Blog > P&L Management Guide for 2026: How to Gain Better Financial Management

P&L Management Guide for 2026: How to Gain Better Financial Management

As the fiscal landscape evolves, mastering the art of P&L management has become a critical survival skill for businesses marching into 2026. Grasping the pulse of one’s finances is akin to navigating the corporate seas; the profit and loss statement is your compass. ‘What is P&L management?’ is more than a question; it’s at the core of steering any business towards success.

What is P&L management?

Profit and loss management, commonly known as P&L management, involves overseeing all financial activities related to the revenues and expenses of a business. The primary aim of P&L management is to enhance a company’s profitability by meticulously tracking, analyzing, and optimizing different aspects of the business finances. Effective P&L management requires a confluence of robust financial strategies and operational efficiencies, targeting sustained revenue growth while mitigating direct costs and operating expenses.

P&L management skills are crucial for business owners and financial professionals as they allow for informed decisions to be made regarding core business operations. Through active P&L management, valuable insights can be obtained from analyzing financial statements and income statements, which are critical tools in monitoring business performance over specific accounting periods.

What is a P&L statement?

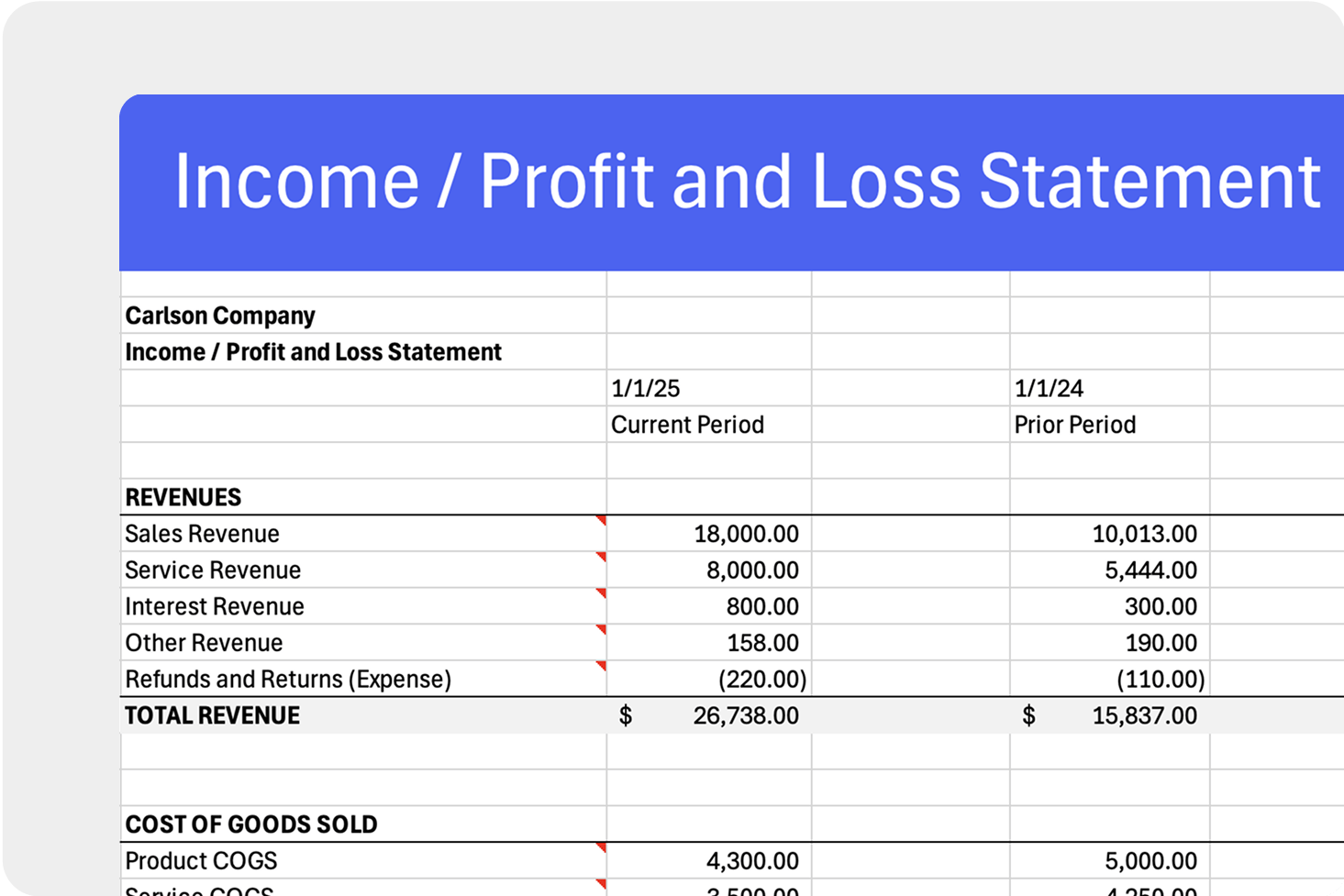

A Profit and Loss (P&L) statement, also known as an income statement, is a financial report that provides a summary of a company’s revenues, costs, and expenses over a period of time. This comprehensive document showcases the business’s financial performance, revealing whether it incurred a profit or a loss during the reported period.

