Blog > Statement of Retained Earnings: What is it? How to Prepare It, and Examples

Statement of Retained Earnings: What is it? How to Prepare It, and Examples

Imagine a reservoir of funds, steadily growing with each fiscal period, held back by a company for future investment, debt reduction, or as a cushion against unforeseen financial challenges. This reservoir is known as retained earnings, a pivotal component of shareholder equity that reflects a firm’s financial health and strategic understanding.

This article will detail what retained earnings are and show an example of how it looks in practice.

What are retained earnings?

Retained earnings are a critical component of a company’s equity that reflects the cumulative profits kept in the business after distributing dividends to shareholders. This financial figure is not a stagnant value but changes over accounting periods as the company earns more profits or incurs losses.

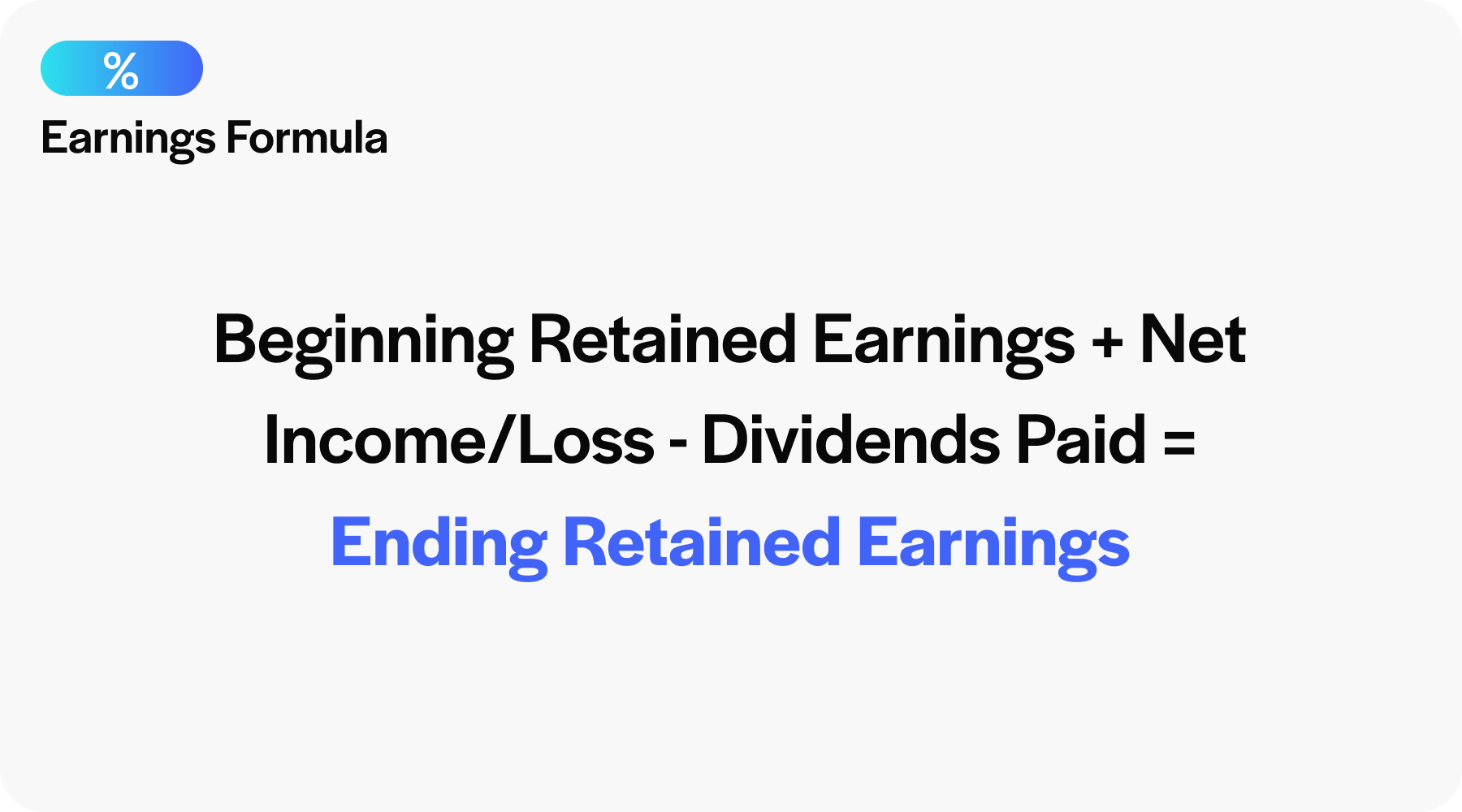

From an accounting perspective, retained earnings can be viewed through the lens of the “Earnings Formula,” which is:

