Blog > How Much Does A Small Business Pay in Taxes?

How Much Does A Small Business Pay in Taxes?

Taxes can seem daunting for small businesses but staying up to date on the latest rates, dates, and procedures makes paying them a breeze.

Luckily, small businesses can better prepare and add to their overall success by being aware of their taxes and the rates they’re subject to.

How much do small businesses pay in taxes?

Since tax rates vary based on the business entity, your company will be subject to its own set of rates depending on which type of small business it is.

For example, if your small business is listed as a corporation, it’s obligated to pay a flat tax rate of 21%. Other business structures such as proprietorships and partnerships are also taxed at the owner’s personal tax rate.

Some business entities have more flexibility when it comes to taxes. Limited Liability Companies (LLCs) fall under this category because they can be taxed as either corporations or pass-throughs.

Let’s look at how each of these individual business entities is taxed.

Small business tax rates

When starting a business, one of the first steps is to determine what business structure it will take on. This will affect how the business entity is taxed and how you file the entity’s taxes.

This article breaks down how each business entity operates and how that entity is taxed, so you can determine which rates your company is subject to.

C-corporation tax rates

A C-corp is a corporation where the owners or shareholders are taxed separately from the business entity — a small percentage of U.S. businesses fall under this category. In C-corps, the shareholders are essentially the owners, and the shares they receive are evidence of ownership.

C-corp tax rates have changed a lot over the past 10 years.

The Tax Cuts and Jobs Act (TCJA) set the federal income tax rate as a flat fee of 21% in 2018 and has held firm since its implementation. Prior to the TCJA, the tax rates for C-corps would fluctuate from 15% to 35% using a tiered structure.

However, high inflation has changed this percentage in the 2023 tax year. As a result of the Inflation Reduction Act of 2022, the Corporate Alternative Minimum Tax (AMT) has been set at a tax minimum of 15% for corporations.

Corporate Dividends tax rates

Dividends are specified amounts of money taken from a business’s profits that are routinely paid to the business’s shareholders. Unfortunately, shareholders are required to pay taxes on both dividends and their own tax returns — double taxation.

There are two different types of dividends: ordinary and qualified. The difference between the two is in the way they’re taxed.

Ordinary dividends are taxed based on the shareholder’s other income rate. Whereas, qualified dividends are taxed at lower capital gains tax which is 0% to 20%. Double taxation can make corporate dividends a hassle but certain business entities may be able to get around it.

