Blog > Preparing for Surcharge Compliance: A Checklist for Businesses

Preparing for Surcharge Compliance: A Checklist for Businesses

If your business accepts credit cards, you’ve likely wondered whether you can pass processing fees on to your customers. Credit card surcharging lets you do just that but doing it the right way is essential. Between card network rules, signage requirements, and state regulations, there’s a lot to keep track of.

This article walks you through what credit card surcharge compliance really means and provides a practical checklist to help your business stay on the right side of the rules. Whether you’re new to surcharging or reviewing your current setup, this guide is for you.

Understanding credit card Surcharge Rules

Before you begin implementing a surcharge policy, it’s essential to understand the fundamental rules that govern how surcharging works. These aren’t just suggestions, they’re critical guardrails that protect your business from non-compliance and ensure transparency with your customers.

Here are three important rules to be aware of:

1. Know Where Surcharging Is Allowed

Not all states allow credit card surcharges. As of 2025, surcharging is prohibited in the following states and territories:

- California – Effective July 1, 2024, surcharging is banned under Senate Bill 478

- Connecticut – State law prohibits surcharges on credit card transactions

- Maine – Surcharges are banned, although offering a cash discount is permitted

- Massachusetts – State law prohibits surcharges on credit card transactions

- Puerto Rico – Surcharging is not permitted under local consumer protection laws

In all other U.S. states, credit card surcharges are permitted, provided businesses follow applicable local laws and card network rules.

