Blog > Project Accounting: Methods And Core Concepts

Project Accounting: Methods And Core Concepts

Understanding the mechanics behind managing individual project expenses is crucial for organizational success. Thankfully, project accounting manages, analyzes, and reports costs and revenues associated with specific projects, enabling businesses to assess profitability and efficiency on a more refined level.

This article will explore project accounting basics, benefits, and how to implement it into your business operations.

What is project accounting?

Project accounting is a specialized form of accounting focusing on the financial tracking and management of individual projects.

This vital tool enables project managers and accountants to monitor project expenses, analyze financial performance, and make more informed decisions. By maintaining a project ledger for tracking direct costs, overhead costs, labor, and other project expenses, project accounting ensures accurate and timely financial reporting.

The core concepts of project-based accounting include resource management, project budgeting, and recording all financial transactions on an accrual basis.

Project accounting ensures teams stay within budget while completing necessary tasks to support their business’s overall financial health. This specialized approach sets project accounting apart from standard accounting.

While project accounting and standard accounting share similarities, the two differ in focus and application.

Project accounting vs. standard accounting

Standard financial accounting is broad, emphasizing a company’s financial data over set periods such as quarterly or annually. It deals with consolidated financial statements reflecting the company’s overall economic performance and health.

In contrast, project accounting narrows this focus, tailoring it to individual projects. It provides detailed insights into project financials, enabling project managers and stakeholders to be more financially transparent.

Now that you know how project accounting differs from its standard counterpart, you can learn about the various benefits it offers for businesses.

6 benefits of using project accounting

Project-based accounting provides numerous benefits, such as tracking actual costs against the project budget, which paints a more detailed picture of a company’s overall financial health.

Here are six top benefits of project accounting:

- Enhanced resource management: Project accounting enables the allocation and monitoring of resources for individual project tasks, ensuring usage and preventing waste.

- Improved financial reporting: Project managers gain insight into project finances through detailed financial reports, such as income statements and project ledgers.

- Informed decisions: Real-time data on project expenses and financial performance guide project managers in making data-driven decisions.

- Better financial control: Actively tracking direct costs, overhead costs, and actual expenditures against budgets helps maintain financial control over project expenses.

- Increased transparency: Financial statements provide a clear view of a project’s financials, enhancing stakeholder communication and trust.

- Fosters long-term success: By adhering to project accounting principles, including the percentage of completion method, businesses ensure the long-term viability of their projects.

Now that you know the benefits of using project accounting, it’s time to set it up.

How to implement project accounting in your business

Implementing project accounting is essential for any business that works on multiple, unique projects, such as construction companies or consulting firms. Understanding how to implement it properly gives organizations a clear financial picture of each project.

Here are 10 steps to incorporate project accounting in your business:

- Define project accounting objectives

- Set up a project accounting framework

- Establish a project accounting subledger

- Develop project budgets and cost estimates

- Implement project-specific financial controls

- Monitor and track project expenses

- Recognize revenue and expenses accurately

- Manage scope creep and financial impact

- Prepare regular financial reports

- Integrate project accounting with overall business accounting

1. Define project accounting objectives

Identifying the specific goals you want to achieve with project accounting is fundamental. Clear objectives guide the setup and utilization of a project accounting system, ensuring it aligns with a business’s overall strategy.

Objectives may include improving the accuracy of cost tracking, enhancing profitability analysis, complying with industry standards and regulations, or providing more detailed financial information to stakeholders.

Establishing these objectives upfront fosters more detailed financial information for stakeholders that provides clarity and direction to help measure the success of implementing a project accounting system.

2. Set up a project accounting framework

Crafting a framework that includes defining project codes, cost centers, and specific account structures tailored to track and manage project-related financial data separately from general accounting is critical for clarity and precision.

This framework allows transactions to be accurately associated with the corresponding projects, facilitating cost control and analysis on a per-project basis. It can also help maintain consistency in recording project data, which is vital for comparing projects and identifying best practices over time.

