Blog > How to Stay Compliant with NACHA Requirements

How to Stay Compliant with NACHA Requirements

Navigating electronic payments requires a thorough understanding of compliance standards set forth by governing bodies such as the National Automated Clearing House Association (NACHA) network.

Ensuring compliance with NACHA requirements is crucial for financial institutions, as it guarantees the secure, efficient, and reliable handling of electronic payments.

This article will explore the essential aspects of staying compliant with NACHA rules, such as risk management, data security, authorization protocols, and more, to help institutions maintain the highest standards of operational integrity and customer trust.

What is NACHA?

The National Automated Clearing House Association (NACHA) governs the operation of the Automated Clearing House (ACH) network, a centralized system financial institutions use to facilitate electronic payments and transactions across the U.S.

Under NACHA’s stewardship, the ACH network processes various payments, including direct payments for payroll, social security benefits, tax refunds, and more. It also manages direct deposits, which can encompass forms of government and business disbursements.

Financial institutions like banks, credit unions, and other network participants must adhere to NACHA guidelines to ensure smooth operations.

NACHA focuses on fostering efficient payments, including same-day payment capabilities and developing compliance standards for electronic transactions that reduce fraudulent transaction risks.

Through a robust risk management framework and stringent security rules, NACHA strengthens trust in the digital payment ecosystem.

Adhering to NACHA requirements

Financial institutions, credit unions, and other ACH network participants need to ensure they remain in lockstep with NACHA regulations to facilitate efficient payments.

Compliance with these standards is pivotal for entities that wish to conduct electronic payments such as direct payments, tax refunds, and social security distributions.

NACHA’s detailed operating rules help prevent fraudulent transactions and safeguard the integrity of electronic transactions across bank accounts and financial accounts.

Risk management

Financial institutions and third-party service providers must construct and execute a risk-based approach to detect and prevent fraudulent ACH transactions. This includes developing policies and tools to adequately identify, assess, and mitigate potential fraud.

A crucial aspect of risk management within NACHA’s framework involves continuous monitoring of transactions to detect anomalies or patterns that may indicate unauthorized activity.

Under NACHA’s operational guidelines, entities are expected to establish risk management practices proportional to the extent and nature of their ACH activities. As transaction volumes or the complexity of the ACH services increase, institutions or service providers must enhance their fraud detection and prevention mechanisms.

Data security

NACHA imposes stringent requirements to protect sensitive financial data. Entities handling this information must ensure storage and transmission encryption, preventing unauthorized access and potential breaches.

Data security in line with NACHA standards involves thorough measures that uphold the confidentiality and integrity of customers’ financial information, contributing to a secure ACH network.

Entities must follow essential practices, such as incorporating strong access controls, routinely updating security protocols, and employing advanced encryption technology. These preventative measures are critical for mitigating risks and protecting against the consequences of data theft, which can have far-reaching implications for consumers and financial institutions.

Authorization requirements

Before initiating ACH debit transactions, NACHA requires that entities obtain explicit, written authorization from the customer.

Authorization documents must be retained and made available upon request, serving as proof of compliance and legitimizing the transaction. This authorization, which is essential for Prearranged Payment and Deposit (PPD) entries, must be straightforward and easily understood by the customer, clearly detailing the transaction terms.

These requirements can protect consumers by confirming their consent, prevent errors, and reduce the likelihood of disputed transactions.

Implementing rigorous authorization methods ensures transparency and supports mutual trust between the consumer and the financial institution or service provider.

Return and correction procedures

Following NACHA standards, financial institutions and other network participants must adhere to precise returns and error correction procedures to ensure seamless payments and regulatory compliance within the ACH network.

NACHA stipulates specific return reason codes, which financial institutions must use to categorize the nature of the error or return, whether due to insufficient funds, account closure, or incorrect account information.

