Blog > Restaurant Credit Card Surcharges: Legalities & Best Practices

Restaurant Credit Card Surcharges: Legalities & Best Practices

Restaurant owners operate on thin margins, and credit card processing fees can quietly eat into profits. In response, many are looking at surcharging as a way to offset those costs. This article will explore the legal landscape and best practices for surcharging in the restaurant industry.

At EBizCharge, we help restaurants navigate these complexities by offering compliant, easy-to-integrate payment solutions that support surcharge programs and improve bottom lines.

What is a Restaurant Credit Card Surcharge?

A restaurant credit card surcharge is an additional fee added to a customer’s bill when they pay with a credit card. This fee is to cover the cost of credit card processing, which is 2% to 4% per transaction.

Surcharges vs. Service or Convenience Fees

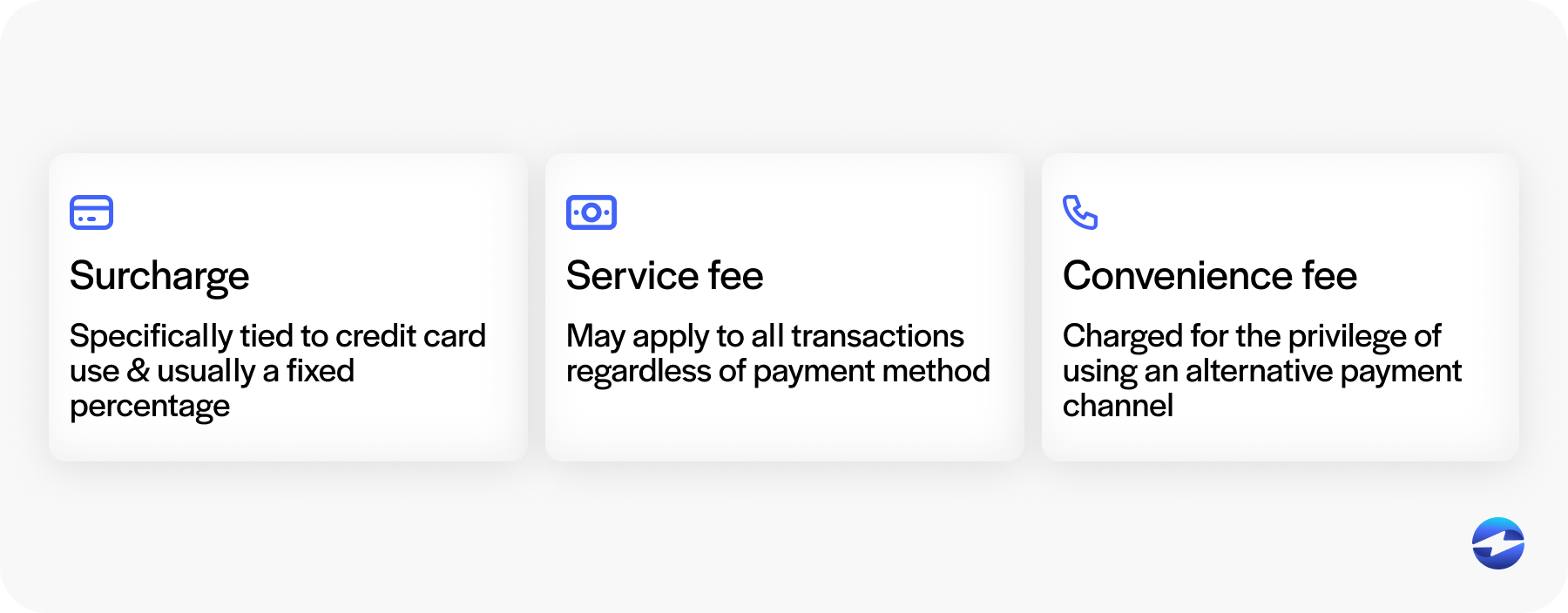

Before you implement a credit card surcharge, you need to understand how it differs from similar fees. Each type of fee has its own use cases and legal implications.

