Blog > Salesforce Point of Sale: Unified Commerce with Native Payments

Salesforce Point of Sale: Unified Commerce with Native Payments

For businesses that sell both online and in person, keeping payments and customer data unified is one of the toughest challenges. A customer might buy online in the morning and visit a store in the afternoon, expecting their account, history, and preferences to be recognized instantly. Without the right systems, this kind of seamless experience becomes impossible. That’s where a Salesforce point of sale solution can change the game. By connecting in-person transactions with the same tools used for online sales, businesses can build a unified commerce model that feels natural to customers and practical for finance and IT teams.

This guide will explore what the Salesforce POS system offers, how it supports omnichannel integration, and why in-person processing is more critical than ever. It’ll also touch on B2B Commerce, payment processing solutions, payment methods, and advanced features that can set your business up for long-term success.

POS Capabilities in Salesforce

At its core, a Salesforce point of sale setup connects in-person transactions to the same ecosystem that manages quotes, orders, and invoices. This means that when a customer pays in a physical location—whether through a card terminal, mobile device, or kiosk—the details flow back into the Salesforce billing platform. Instead of treating in-person sales as disconnected events, Salesforce keeps them aligned with accounts, contracts, and order histories.

For sales teams, this alignment is powerful. Customer data is always up to date, whether the last transaction happened online or in-store. For finance, it means fewer reconciliation headaches because every payment feeds directly into Salesforce billing. And for customers, it creates consistency—no matter how they choose to interact with the business, their records and payment histories remain accurate.

The Salesforce POS system supports a range of Salesforce payment options, from credit cards to ACH transfers to digital wallets. By combining these with modern hardware and integration tools, businesses can offer flexibility at checkout without sacrificing accuracy in the back office.

Omnichannel Integration

Omnichannel isn’t just a buzzword. For businesses managing both online and physical sales, it’s the reality of how customers expect to shop. A buyer who places an order through an online portal might want to pick it up at a retail location. Or a business client might negotiate a contract online but prefer to pay in person with a corporate card. Without Salesforce integration, these handoffs become disjointed and messy.

The power of Salesforce lies in its ability to unify these channels. With the right Salesforce payment gateway, both online and in-person transactions feed into the same data model. That means finance teams see a complete picture of revenue without piecing together reports from multiple systems. Sales teams benefit too, since customer interactions reflect real-time updates across every channel.

When omnichannel integration is done right, businesses can launch loyalty programs, subscription renewals, or targeted promotions without worrying about whether the POS data matches online records. Everything flows into the same Salesforce billing platform, creating a single, reliable source of truth.

In-Person Payment Processing

For many businesses, in-person payments remain a critical part of revenue. Even in industries shifting heavily online, customers still want the option to pay face-to-face. The challenge is making sure those transactions aren’t siloed.