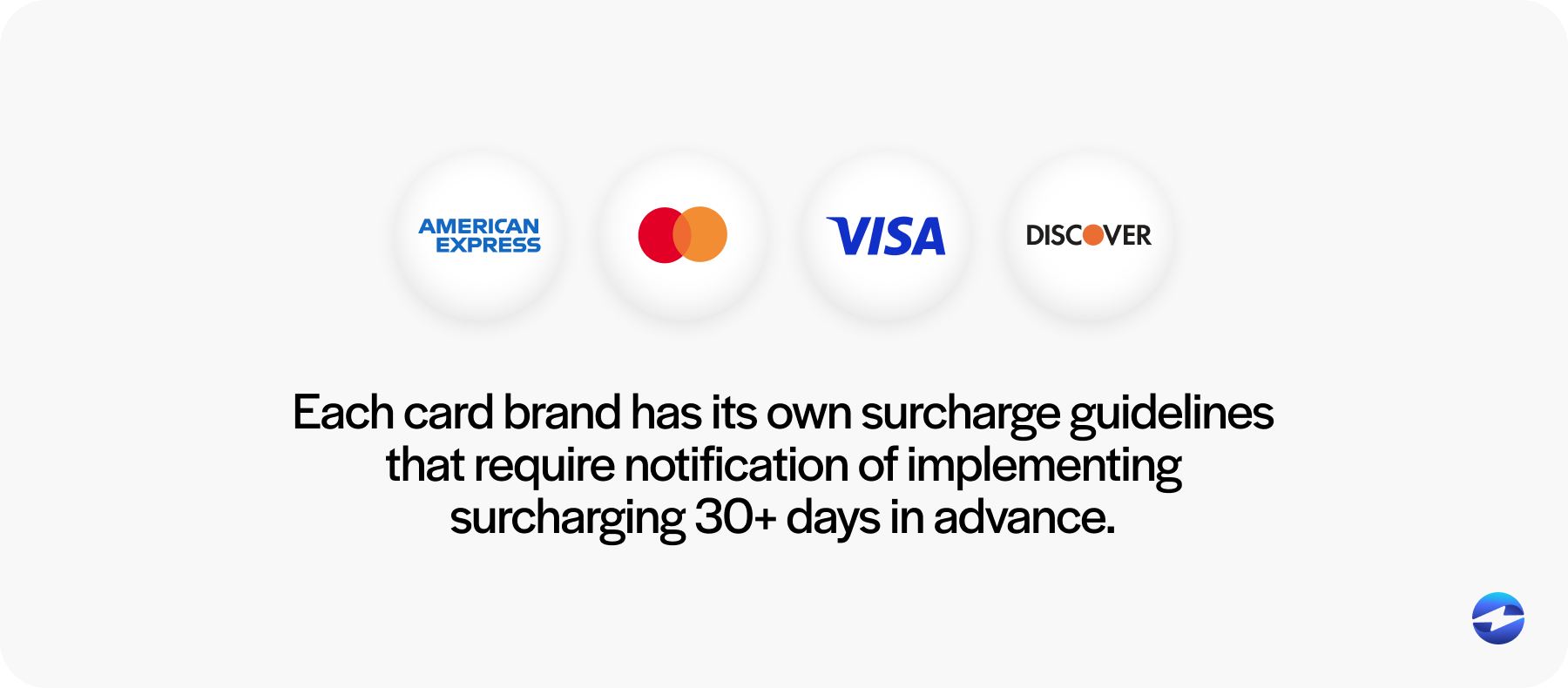

2. Notify Networks and Understand Their Requirements

Your next move is notifying the card brands and your acquiring bank. Most processors can help with this paperwork, but it’s your responsibility to make sure the notifications are filed and acknowledged. Each card brand—Visa, Mastercard, American Express, Discover—has its own surcharge guidelines. For example, Visa credit card surcharge rules require merchants to:

- Notify Visa and their payment processor at least 30 days before starting to surcharge

- Cap surcharge amounts at 3% or the cost of processing (whichever is lower)

- Apply the surcharge only to credit card transactions (not debit)

- Use proper credit card surcharge signage

You can review Visa’s official surcharge policy here.

Mastercard has its own set of requirements. These include notification before surcharging, disclosure of the surcharge amount on receipts, and ensuring the surcharge does not exceed 3% or the cost of acceptance. You can access Mastercard’s official rules here.

3. Apply Surcharges Consistently Across All Cards

Regardless of the brand, the key is consistency: if you surcharge one, you must surcharge all. This is not just best practice, it’s an explicit requirement of card network policies. For example, Visa and Mastercard both state that if a business chooses to surcharge, it must apply the surcharge uniformly to all credit card brands it accepts. You can’t selectively surcharge just Visa or just Mastercard and leave the others out. Doing so violates network agreements and can result in penalties or loss of processing privileges.

This rule ensures fairness and transparency for customers and helps prevent confusion at the point of sale. It’s considered a foundational principle of surcharge compliance and should be one of the first things a business evaluates before implementation.

Once you’re confident that you understand the core rules, it’s time to focus on the real-world practices that make your surcharge policy visible and enforceable. That starts with clear communication, specifically, how you inform customers at the right moments, in the right ways, using proper signage.