Beginning Retained Earnings + Net Income/Loss – Dividends Paid = Ending Retained Earnings

This calculation demonstrates how retained earnings are adjusted over each financial period, reflecting the business’s ongoing financial activity. Contrary to common misconceptions, retained earnings are not a pool of cash but an expression of how much of the company’s earnings have been reinvested in the business or kept as a reserve.

Why are retained earnings so important?

Retained earnings hold enormous significance for business owners and potential investors as they are a barometer of a company’s financial health and historical profitability. When a company consistently boasts positive retained earnings, it’s generally seen as a signal of a profitable company that can self-fund its growth, appealing to investors seeking stable investments.

From an internal point of view, these earnings are a source of surplus income that can be strategically allocated, whether for expanding operations, investing in research and development, or paying off debts without needing external borrowing. This financial flexibility adds resilience to the business, helping it navigate harsh market conditions.

Moreover, as part of the equity statement, the retained earnings statement offers insights into how management balances dividend payouts against reinvestment for growth, which can influence shareholders’ strategic decisions. The presence of ample retained earnings enables a company to declare stock dividends that attract more investors, increasing the value of the common stock.

While the importance of retained earnings may be clear, there are two different types of retained earnings that must be distinguished.

The difference between appropriated and unappropriated retained earnings

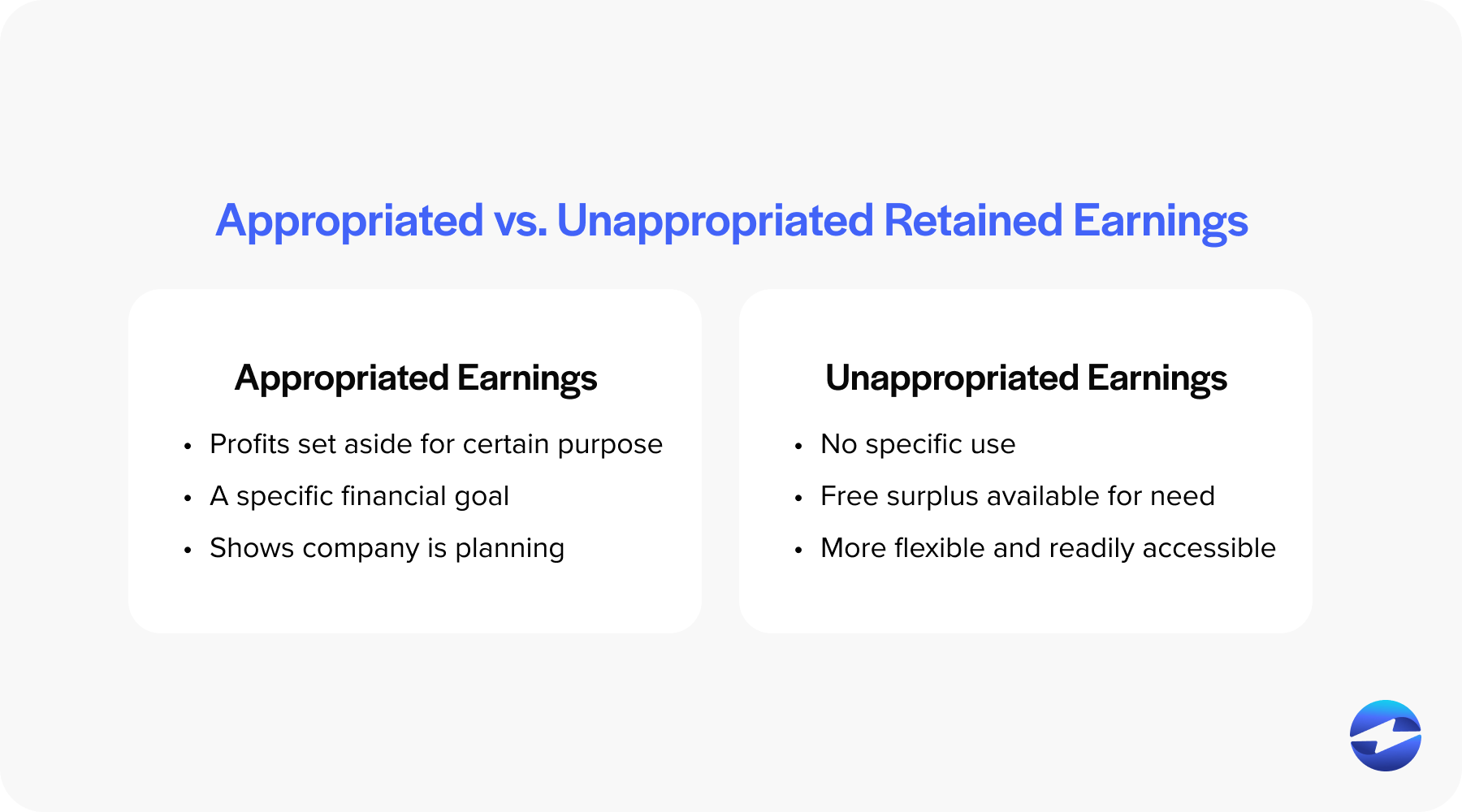

Understanding the difference between appropriated and unappropriated retained earnings is crucial for anyone analyzing a company’s financial statements. While both are part of retained earnings, they serve different purposes and signal unique information to the users of the financial statements.

