Blog > How to Add a Credit Card Surcharge: A Step-by-Step Guide

How to Add a Credit Card Surcharge: A Step-by-Step Guide

If you’re a business owner looking for ways to cut down on credit card processing costs, adding a surcharge might be one option worth considering. A credit card surcharge is a small fee passed along to the customer when they choose to pay with a credit card. The goal is simple: to help offset the credit card processing fees you’re already paying to accept those cards.

But as straightforward as that sounds, adding a surcharge for credit card payments isn’t something you can do on a whim. There are card brand rules to follow, legal requirements to meet, and customers to consider. This guide walks you through each step of the process so you can add a credit card surcharge fee the right way—clearly, legally, and with confidence.

Step 1: Understand the Basics

Before you begin, it’s important to know exactly what a credit card surcharge is—and what it’s not. A surcharge is an added fee for customers who choose to pay with a credit card. They differ from blanket fees and don’t apply to cash, checks, or debit cards. Surcharges are commonly mistaken for convenience fees, but it’s important to understand the difference.

A surcharge is added only when a customer uses a credit card. A convenience fee, on the other hand, is charged for offering an alternative payment method—like paying online instead of in person. Mixing these two up can lead to customer confusion or even compliance issues, so it’s good to get the terminology right from the start.

It’s also important to note that not every state allows surcharging. States like Connecticut and Massachusetts prohibit it outright, while others have more nuanced restrictions. Make sure you check your state’s rules before proceeding.

Step 2: Notify Card Networks and Payment Processor

The next step is notifying the card networks and your payment processor. This is more than a formality—it’s a requirement.

Visa, Mastercard, American Express, and Discover all ask for at least 30 days notice before you start surcharging. Each has its own online form or portal for submitting this notification. You’ll also want to loop in your payment processor during this step. Not all systems are set up to handle surcharges, so it’s smart to confirm they support what you’re trying to do.

This part is often overlooked, but it’s crucial. If you skip the notice, you’re opening yourself up to penalties or disputes that could have been easily avoided.

Step 3: Set Your Surcharge Fee

Now that you’ve got the green light, it’s time to decide how much you’ll charge.

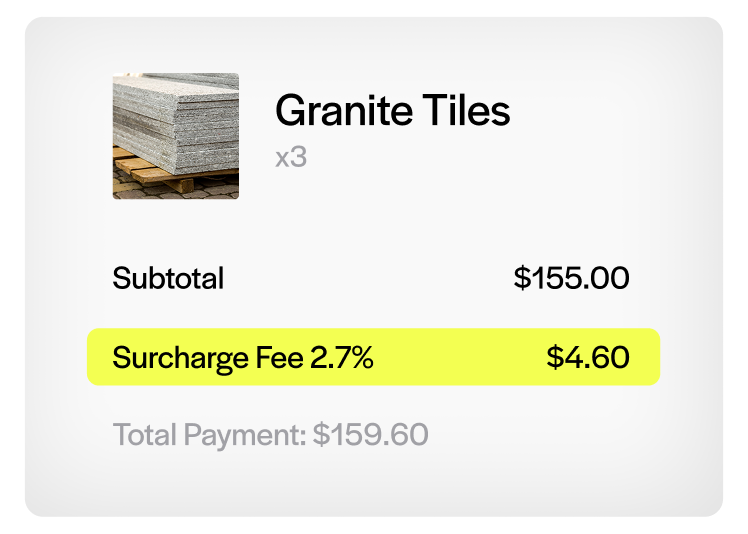

Most card networks cap the credit card surcharge fee at 3%, or the actual cost of payment processing—whichever is lower. That means you can’t profit from a surcharge. It’s meant to recoup costs, not generate revenue. This is also where things get a bit tricky with American Express. They have what’s called an “equal treatment” policy. If you apply a surcharge to Amex, you need to apply it to Visa, Mastercard, and Discover as well—and the terms have to be the same across the board. So if you’re surcharging one, you’re surcharging all.

If you’re unsure how much a credit card surcharge is allowed for your business or how to apply it correctly, talk to your processor or legal advisor.

Step 4: Update Your Signage and Policies

Next up: let your customers know.

You’re required to post clear signage at the entrance of your business and at the point of sale. If you’re an online business, that means making the surcharge visible before the customer enters payment info—usually during checkout.

These notices must be easy to understand. You don’t need to use fancy language. Just keep it simple: “A 3% surcharge is applied to credit card purchases to help cover processing fees. This fee does not apply to debit cards.”

You’ll also need to make sure the credit card surcharge fee appears as a separate line item on all receipts—both printed and digital. This helps avoid disputes and keeps everything transparent.

Step 5: Configure Your Payment System

Once your policies are in place, it’s time to make sure your tech is ready. Your point-of-sale (POS) system, invoicing software, or online checkout platform needs to be set up to apply the surcharge correctly. That means:

- Only charging the fee on credit cards.

- Excluding debit and prepaid cards (which you’re not allowed to surcharge).

- How to calculate credit card surcharge accurately within your system.

- Display it as a separate line item on the customer’s receipt.

Many modern systems can handle this, but not all of them do. So, test thoroughly. If you’re unsure, ask your provider for help.

Step 6: Train Staff and Test Your Setup

This is the part that’s easy to forget, but it matters.

Make sure your employees know how the surcharge works and can explain it to customers. The last thing you want is a customer asking a question and getting a confused or inconsistent answer.

It also helps to run a few test transactions on different card types to ensure everything works as expected. Check that debit cards aren’t being surcharged and that receipts reflect the fee properly.

Step 7: Monitor, Maintain, and Stay Compliant

Once your system is up and running, your job isn’t done.

