Blog > Markup vs Margin: What’s the Difference?

Markup vs Margin: What’s the Difference?

Defining the key differences between margin and markup can yield valuable financial insights for businesses. From understanding the impact on your bottom line to practical examples and real-world applications, you’ll gain the confidence to make informed decisions that propel your business toward greater profitability.

Markups and margins are commonly used in the financial world but can often be misunderstood or used interchangeably. This article will clarify any confusion around these terms and show your business how to correctly calculate profit margins and markups.

Understanding the difference between markup and margin

Understanding the difference between markup and margin is crucial for any business owner or finance professional, as it can significantly impact the financial health of a business. Simply put, profit margin is the percentage of revenue that results in a profit, whereas a markup is the percentage added to the cost of production to arrive at the selling price.

Profit margin is the revenue remaining after deducting the cost of goods sold (COGS), while markup represents the retail price minus the cost of a product. In terms of calculation, margin equals sales minus COGS, while markup is derived from the selling price subtracted from the cost price.

Let’s dive into the specifics of these terms to help you better understand the difference between profit margin and markup.

Profit margin

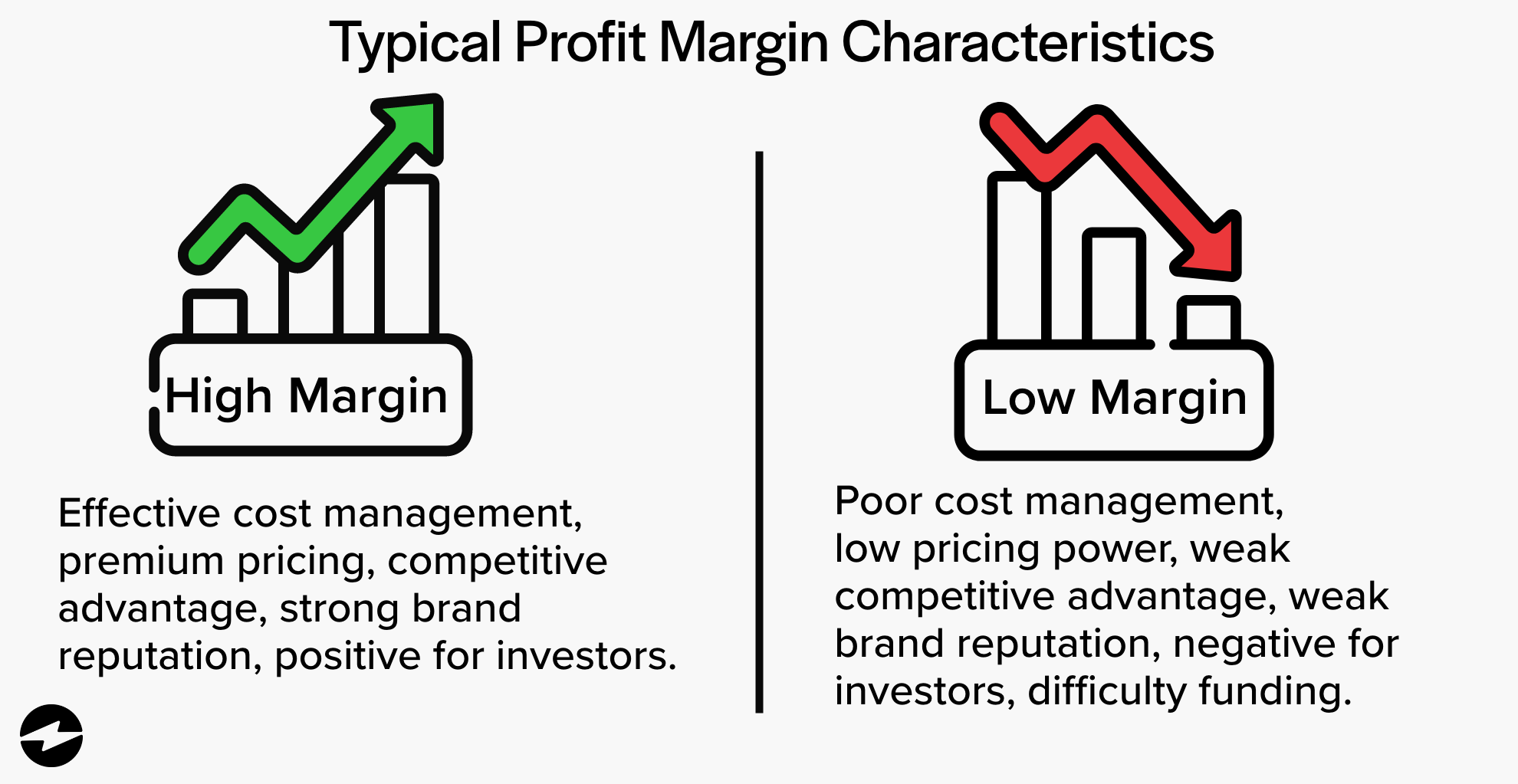

Profit margin is a valuable financial metric business professionals use to determine a company’s financial health and stability. It represents the percentage of profit a firm receives from each dollar of revenue it generates after deducting all the expenses associated with producing and selling its products or services.

A higher profit margin means the company generates more profit per dollar of revenue earned, which is generally acceptable, and is operating efficiently and effectively controlling its costs.