Credit Card Surcharge Signage

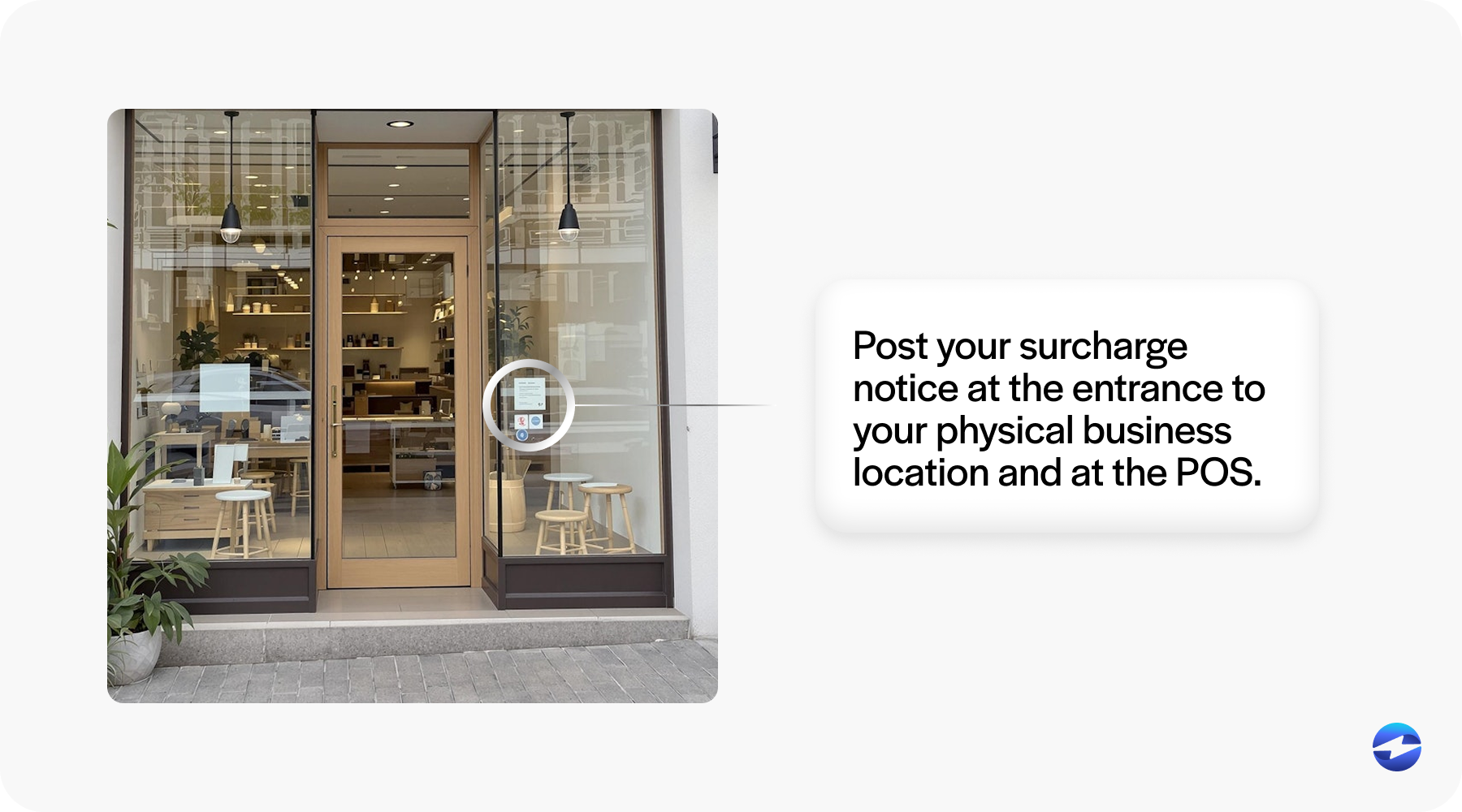

Card networks and several states mandate that customers must be informed about any surcharges before they make a purchase. Clear, visible signage isn’t just a best practice, it’s a required part of your compliance plan.

You should post surcharge notices in two prominent locations:

- At the entrance to your physical business location, such as your front door or shop window. This gives customers fair warning before they walk in.

- At the point of sale, whether that’s a register, a card terminal, or an e-commerce checkout page. The customer should know exactly what they’re being charged and why before finalizing payment.

Ensure your signs are legible. Font size, contrast, and placement all matter. A printed notice in 8-point font taped behind the register probably won’t meet requirements. If you need help creating a surcharge sign or just want to download a free printable credit card fee sign, you can easily find templates online.

The way you describe your surcharge is also very important. It can either keep you compliant or get you flagged.

Credit Card Surcharge Fee Wording

It’s not just about being clear, it’s about aligning with the expectations of card networks and regulators.

The ideal wording for surcharge disclosures should include:

- The specific amount or percentage being charged

- That the surcharge applies only to credit card transactions

- That the fee does not exceed the cost of acceptance

Here are two phrases that meet those standards:

- “A 3% surcharge is applied to all credit card purchases.”

- “We impose a surcharge on credit cards that is not greater than our cost of acceptance.”

