Blog > Payment Processing for Industrial Equipment Manufacturers on Epicor

Payment Processing for Industrial Equipment Manufacturers on Epicor

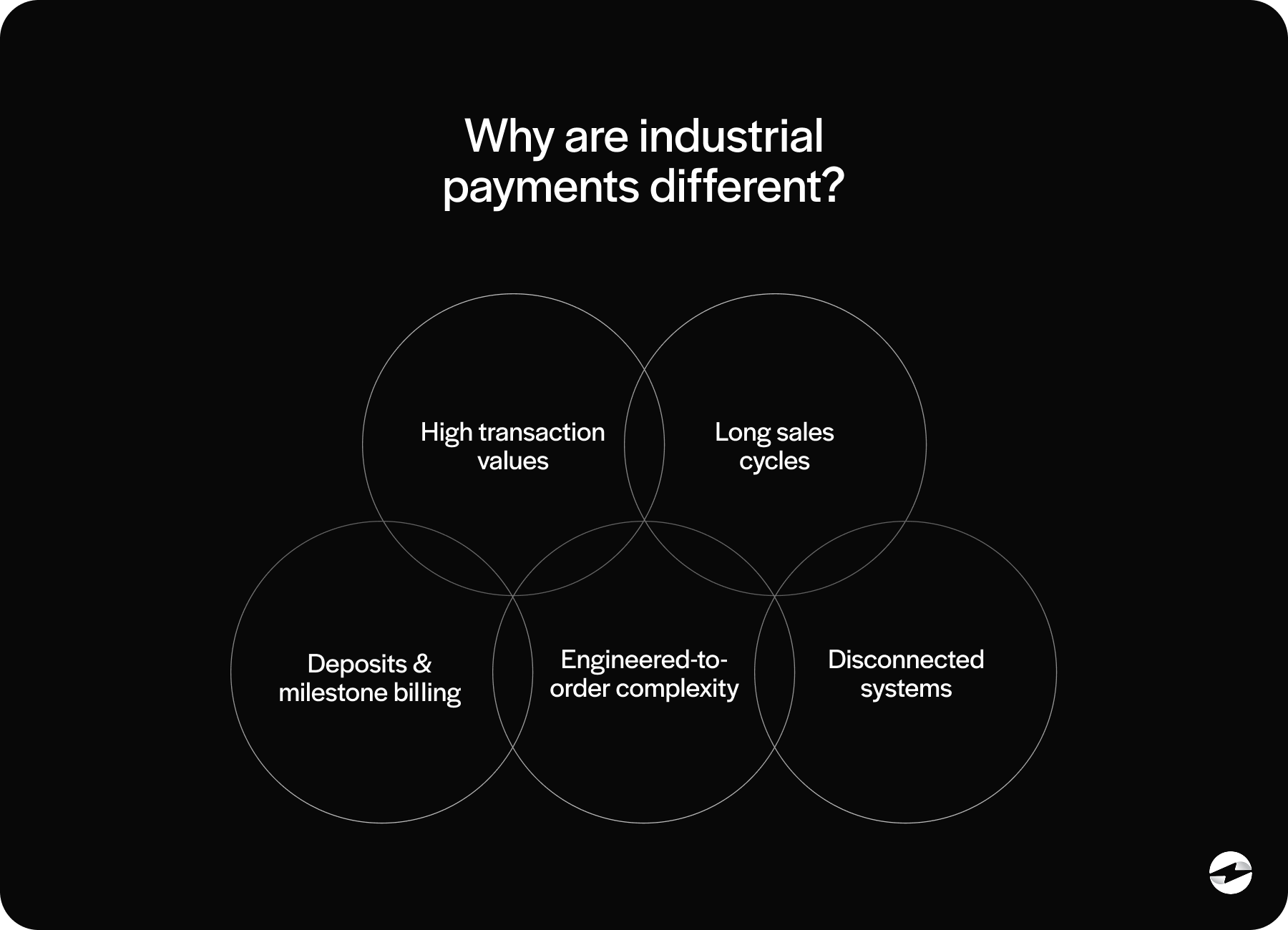

Industrial equipment manufacturing moves at a different pace than most businesses. Sales cycles are long, projects are often engineered to order, and payment terms are carefully negotiated because the dollar amounts are significant and the risk needs to be managed on both sides.

If you work in finance, operations, or leadership at an equipment manufacturing company, you feel this every day. Cash flow is critical, but flexibility matters just as much. Payments need to come in on schedule, post correctly, and stay clearly connected to the equipment orders behind them.