- Appropriated retained earnings are those profits that a company’s management has set aside for a specific purpose. This could be for future expansion projects, research and development, debt reduction, or any plan requiring reserved funds. This reservation reflects a commitment by the company to specific financial goals or obligations and sends a powerful message about plans.

- Unappropriated retained earnings are not earmarked for any specific use and can be considered the free surplus available for any corporate need. The company has these earnings to be used as deemed fit, such as dividend distribution or unexpected expenses. This portion of retained earnings is more flexible and readily accessible than its appropriated counterpart.

Whether appropriated or unappropriated, retained earnings play a vital role in a company’s statements.

Net income vs retained earnings

Net income and retained earnings are crucial to a company’s financial health, but serve different roles in financial statements. Net income, also known as net profit, is the amount of money a company earns after subtracting all expenses, taxes, and costs associated with its operation. It is a key figure on the income statement and provides a snapshot of a company’s profitability during a specific accounting period.

While net income measures a company’s earnings for a single period, retained earnings show the accumulation of profits over time. Both figures are essential for assessing a company’s financial performance, with net income indicating short-term profitability and retained earnings displaying long-term economic strength through its reserves.

Here’s a summarized chart of the difference between the two terms:

| Financial Term | Definition | Financial Statement |

|---|---|---|

| Net Income | Profit after all expenses and taxes | Income Statement |

| Retained Earnings | Cumulative earnings kept for reinvestment/dividend reserves | Retained Earnings Statement/Balance Sheet |

Net income and retained earnings may have distinctive differences, but both play a pivotal role in allowing financial professionals to gain a better look at their company’s finances.