These phrases work because they are direct, informative, and non-deceptive. Avoid terms like “convenience fee,” “processing fee,” or “handling charge” unless you have specific legal grounds to use them, they can lead to compliance violations if used improperly.

It’s also important that the same wording is reflected on the receipt. The surcharge should appear as a separate line item that clearly labels the fee and the reason for it. This helps avoid disputes and ensures the customer isn’t caught off guard.

Ensuring Your Systems and Staff Are Surcharge-Ready

Legal steps and signage are just part of the equation. You also need to make sure your business is operationally ready to handle surcharging day in and day out.

Start with your technology. Your POS system should be capable of calculating the correct surcharge and itemizing it separately on the receipt. Many modern systems support this, but it may require a software update or configuration change.

Make sure your eCommerce checkout process reflects the same transparency. Customers shopping online should be notified of the surcharge during the checkout process, before they finalize their purchase, not just on the receipt afterward.

Next, think about your team. Anyone involved in processing payments should be able to confidently explain the surcharge policy. Consider developing a quick training session or FAQ sheet to prepare staff for common questions like:

- “Why am I being charged this fee?”

- “Can I avoid the surcharge by paying a different way?”

- “Is this even legal?”

Finally, review all the customer-facing materials. Your website, receipts, email confirmations, and printed signage should all reflect consistent, compliant language. Take a walk through the customer experience yourself. If anything feels unclear, inconsistent, or surprising, fix it before launch.

Now it’s time to pull it all together in one place and run through a checklist that ensures nothing has slipped through the cracks.

