Blog > Magento + SAP ECC + Payment Processing: The Complete Integration Guide for 2025

Magento + SAP ECC + Payment Processing: The Complete Integration Guide for 2025

For eCommerce businesses, running systems that don’t talk to each other can create endless headaches. Orders get stuck, finance teams spend hours reconciling mismatched data, and customers are left frustrated. That’s why integration has become such a focus. If you’re using Magento for your online store and SAP ECC for your ERP, tying the two together with a strong payment processing solution can make all the difference.

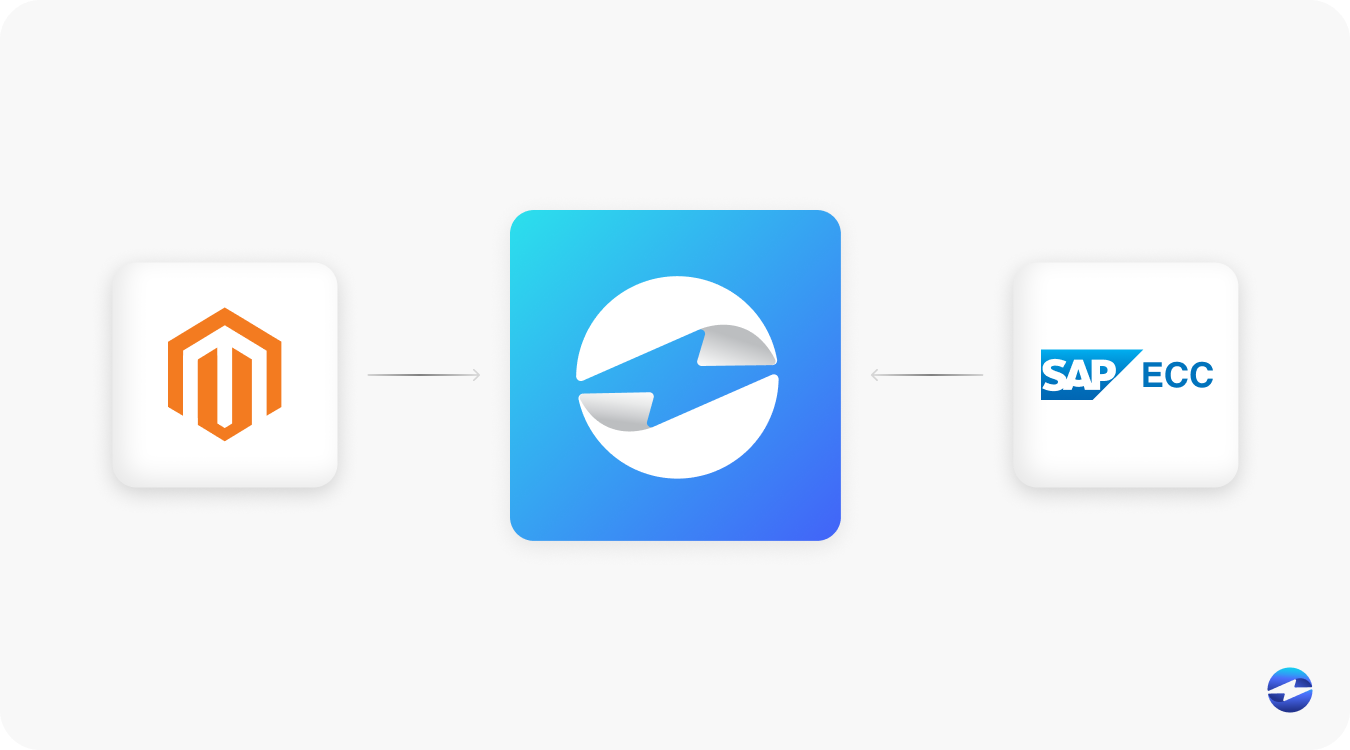

This guide will explore what a three-way integration really looks like, the challenges it solves, and how companies can set up workflows that reduce manual effort and improve accuracy. We’ll also discuss how EBizCharge fits into the picture as a connector between Magento and SAP ECC. Our goal is to provide practical guidance for 2025 and beyond—guidance you can actually use if you’re in the middle of a Magento SAP ECC integration or planning one soon.

Understanding the Three-Way Integration

At the highest level, you’re working with three moving parts. Magento is the front end, where customers browse, place orders, and make payments. SAP ECC is the SAP system handling finance, inventory, supply chain, and reporting. The missing link is the payment processor, which ensures funds are captured securely and data flows back correctly.