- Surcharges are specifically tied to credit card use and are usually a fixed percentage.

- Service fees may apply to all transactions regardless of payment method.

- Convenience fees are charged for the privilege of using an alternative payment channel (e.g. paying online or over the phone).

Understanding the difference helps with legal compliance and customer confusion.

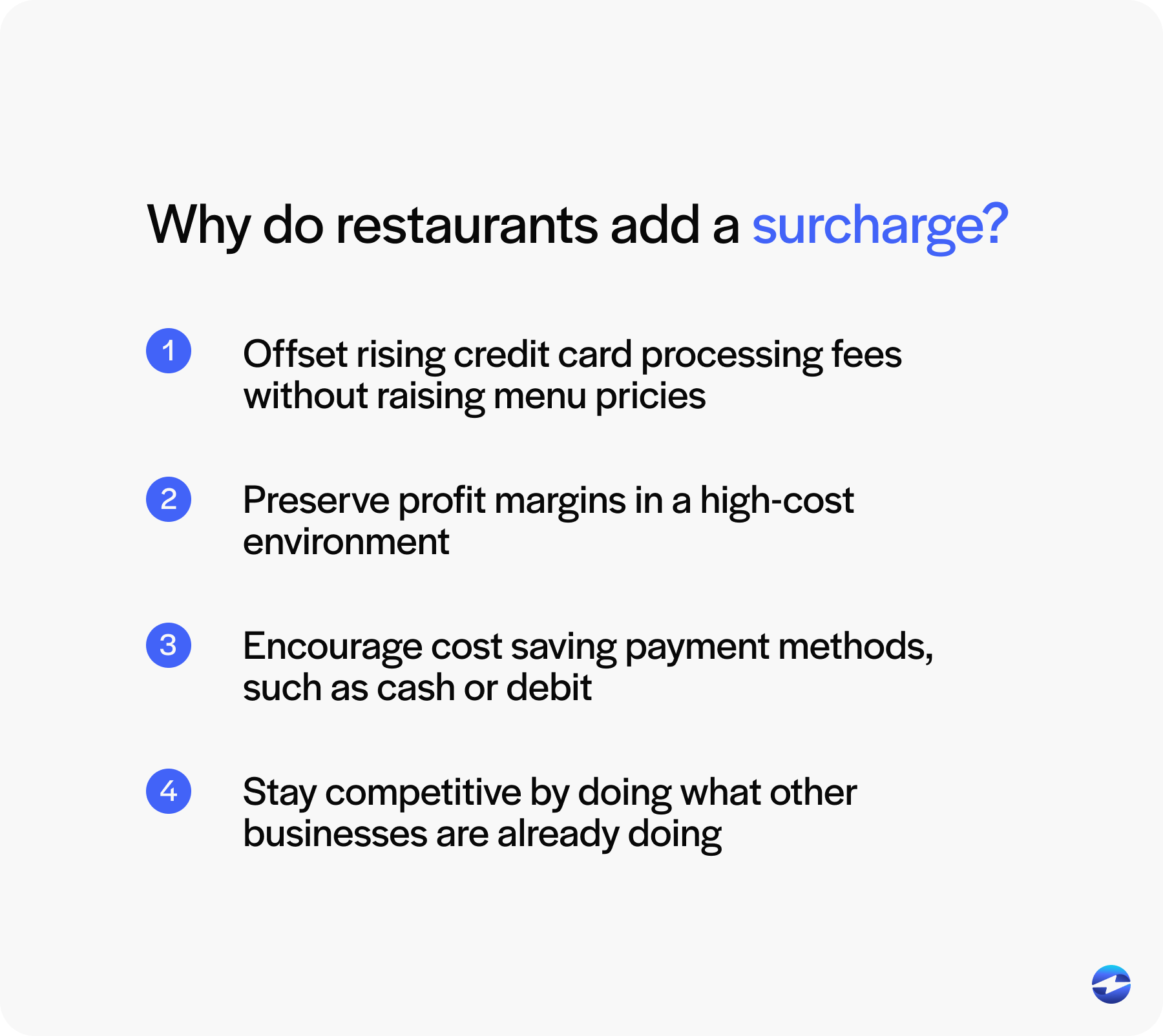

Why Restaurants Add a Credit Card Surcharge

Many restaurant owners are looking at credit card surcharges as a financial strategy to combat rising operational costs. As credit card usage continues to grow so do the associated processing fees that eat into profits. Surcharging gives restaurants a way to shift some of those costs without penalizing all customers equally.

Adding a surcharge can be a strategic decision for restaurants looking to:

- Offset rising credit card processing fees without raising menu prices

- Preserve profit margins in a high-cost environment

- Encourage cost saving payment methods, such as cash or debit

- Stay competitive by doing what other businesses are already doing

Surcharge Legal Considerations by State

Understanding the legal framework around credit card surcharges is key for restaurant owners looking to implement this strategy. While surcharging can be a financial relief, navigating the regulatory landscape requires attention to both federal and state level guidelines.

Federal Overview

Surcharging is legal at the federal level in the United States but businesses must follow rules set by credit card networks like Visa and Mastercard.

State-by-State Legality

Some states have restrictions or bans on credit card surcharges. As of June 2025 surcharges are prohibited or restricted in the following:

- California

- Connecticut

- Maine

- Massachusetts

- Puerto Rico

Laws are changing so be sure to verify local regulations before implementing a surcharge program.

Importance of Legal Counsel

Because of the complex and changing legal environment restaurant owners should consult with legal or compliance experts to make sure they are in compliance.

Requirements for Compliance While Surcharging

To legally add a surcharge restaurants must follow the rules set forth by the credit card networks and local regulations. Failure to comply can result in fines, legal challenges or even being barred from accepting card payments. Be sure to implement each component of a compliant surcharge program with care and transparency.

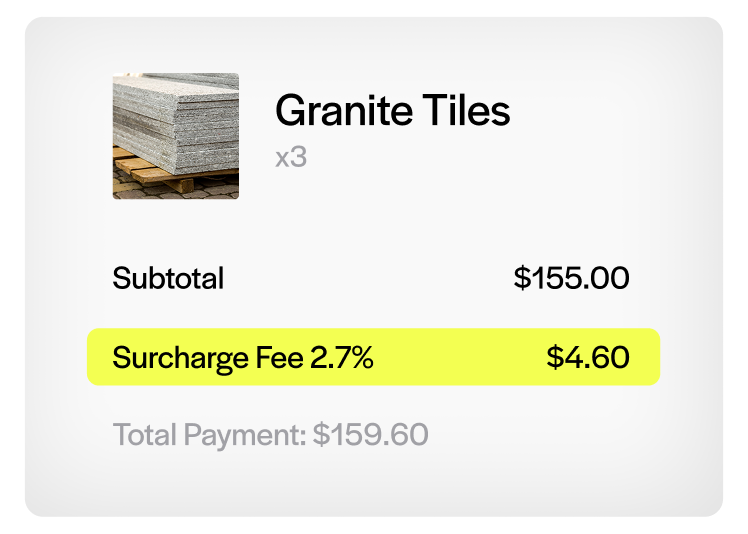

Surcharge Limits

- The surcharge cannot exceed the cost of acceptance

- Capped at 4% by card network rules

- Must be calculated and applied uniformly for all applicable card types

Card Network Rules

- Must notify Visa, Mastercard or other networks at least 30 days prior to implementation

- Must not apply to debit or prepaid cards, even if run as “credit”

- The surcharge cannot be greater than what the merchant pays to process the transaction

Disclosure Requirements

- Display clear signage at the point of entry and point of sale

- Ensure staff are prepared to answer questions regarding the surcharge

- Include surcharge line item on both customer and merchant receipts

- Online and printed menus should reflect surcharge information, where applicable

Sample Surcharge Notice

“We impose a surcharge on credit card transactions that is not greater than our cost of acceptance. We do not surcharge debit cards.”

