Blog > How To Find a Merchant Service Provider For Your Firearms Business

How To Find a Merchant Service Provider For Your Firearms Business

The firearms industry over the years has experienced some controversy and is considered a high-risk industry, but it still brings in an average $17 billion in yearly revenue and should be taken seriously by payment processing companies.

What is considered a high-risk business?

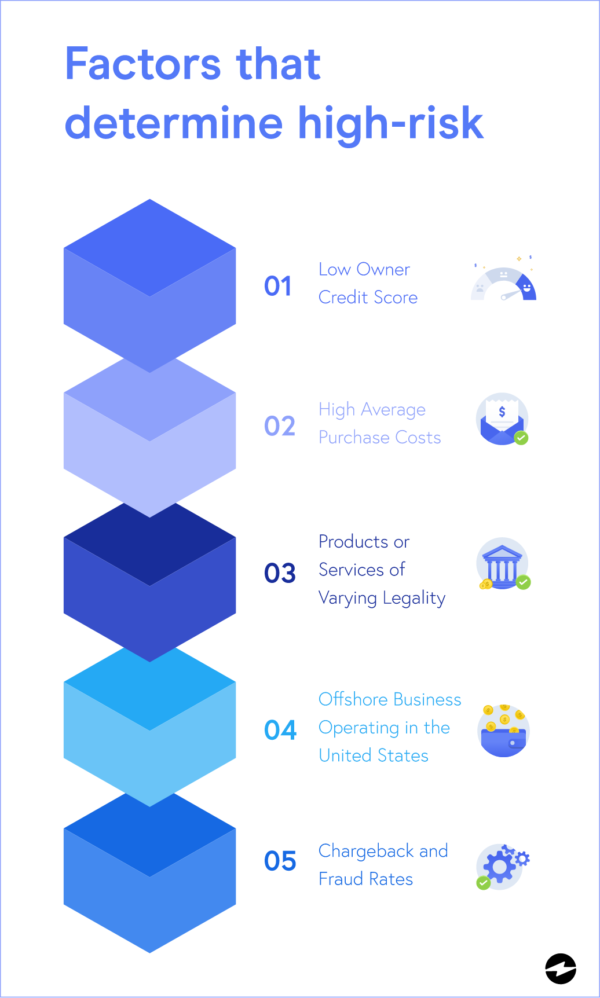

A high-risk business is one that merchant service providers and banks consider likely to fail and file for bankruptcy. Banks, merchant service providers, and insurance companies generally consider a few factors to determine if your company is a high-risk business. These factors include:

- Low Owner Credit Score: This factor relies on the business owner themself. If they have a low personal credit score, then merchant service providers are unlikely to allow these businesses to accept credit card payments.

- High Average Purchase Costs: If your company is constantly accepting high-cost purchases on credit, then merchant service providers and banks are hesitant to allow you to accept credit cards.

- Products or Services of Varying Legality: If your business is selling products or services with varying legality nationwide then merchant service providers are unlikely to work with you.

- Offshore Businesses Operating in the United States: If you’re an international company with a majority of your customer base in the USA, financial institutions will consider your country’s banking requirements before choosing to work with you.

- Chargeback and Fraud Rates: A high chargeback or fraud rate is the largest determinant of whether or not a merchant service provider will choose to work with your company. A merchant service provider will study your customers’ behaviors to see how significant the chargeback and fraud rates are.

Why is the firearms industry considered high-risk?

The guns and ammunition industry is considered highly risky because, mainly, the bad publicity and poor reputation firearms businesses have attracted over the years. While it is protected legally by the 2nd Amendment in the US Constitution, many banks and credit card processing companies still avoid working with the industry.

Another factor that makes the firearms industry a high-risk industry is because many guns and ammunition are sold online with high average purchase costs. This results in chargebacks when customers receive their firearms and immediately reverse the payments via their banks.