On their own, each of these tools is powerful. Magento provides flexibility and customization for eCommerce, SAP ECC is still widely used for its reliability as an enterprise backbone, and modern payment processing solutions bring compliance, fraud protection, and customer convenience. However, the real value happens when all three systems work together. That’s where Magento ERP integration comes in—building connections so data doesn’t just sit in silos.

Challenges of Magento + SAP ECC + Payment Processing

Bringing these systems together isn’t without challenges. Many businesses rely on workarounds like exporting spreadsheets from Magento and manually keying data into SAP billing software. That approach is error-prone and drains staff resources. A single mistyped number can throw off reconciliation and lead to wasted hours.

Compliance is another concern. If payment data doesn’t sync properly, you risk exposing sensitive cardholder information or failing to meet PCI standards. Then there’s the issue of timing. Without real-time updates, reports lag behind reality, leaving leadership with an incomplete view of cash flow. For businesses juggling custom pricing, taxes, or shipping complexities, the chance of mismatches is even greater.

These are the exact issues that a proper SAP ECC integration with Magento and a payment processor is designed to fix.

Data Synchronization in Three-Way Integration

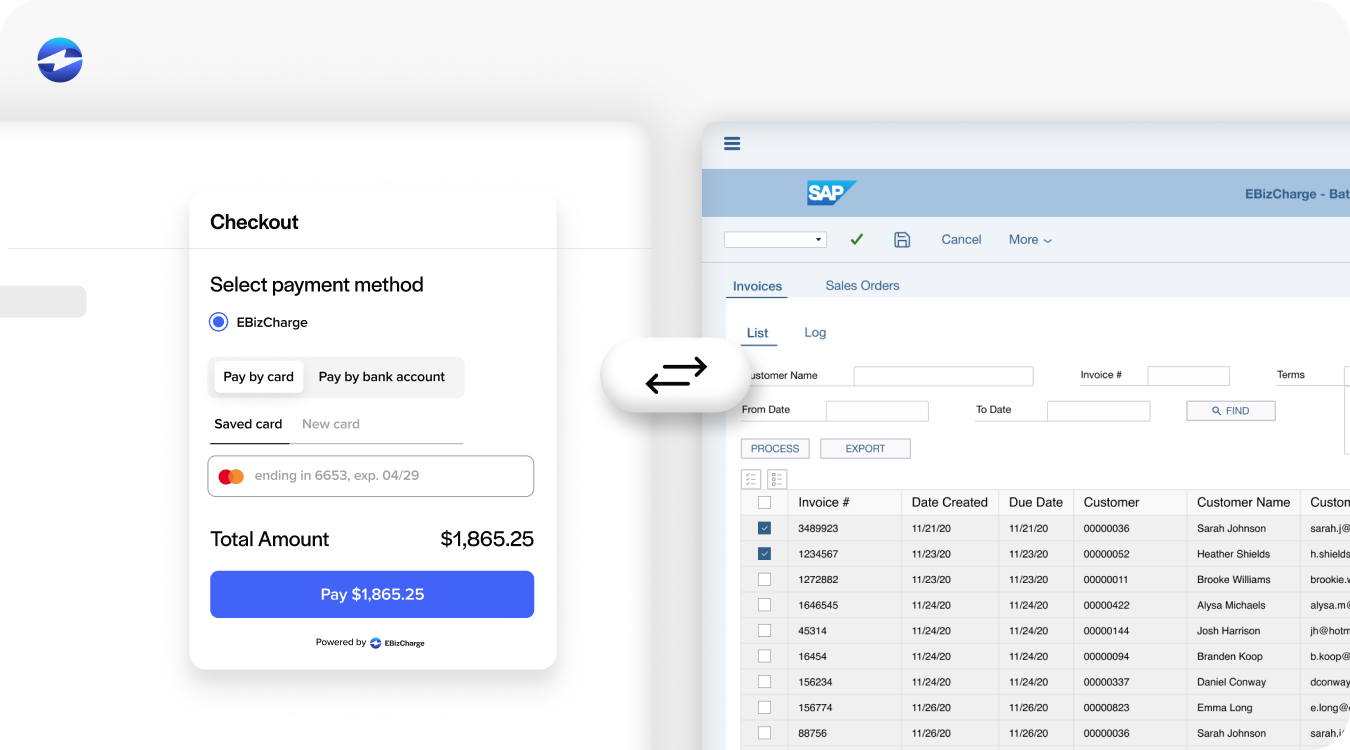

One of the most critical elements of a Magento SAP ECC integration is data synchronization. When a customer places an order in Magento, payment capture should feed directly into Accounts Receivable in SAP ECC. At the same time, inventory levels need to adjust automatically, and the General Ledger should reflect updated balances.

