Blog > Navigate Dual Pricing: A Practical Approach to Lower Processing Fees

Navigate Dual Pricing: A Practical Approach to Lower Processing Fees

Businesses are constantly seeking innovative ways to manage their costs effectively. Among these strategies, dual pricing has emerged as a pivotal concept that can significantly influence processing fees.

Understanding dual pricing is essential for any business aiming to maximize profitability and improve its payment models.

What is dual pricing?

Dual pricing is a strategy where businesses offer two different prices for a product or service based on the payment method, such as cash or credit cards.

When used legally, the dual pricing approach can help businesses navigate the complexities of processing fees and empower consumers to make informed decisions at the point of sale (POS).

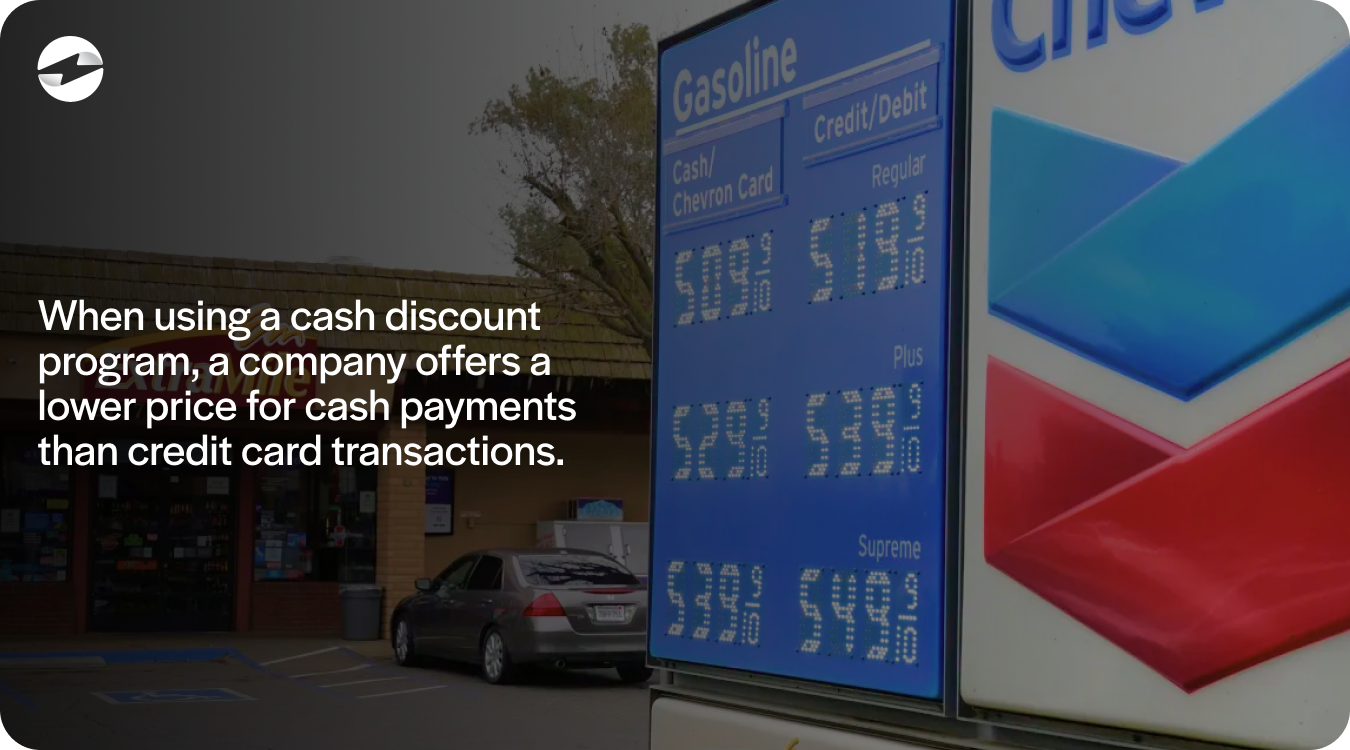

Often seen in places like gas stations displaying a cash and credit price, the dual pricing model aims to offset credit card processing fees by encouraging cash payments.

By clearly differentiating between cash transactions and credit card purchases, dual pricing allows for transparent cost allocation related to payment processing fees.

Why is dual pricing essential to understand?

Understanding dual pricing is crucial for merchants and consumers, as it can offer cost savings and valuable financial insights.

For businesses, it provides a legal way to manage the hefty credit card processing costs and maintain competitive pricing for cash-paying customers.

From a consumer’s perspective, awareness of dual pricing can improve decision-making regarding preferred payment methods. It can also affect customer trust and purchasing behavior, especially for those wanting to avoid extra fees associated with credit card transactions.

While dual pricing is a relatively simple concept to follow and understand, businesses may make some common mistakes when dealing with them.