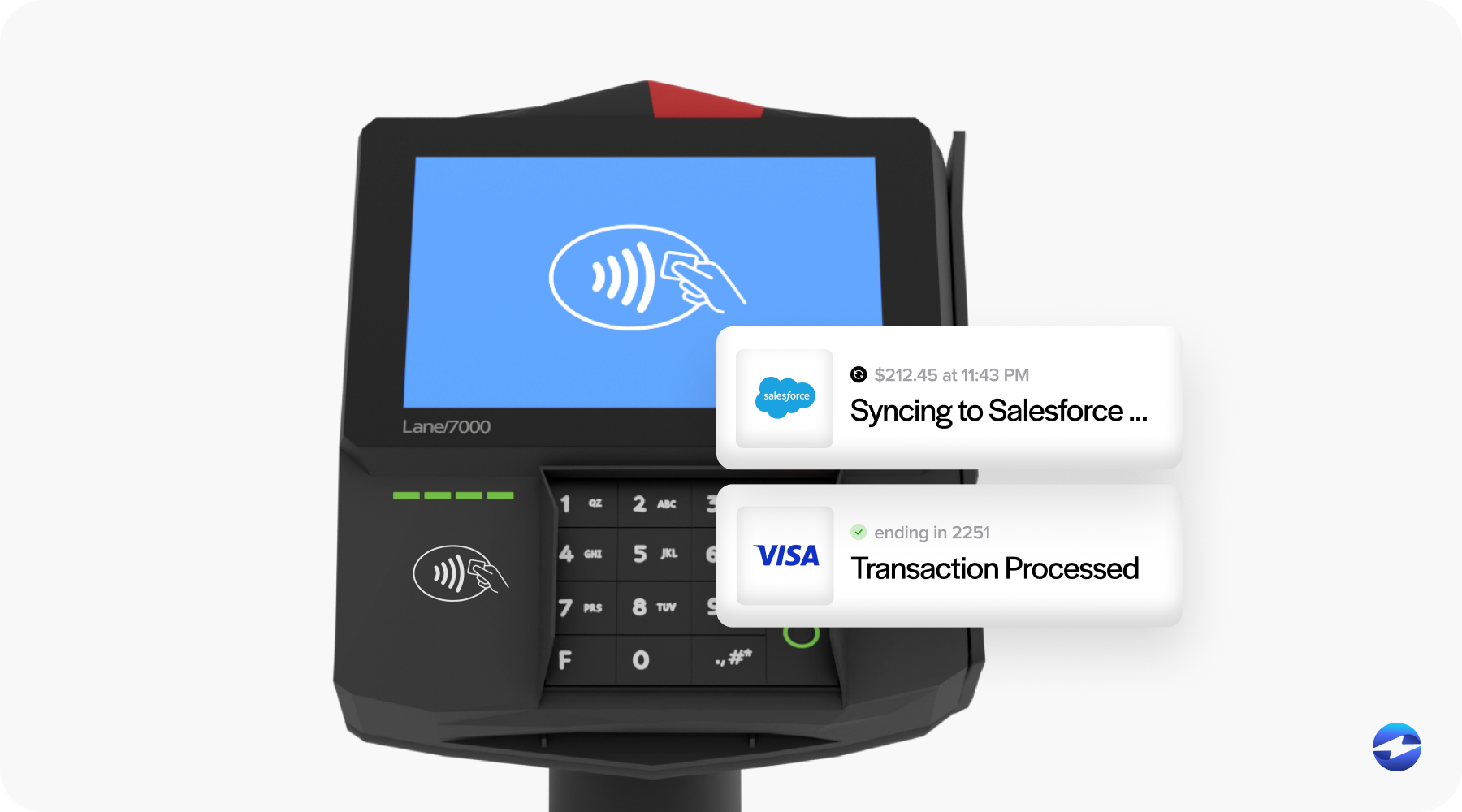

With a Salesforce POS system, in-person transactions connect directly to the payment processor through a Salesforce payment gateway. This ensures secure authorization, settlement, and reconciliation in real time. Customers can pay with cards, mobile wallets, or other Salesforce payment options, and the records automatically update in Salesforce.

A strong payment processing solution is essential here. It reduces failed transactions, speeds up settlement, and adds safeguards like tokenization and encryption. For businesses running recurring charges or subscription billing, in-person payments can even feed into ongoing schedules managed within Salesforce. This creates a more consistent customer experience while reducing manual work for finance teams.

The Role of B2B Commerce

B2B sales bring unique challenges to in-person and online transactions. Clients often place large, complex orders with negotiated pricing and extended payment terms. Some may prefer to pay by ACH or wire transfer instead of a card. Others may expect invoices with Level 2/3 data for corporate compliance.

The Salesforce POS system helps by tying B2B sales into the same workflows that already handle online transactions. Whether an order is processed at a trade show, through a rep with a mobile device, or online through Salesforce B2B Commerce, the payment details sync back into Salesforce. Finance teams can apply payments directly against contracts, and sales teams can see up-to-date balances without toggling between systems.

For B2B companies, this kind of unified commerce is not just convenient—it’s critical for maintaining accuracy and efficiency.

Payment Processing and Advanced Features

A unified POS setup in Salesforce is only as strong as the payment processing solution behind it. That’s why advanced features matter. Tokenization ensures sensitive card data never sits in Salesforce, reducing the scope of PCI compliance. Fraud detection tools catch suspicious activity before it escalates. Multi-currency support makes it easier to handle international customers. And dashboards built into Salesforce give leadership teams a clear view of payment performance.