This is where Epicor ERP plays a central role. Epicor software helps industrial equipment manufacturers manage complex jobs, production schedules, and financials in a single system. But payment processing only delivers real value when it’s closely aligned with those workflows instead of operating on the side.

This article focuses on industrial equipment payments and how manufacturers can manage them effectively using Epicor. The goal is to provide practical guidance for building reliable, integrated payment workflows that support long sales cycles, large transactions, and the realities of equipment manufacturing.

Understanding Payment Challenges in Industrial Equipment Manufacturing

Payment challenges in industrial equipment manufacturing tend to show up in familiar ways.

Transaction values are high, and a single invoice can represent months of design, production, and coordination. Customers often expect deposits before work begins, progress payments as milestones are reached, and final balances tied to delivery or acceptance.

All of this makes heavy equipment payment processing more involved than standard invoicing. Payments are rarely completed in one step. They need to be tracked carefully across jobs, timelines, and billing stages.

When payment systems are disconnected, the rate of risk increases. Manual entry raises the chance of misapplied payments, and delayed posting makes it harder to see what is truly outstanding. Over time, these gaps slow collections and reduce confidence in cash flow visibility.

How Epicor Supports Payment Workflows for Industrial Equipment Manufacturers

Epicor is designed to connect operational and financial data across the organization: sales orders link to jobs, jobs link to invoices, and invoices flow into accounts receivable. This structure allows Epicor equipment manufacturers to keep production and finance aligned.

Payment processing fits into this flow by closing the loop. When payments are properly integrated, invoice status updates automatically and financial reporting reflects reality.

Without strong Epicor integration, payments can become detached from equipment orders and production milestones. That disconnect creates confusion and extra work for finance teams.