Real-time synchronization eliminates duplicate entries and reduces errors. For example, when a refund is processed, the update should show instantly in Magento for the customer, in the SAP billing module for finance, and in the reporting dashboards for leadership. Automating these updates ensures data stays accurate across the board.

Think of synchronization as the glue holding the integration together. Without it, even the best payment processor or ERP won’t deliver the efficiency you need.

Automated Workflows for Efficiency

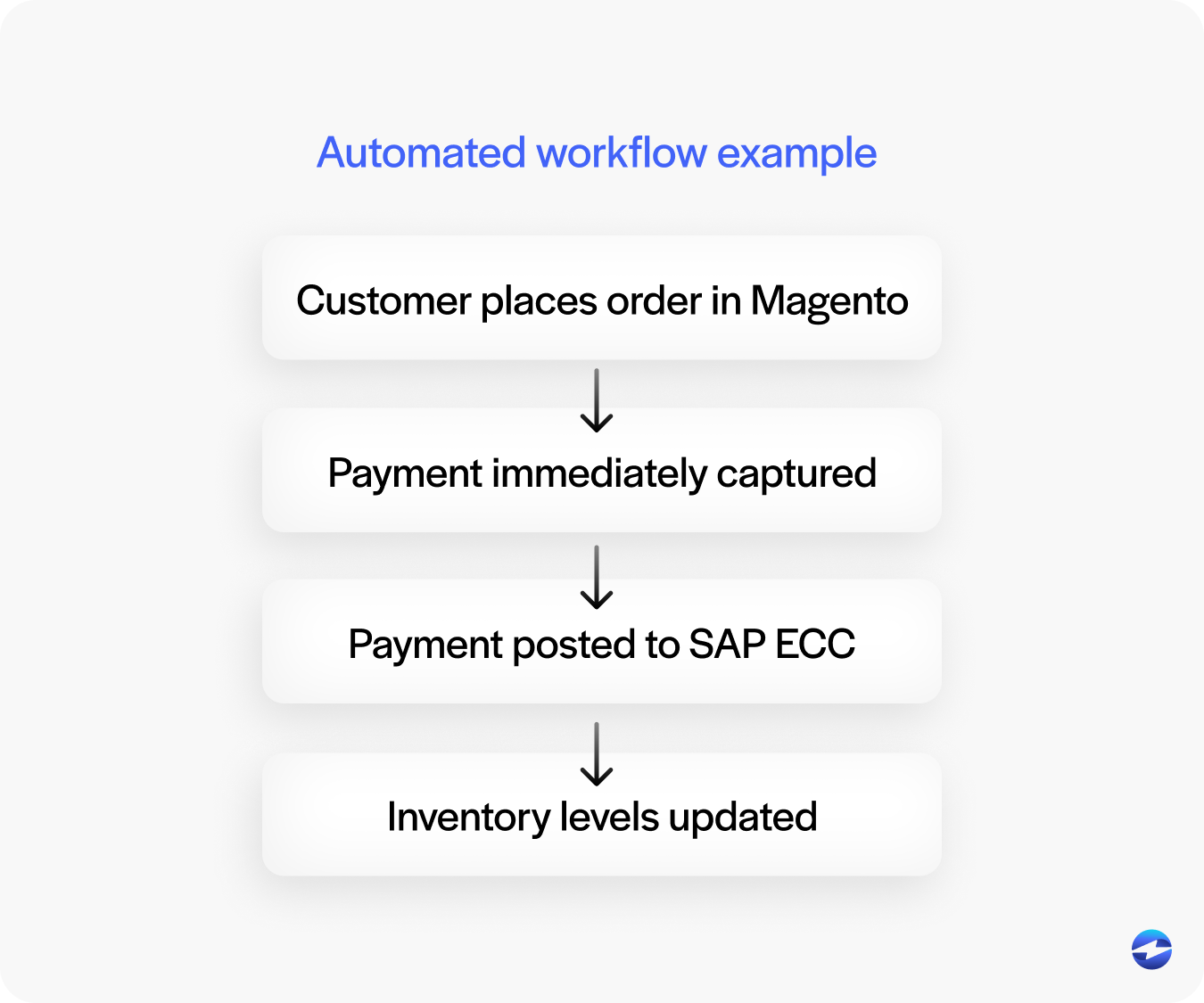

Automation is where integration really shows its value. Instead of treating each order as an isolated job, you can build workflows that carry the process from start to finish without interruptions. For example, when a customer places an order in Magento, the payment is captured immediately, posted into SAP billing software, inventory levels are updated, and Accounts Receivable reflects the change—all without anyone manually entering data.