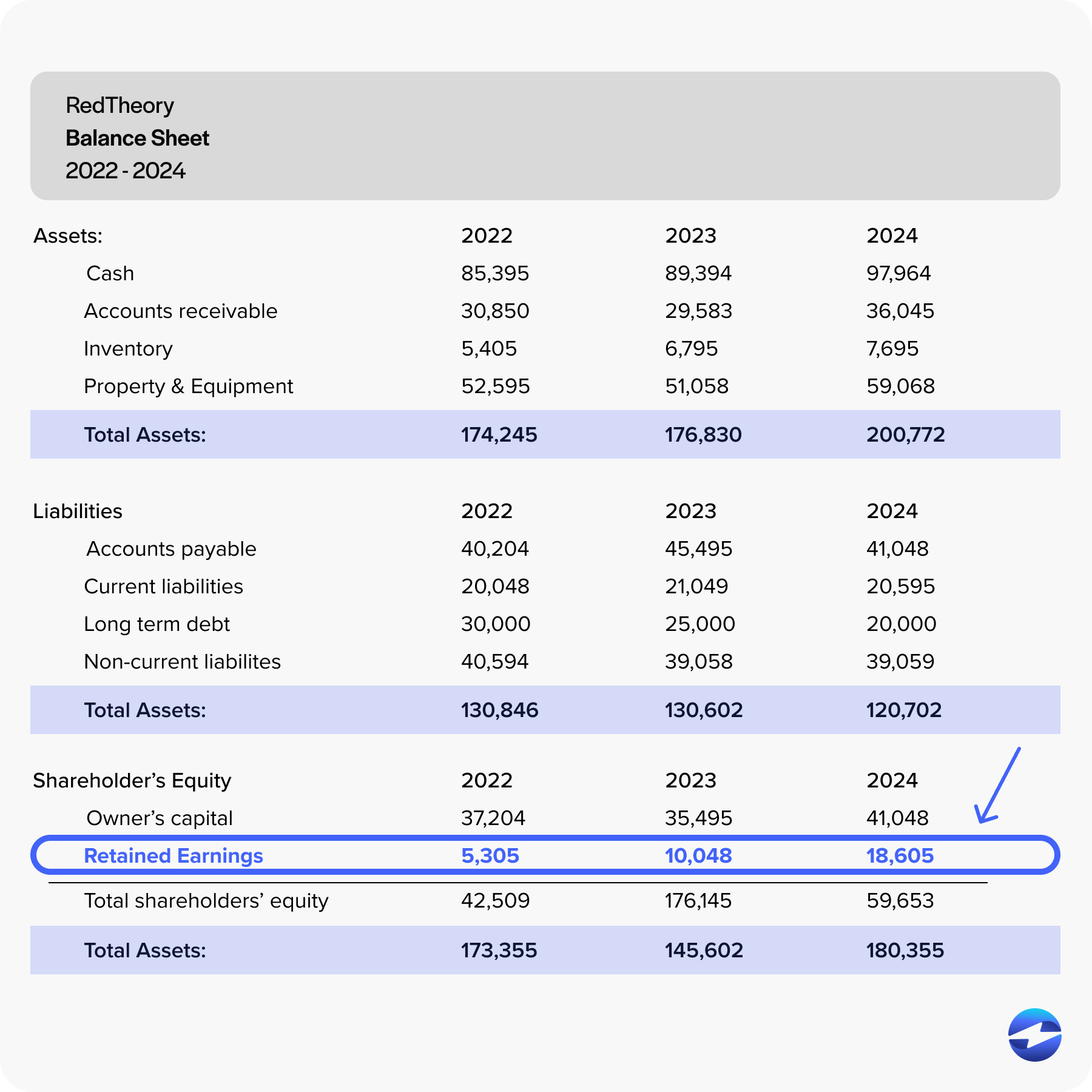

Where are retained earnings on the balance sheet?

Retained earnings are a key component of a company’s equity on the balance sheet. They are typically found in the equity section, which is located at the bottom half of the balance sheet.

Are retained earnings an asset?

Retained earnings are not an asset but reflect the shareholder’s equity in a business. While assets are resources owned by a company that has tangible or economic value, retained earnings are an equity component that indicates the portion of profit reinvested in the company for its future growth or to safeguard against future risks and liabilities.

Is retained earnings a debit or credit?

In accounting, retained earnings hold a credit balance. If a company is profitable and decides to maintain a portion of its profits, it will credit the retained earnings account. On the other hand, if a company incurs a loss or distributes dividends to shareholders, the retained earnings account is debited. This reflects the accounting principle that increases in equity, such as profits kept within the company, and credits, while decreases in equity, such as losses or dividends, are debits.

What is a statement of retained earnings?

A statement of retained earnings is a financial document that outlines the changes in a company’s retained earnings over a specific accounting period. It reveals the movements in earnings retained within a business for reinvestment or future use rather than being distributed to shareholders as dividends. In essence, the statement of retained earnings serves as a bridge between the income statement and the balance sheet, showing how the company’s profits for a certain period contribute to the cumulative earnings retained over time.

What is on a retained earnings statement?

A retained earnings statement typically includes the following key components:

- The opening balance of retained earnings at the beginning of the period.

- Net income or loss for the current period as reported on the income statement.

- Dividends paid out to shareholders during the period.

- Any adjustments due to errors or changes in accounting principles affect the retained earnings.

- The closing balance of retained earnings at the end of the period.

By examining these items, stakeholders can ascertain the company’s ability to generate profit and retain it within the company. It also shows how much these retained earnings have been affected by dividend payments or other shareholder distributions.

