Blog > How to Charge Customer Processing Fees: Square and EBizCharge Compared

How to Charge Customer Processing Fees: Square and EBizCharge Compared

If you’re a business owner thinking about passing credit card processing fees onto your customers, you’re not alone. With the steady rise in interchange rates and card fees, more and more merchants are asking the same question: Should I be covering these costs, or is it time to share them with my customers? It’s not an easy decision, but it’s an increasingly common one, especially for businesses that operate on thin margins or process a lot of card transactions.

Two names tend to pop up in this conversation: Square and EBizCharge. Both offer ways to collect payments, but they approach customer fees quite differently. This article walks through what those differences are, how each system handles surcharges and service fees, and what you need to know if you’re considering a switch, or just trying to make what you’ve got work better.

Understanding Customer Processing Fees

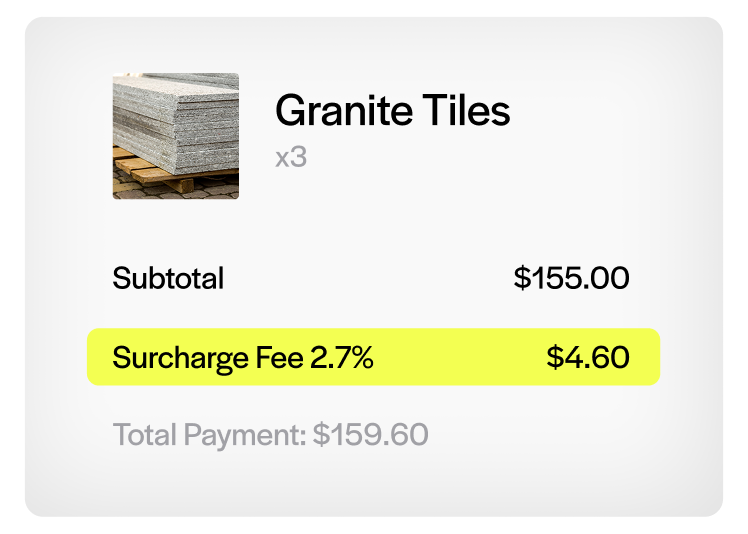

When we talk about customer processing fees, we’re talking about the charge’s businesses pay to their payment processor whenever a customer pays with a credit card. These fees typically include interchange fees, assessment fees, and processor markups. While they may seem small per transaction, they add up quickly, especially for businesses with high sales volumes or slim margins.