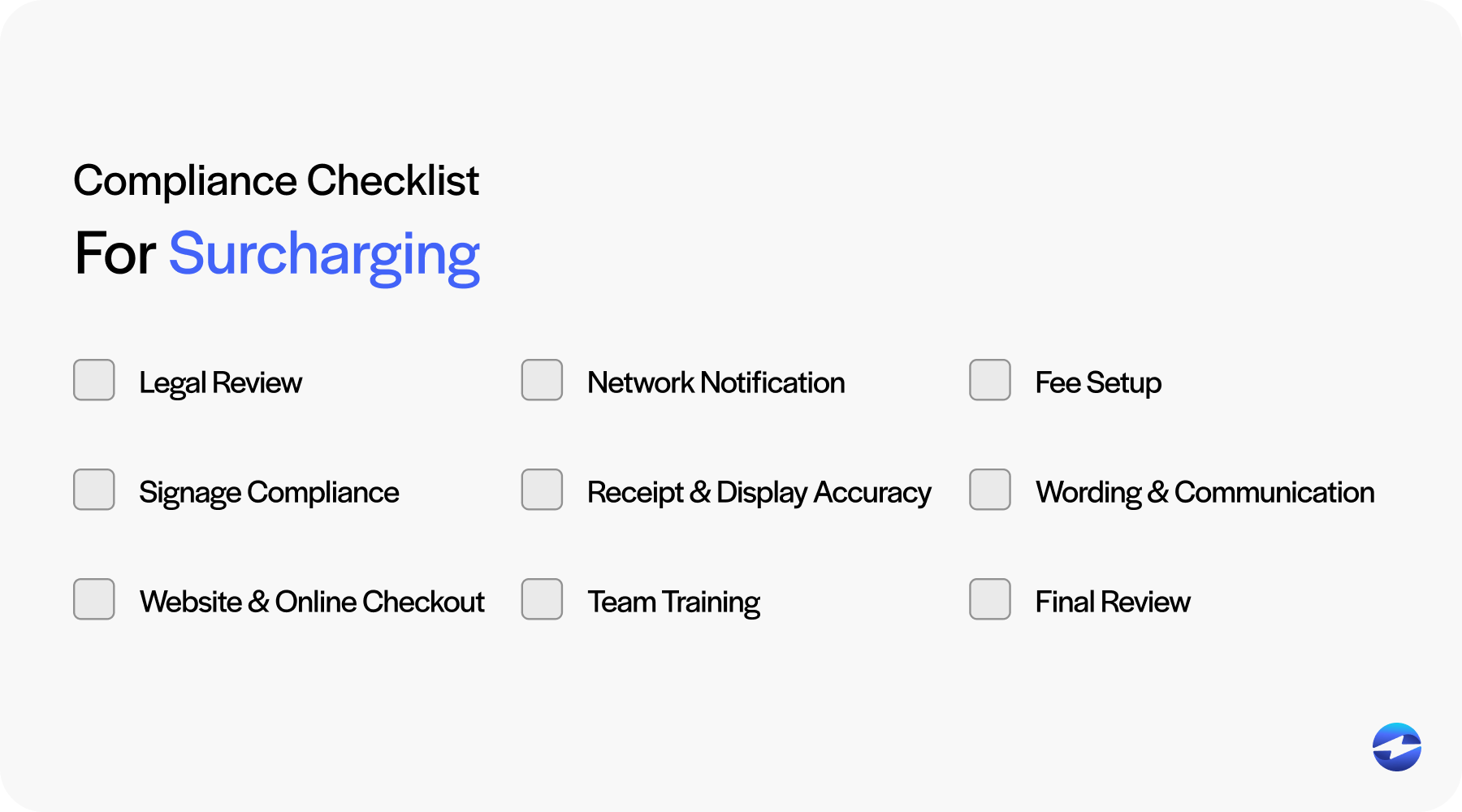

Surcharge Compliance Checklist

Use this checklist to make sure you’ve covered all your bases. Each item reflects a critical part of the surcharge setup process:

- Legal Review

- Confirm that surcharging is legal in your state or territory

- Check for any state-specific rules or limitations

- Network Notification

- Notify Visa, Mastercard, and other applicable card networks at least 30 days before implementation

- Notify your acquiring bank and submit any required documentation

- Fee Setup

- Determine your actual cost of acceptance

- Ensure the surcharge does not exceed 3% or your cost of processing, whichever is lower

- Signage Compliance

- Post clear, compliant signage at the entrance of your physical location

- Post signage at the point of sale or display digital notices on your eCommerce checkout pages

- Receipt and Display Accuracy

- Configure your POS system or gateway to itemize surcharges separately

- Ensure receipts clearly label the surcharge amount and its purpose

- Wording and Communication

- Use compliant credit card surcharge fee wording across all disclosures

- Avoid misleading or prohibited terms (e.g., “convenience fee” unless permitted separately)

- Website and Online Checkout

- Update your online checkout experience to disclose surcharges clearly

- Ensure customers see the surcharge amount before confirming payment

- Team Training

- Train staff on how to explain the surcharge policy to customers

- Prepare responses to common customer concerns and questions

- Final Review

- Audit your signage, website, receipts, and systems for consistency and compliance

- Consult with legal, compliance, or processing partners for a final check

- Ongoing Monitoring

- Periodically re-check laws and card network policies

- Stay informed of changes that could affect your surcharge strategy

Keep this checklist handy as you prepare to roll out or review your surcharge program. Being compliant isn’t just about avoiding penalties,it’s about being transparent and fair with your customers too. Every detail matters,from the way you word your signage to how your staff explains the charge at the register. Small oversights can create big risks.

Safeguarding Your Business with Proper Surcharge Practices

Surcharging can help your business manage processing costs, but only if it’s done by the book. Following credit card surcharge rules, placing proper credit card surcharge signage, respecting visa credit card surcharge rules, and using the right credit card surcharge fee wording are all essential steps.

If the process feels overwhelming, or if you want to make sure you’ve covered every compliance detail, EBizCharge can help. Our team is experienced in helping businesses set up surcharge programs that are both compliant and seamless. We can assist with signage templates, POS configuration, legal guidelines, and employee training resources so you’re never left guessing.

By investing a little extra effort upfront, you can build a compliant, customer-friendly surcharge program that protects your margins without damaging trust. Revisit these rules regularly, update your practices as laws and card network rules evolve, and don’t hesitate to consult with experts when you need backup. It’s worth doing right.