The P&L statement comprises various components such as revenue streams, direct costs, operating costs, administrative expenses, and potentially operating expenses. It delivers a transparent picture of the company’s financial well-being, facilitating the analysis of revenue growth and cost reduction opportunities. By comparing income statements from different reporting periods, businesses can track their financial trajectories and adjust their business strategies accordingly.

With the use of appropriate accounting software, the generation and analysis of P&L statements become streamlined, guaranteeing that every entry is accurate and reflective of the true state of the company’s finances. Careful inspection of P&L statements aids business owners in aligning their business operations with their overall business goals and model.

How to Read and Interpret a P&L Statement

Understanding a Profit and Loss (P&L) statement is crucial for effective financial management.

Here’s a simple guide to interpreting a P&L statement:

Revenue

- Begins with the total revenue or sales made during the accounting period.

- Includes income from various revenue streams.

Direct Costs

- Immediately below revenue, direct costs associated with producing goods or services are listed.

Gross Profit

- Subtracting direct costs from revenue gives the gross profit.

Operating Expenses

- General and administrative expenses, along with other operating costs, are listed next.

Operating Profit

- Gross profit minus operating expenses equals operating profit.

Net Profit

- After accounting for taxes, interests, and other non-operational items, what remains is the net profit or loss.

Key Totals to Note:

- Gross Profit: Marker of core business efficiency.

- Operating Profit: Shows profitability from regular business operations.

- Net Profit: The bottom line, indicating overall profitability.

Use this information to compare against previous periods, forecast future performance, and make informed business decisions.

Why is P&L management important?

P&L management is fundamental for steering a business towards success. By closely inspecting P&L statements, which reflect income and expenses over a period of time, business owners gain valuable insights into their company’s financial health. Effective P&L management allows for the identification of trends in revenue and costs, providing a factual basis for informed decisions.

It’s not simply about tracking cash flow; P&L management digs into direct costs and operating expenses, highlighting areas that require attention. This could mean adjusting pricing strategies, cutting unnecessary costs, or boosting investment in profitable areas. Regular P&L reviews are crucial for maintaining a sustainable balance between revenue growth and cost management.

Profit and loss management also informs strategic planning. By using historical data, businesses can forecast future performance and set realistic business goals. A well-managed P&L can reflect the efficiency of core business operations and pave the way for long-term viability and success.

P&L management gives a comprehensive view of financial performance, guiding business strategies and ensuring that resources are wisely allocated to bolster profitability.

Key Components of P&L Management

P&L management encapsulates several crucial facets that collectively shape a company’s financial stability. At the heart of profit and loss management is the income statement, which contains vital data points that businesses analyze to gauge performance. The income statement is composed of revenue and sales, cost of goods sold (COGS), operating expenses, and the resulting net profit. Each of these elements serves as a critical signpost for financial report assessment.

Understanding these components helps in evaluating the nuances of financial statements. From these evaluations, businesses can derive informed business decisions that impact their business model and operations. Accurate tracking and management of these categories are crucial for seamless business finances and maintaining a clear view over different accounting periods.

Revenue and Sales Management

Managing revenue and sales is a key indicator of a company’s financial health. Sales figures represent the primary cash inflow and are the foundation for a business’ financial structure. Effective revenue management ensures that the business capitalizes on its revenue streams. This includes pricing strategies, sales volume analysis, and leveraging market opportunities.

Proper monitoring and analyzing sales data provide valuable insights into consumer behavior and market trends. These insights facilitate adjustments in marketing strategies and business operations, ensuring that the company stays aligned with its target market’s demands. For businesses, staying atop of their revenue data is crucial for sustaining and increasing profit margins over time.

Cost of Goods Sold (COGS)

The Cost of Goods Sold, commonly abbreviated as COGS, represents the direct costs attributed to the production of the goods sold by a company. This includes the cost of the materials and labor directly used to create the product. COGS is a vital metric in P&L management as it directly affects a business’ gross profit. Managing these costs effectively is essential to maintain a competitive edge and healthy margins.

Reducing COGS without compromising quality can lead to significant profit improvements. Strategies such as bulk purchasing, efficiency improvements, and supplier negotiations are often implemented to lower these costs. Managing this aspect effectively can lead to a more profitable business model.