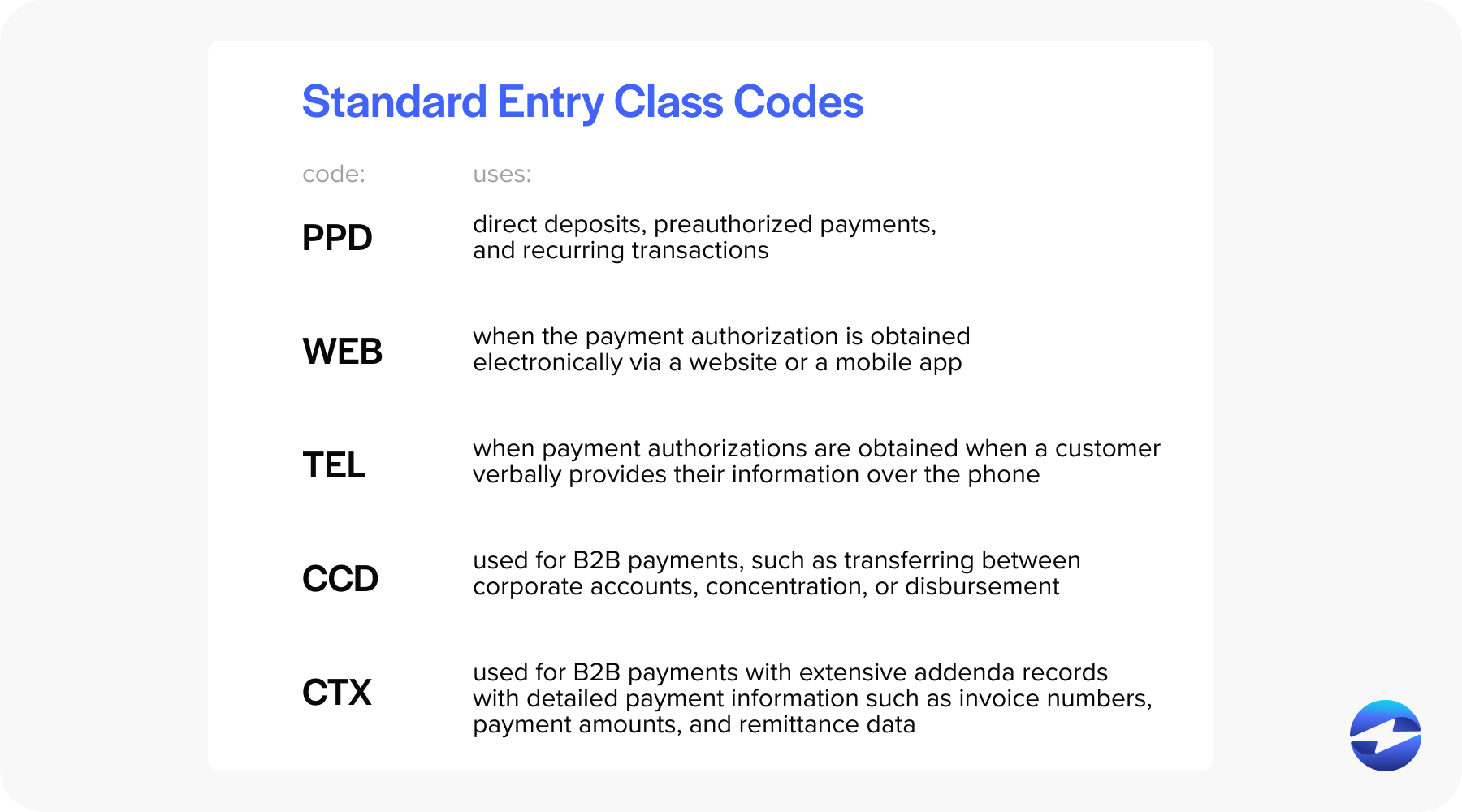

Standard entry class codes

To ensure proper processing and tracking of various transactions in compliance with NACHA requirements, specific Standard Entry Class (SEC) Codes are used for different types of electronic payments:

- PPD entries: PPD entries are used for direct deposits, preauthorized payments, and recurring transactions such as payroll deposits, pension payments, and utility bill payments. With a PPD, funds are electronically transferred into or out of a consumer’s bank account. A predetermined schedule ensures timely and reliable transactions without the need for manual intervention each time.

- Internet-initiated mobile entries (WEB): WEB entries are specifically designed for transactions where the payment authorization is obtained electronically via a website or a mobile app. WEB entries are commonly used for online bill payments, eCommerce purchases, and other digital transactions, offering a convenient and secure way to manage payments in the digital age.