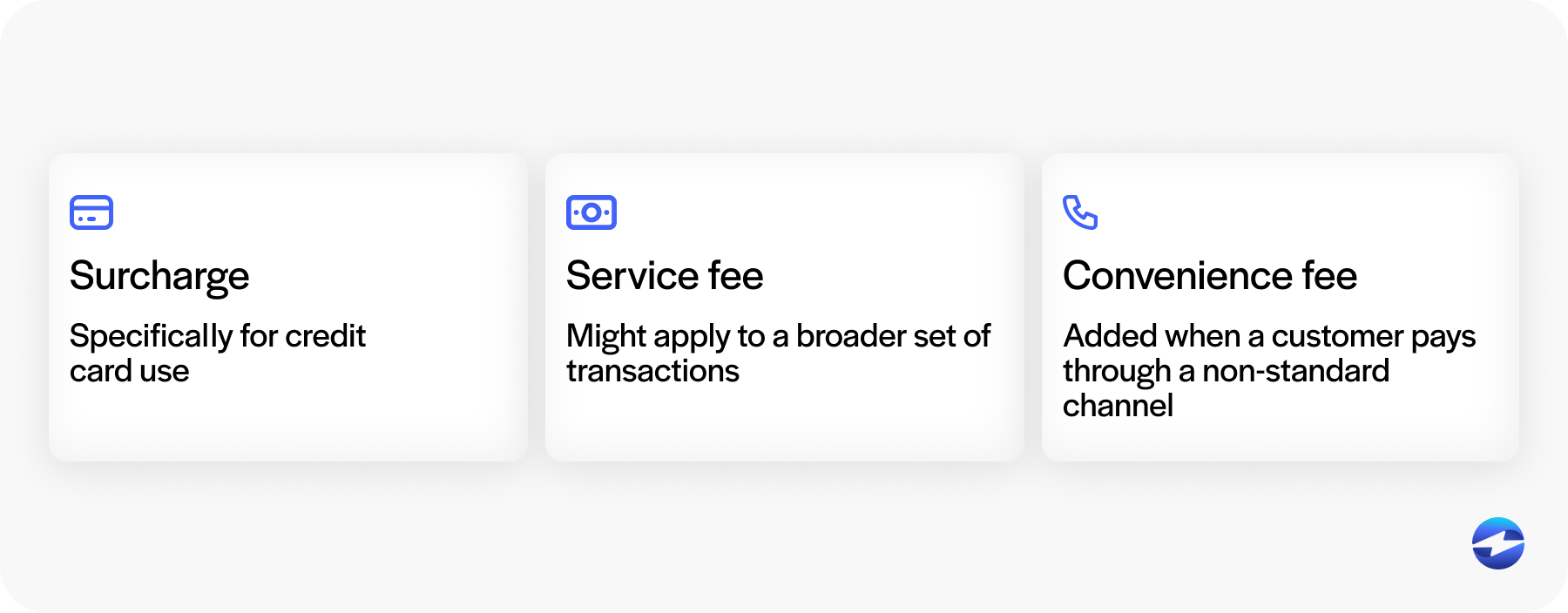

To offset these costs, many businesses choose to pass them along to their customers in the form of a surcharge, service fee, or convenience fee.

- A surcharge is specifically for credit card use.

- A service fee might apply to a broader set of transactions.

- A convenience fee is added when a customer pays through a non-standard channel, like online instead of in person.

Instead of absorbing the fees themselves, the business adds a clearly stated charge to the customer’s bill when they pay with a credit card. It’s a way to preserve margins without raising prices across the board. It’s legal in most U.S. states (though not all), and there are specific rules governing its disclosure and calculation.

While the term ‘customer processing fee’ may be used informally to describe this added charge, the actual method used and how it’s labeled matter both legally and practically.

These distinctions matter, especially if you’re trying to stay compliant. Visa and Mastercard have their own rules, and so do various states. If you get it wrong, you could end up refunding charges or even facing penalties. That’s why businesses looking to pass on processing costs need a system that’s not only flexible but also helps keep them on the right side of the law.

How Square Handles Customer Fees

Square is a popular tool for small businesses, especially retailers and food service operations. If you’re asking, “How do I charge a customer processing fee on Square?” you might not get a clear answer right away. That’s because automatic surcharging is not widely available on Square’s U.S. platform at this time. While a surcharging feature has been introduced in beta in some regions, like Australia, it’s not yet a standard part of Square’s offering for most users. For now, merchants looking to add processing fees typically have to rely on manual workarounds.

How do I charge customer processing fees on Square?

