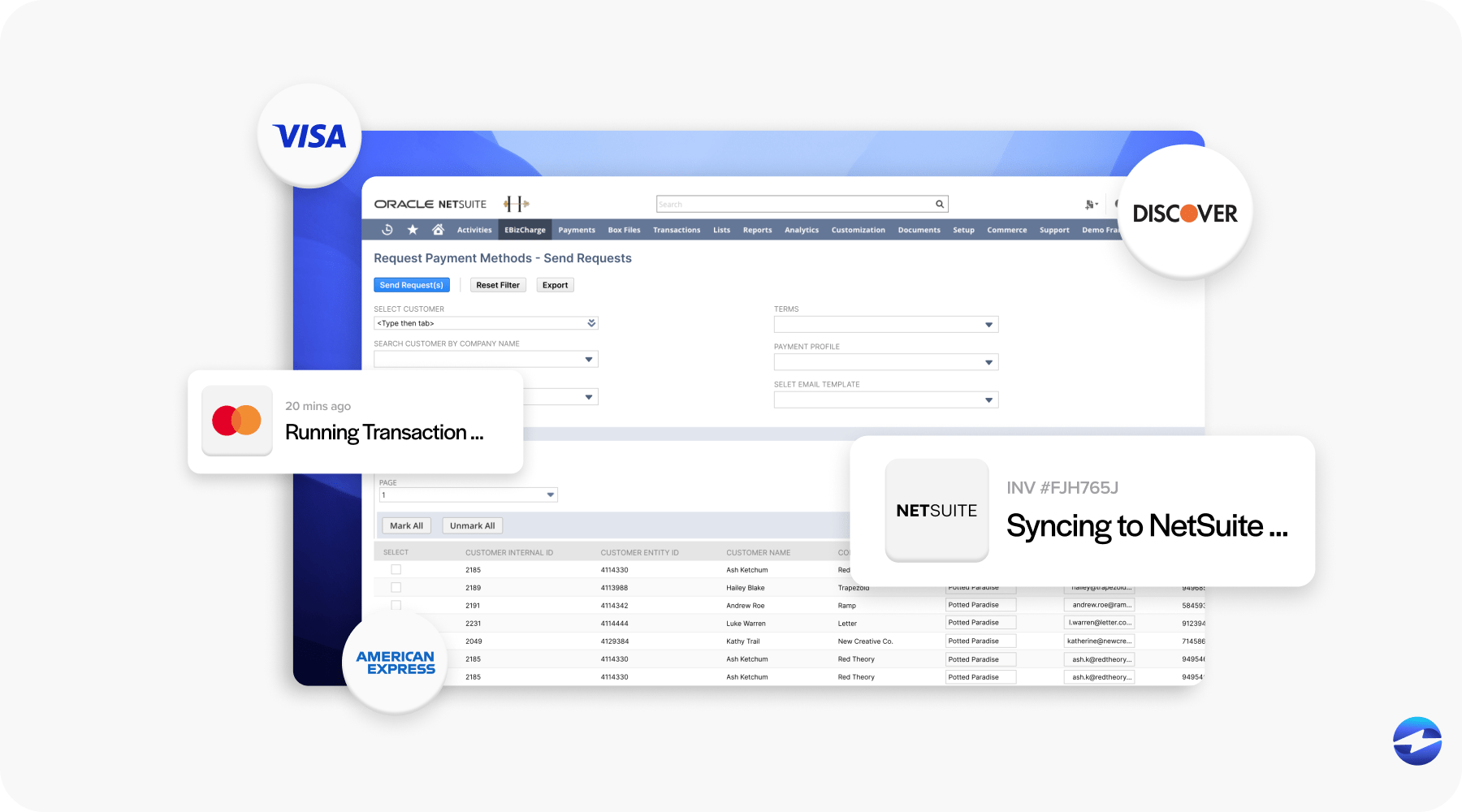

If you’re ready to reduce friction in your NetSuite billing operations, EBizCharge is a game-changer. This top-rated payment solution embeds directly into NetSuite, allowing teams to accept payments and apply them to open invoices without ever leaving the ERP. This seamless integration not only saves time but also reduces errors by eliminating the need for duplicate data entry across systems.

EBizCharge supports secure NetSuite credit card processing, bank transfers, and ACH, all while maintaining PCI compliance and data security best practices. It streamlines both inbound payments and reporting, helping your team maintain compliance and move faster from invoice to payment.

With automated payment posting and real-time reconciliation, EBizCharge significantly shortens the quote-to-cash cycle and improves visibility into accounts receivable. Finance teams can access transaction histories, payment statuses, and customer balances all in one place, directly within NetSuite.

More than just a payment processing solution, it helps automate collections workflows, sends timely reminders, enables customers to pay via secure hosted links, and reduces the need for manual follow-up. For teams looking to optimize how they handle recurring or high-volume billing, EBizCharge offers the kind of embedded automation that elevates billing efficiency across the board.

Common Pitfalls to Avoid

Even with powerful tools at your disposal, implementing NetSuite billing automation isn’t always smooth sailing. Rushing the setup or overlooking details can lead to unintended complications down the road. It’s important to approach the automation process with a full understanding of the risks so you can avoid missteps that could slow your progress or impact your billing accuracy.

Here are a few obstacles to keep in mind:

- Over-customizing your billing schedule in NetSuite can make future updates harder.

- Poor data hygiene leads to inaccurate invoices and missed charges.

- Failing to test edge cases can result in revenue leakage or customer frustration.

A clear rollout plan and thorough testing process are key to successful NetSuite billing automation.

Bringing Efficiency and Accuracy to NetSuite Billing

Automating your NetSuite billing process isn’t just about saving time—it’s about building a scalable system that supports growth without added complexity. With the right combination of tools, workflows, and a reliable payment processor, your billing and collections process can become a strength instead of a bottleneck.

For teams ready to ditch the spreadsheets and late-night reconciliations, automating billing in NetSuite is a smart next step. The result? Fewer errors, faster payments, and a finance team that has time to focus on the big picture.