Many credit card processing companies refuse to work with high-risk firearms businesses because it could lead to brand damage since the issue of firearm sales is highly politicized. Fortunately, there are credit card processing companies that do value firearms businesses and choose to work with them.

What should you do if you are a high-risk firearms business owner?

While it may be degrading that many of the popular merchant service providers refuse to work with high-risk industries such as the firearms industry, there are credit card processing companies that value your business and are enthusiastic about working with you.

If you are a high-risk firearms business owner, don’t panic, then consider the key features below before selecting your merchant service provider.

Key features to look for when considering a merchant service provider for your high-risk firearms business…

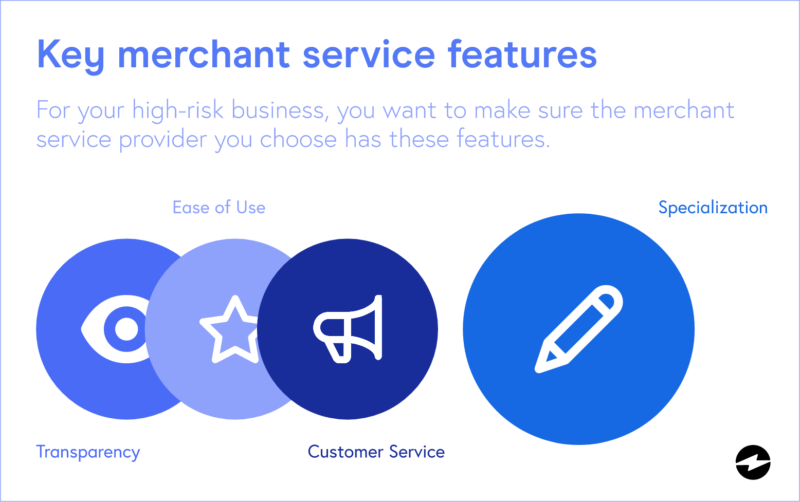

Looking for a merchant service provider as a high-risk firearms organization comes with many difficulties, so you’ll need to consider a few things before making a final selection. Here are the key features your high-risk firearms business should consider when selecting a merchant service provider:

- Transparency: Many merchant service providers that work with high-risk companies will have unethical pricing schemes, so make sure to understand the market and choose a credit card processing company with an ethical and upfront pricing scheme.

- Customer Service: Considering that there is a limited number of merchant service providers willing to work with a high-risk firearms business, it’s important to ensure that their customer support is exceptional.

- Ease of Use: Make sure the company you are working with has an intuitive solution for accepting credit cards and that they are an easy merchant service provider to work with.

- Specialization: Make sure the merchant service provider you select has specialized in working with high-risk firearms businesses and has a history with working with high-risk companies.

What merchant service provider is right for your high-risk firearms business?

When reviewing the features to look for in the previous section, consider EBizCharge for handling your firearm’s credit card processing. They fully integrate into many different eCommerce, accounting, and CRM software and offer multiple unique methods for your business to get paid.

EBizCharge has a high level of transparency with their pricing by having no hidden fees, no long contracts, and a low-price guarantee. Their customer service is in-house and unlimited with professionals available by online chat, email, or phone all trained to help support your business. EBizCharge is easy to set up and integrate into your company’s software and has no fees for the installation process. EBizCharge has a history in working with firearms businesses so your company should feel confident when choosing them as your merchant service provider.

Owning a firearms company comes with many challenges and accepting credit card payments from your valued customers is one of the top issues. Fortunately, there are merchant service providers, like EBizCharge, that value your high-risk organization and are motivated to see you succeed.

Summary

- What is considered a high-risk business?

- Why is the firearms industry considered high-risk?

- What should you do if you are a high-risk firearms business owner?

- Key features to look for when considering a merchant service provider for your high-risk firearms business…

- What merchant service provider is right for your high-risk firearms business?

EBizCharge is the leading merchant services solution for high-risk businesses.

EBizCharge is the leading merchant services solution for high-risk businesses.