Payment Processing Options for Epicor Users

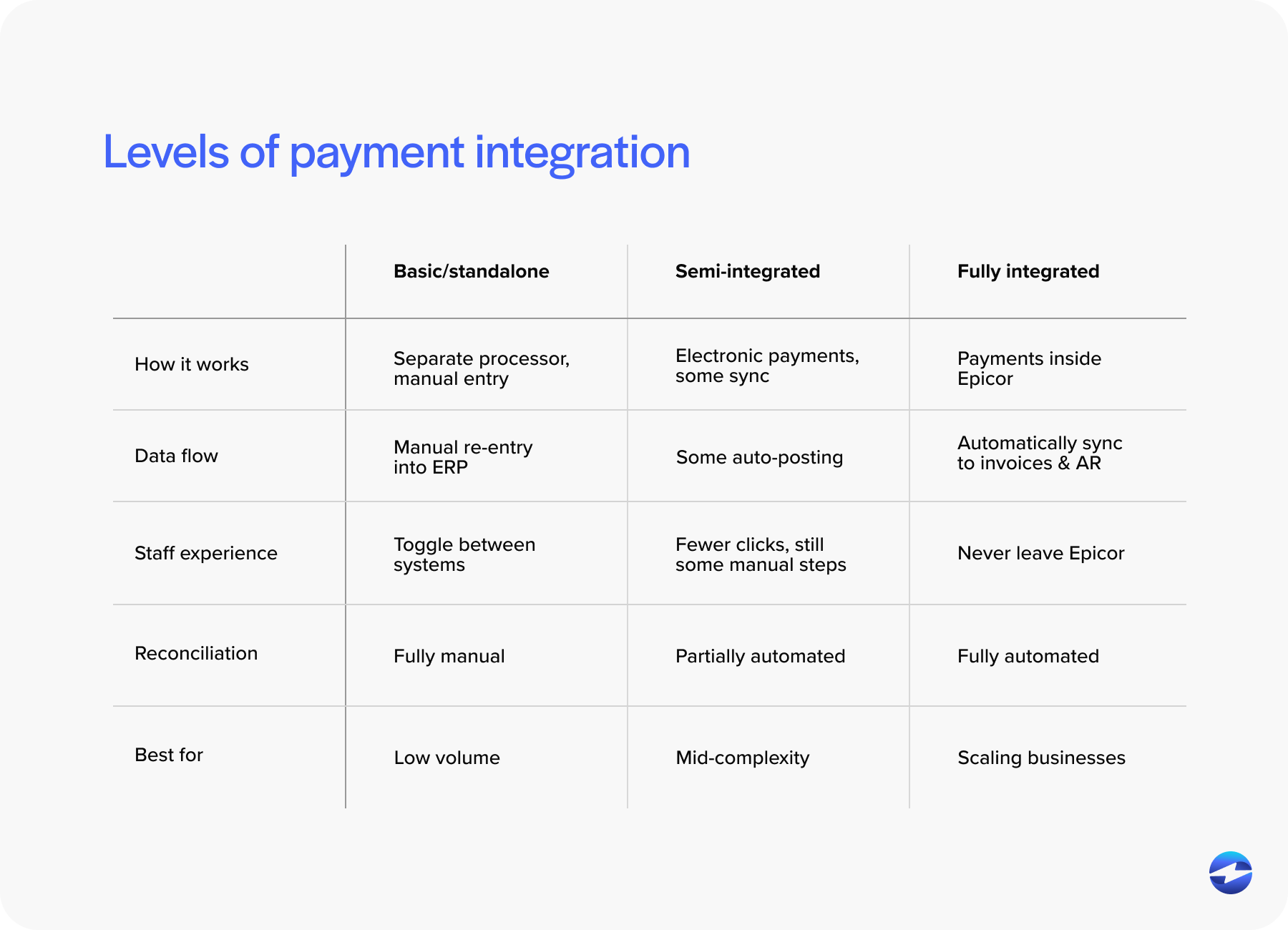

Industrial equipment manufacturers using Epicor generally have several payment processing paths available. Some rely on standalone tools that operate outside the ERP. These can accept payments, but posting and reconciliation usually require manual effort.

Others use semi-integrated tools that pass data back into Epicor after processing. This reduces some work, but delays and exceptions are common.

The most effective approach is a fully integrated payment processing solution that works directly within Epicor. Payments are initiated, processed, and posted as part of a single workflow.

This is true not only for equipment manufacturers, but also for discrete manufacturers and job shops using Epicor Kinetic. While their payment volumes and timelines differ, the need for accuracy and visibility is shared.

For large B2B transactions, Level 3 credit card processing can also play a role. It helps reduce interchange costs by passing additional transaction data, which can be meaningful when invoices are large.

Integrating Payments Into Epicor for Equipment Manufacturing

For industrial equipment manufacturers, integration quality matters more than almost anything else. Large, complex orders often span months. Payments need to stay connected to jobs, invoices, and customer accounts throughout that lifecycle.

