Blog > Push Payments: What Are They And Why Are They Needed?

Push Payments: What Are They And Why Are They Needed?

Payments have always been an essential part of our daily lives, be it for personal or business purposes. Over the years, the methods of making payments as well as the technology involved have evolved significantly. Today, we have multiple options to choose from, including traditional methods like checks and cash as well as digital methods like bank transfers and digital wallets.

In recent years, two new payment methods have emerged that have gained a lot of attention, push payments and pull payments. In this article, we will discuss how push payments work as well as how they benefit lenders.

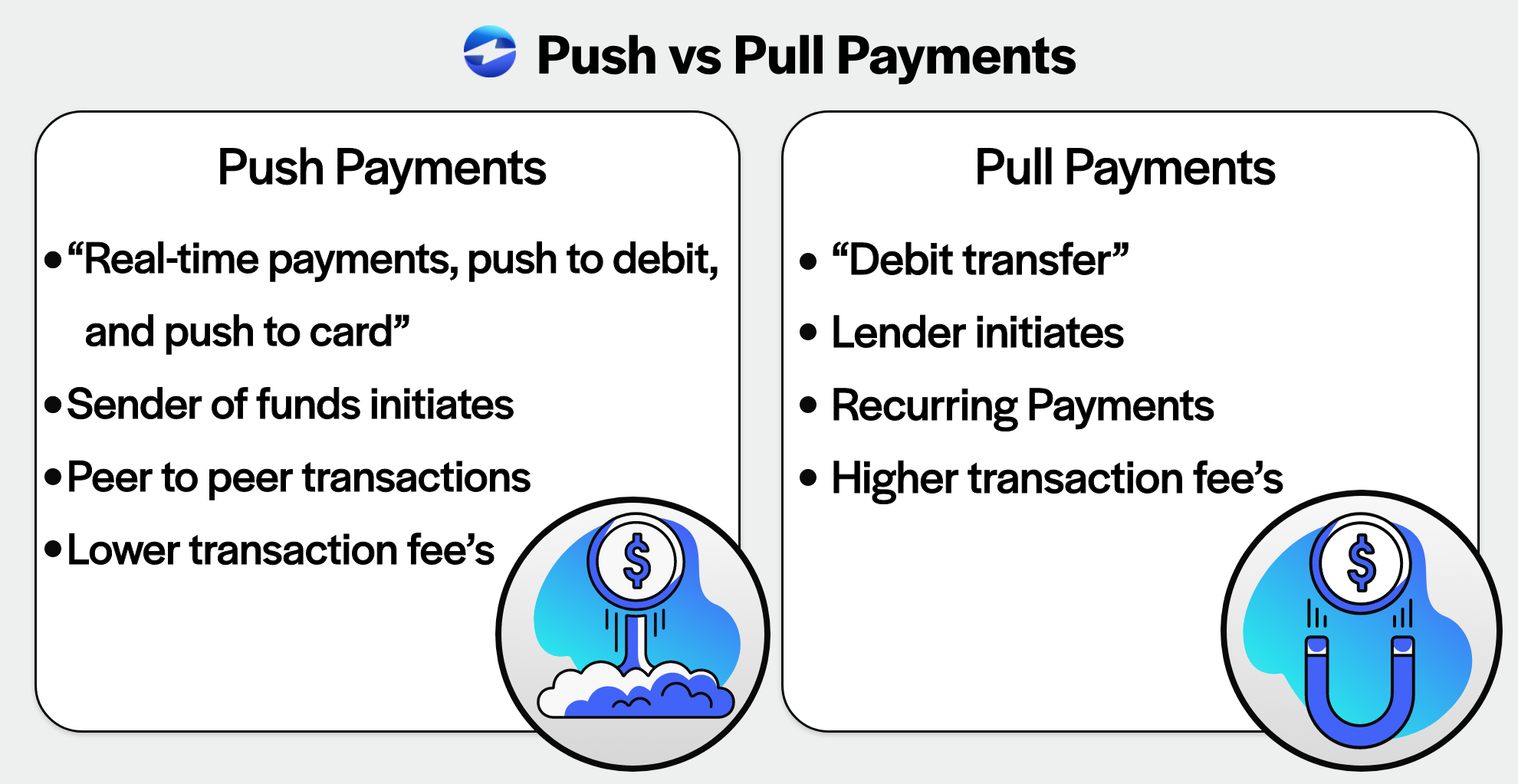

Push payments vs pull payments

Push payments, also known as real-time payments, push to debit, and push to card, are electronic transactions processed in real time, providing immediate access to funds. They are initiated by the sender of the funds. Push payments are often used for peer-to-peer transactions, such as sending money to a family member or for making payments to merchants or other businesses. These payments provide customers with a fast, secure, and convenient way to transfer funds.

A pull payment on the other hand, also known as a debit transfer, is a method of payment processing where the lender initiates the payment. In this scenario, the lender pulls the funds from the borrower’s account after the borrower provides all necessary information and payment authorization. The funds are transferred from the borrower’s account to the lender’s account, and the payment is complete. Pull payments are often used for recurring payments, such as monthly bills or subscription services.

So, the main difference between these two types of payments is who is initiating the payment. Additionally, push payments may be subject to lower transaction fees compared to pull payments.

How do push payments work

Push payments rely on real-time payment systems that enable the transfer of funds to be processed in a matter of seconds.

When a sender initiates a push payment, the payment is sent through the payment network, which forwards the payment to the recipient’s financial institution. The recipient’s financial institution then transfers the payment to the recipient’s account.

It’s important to note that push payments can only be processed if both the sender and the recipient have a bank account that is enabled for push payments. Additionally, both parties must have agreed to use push payments as a method of payment.