- Telephone-initiated entry (TEL): TEL entries are used for ACH transactions where payment authorizations are obtained when a customer verbally provides their bank account information to a company or a service provider over the phone. These entries are common for bill payments or purchases made through telemarketing, allowing consumers to authorize payments conveniently without using online platforms.

- Cash concentration or disbursement (CCD): CCD entries are primarily used for business-to-business (B2B) payments. They facilitate the transfer of funds between corporate accounts, enabling businesses to consolidate funds from multiple locations into a central account (concentration) or to distribute funds from a central account to various accounts (disbursement). CCD transactions efficiently manage corporate cash flows, payroll, vendor payments, and other financial operations, streamlining the management of large volumes of business transactions.

- Corporate trade exchange (CTX): CTX entries are used for B2B payments, including extensive addenda records with detailed payment information such as invoice numbers, payment amounts, and other remittance data. CTX transactions are also common for invoice settlements and other financial interactions that benefit from detailed record-keeping and reporting.

Each SEC code has its defined usage, ensuring the correct handling of electronic transactions and aiding in fraud detection. Financial institutions and network participants must remain vigilant in using the appropriate SEC codes to maintain compliance standards and facilitate efficient payments.

Audit requirements

Annual compliance audits are critical to adhering to NACHA guidelines for financial institutions and other network participants involved in electronic payments. These audits ensure all stakeholders, from credit unions to major banks, conform to established transaction standards for various payment types, such as direct payments for social security or tax refunds.

NACHA has streamlined the audit process by consolidating the methodologies into a single section within NACHA regulations. This harmonization allows for more straightforward navigation and understanding of the required audit procedures.

Phased implementation of fraud monitoring

Phased implementation of fraud monitoring involves a structured, step-by-step approach to enhancing the security of electronic payments. This rule mandates that financial institutions and payment processors gradually adopt advanced fraud detection and prevention measures to adapt to new requirements over time and ensure minimal operational disruptions.

The phased fraud monitoring implementation process begins with an initial assessment of current capabilities and identification of vulnerabilities. Institutions then implement basic fraud monitoring tools to establish baseline metrics and detect high-risk transactions. As the phases progress, more sophisticated technologies, like machine learning and artificial intelligence, are integrated for real-time analysis and improved reporting systems.

Advanced stages include multi-factor authentication (MFA), encryption techniques, and continuous staff training.

This gradual implementation helps manage risks effectively, adapt to evolving fraud patterns, and allocate resources efficiently, ultimately leading to continuous improvement in fraud monitoring systems and enhanced security of ACH transactions.

Institutions must report their progress to NACHA throughout this phased approach to ensure compliance with guidelines and document all measures taken.

Adhering to NACHA requirements and compliance measures is integral to maintaining a foolproof ACH network and meeting security standards. Fortunately, NACHA provides extensive resources and support to help ensure compliance.