3. Establish a project accounting subledger

Implementing a dedicated subledger within the existing accounting system is crucial for efficiently capturing and organizing all project-related financial transactions.

Subledgers are centralized repositories for all project expenses, revenues, and other transactions, segregating them from the general ledger. They also ensure the financial integrity of project accounting remains intact and simplify both project-level and overall financial reporting.

4. Develop project budgets and cost estimates

Working closely with project managers to create detailed budgets and cost estimates is fundamental to project accounting.

Accurate budgets and cost projections form a baseline to measure actual performance. They enable project managers to anticipate potential financial risks and take proactive measures to remain within cost limits, thus ensuring they stay within the budget.

5. Implement project-specific financial controls

Establishing controls to monitor project expenses is crucial in ensuring adherence to budgets and managing approvals for project-related expenditures.

These controls, such as spending limits and authorization requirements, help prevent budget overruns and maintain financial discipline throughout the project’s lifecycle. They also play a crucial role in fraud prevention and compliance with fiscal policies.

6. Monitor and track project expenses

Regularly tracking actual project costs, revenues, and budgets helps maintain clear visibility into the financial state of each project.

Frequent monitoring enables real-time assessment and response to potential issues, such as cost overruns or delays in revenue recognition.

7. Recognize revenue and expenses accurately

Accurately applying revenue recognition methods that align with project milestones or completion percentages is pivotal.

Correct recognition of revenue and expenses ensures that financial statements accurately reflect each project’s financial position. It also informs stakeholders about progression and profitability and assists in maintaining the consistency and reliability of financial reporting.

8. Manage scope creep and financial impact

Routine monitoring of a project’s scope to identify any changes or expansions is necessary for managing its financial impact.

Scope creep can result in unplanned expenses that jeopardize the project budget and overall profitability. Timely detection allows project teams to adjust cost estimates, seek additional funding, or renegotiate project contracts, minimizing negative financial consequences.

9. Prepare regular financial reports

Regularly generating and reviewing reports provides insights into a project’s profitability, cost variances, and financial health.

These reports, which can include income statements, balance sheets, and cash flow statements on a project basis, are essential tools for stakeholders to evaluate and make decisions regarding ongoing and future projects.

10. Integrate project accounting with overall business accounting

Ensuring that project accounting processes are aligned with overall business accounting practices is vital for accurate and comprehensive financial management.

Integration facilitates a seamless flow of financial information throughout the business and simplifies the consolidation of project data into a company’s statements. This holistic approach enhances transparency, supports financial analysis, and improves decision-making at all organizational levels.

Now that you know the steps involved in implementing project accounting, it’s time to choose your project accounting software.