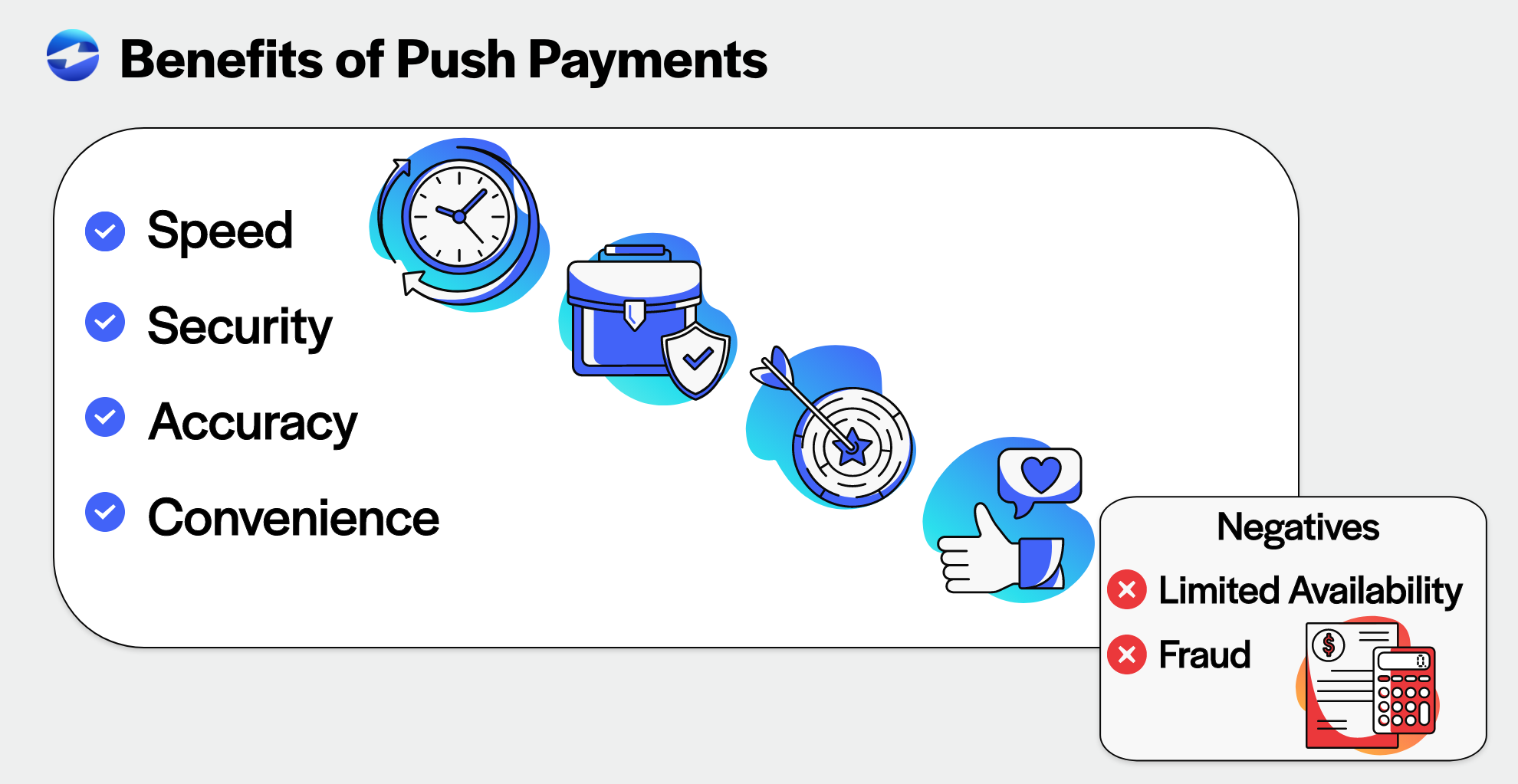

Benefits of push payments for lenders

Push payments offer several advantages for lenders which include:

Speed: Push payments are processed in real time, so funds are available to the recipient almost instantly. This is a huge improvement over traditional payment methods, which can take several days to clear.

Security: Push payments use encryption and secure transmission methods to protect sensitive financial information. This reduces the risk of fraud and helps ensure only the intended recipient receives the funds.

Accuracy: Push payments are less prone to errors than traditional payment methods, as they rely on automated systems to process transactions. This reduces the risk of human error and helps ensure payments are accurate and on time.

Convenience: Push payments are easy to use and can be initiated from a variety of devices, including smartphones, laptops, and tablets. This makes it easier for lenders to manage their finances and provide customers with the best possible experience.

Despite these benefits, there are also some disadvantages associated with push payments.

Do push payments have any drawbacks?

Push payments carry some drawbacks such as limited availability due to lack of widespread adoption, technical difficulties, and fraud.

Limited availability

Push payments are only available to those with bank accounts enabled for push payments. Although many accounts allow for these payments, some are not equipped for them. So, be sure to check with your financial institution.

Technical difficulties

The technology behind push payments is complex, so technical difficulties can be a recurring problem. Considering how new these payments are, it’s important to be patient with the evolving technology.

