Blog > How to Find the Best Payment Gateway for eCommerce

How to Find the Best Payment Gateway for eCommerce

You’ve done your research, found your niche, and set up your online eCommerce site. You’re ready to dive into the eCommerce world.

But how do you find the best payment gateway for eCommerce?

In this article, we’ll discuss the requirements for processing cards online, how payment gateways can address common problems faced by eCommerce stores, and two key features to look for in payment gateways.

What you need to start selling online

If you want to sell products or services through an eCommerce store, then you must have these three crucial ingredients:

eCommerce store

Of course, if you want to sell products online, you need a web-based storefront. There are dozens of eCommerce platforms out there, including Magento, Epicor ECC, and WooCommerce. These platforms make it easy for you to set up an online store and come with useful features to streamline the eCommerce experience.

Businesses can also tap into many resources to improve their eCommerce stores, like applications to monitor and encourage returning customers.

Merchant account

Any business that wants to accept credit card payments—regardless of whether it’s brick and mortar or an online store—must open a merchant account with a credit card processor. This account is different from a regular business account, and it’s what allows you to accept and process credit, debit, or ACH check transactions.

Payment gateway

In addition to a merchant account, you’ll need a payment gateway to accept credit card payments online. But what exactly does a payment gateway do, and where does the merchant account fit into all of this?

Credit card transactions are deceptively complex. From the customer’s perspective, they simply swipe their card or enter their information online and the transaction is swiftly approved or declined. However, in those brief seconds after swiping the card or hitting submit, a flurry of messages ping back and forth between several different entities.

Because payment gateways are an integral part of any online store, it’s imperative that you do your research to find the best payment gateway for your eCommerce business. But how can payment gateways help you?

How a payment gateway can benefit your eCommerce business

Payment gateways reduce costs

eCommerce is an easy field to enter—almost anyone can open an online store with limited capital and a few employees. And it shows—according to eMarketer, the industry is expected to reach $2.86 billion in worldwide sales by 2018.

However, the ease with which you can dive into eCommerce also means that the competition is fierce. According to LemonStand, there are 12 million eCommerce stores—but only 650,000 sell over $1,000 per year (about 5.4%!)

Hundreds of online stores sell the exact same products and can only differentiate themselves from competitors by offering slightly cheaper prices. And since many eCommerce stores operate on a shoestring budget, this pricing arms race means that profit margins can become razor-thin.

In this climate of pricing competition, every penny counts. So why spend unnecessary money on your payment gateway? Avoid fees and charges and do your research to ensure you fully understand the pricing model you’re signing up for. If possible, find a payment gateway that offers flat-rate pricing options. And to truly get the most out of your payment gateway, search for gateways that can lower your processing costs and save you money every month.

Payment gateways secure customer data

In addition to concerns about costs, many eCommerce retailers struggle with data security. Customers are extremely wary about disclosing their data online—in the wake of many high-profile data breaches at major companies like Home Depot, Yahoo!, and British Airways, customers are increasingly paranoid about sharing their credit card information online.