Common dual pricing mistakes that can lead to illegal surcharging

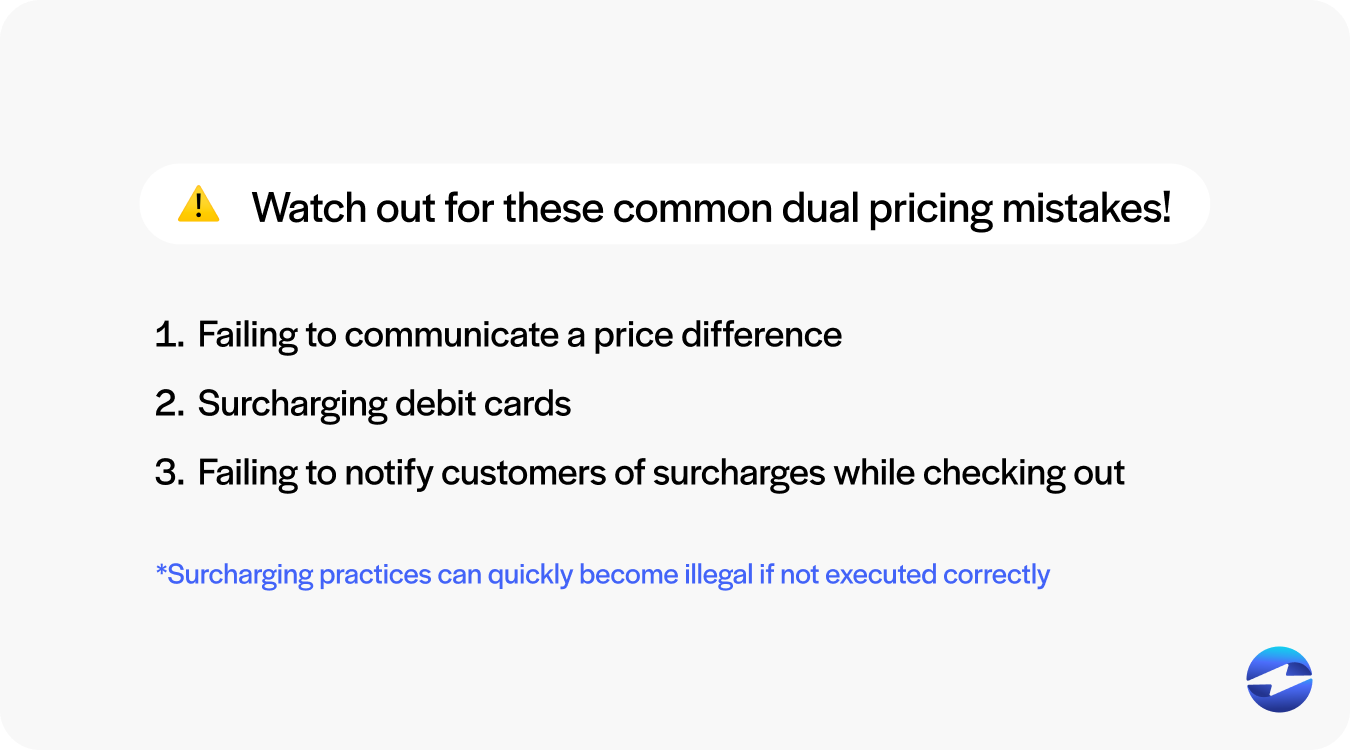

Dual pricing allows businesses to display cash and credit card prices, helping them legally offset credit card processing fees. However, surcharging practices can quickly become illegal if not executed correctly.

One common mistake is failing to communicate the price difference to customers, leading to less clarity and satisfaction. It’s crucial to visibly and legibly display cash and credit prices to maintain transparency and trust.

Another error businesses make is applying surcharges to debit cards, which some credit card networks prohibit. Merchants should ensure their dual pricing strategies comply with card network regulations and state surcharging laws. Some states also have specific laws against certain types of surcharges, so it’s important to stay informed about the legal landscape in your area.

Failing to notify customers of surcharges during the checkout process can also land businesses in hot water. Consumers should be aware of any additional fees during credit card transactions before purchasing.

To avoid penalties, it’s essential to maintain compliance with the guidelines set by credit card companies and educate your staff about proper practices. Businesses can also use legal strategies like cash discounting to avoid penalties and save on processing fees.

How cash discounting mitigates fees for merchants and consumers

Cash discounting is a strategy that helps businesses manage credit card processing fees by incentivizing customers to pay with cash.

When using a cash discount program, a company offers a lower price for cash payments than credit card transactions. This encourages customers to choose cash, reducing the number of credit card payments and, consequently, the associated payment processing fees.