This notice should be printed in a font and format that is visible and understandable. Consider posting it at eye level at the cash register and on digital ordering platforms as well.

Best Practices for Surcharging

Restaurants must walk a fine line between profitability and customer experience. Without careful execution, surcharges can feel like a surprise to customers and damage repeat business. These best practices can help ensure a smoother implementation that respects both business goals and customer expectations.

Informing Customers

- Use signage and verbal reminders to avoid surprises

- Clearly state the surcharge amount on menus or bills

- Be proactive in your communication—customers appreciate transparency

Training Your Team

- Teach staff how to explain surcharges confidently

- Equip them to handle objections diplomatically

- Include surcharge education in onboarding processes and roleplay common scenarios

Using Technology

- Adopt POS systems that automate surcharge calculations

- Ensure your system updates receipts and back-end accounting

- Use technology to keep surcharge applications consistent across all order channels, including online orders and delivery platforms

Reducing Friction

- Offer incentives for cash payments

- Keep surcharge rates fair and transparent

- Use clear, friendly language in signage to explain the reason for surcharges

- Monitor customer feedback and adjust communication if needed

How to Get Started Surcharging

Getting started with surcharging may seem overwhelming, but the right tools and guidance can make the process smooth and compliant. From understanding the rules to selecting the right technology partner, every step matters in ensuring a seamless rollout.

Here are the steps to get started surcharging:

1. Research Surcharge Laws

- Understand federal guidelines and credit card network rules

- Check state laws to confirm surcharge legality in your location

- Consult legal counsel to ensure full compliance

2. Notify Credit Card Networks

- Inform Visa, Mastercard and other applicable networks at least 30 days in advance

- Maintain documentation of your notification

3. Choose the Right Technology Partner

- Select a payment processor like EBizCharge that supports surcharge features

- Ensure the POS system can calculate, display and record surcharges accurately

4. Set Your Surcharge Rate

- Find a solution that will automatically calculate and apply the correct legal surcharge rate, such as EBizCharge

- Ensure the system adjusts for varying card processing costs and stays within the 4% cap

5. Prepare Your Disclosures

- Create customer-facing signage for your restaurant’s entrance and point of sale

- Update menus and online ordering platforms

- Ensure receipts reflect surcharge amounts clearly

6. Train Your Staff

- Train staff on what the surcharge is and why it’s implemented

- Prepare responses to common customer questions and concerns

7. Launch and Monitor

- Start applying the surcharge in live transactions

- Collect feedback and track any impact on customer satisfaction or sales

- Make adjustments as needed to optimize your approach

Surcharging Alternatives

If surcharging isn’t for you, restaurants can explore several other ways to manage credit card processing costs without annoying customers or navigating complex compliance requirements. These alternatives can help preserve profit margins while maintaining a positive customer experience.

Dual Pricing Models

- Offer one price for cash and a higher price for credit card users

- Display both prices clearly so customers know the cost difference

- Train staff to explain the pricing structure and answer questions

Cash Discounts

- Provide a small discount to incentivize cash payments

- Promote the discount as a reward for paying with cash, not a penalty for using cards

- Use signage and receipts to show the cash discount applied

Other Cost Saving Strategies

Negotiate better rates with your current provider

Consolidate payment systems to reduce operational overhead and transaction fees

Review processor statements regularly to find hidden fees or opportunities to save

Route transactions through lower-cost networks when possible. For more on network fees, check out this interchange fee guide.

Surcharging for Restaurants in a Nutshell

Surcharging can be a great way for restaurants to recover costs but must be done correctly to avoid legal and customer fallout. Transparency, compliance, and customer experience are key.

The EBizCharge payment processing solution can help. Get started with a compliant surcharge program today that has access to many helpful payment features and over 100+ native integrations into the business’s systems you already use.