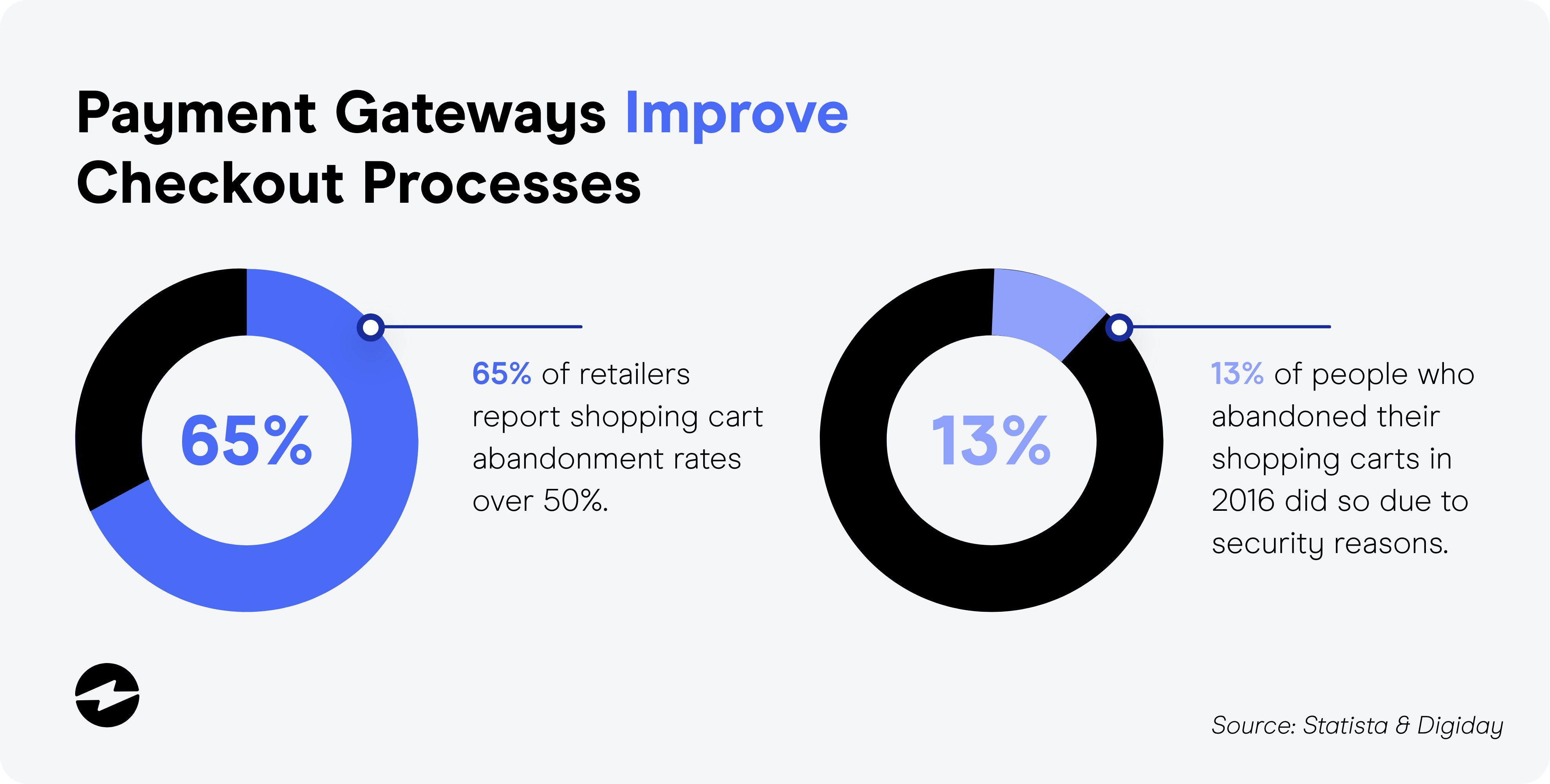

And this paranoia can affect revenue—a study by eMarketer found that 13% of people who abandoned their shopping carts in 2016 did so due to security concerns. Customers won’t purchase from a site that they feel is unsafe.

So how can you reassure your customers and protect them from data breaches? Find a payment gateway that’s PCI compliant and uses the latest data security techniques like tokenization and encryption to guard against attacks. When your payment gateway is secure, it benefits both you and your customers. Your customers will feel safer and will be more likely to return to your online store, while you’ll be protected in the event of an attack.

What happens if your eCommerce store isn’t PCI compliant? It can have drastically negative effects for both you and your customers. If an attack occurs, you may be responsible for paying damages that add up to thousands or even millions of dollars. You’ll undoubtedly lose the trust and respect of your customers, who will be forced to deal with the consequences of stolen records.

Payment gateways preserve the checkout process

One of the most frustrating challenges in the eCommerce industry is cart abandonment, and for good reason—according to Digiday, 65% of retailers report shopping cart abandonment rates over 50%. And one of the biggest factors contributing to cart abandonment is a difficult or confusing checkout process.

In the face of such alarming statistics, many online retailers are reluctant to adopt payment gateways because they’re afraid the gateway will negatively alter the checkout experience by adding steps to the process. However, the best payment gateways for eCommerce will integrate seamlessly with your existing checkout process, ensuring that returning customers aren’t blindsided by additional steps or forms.

Two key features to look for in payment gateways

There are two key features you should keep in mind when searching for a payment gateway.

Support

As an eCommerce retailer, you can’t afford to spend hours on hold while you wait for support to solve your problem. You need answers, fast. So look for a payment gateway that offers in-house, 24/7 support.

Some credit card processors offer both merchant accounts and payment gateways—if possible, apply with these processors so that you have a single point of contact when you encounter problems with your eCommerce credit card processing.

Also, be aware of chargeback services offered by payment gateways. Chargebacks are a huge problem for eCommerce retailers, as customers are likely to forget or regret their purchases. Some payment gateways provide chargeback services or teams to notify you when chargebacks occur, helping you to resolve the situation quickly.

Setup

If the installation for your payment gateway requires a lengthy process, you can lose valuable time when customers could be purchasing from your site. Be sure to read the fine print about the setup process and look for payment gateways that can be quickly and easily integrated with your existing platform.

Additionally, the best payment gateways will not change or alter the checkout process on your site. This means that returning customers will not be confronted with a new process and new customers will not be saddled with an additional step. In both cases, keeping your checkout process as lean as possible will help you lower cart abandonment rates and increase conversions.

The final take

Choosing a payment gateway is an important decision for the success of your eCommerce store. The best payment gateway for eCommerce will reduce costs, secure customer data, preserve the checkout process, and offer 24/7 support and painless setup.