Fraud

Push payments can be subject to fraud for several reasons including:

1. Lack of reversibility: Unlike traditional payment methods such as checks or credit card transactions, push payments are typically irrevocable. This means that once a payment has been sent, it can’t be reversed, making it easier for fraudsters to steal funds.

2. No chargeback protection: Push payments also lack the chargeback protection offered by credit card transactions. This means if fraud takes place, the victim may not get money back.

3. Social engineering attacks: Fraudsters may use social engineering tactics such as phishing scams or impersonation attacks to trick people into sending money through a push payment.

4. Unsecured devices: If a device isn’t secure — infected with malware, compromised passwords, etc. — it can be easier to hack an account and initiate push payments.

5. Human error: People can also make mistakes, such as sending a payment to the wrong recipient or for the wrong amount, which can result in fraud.

To mitigate the risk in push payments, it’s important to take appropriate security measures, such as using strong passwords, keeping software and devices up-to-date, and being vigilant against phishing scams.

Payment providers may provide additional security features, including two-factor authentication, to help protect their users.

The future of push payments

Push payments are a cost-effective, valuable tool for lenders, providing improved efficiency, increased security, and a better customer experience.

Push payments have the potential to revolutionize the future lending industry, as more lenders adopt this technology, more customers become familiar with it, and more countries adopt real-time payment systems.