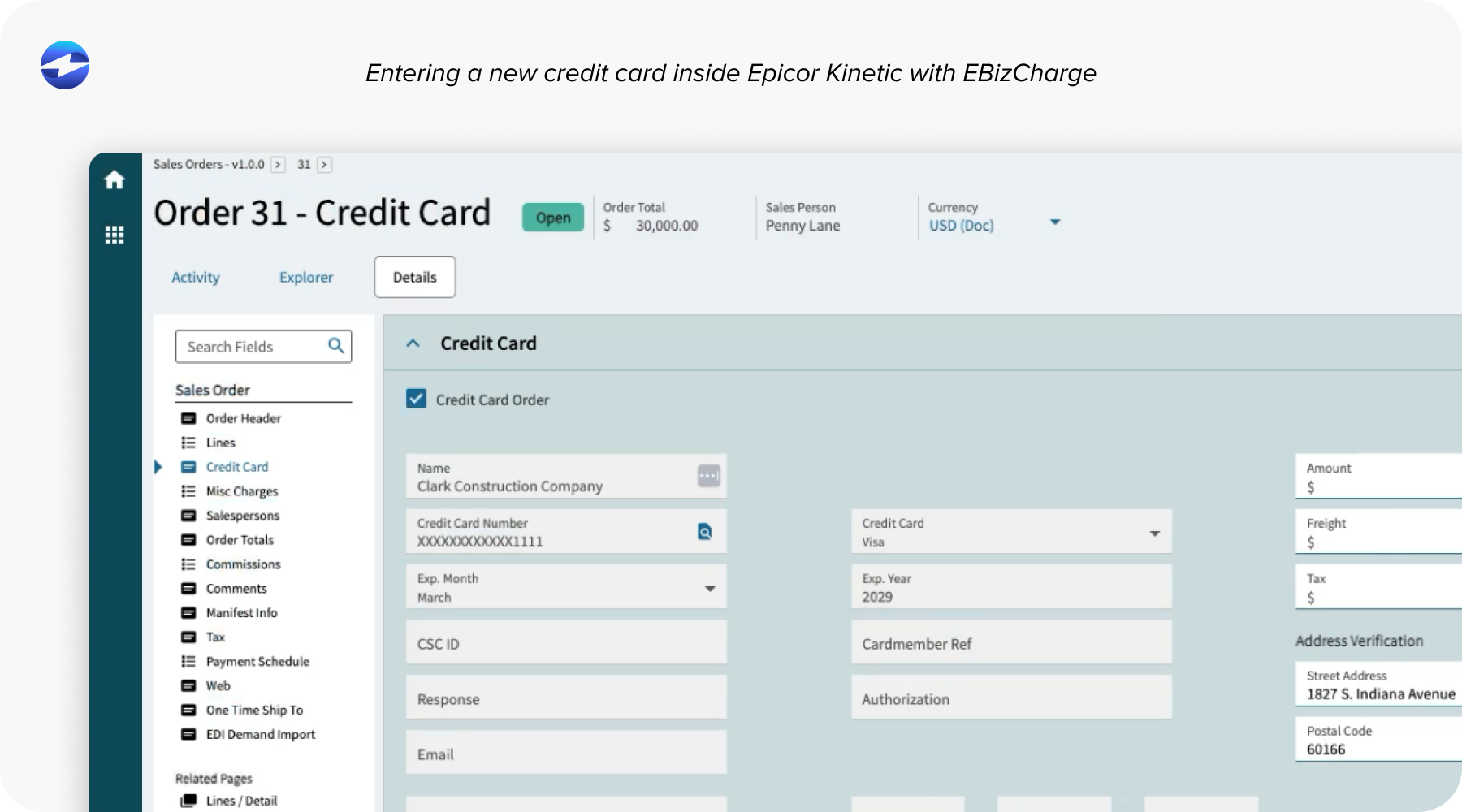

Tight Epicor integration allows payments to be accepted and posted directly within Epicor screens. This reduces manual entry and keeps financial records accurate.

Embedded payment processing also improves visibility. Finance teams can see payment status without pulling reports from multiple systems or reconciling spreadsheets.

Supporting Deposits, Progress Payments, and Milestone Billing

Deposits are a normal part of industrial equipment manufacturing, especially when projects are custom or built to order.

Customers are often asked for an initial payment before production begins to help offset upfront costs. Additional payments may follow at key points, such as completed milestones, inspections, or delivery dates.

Epicor supports these billing structures, but payment tools still need to handle them carefully. Deposits must be applied to the correct jobs, and progress payments should clearly and consistently reduce outstanding balances.

When payments are fully integrated into Epicor, partial payments remain easy to track and audit. That visibility is critical for industrial equipment payments, where timing and accuracy matter just as much as the final dollar amount.

Epicor Kinetic and Other Epicor ERP Considerations for Equipment Manufacturers

Many manufacturers are moving from older Epicor versions to Epicor Kinetic, and that shift often brings questions about how payments should be integrated going forward.

For equipment manufacturers, there are generally a few integration paths to consider. Some rely on basic connections that pass payment data back into Epicor after the fact. Others choose deeper, embedded integrations that allow payments to be accepted and posted directly within Epicor screens. The Epicor Kinetic ERP system supports modern workflows, but the value comes from choosing an integration approach that keeps payments closely tied to jobs, invoices, and customer records.

The key is consistency across versions. Payment solutions should support both Epicor ERP and Epicor Kinetic, so teams don’t have to redesign workflows during upgrades or system transitions. When integrations are designed specifically for the Epicor ecosystem, manufacturers can modernize their ERP environment while keeping payment operations stable and cash flow uninterrupted.

Improving Cash Flow Predictability for Industrial Equipment Manufacturers

Cash flow predictability is essential in capital-intensive manufacturing. Integrated payments reduce delays between invoicing and posting. Finance teams can see what has been paid and what remains outstanding in real time.

This visibility supports better forecasting and fewer surprises. Over time, well-designed heavy equipment payment processing improves confidence in financial planning.

Predictable cash flow also allows manufacturers to invest more confidently in production, staffing, and inventory.