Choosing the best project-based accounting software

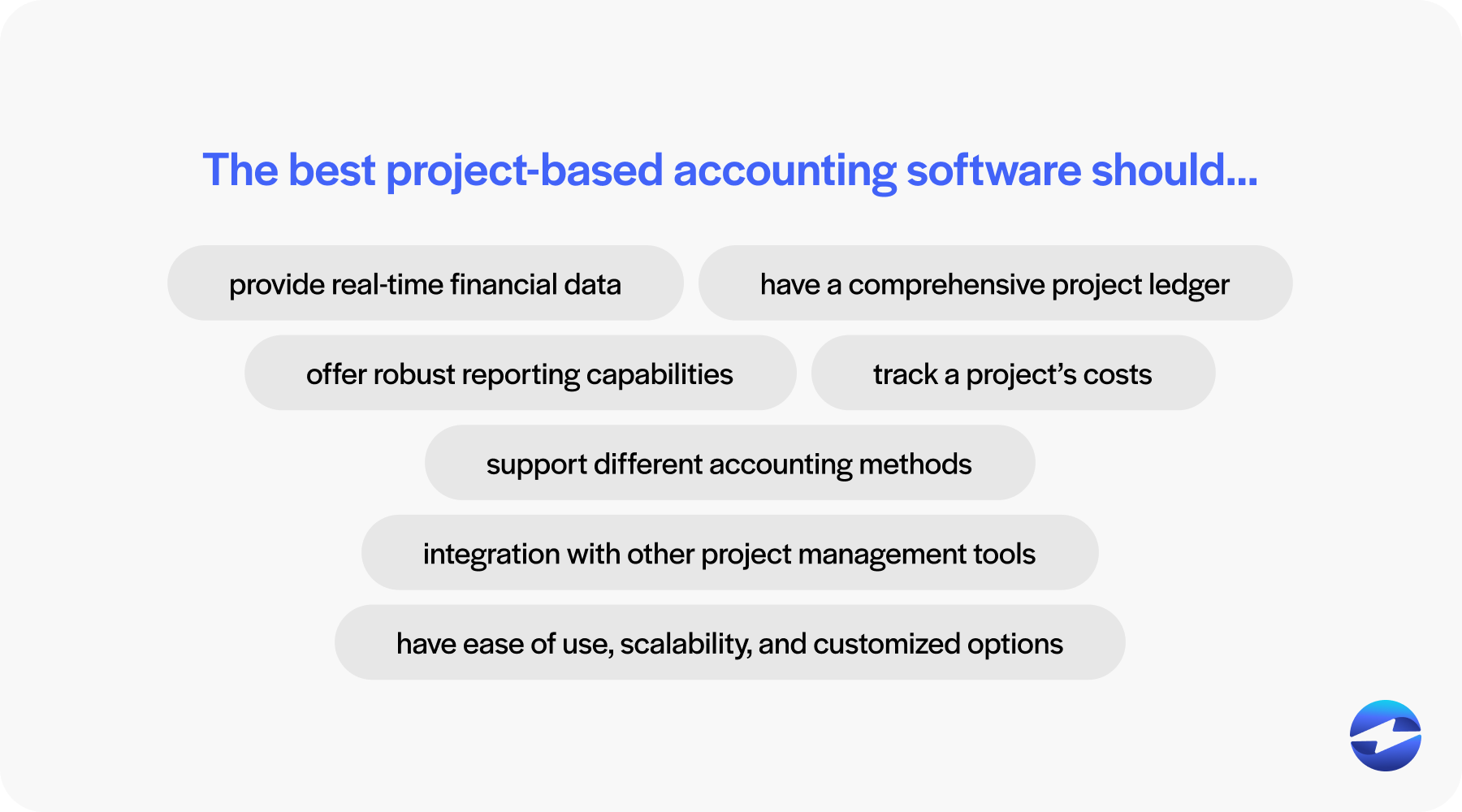

When choosing project-based accounting software, prioritize solutions that align with your company’s specific needs and scale.

Look for software that provides real-time financial data. The best project accounting software will include essential features like a comprehensive project ledger that tracks project expenses, income, and profitability.

The software should offer robust reporting capabilities, including financial reports and statements tailored to individual projects. It should also track a project’s direct and actual costs and overhead expenses to ensure accurate financial data.

Since resource management features are crucial for optimizing project budgets and resources, your software should support different accounting methods, like percentage of completion or accrual method, which are essential for businesses like construction companies involved in long-term projects.

Integration with other project management tools can also enhance efficiency, ensuring seamless coordination between project teams and financial management functions.

Lastly, consider ease of use, scalability, and customization options to cater to specific project-based accounting needs.

EBizCharge offers a top-rated payment software for all your project accounting needs

EBizCharge is a top-rated platform for project accounting needs designed to simplify the complex accounting tasks associated with project management. Its payment processing software ensures that project managers can track project expenses, manage project budgets, and effectively oversee the financial health of individual projects.

By incorporating a robust project ledger, the EBizCharge platform allows for seamless tracking of the actual costs against forecasts, aiding informed decisions. It also provides accurate and timely financial reports, which are integral to financial management and resource management.

EBizCharge is embedded with project-based accounting models that meet reporting requirements, provide the necessary tools to maintain financial statement accuracy, and assist in tracking direct and overhead costs associated with project tasks.

Overall, EBizCharge empowers project teams to maintain tight control over project financials, enhancing the business’s overall financial performance on a project basis.