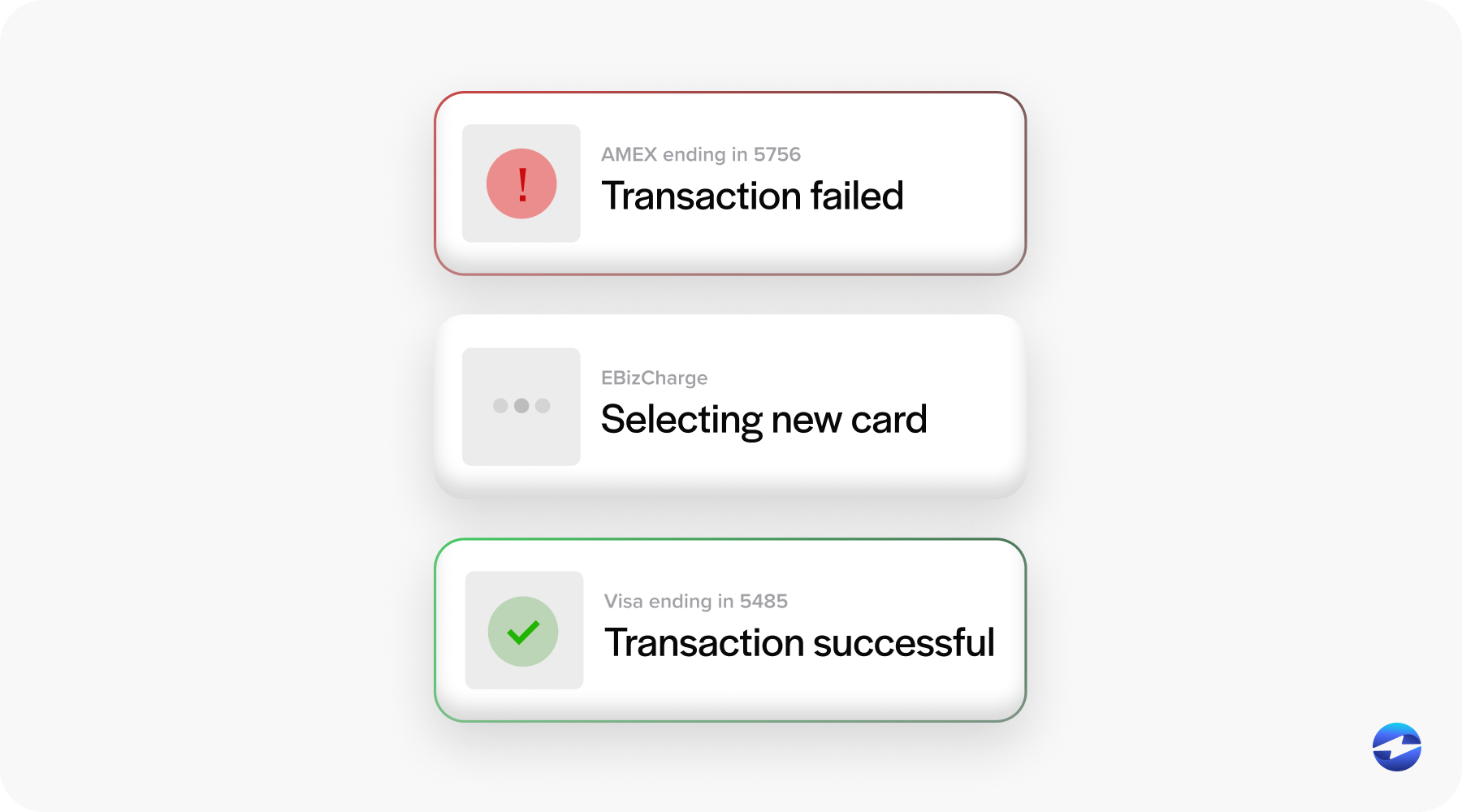

The Salesforce billing platform also adds automation. Invoices can be generated instantly, recurring charges can be scheduled, and dunning workflows can handle failed payments without manual intervention. These advanced features mean IT and finance teams spend less time fixing errors and more time focusing on strategic growth.

Why EBizCharge Fits Salesforce POS

Among the many solutions available, EBizCharge stands out as a good fit for businesses using Salesforce. It’s more than just a payment processor—it’s a complete payment processing solution built to work natively inside Salesforce. Payments are posted directly to invoices and accounts in real time, which means fewer manual steps for finance teams and fewer integration issues for IT managers.

EBizCharge also supports a wide range of Salesforce payment options, from ACH and credit cards to digital wallets. PCI-compliant safeguards like tokenization, fraud monitoring, and secure encryption come built in. On top of that, customer portals provide a secure, user-friendly way for buyers to pay online or manage recurring payments. For businesses running a Salesforce POS system, these features help reduce friction and strengthen customer trust.

Because EBizCharge was designed with Salesforce integration in mind, it minimizes the need for custom coding or complex sync jobs. This makes it easier for IT managers to maintain and for finance teams to trust the numbers they see in the Salesforce billing platform.

Building a Unified Commerce Experience

At the end of the day, the goal of a Salesforce point of sale system isn’t just to process payments. It’s to unify customer experiences across every channel. When online, mobile, and in-person payments all flow through Salesforce, businesses gain consistency, customers get reliability, and finance teams achieve clarity.

For IT managers, finance leaders, and eCommerce professionals, the lesson is clear: the more unified your payment ecosystem, the less time you’ll spend reconciling errors or patching together disconnected systems. By leveraging the Salesforce billing platform with the right payment processor and tools like EBizCharge, your POS strategy becomes more than a checkout solution—it becomes a driver of long-term growth.