Statement of retained earnings example

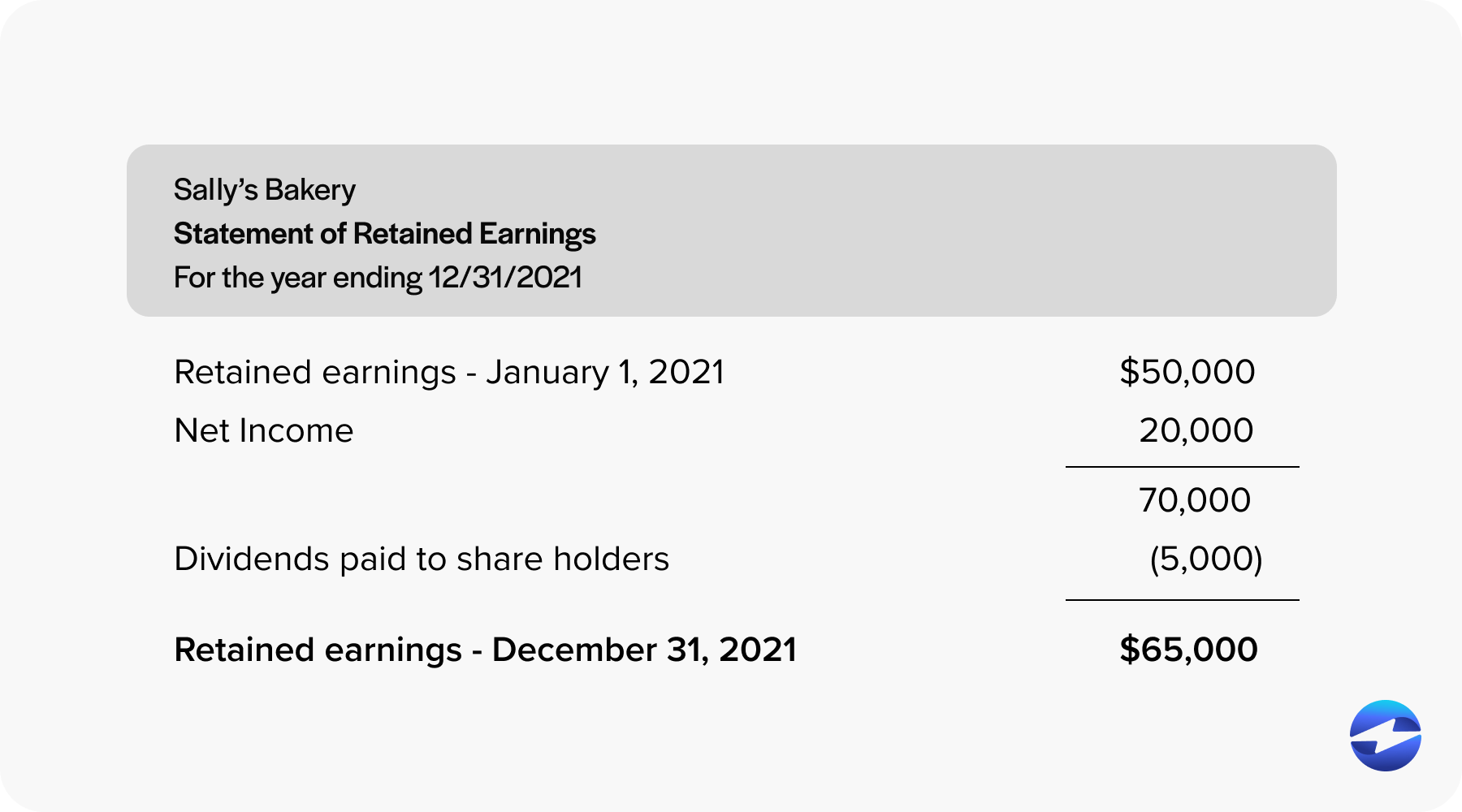

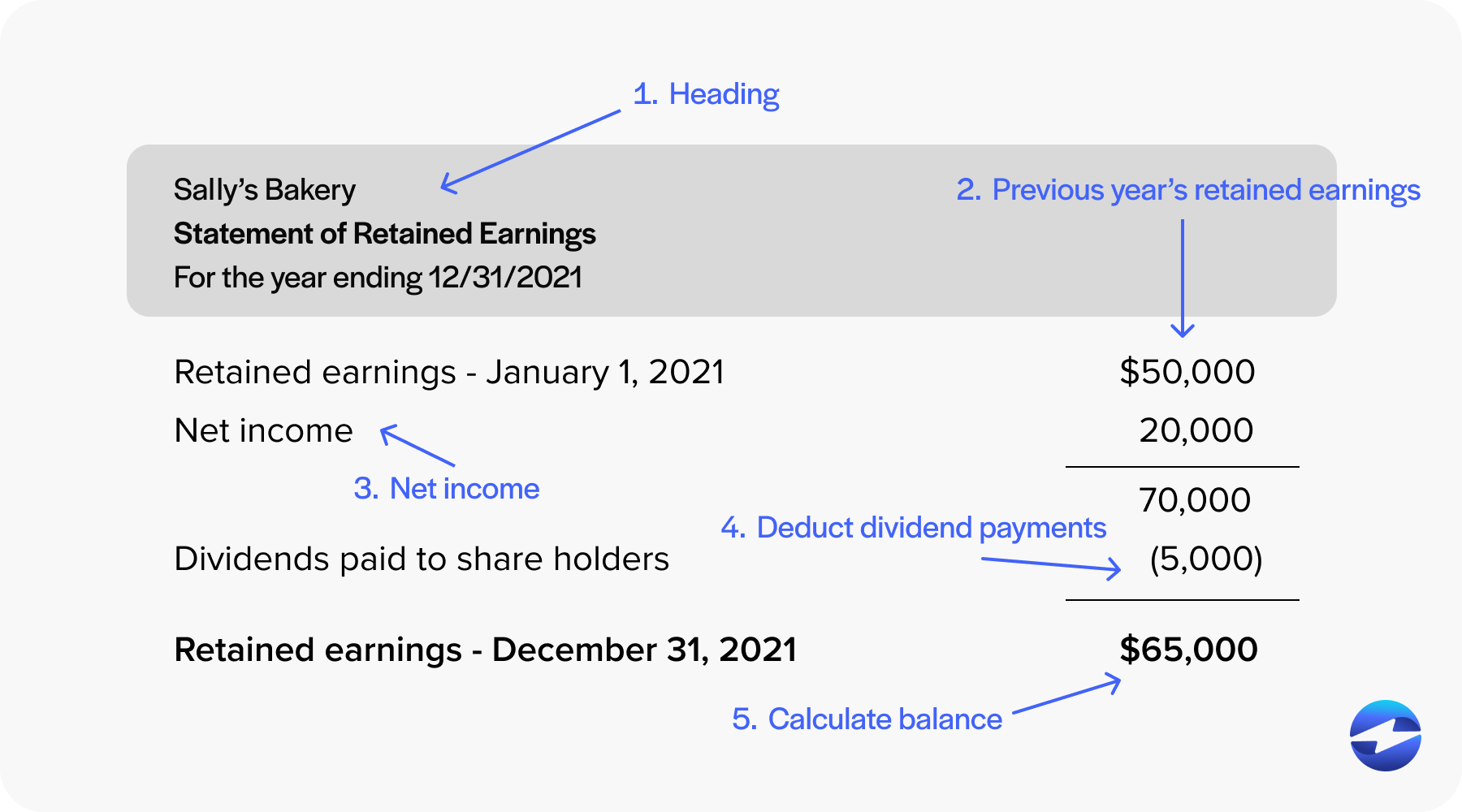

To illustrate, let’s consider a simple example using Sally’s Bakery:

Let’s start with the opening retained earnings for Sally’s Bakery, which, at the beginning of 2021, was $50,000. Over the year, Sally’s Bakery reported a net income of $20,000. They also declared and paid dividends of $5,000 to the shareholders during the same period. Here’s how the retained earnings statement would be presented:

Retained Earnings, January 1, 2021: $50,000 Add: Net Income for 2021: $20,000 Less: Dividends Paid in 2021: $5,000 Retained Earnings, December 31, 2021: $65,000

This example separates each element that affects the retained earnings, presenting a transparent view to anyone examining the financial health of Sally’s Bakery. The statement shows that the retained earnings have increased after accounting for the net income and dividends paid.

Five-step process on how to prepare a statement of retained earnings

Preparing a retained earnings statement involves a systematic approach to clarifying a company’s financial prudence. The following five-step process can aid accountants and business owners in consolidating this essential financial document with ease. Here’s the five-step process on how to prepare the statement of retained earnings:

1. Provide a heading

The first step in creating a retained earnings statement is clearly labeling the document. This heading should identify the company’s name, the document’s title as “Statement of Retained Earnings,” and the specific time frame the statement covers, typically one accounting period.