Operating Expenses

Operating expenses encompass all costs required to run the business that aren’t directly linked to production, such as rent, utilities, insurance, and administrative costs. These expenses affect the bottom line and are generally fixed or semi-fixed costs that do not fluctuate widely with sales volume.

Continual monitoring and controlling of operating expenses are required to ensure that they do not erode the company’s earnings. Expense management can include strategies like optimizing workflows, reducing utility costs, and identifying areas to cut without affecting core business functions. Managing these regularly can enhance overall financial performance.

Net Profit

Net profit, the company’s bottom line, is the ultimate measure of profitability after all revenues and expenses have been accounted for. It is what remains after COGS, operating expenses, taxes, and interest have been deducted from total revenue. This figure not only signifies the company’s financial health at the end of an accounting period but also serves as a basis for investment, distribution to shareholders, and as a barometer for business growth and sustainability.

Analyzing net profit over consecutive reporting periods offers valuable insights into the business’s performance trends and informs future business strategies. It is the final testament to the effectiveness of a business’s financial management across all previous categories. Keeping net profit healthy is key to enduring business success.

What does it mean to have P&L responsibility?

Profit and Loss (P&L) responsibility refers to the accountability for tracking and managing the income and expenses of a business or a specific project within the organization. Individuals with P&L responsibility are tasked with overseeing financial transactions to ensure the company’s profitability is maximized. This involves keen oversight of revenue streams and direct costs associated with generating that revenue, such as materials and labor, and managing operating expenses like rent, utilities, and salaries.

Those in charge of P&L must possess strong financial management skills to accurately predict and respond to market changes, identify potential savings, and strategically drive revenue growth. Ultimately, P&L management shapes the business strategies that determine the company’s financial success over time.

What does P&L management involve?

P&L management involves overseeing the profit and loss statement, a financial report detailing a company’s revenues, costs, and expenses during a specific period. This statement is a vital tool for tracking the financial performance of a business. Proper management of the P&L encompasses several key aspects.

Firstly, it requires meticulous record-keeping of all revenue streams and direct costs. These figures provide clarity on the gross profit, highlighting the efficiency of core business operations.

Secondly, P&L management scrutinizes operating expenses, including administrative and other overhead costs, to ensure they align with the business model and do not detract from profitability.

P&L management also demands regular comparison against previous periods, offering valuable insights into trends and enabling informed decisions to be made for future revenue growth.

Lastly, effective P&L management means examining the financial statements and utilizing sophisticated accounting software to identify areas where the business can optimize operations, reduce expenses, or adjust business strategies.

The goal is to enhance the company’s financial health and achieve business goals through systematic analysis and strategic planning of all factors affecting profit and loss.

Six challenges that complicate P&L management

P&L management inherently involves a variety of challenges that can convolute the financial overview and decision-making process of a business. These predicaments range from customer interaction nuances to the meticulousness required in accounting practices. Let’s delve into six significant challenges that companies must navigate to maintain robust profit and loss management.

1. Customer service

Maintaining a sufficient level of customer service is crucial for sustained revenue growth, but it also incurs substantial financial costs. Investment in staff training, customer support platforms and quality assurance all weigh heavily on the operating expenses of a business. If not carefully balanced within the P&L statement, ambitious customer service objectives can inadvertently affect the profitability margins.

2. Accounting practices

Effective P&L management is rooted in precise accounting practices. However, discrepancies can arise due to human error, outdated accounting software, or complex financial transactions that are difficult to categorize. These missteps can lead to inaccurate financial reports, impacting the ability to make informed decisions. Regular audits and the integration of robust accounting systems are pivotal in mitigating such challenges.

3. Regulatory compliance

Businesses must adhere to an array of regulatory obligations that can influence P&L management. Compliance requirements often entail additional expenses like legal fees, compliance officers, and new processes. Moreover, failure to comply can result in substantial fines, further impacting the profit and loss statement.

4. Unbalanced budgets

Allocating financial resources requires strategic foresight and adaptability. Budgets that do not align with current market conditions or that overestimate revenue streams can upset the balance of income and expenses, leading to financial discrepancies. Regular budget reviews and flexible planning are essential to keep P&L statements reflective of the company’s financial status.

5. Unexpected costs

Even the most astute financial planning cannot always predict unforeseen expenses. These might include emergency repairs, legal disputes, or sudden market changes. Their unpredictable nature can swiftly turn a profitable quarter into a loss-making period. Contingency funds and insurance can serve as buffers against such financial shocks.