For business owners, cash discounting can lead to significant savings. Businesses can offset the costs levied by credit card networks on each transaction by offering a small discount for cash-paying customers. This dual pricing model helps reduce overall payment

processing costs while accommodating customers who prefer cash as their preferred payment method.

Implementing a cash discount strategy also helps build customer trust by clearly stating the difference between cash and credit card prices. This transparency ensures consumers understand why they’re paying a higher fee for credit card purchases, which may result in increased cash transactions, saving the business money in the long run.

Overall, cash discounting is a legal and effective way for businesses to maintain their bottom line while offering diverse payment methods.

Alongside cash discounting, businesses can implement legal surcharging measures by working with a reliable payment processor like EBizCharge that complies with all regulations and ensures the most seamless payment processing operations.

How EBizCharge enables merchants to legally surcharge customers

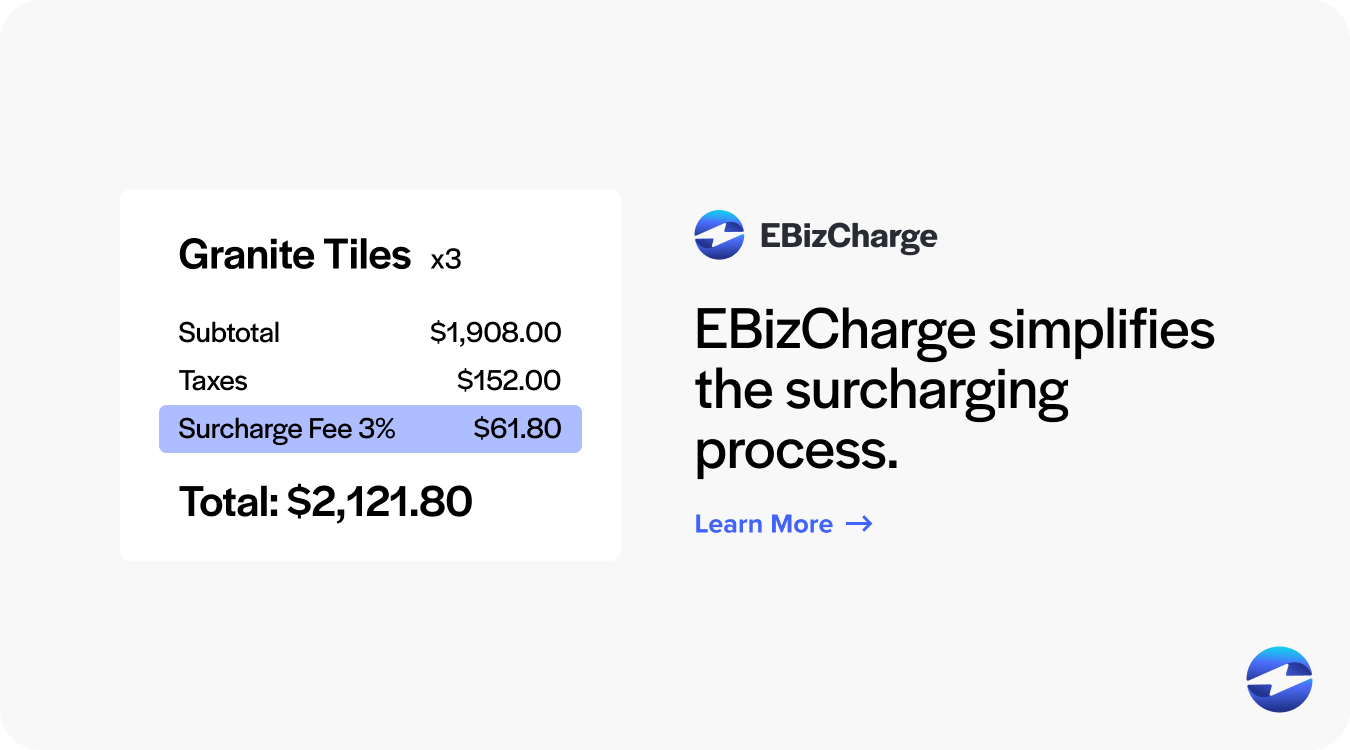

Surcharging with EBizCharge provides a practical way for businesses to legally offset credit card processing fees. This strategy involves adding a surcharge to credit card transactions, allowing business owners to pass part of the processing cost to customers who pay with credit cards.

EBizCharge simplifies the surcharging process by automatically calculating and applying the surcharge at checkout based on the customer’s payment method. This automation ensures full transparency, fostering customer trust and reducing potential disputes.

EBizCharge’s surcharging program also helps businesses adhere to credit card network regulations, ensuring compliance and avoiding potential fines or penalties.

By working with a reliable payment processor like EBizCharge to effectively and legally apply surcharging, merchants can better manage operational costs without negatively impacting customers who pay with cash or other fee-free methods.