2. Open with the balance sheet from the previous year

Begin the statement by stating the opening balance and retained earnings amount carried over from the previous fiscal year’s end. This figure is found on the balance sheet under the equity section. Opening with the correct balance is vital as it sets the groundwork for the subsequent calculations.

3. Net income

Next, add the net income reported on the income statement for the current period. Net income represents the company’s profits after all expenses and taxes have been deducted. If a net loss occurs, instead of adding, it should be deducted from the retained earnings balance.

4. Deduct dividend payments

Subtract any dividends paid to shareholders during this period from the retained earnings. This includes both cash dividends and stock dividends. Dividends are distributions of the company’s profits to its shareholders, decreasing the retained earnings balance.

5. Calculate the balance

Finally, calculate the closing balance of retained earnings for the current period. This involves adding the net income or subtracting any net loss reported from the opening balance, followed by deducting dividends. This final total provides the earnings retained by the company at the end of the period and will be the opening balance for the next period’s retained earnings statement.

Following these steps, companies can ensure that their retained earnings statement accurately reflects the internal funding retained for future business growth or debt repayment.

What affects retained earnings?

There are many factors that could impact retained earnings and, thus, either decrease or increase the value on the balance sheet.

Here are some factors that affect retained earnings, notably:

- Net Income/Net Loss: The company’s bottom line has the most direct impact on retained earnings. Profitable companies report net income, which increases retained earnings, while net losses decrease them.

- Dividend Payments: When a business declares dividends to shareholders, it’s effectively sharing its profits. These payments reduce retained earnings.

- Accounting Adjustments: Revisions or corrections to past financial statements can retroactively alter retained earnings.

- Legal Issues: Fines or settlements from litigation can diminish retained earnings.

- Changes in Accounting Policies: Switching accounting methods might lead to adjustments in the reported earnings figures.

In practice, to see the dynamic of these factors:

| Factor | Effect on Retained Earnings |

|---|---|

| Net Income | Increases |

| Net Loss | Decreases |

| Declared Dividends | Decreases |

| Accounting Adjustments | Increases or Decreases |

| Legal Issues | Decreases |

| Accounting Policy Changes | Varies |

Understanding how retained earnings evolve allows business owners and investors to grasp a company’s financial health and ability to grow or return value to shareholders.

Improving financial awareness with statement of retained earnings

The statement of retained earnings is a crucial financial document that tracks the cumulative earnings retained by a company over time. By understanding and effectively managing retained earnings, businesses can reinvest in growth opportunities, pay down debt, and improve overall financial stability.

Keeping retained earnings accurate starts with accurate payment records. If your team is still entering payment data by hand, small errors are going to creep in and throw off your numbers over time. Using a payment gateway integration that connects directly to your accounting software takes that risk off the table. Solutions like EBizCharge offer QuickBooks credit card integration, a NetSuite payment gateway, and Acumatica credit card processing — so every payment posts to your books automatically. When your revenue is tracked in real time, your retained earnings calculations stay reliable without manual reconciliation.

Frequently asked questions

How do you calculate retained earnings?

To calculate retained earnings, you can use this simple formula:

Retained Earnings = Starting Retained Earnings + Net Income (or Loss) – Dividends.

Basically, you take the amount of retained earnings from the previous period, add any profits (or subtract losses) from the current period, and then subtract any dividends you’ve paid out to shareholders. This shows how much profit the company has kept to reinvest.

What type of account is retained earnings?

Retained earnings is a permanent equity account on the balance sheet. It’s part of shareholder’s equity and tracks how much profit the company has kept (rather than paid out as dividends). Over time, it shows the company’s accumulated profits that are reinvested in the business.

What makes up retained earnings?

Retained earnings are made up of net income (the profit the company has made) minus dividends (the portion of profits paid out to shareholders). It grows over time when the company makes a profit and doesn’t pay all of it out as dividends, but it can shrink if the company has a loss or pays out more in dividends than it earned.

Does retained earnings have a credit balance?

Yes, retained earnings usually have a credit balance, reflecting profits not distributed as dividends. When losses surpass profits, a debit balance, also known as an “accumulated deficit,” occurs.

- What are retained earnings?

- The difference between appropriated and unappropriated retained earnings

- Net income vs retained earnings

- Where are retained earnings on the balance sheet?

- Statement of retained earnings example

- Five-step process on how to prepare a statement of retained earnings

- What affects retained earnings?

- Improving financial awareness with statement of retained earnings

- Frequently asked questions