These workflows can extend to refunds, partial shipments, or even complex B2B transactions. Automatic notifications can keep both teams and customers in the loop, while financial reports update almost in real time. The payoff isn’t just about moving faster. It’s about accuracy, reducing manual workload, and giving customers a smoother experience. Orders update promptly, finance teams close the books with less hassle, and leaders can make decisions with confidence knowing the numbers are reliable.

Use Cases for eCommerce Businesses

The value of Magento and SAP ECC integration becomes clear when you look at real-world use cases.

- B2C merchants: High-volume stores can’t afford delays or mismatched data. Automated syncing ensures each order is captured accurately, no matter how many sales happen in a day.

- B2B businesses: With large invoices, custom pricing, and ACH or corporate card payments, automation simplifies what would otherwise be a complex cycle. Here, features like Level 3 data and tokenization are especially important.

- Global merchants: For businesses selling internationally, multi-currency support and tax handling are critical. An integrated payment processor ensures consistency and compliance across borders.

- Subscription businesses: Companies offering recurring billing benefit from automatic posting into SAP billing and reconciliation in the General Ledger.

Each of these cases highlights how integration directly improves efficiency and trust across operations.

EBizCharge as the Integration Connector

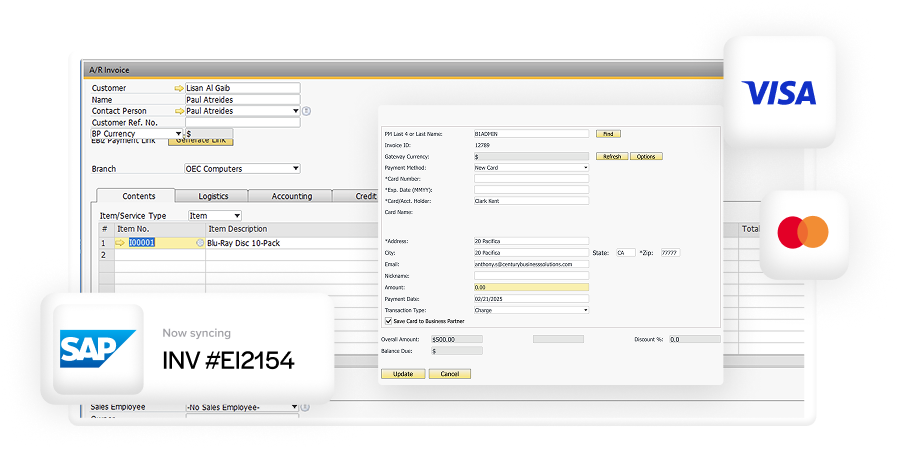

This is where EBizCharge comes in. It’s designed to act as the bridge between Magento, SAP ECC, and payment processing. With direct connections, EBizCharge automates payment posting into Accounts Receivable and the General Ledger. That means no duplicate entry, fewer reconciliation errors, and faster closings.

EBizCharge also provides customer portals, giving clients a secure way to pay invoices online. For businesses managing B2B payments, this is a huge time saver. Security features like PCI compliance, tokenization, and fraud monitoring are built in, so sensitive data is never exposed unnecessarily.

As transaction volumes grow, scalability becomes a must. EBizCharge adapts to handle higher volumes without introducing delays. It also supports multi-currency, making it ideal for international merchants. In short, EBizCharge simplifies the Magento ERP integration process and turns three separate systems into one seamless payment processing solution.

Best Practices for Successful Implementation

Pulling off a smooth SAP ECC integration with Magento and payments takes time and planning. The first step is mapping out your workflows. In practice, that means laying out exactly what happens from the moment an order is placed in Magento to the point when it appears in the SAP system. Before going live, it’s worth running plenty of test transactions to ensure data moves where it should and nothing slips through the cracks.

It’s also important to get your people on board. Sales, finance, and operations teams should all be comfortable with how the new setup works. Training goes a long way toward preventing mistakes once the system is live. When you launch, don’t treat the project as finished —keep monitoring it. Dashboards and alerts can help you spot problems early, and regular reviews allows you to fine-tune processes as your business grows and changes.

Streamlining Payment Processing with Magento, SAP ECC, and a Trusted Payment Processor

A thoughtful Magento SAP ECC integration ensures data flows correctly, reports update faster, and manual tasks are reduced. By linking Magento with SAP billing software and a trusted payment processor, companies can build a solid structure that supports growth.

The results are easy to see: fewer mistakes, stronger compliance, better cash flow, and an improved customer experience. With solutions like EBizCharge, this kind of three-way integration has become more achievable than ever. For merchants looking ahead to 2025, choosing a proven payment processing solution with direct Magento and SAP ECC integration is one of the smartest investments you can make.