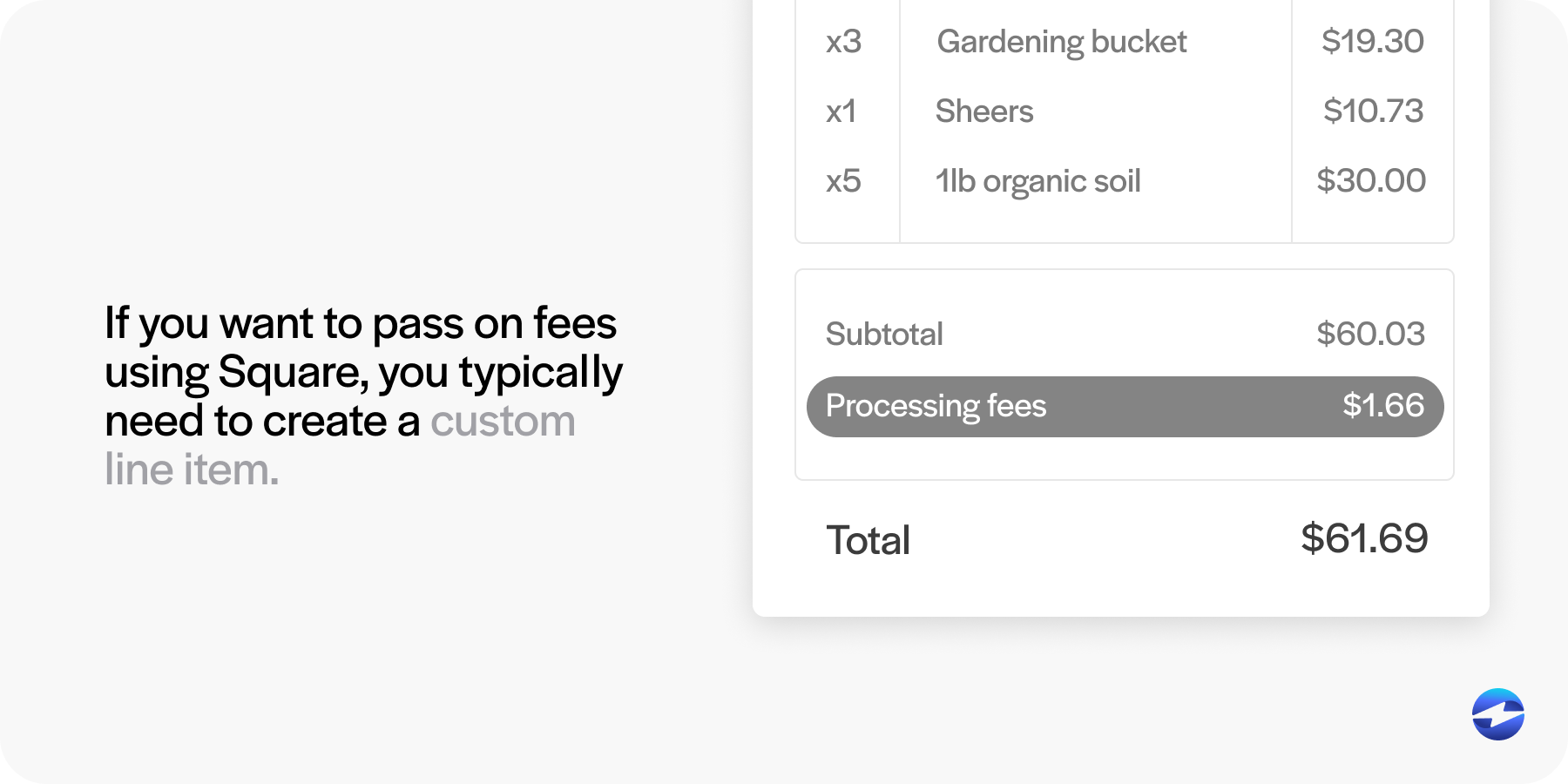

Instead, if you want to pass on fees using Square, you have to use a workaround. This typically involves creating a custom line item, such as “Service Fee” or “Processing Charge,” and manually adding it to each transaction. It’s clunky, time-consuming, and, depending on your staff, prone to being skipped or entered incorrectly. It also doesn’t ensure you’re staying compliant with card brand rules or state laws.

Some Square users also try increasing prices to account for card fees. That can work, but it affects all customers’ cash, check, or credit card, and it might not sit well with your regulars. Other businesses attempt to offset costs using Square’s tipping feature or pricing tweaks.

Searches like “how to add service charge on Square” or “Square service fee” often lead to forum posts and workarounds, not official guidance. While Square does provide a transparent Square processing fee model (usually 2.6% + 10¢ for in-person swipes), it puts the burden on you to figure out how to recover that cost.