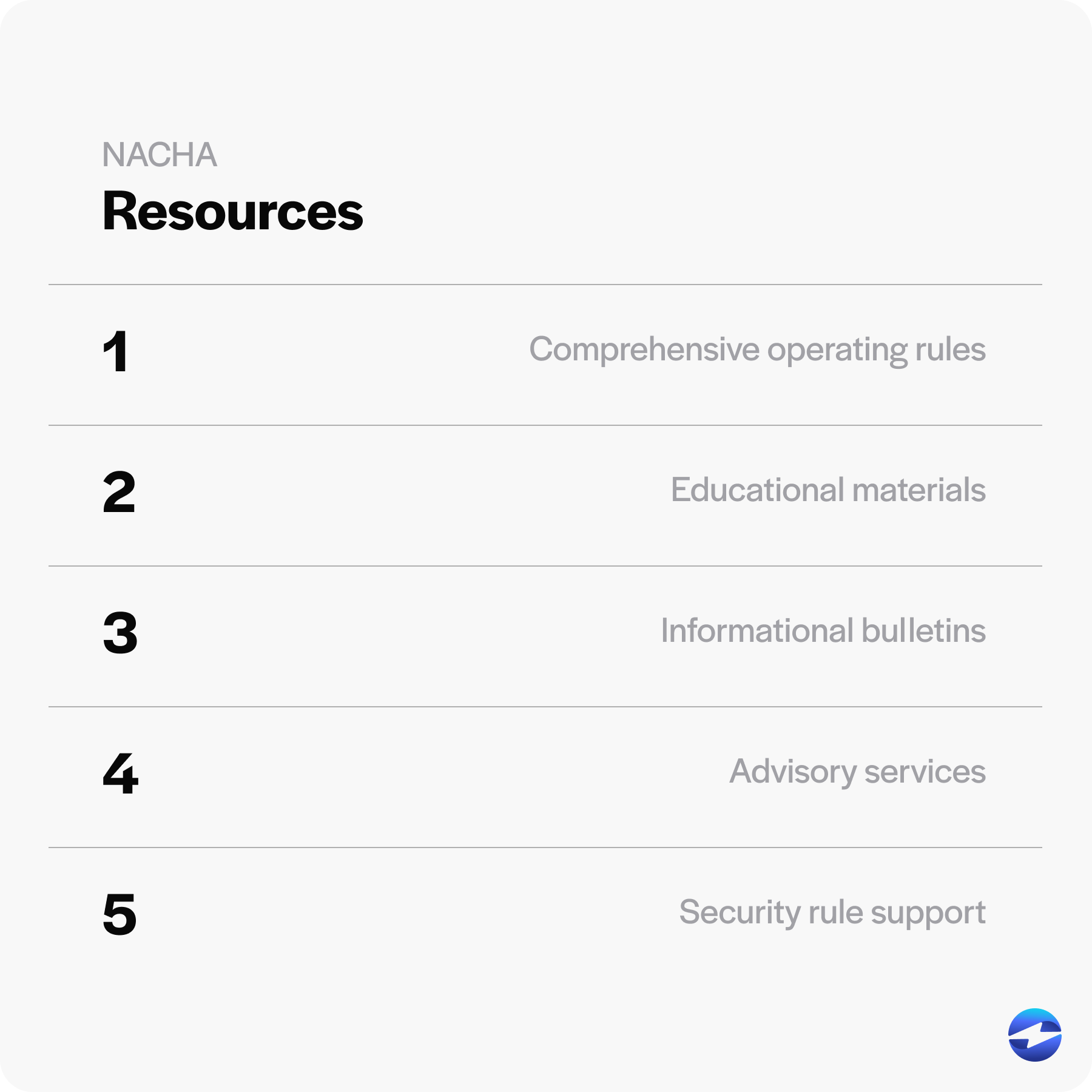

Resources and support

In addition to ensuring compliance with the operating rules for electronic payments, NACHA provides resources and support to uphold regulatory requirements and foster efficient payments.

Resources available through NACHA include:

- Comprehensive operating rules: An extensive guide to the regulations governing ACH payments, including direct and same-day payments, ensuring all types of payments are handled with uniform standards.

- Educational materials: A mixture of webinars, courses, and publications to educate on electronic transactions, compliance standards, and risk management practices.

- Informational bulletins: Provides timely updates on regulatory compliance issues, operating rule changes, or fraud prevention tool enhancements.

- Risk management tools: Guidance on how to employ fraud detection systems designed to spot potential fraud in electronic transactions.

- Advisory services: Tailored consulting on implementing and maintaining an efficient payment environment.

- Security rule support: Detailed instructions on adhering to the security requirements necessary to protect financial accounts from unauthorized access.

By leveraging these resources, institutions can align their activities with NACHA’s regulatory requirements, ensuring the ACH network remains a reliable channel for transactions.

Committing to compliance

Staying NACHA compliant isn’t only a regulatory necessity; it’s a cornerstone of maintaining trust and security within the financial ecosystem.

Compliance ensures financial institutions provide reliable and efficient electronic payment services, fostering consumer confidence and safeguarding sensitive payment data.

By adhering to NACHA’s comprehensive rules and guidelines, institutions can mitigate risks, prevent fraud, and uphold the integrity of the ACH network. This commitment to compliance ultimately supports the seamless operation of digital payments, promoting a robust and trustworthy financial infrastructure that benefits businesses and consumers alike.