6. Inaccurate data collection

Trustworthy data forms the backbone of P&L management. Yet, the accurate collection and analysis of financial data remain a stumbling block for many businesses. Inaccurate or incomplete data undermines the validity of financial statements and the strategic decisions deriving from them. Investing in state-of-the-art data collection and analytics solutions is imperative for ensuring reliability.

Navigating these challenges demands a combination of forethought, precision, and agility within the framework of P&L management. By recognizing and preparing for these hurdles, businesses can ensure a more accurate and effective financial management system that supports long-term stability and growth.

Benefits of effective P&L management

Proficient profit and loss management offers extensive benefits that extend beyond the basics of accounting. It serves as the heartbeat of a company’s financial performance, providing insight and direction. P&L management imparts clarity on where the business excels and where it doesn’t, leading to actionable business strategies. The culmination of all its advantages fosters a company’s ability to remain competitive, agile, and financially sound over time.

Enhanced Financial Insight

Delving into profit and loss management unlocks valuable insights into the financial workings of a business. A comprehensive income statement presents a clear picture of revenue streams and operating costs over a set accounting period. With such financial statements, businesses gain visibility into the direct costs and administrative expenses that impact the bottom line. This transparency is vital in identifying areas of overspending, isolated financial issues, and areas ripe for optimisation.

Improved Profitability

Effective P&L management shines a spotlight on profit margins, revealing the potential for revenue growth and cost reduction. By drilling down into the details of loss statements, companies can pinpoint inefficiencies and adjust their business operations accordingly. Streamlining expense categories, refining core business operations, and eliminating unnecessary costs invariably lead to an enhanced bottom line. Rigorous P&L practices ensure that every dollar spent is serving the overarching business goals, thus maximizing profitability.

Better Strategic Planning

Robust P&L management equips business owners with the knowledge to plan strategically for the future. Informed decisions arise from an acute understanding of past and current financial performance gleaned from balance sheets and cash flow statements. Businesses can project future periods with greater accuracy, align business strategies with financial realities, and adapt to changing economic conditions. By maintaining a dynamic approach to P&L management, companies can set informed, realistic targets and devise business models that ensure success in forthcoming accounting periods.

Four steps to streamline P&L management

Profit and loss (P&L) management is crucial for maintaining the financial health of a business. Streamlining P&L management processes can lead to more accurate financial reporting, informed business decisions, and ultimately, improved business outcomes. Here are four essential steps businesses can take to streamline their P&L management.

1. Automate Data Collection

The era of manual data entry is behind us, and the move to automation is critical for efficient P&L management. Automating data collection reduces human errors, saves time, and ensures data consistency. Adopting accounting software tools can automatically import transactions and categorize them into revenue and expense streams. This serves as a solid foundation for accurate financial report generation.

2. Conduct Regular Reviews with Management

Consistency is key in P&L management. Regular reviews conducted by management and financial teams help identify any irregularities or trends that may require attention. During these P&L reviews, participants should examine the income statement in comparison to previous periods, assess the effectiveness of business strategies, and scrutinize direct costs and operating expenses. These sessions serve as a platform for collaborative financial planning and decision-making.

3. Revisit Accounting Principles

Maintaining up-to-date knowledge of accounting principles is essential for creating accurate financial statements. It’s not uncommon for accounting guidelines to be updated or revised, so revisiting these principles periodically can ensure compliance and precision. This exercise can help in refining the categorization of expenses and revenues, which is fundamental for insightful P&L management.

4. Understand the Data

To utilize P&L management effectively, it is important for those involved to thoroughly understand the financial data. This can include deciphering fluctuations in profit margins, identifying the reasons behind a decrease in revenue growth, or recognizing the impact of external economic factors. By understanding the data, business owners and managers can make informed strategic decisions that align with their business goals and adapt quickly to market changes.

Streamlining P&L management demands a combination of leveraging technology, maintaining regular oversight, staying informed on accounting practices, and cultivating a deep comprehension of financial data. Implementing these steps can help businesses enhance their financial performance and achieve a stronger competitive edge.

Manage P&L and increase cash flow with EBizCharge

P&L management is crucial for monitoring business finances and driving revenue growth. Understanding P&L management involves scrutinizing both profit and loss statements to make informed decisions. One solution to help add visibility to your business revenue is EBizCharge.

EBizCharge facilitates better P&L management by integrating with business systems, thus simplifying payment processes and reducing administrative expenses. With this advanced software, businesses can streamline operating costs associated with credit card processing.

- What is P&L management?

- How to Read and Interpret a P&L Statement

- Why is P&L management important?

- Key Components of P&L Management

- What does it mean to have P&L responsibility?

- What does P&L management involve?

- Six challenges that complicate P&L management

- Benefits of effective P&L management

- Four steps to streamline P&L management

- Manage P&L and increase cash flow with EBizCharge