Bottom line? Square isn’t really designed with surcharging in mind. While the platform allows you to create manual service charges, these fees must be manually added to each transaction. They aren’t tied specifically to credit card usage and won’t adjust dynamically based on card type—meaning the burden is on staff to remember, apply, and explain the fee every time. That opens the door for human error, inconsistency, and potentially frustrated customers. If you want to recover fees easily and consistently, you’ll need to do a bit of legwork—or look elsewhere.

EBizCharge’s Approach to Customer Fees

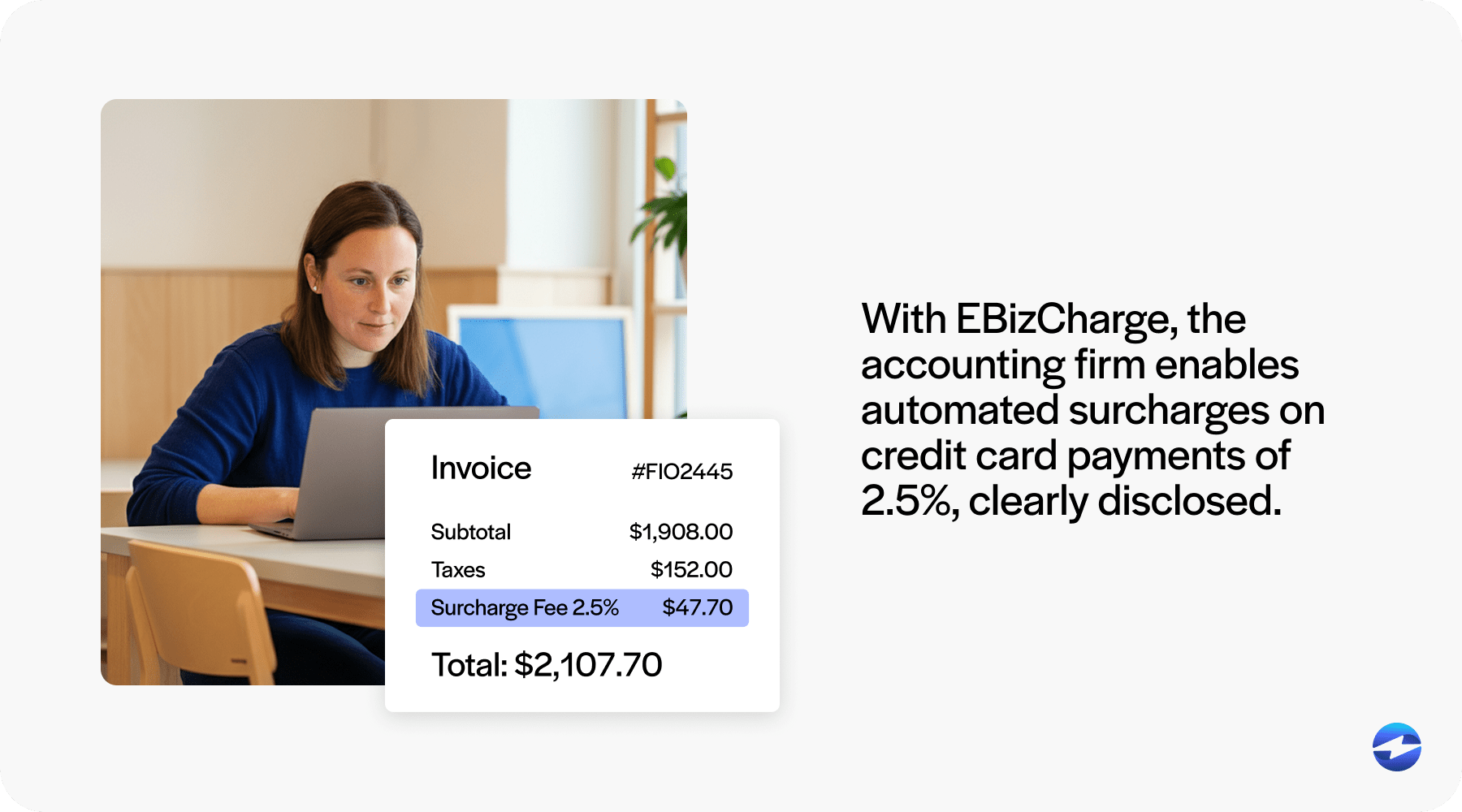

EBizCharge was built with surcharging in mind. It lets you automatically add a surcharge to eligible credit card transactions either as a flat fee or as a percentage. That means no manual entry, no guesswork, and no awkward explanations at the register. When your customer pays, the system calculates and displays the fee transparently.

The platform also includes built-in tools to help ensure you’re following surcharging rules. It won’t apply a surcharge to debit cards, for example (which isn’t allowed under current regulations). It also offers templated notifications and receipt language to help you stay compliant.

Another key benefit is integration. EBizCharge works inside many popular accounting systems like QuickBooks, NetSuite, Sage, and others so you can apply surcharges directly to invoices or payment links. It’s seamless, and it doesn’t require your team to change their workflow.

If you’re managing multiple sales channels, in-store, online, and invoicing, EBizCharge gives you a unified way to apply and manage surcharges across the board. If you ever need to adjust your policy, it’s just a few clicks not a process overhaul.

Square vs. EBizCharge: A Comparison

Here’s a quick look at how Square and EBizCharge compare:

| Feature | Square | EBizCharge |

|---|---|---|

| Supports automated surcharging | ❌ | ✅ |

| Integrated compliance tools | ❌ | ✅ |

| Customizable service charge options | ✅ (limited) | ✅ (full control) |

| ERP/accounting integration | ❌ | ✅ |

| Customer communication tools | ✅ | ✅ |

This side-by-side breakdown shows the core differences, but sometimes the real impact of these features becomes clearer through practical examples.

Real-World Scenarios and Use Cases

While features and charts are helpful, what really matters is how these tools hold up when a business is trying to serve customers, manage cash flow, and make decisions in real time. Here are 2 common examples of what surcharging could look like with each solution:

Example 1: A local café owner uses Square for point-of-sale. Their margins are tight, and card fees are eating into profits. They’d like to pass those fees on, but Square doesn’t offer a clean way to do it. So, the staff manually adds a “Service Fee” line to each order. Sometimes it gets missed. Customers are confused. It’s also challenging to ensure that it’s being done consistently and correctly. Eventually, the owner gives up on surcharging.

Example 2: A regional accounting firm switches to EBizCharge. They send out dozens of invoices every month, many of which are paid by credit card. With EBizCharge, they enable automated surcharges on credit card payments of 2.5%, clearly disclosed. Their ERP handles the math and the messaging. Clients still have the option to pay via ACH or debit at no charge. Over the course of a year, the firm recovers tens of thousands of dollars in fees without friction.

These examples highlight just how important the right tools and systems are. When it comes to something as sensitive and essential as recovering processing costs, your system either works for you, or it adds to your daily stress. For most businesses, especially those juggling multiple channels or invoices, the difference between the two can show up in every transaction.

Choosing the Right Tool to Pass on Fees

If you’re running a business and thinking about surcharging, it’s worth asking a few simple questions:

- Are you spending more time managing workarounds than running your business?

- Are you unsure whether your fees are compliant with state laws and card network rules?

- Is your current system making it tough to communicate clearly and consistently with customers?

If any of these sound familiar, it might be time to look into a system that’s designed specifically for this kind of challenge.

Square has its strengths especially for newer businesses or those with low transaction volume, but when it comes to recovering credit card processing fees, its options are limited.

EBizCharge offers a more complete solution. It handles the heavy lifting automating fees, keeping you compliant, and integrating with the tools you already use. More importantly, it gives you back control over your margins. If you’re ready to stop eating processing fees or just tired of patchwork solutions, it’s worth seeing what EBizCharge can do for your business.