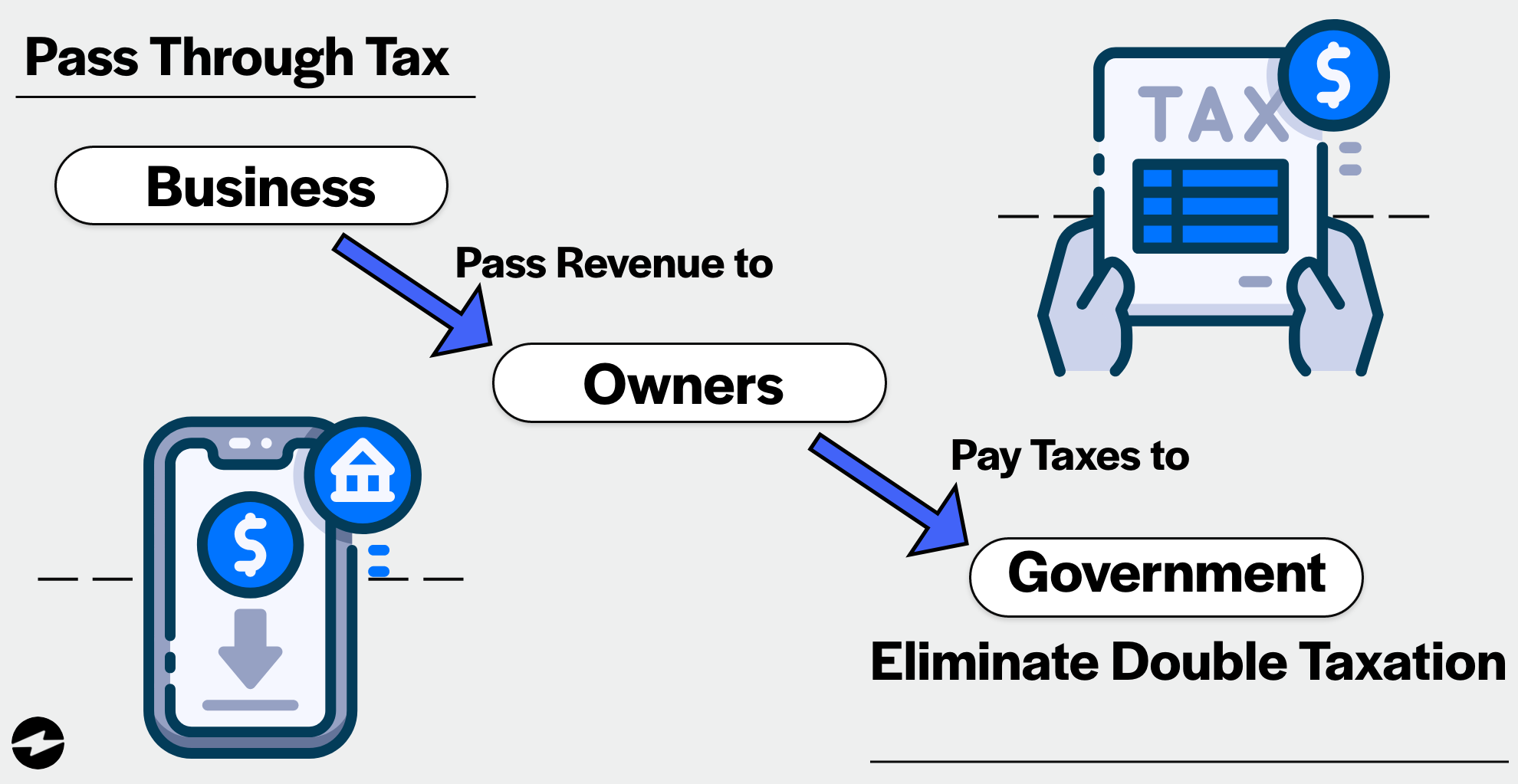

Pass-through entity tax rates

Pass-throughs are legal business entities that “pass” their income to their owners, shareholders, or investors. These individuals pay taxes on the revenue, allowing the business to avoid double taxation.

Roughly 95% of businesses are pass-through entities, including sole proprietorships, partnerships, S-corps, and LLCs.