Regulations can change. Card network rules can be updated. Even your own credit card processing fees might shift over time. Make it a habit to review your surcharge policy at least once a year.

Also, keep an eye on your signage. Make sure it doesn’t get covered up, fall off, or become outdated. If your surcharge changes, update the notices and your POS system accordingly.

Compliance isn’t something you set and forget. It’s a moving target—so check in regularly.

Common Mistakes to Avoid

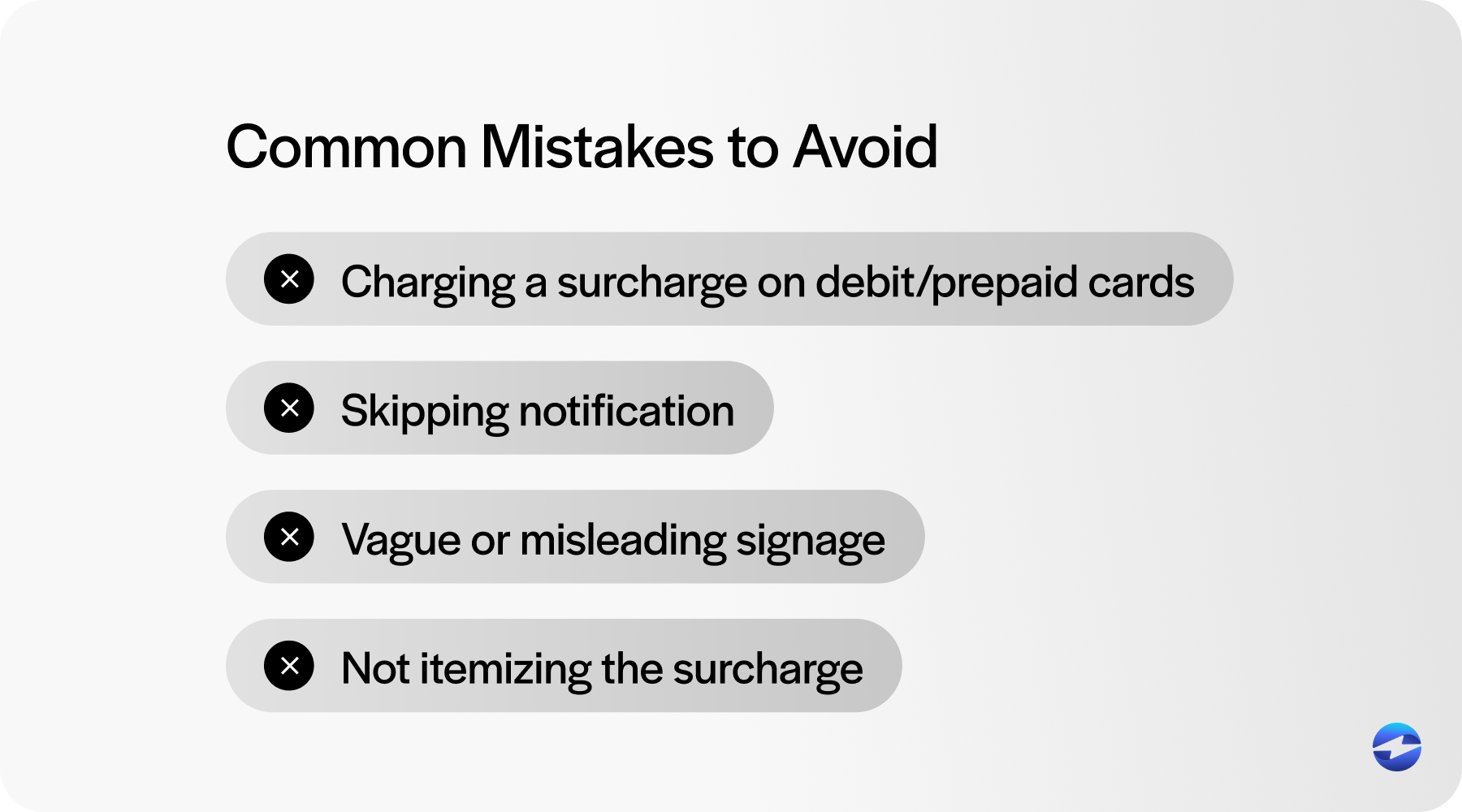

A few common mistakes trip up a lot of well-meaning businesses:

- Charging a surcharge on debit or prepaid cards. Even if the transaction is “run as credit,” it’s still a debit card, and surcharging it violates the rules.

- Skipping notification. If you don’t tell the card networks and your payment processor in advance, you’re already out of compliance.

- Vague or misleading signage. Be specific and clear in your language.

- Not itemizing the surcharge. This needs to be its own line on the receipt—always.

Avoiding these pitfalls will save you a lot of trouble down the line.

How EBizCharge Can Help

Setting up a surcharge isn’t impossible, but there’s a lot to keep track of. EBizCharge offers tools that make it easier.

You can automate how to calculate credit card surcharge amounts, apply them only where allowed, and generate compliant receipts and signage. The system is built to help you stay within the bounds of the law and card network rules—and it integrates with many common POS and accounting platforms. It also gets updated automatically when policies change, so you don’t have to worry about missing something important.

If you’re not sure where to start, or you’re looking to simplify things, EBizCharge can be a solid partner for managing payment processing and adding surcharges for credit card payments effectively.

- Step 1: Understand the Basics

- Step 2: Notify Card Networks and Payment Processor

- Step 3: Set Your Surcharge Fee

- Step 4: Update Your Signage and Policies

- Step 5: Configure Your Payment System

- Step 6: Train Staff and Test Your Setup

- Step 7: Monitor, Maintain, and Stay Compliant

- Common Mistakes to Avoid

- How EBizCharge Can Help