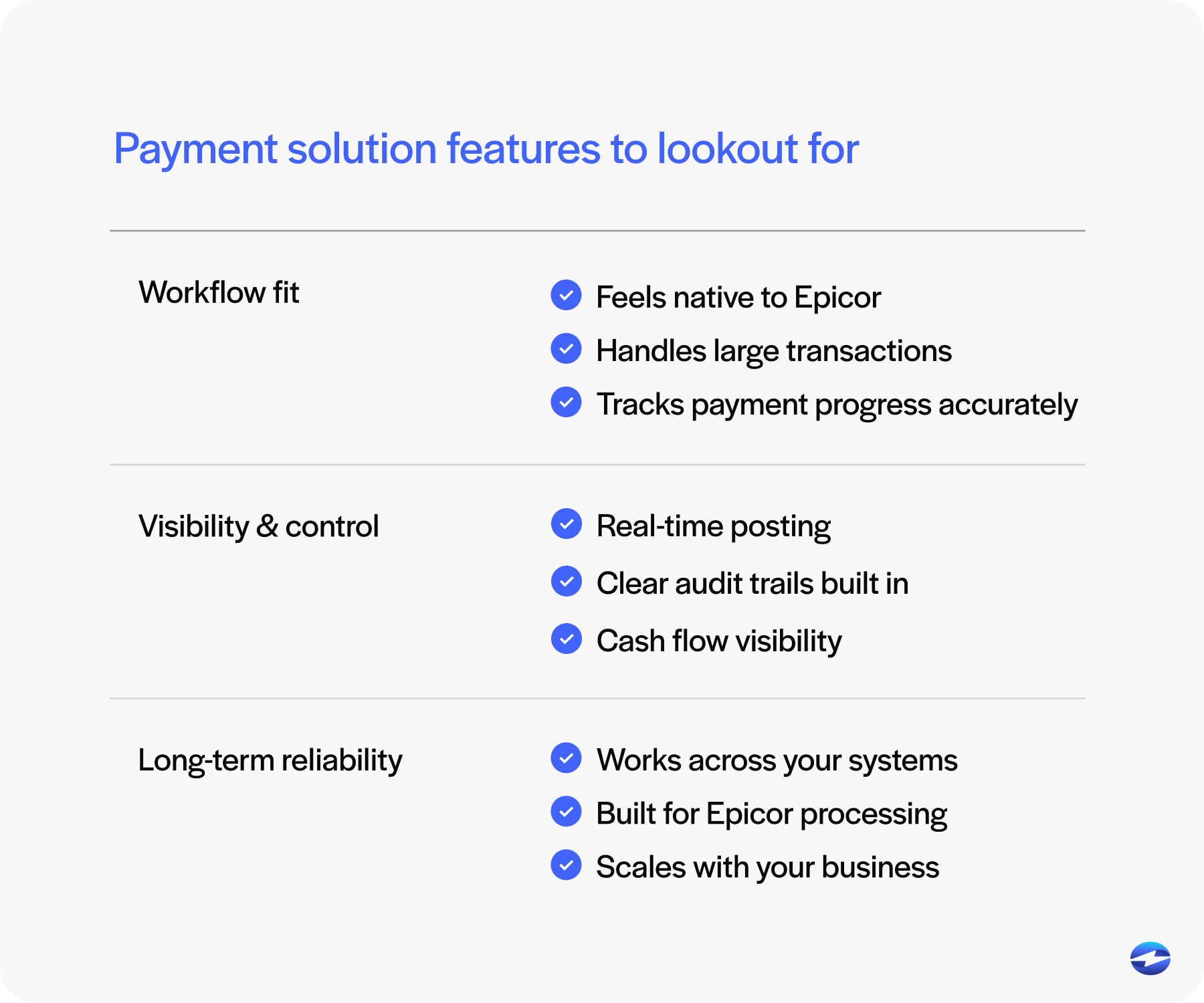

Key Features to Look for in a Payment Processing Solution for Equipment Manufacturers

Not all payment tools are built with industrial equipment manufacturing in mind, and that difference becomes clear once payments are tied to large projects and long timelines.

Look for a solution that feels native to Epicor and can handle large transactions, deposits, and milestone billing without workarounds. Security and audit trails should be part of the foundation, so finance teams can trust the data without extra checks.

Just as important is the experience of the payment processor behind the integration. Epicor-specific knowledge helps prevent posting issues, supports smoother upgrades, and improves reliability as transaction volume and complexity increase.

The right payment processing solution makes it easier to manage operational complexity while still maintaining strong financial control.

Why EBizCharge Is a Strong Option for Industrial Equipment Manufacturers Using Epicor

EBizCharge is built for manufacturers who deal with long sales cycles, large invoices, and payment terms that rarely fit a standard mold.

By integrating directly with Epicor ERP and Epicor Kinetic, EBizCharge brings payment processing into the same job, invoice, and AR workflows your teams already rely on. Payments stay clearly connected to equipment orders from start to finish, even when projects stretch over months.

The platform is designed to support the way equipment manufacturers actually bill. Large-ticket transactions, deposits, progress payments, and milestone billing can all be handled without workarounds or manual cleanup. Customers get flexible payment options, including ACH and Level 3 credit card processing, while finance teams maintain visibility and control.

With deep Epicor integration, support for the Epicor Kinetic ERP system, and guidance from an experienced payment processor, EBizCharge helps industrial equipment manufacturers improve cash flow predictability and manage complex, high-value payments with confidence.