On the other hand, a lower profit margin may indicate that a company is struggling to generate enough profit from its operations due to various reasons, such as higher expenses, lower sales, or ineffective pricing strategies. In such cases, the company may need to review its cost structure, improve operational efficiency, or adjust pricing to increase its profit margins.

Profit markup

Markup is the amount added to the cost of goods sold (COGS) to determine the selling price of a product or service. Businesses commonly use it to ensure they cover all their expenses and generate a profit.

While markups can help companies determine the minimum selling price for a product or service, it doesn’t factor in other variables like competition or customer demand.

It’s also important to note that a high markup can mean something different than a high-profit margin or revenue. Therefore, it’s crucial to understand markup and profit margin to make informed pricing decisions and ensure your business remains profitable.

For example, if you only consider markup when pricing your products, you may charge too little or too much for your product, resulting in lost profits or reduced sales. By understanding profit margin, you can better evaluate the profitability of a product and set prices that maximize profits without sacrificing sales.

Additionally, understanding the difference between profit margin and markup can help you compare the performance of different products, evaluate your competitors’ pricing strategies, and identify areas where you can cut costs to improve profitability.

Now that you know the differences between profit markups and margins and their significant role, the next step is to learn how to calculate each and apply these formulas in your business.

Knowing the profit margin vs markup formula

The markup vs margin formula is crucial to making informed pricing decisions and ensuring profitability.

Learning how to calculate markup and margin and seeing these calculations applied in examples will help your business understand how to use them in everyday operations.

Profit margin formula

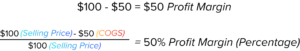

Profit margin is a financial metric measuring a company’s profit for each dollar of revenue earned — it’s the percentage of income that’s profit. The profit margin can provide insight into a company’s financial health and profitability.

To calculate profit margin, you’ll first need to subtract the cost of goods sold (COGS) from the selling price. Then, divide the result by the selling price and multiply it by 100 to get a percentage.

Selling Price – COGS = Profit Margin

(Selling Price – COGS)/ Selling Price = Profit Margin (Percentage)

For instance, if a hardware store sells a power drill for $100 that costs $50 to produce, the profit margin would be $50 (or 50%).

$100 – $50 = $50 Profit Margin

($100 Selling Price -$50 COGS) / $100 Selling Price = 50% Profit Margin Percentage

Understanding your company’s profit margin is crucial to evaluate financial performance and make informed decisions.

Next, you can learn the profit markup formula and see it applied in examples.

Profit markup formula

Markup is the amount added to the cost of production to arrive at the selling price, and it’s expressed as a percentage that’s often used interchangeably with the term markup percentage.

Simply put, markup is the difference between the selling price and the cost of goods sold (COGS).

![]()

Selling Price – COGS = Profit Markup

You can also calculate the markup percentage from the selling price and cost of goods sold (COGS). The formula is as follows:

((Selling Price – COGS)/ Selling Price ) x 100 = Markup Percentage

To calculate the selling price, you can multiply the cost of goods sold (COGS) by the markup percentage, then add the COGS back to obtain the selling price.

![]()

(COGS x Markup Percentage) + COGS = Selling Price

For instance, let’s say a clothing company produces a shirt for $50, and they want to add a 50% markup to the cost of goods sold (COGS). The selling price would be $75.

![]()

($50 x .50) +50 = $75 Selling Price

Now, inputting the selling price into the profit markup formula, we find the clothing store implemented a $25 profit markup.

![]()

$75 – $50 = $25 Profit Markup

Understanding your markup is crucial to ensure you’re pricing products correctly and generating sufficient revenue to cover your costs and make a profit.

When should you use margin or markup formulas?

Now that you know the differences between margin and markup and how to calculate them, you must understand which situations to use these formulas.

Margin is a better metric to compare products or services allows you to factor in the different selling prices of each product or service and determine which ones are more profitable. This is because the margin is calculated as the difference between the selling price and the cost of goods sold (COGS) and expressed as a percentage of the selling price.

For example, if you have two products with the exact cost of goods sold but different selling prices, the one with the higher selling price and margin is more profitable. Here’s an example:

Screwdriver at Bob’s Hardware: ($85 Selling Price – $65 COGS) / $85 Selling Price = 24% Profit Margin

Screwdriver at Richard’s Hardware: ($100 Selling Price – $65 COGS) / $100 Selling Price = 35% Profit Margin

As you can see, the screwdriver at Richard’s Hardware sold for a higher selling price at the same COGS, resulting in a higher profit margin.

In contrast, markup is calculated as the percentage added to the cost of production to arrive at the selling price. Markup doesn’t consider other expenses — overhead costs, taxes, interest payments, etc. — factored into the selling price.

Therefore, using markup to compare products or services can be misleading because it needs to consider the actual selling price and the costs involved in producing and selling them.

Enhance your financial management with EBizCharge

Managing finances can be daunting for businesses of all sizes, so using valuable formulas like profit markups, profit margins, and other data-driven resources are essential to ensure the most profitability.

Businesses can also look to reliable providers like EBizCharge that offer payment processing solutions to simplify payment collections and better manage their finances. With EBizCharge, you can easily track your revenue, expenses, margins, and markups to make more informed decisions and maximize your profits.

Get a free cost-comparison of your current payment processing costs vs. EBizCharge

Get a free cost-comparison of your current payment processing costs vs. EBizCharge