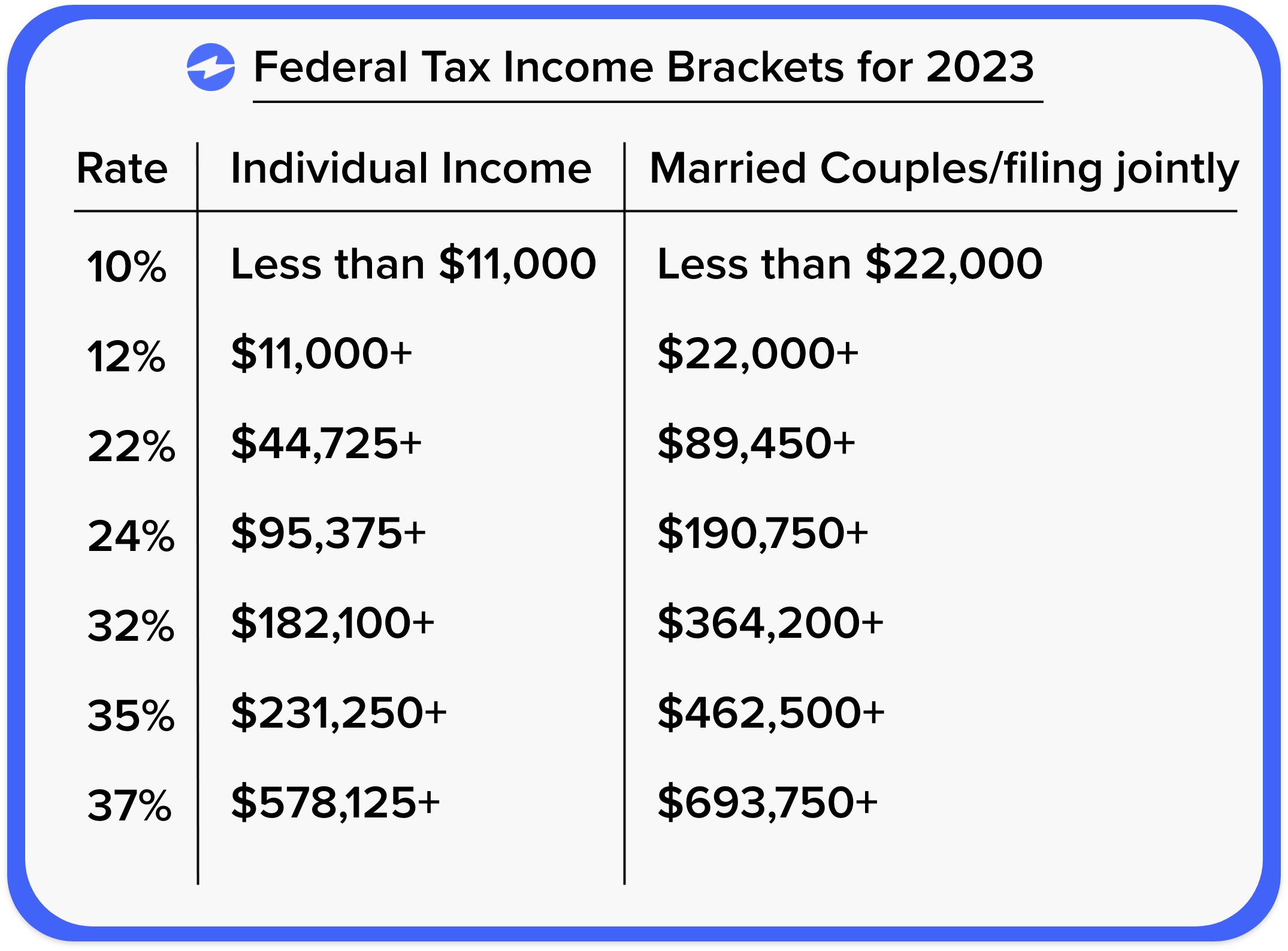

Pass-throughs are taxed at the owner’s personal tax rate, usually between 10% and 37%. Here’s a quick break-down of the federal income tax brackets for 2023:

Limited Liability Companies (LLC) tax rates

LLCs are a good business structure for owners because owners are not responsible for the business’s debts or liabilities, hence the name. They’re a bit different from other business types because they can be taxed in multiple ways, meaning LLC taxation rates will vary.

Depending on how many individuals are listed as business owners, the IRS will elect to tax an LLC as a proprietorship or a partnership. LLCs can also elect to be taxed as S-corps or C-corps. Those taxed as C-corps will have their profits taxed at the corporate level rather than at the owner’s individual rate.

For owners who keep a considerable amount of their profits within the business rather than using them to be paid out as dividends, electing to be taxed as a C-corp is a favorable option because retained earnings aren’t subject to double taxation like dividends are.

Electing to be taxed as a C-corp also grants LLC members the option of tax-advantaged fringe benefits and stock options. Fringe benefits are supplementary benefits to an employee’s salary, such as a company car or health insurance, and are highly sought after when job hunting.

Other tax types for small businesses

Now that you know the various individual business entities and how they’re taxed, you can learn more about the other taxes to expect when starting a business.

Payroll taxes

Payroll taxes are taxes that are withheld from an employee’s wages and are paid to the government by the employer.

Payroll taxes cover a wide range of smaller individual taxes, including federal, state, and local income taxes. These taxes are used for various expenditures including social security, Medicare, local infrastructure, government spending, and more.

If your business includes employees on its payroll, the FICA tax rate would be 15.3% of the employee’s wages — 12.4% for social security and 2.9% for Medicare. The employer pays half of those taxes, while the other half is paid out of the employee’s pocket.

Some pass-through companies don’t have employees. If your business falls under this category, you’ll pay self-employment taxes at 15.3%.

Excise taxes

Excise taxes are imposed on niche businesses that produce, sell, or consume specific commodities.

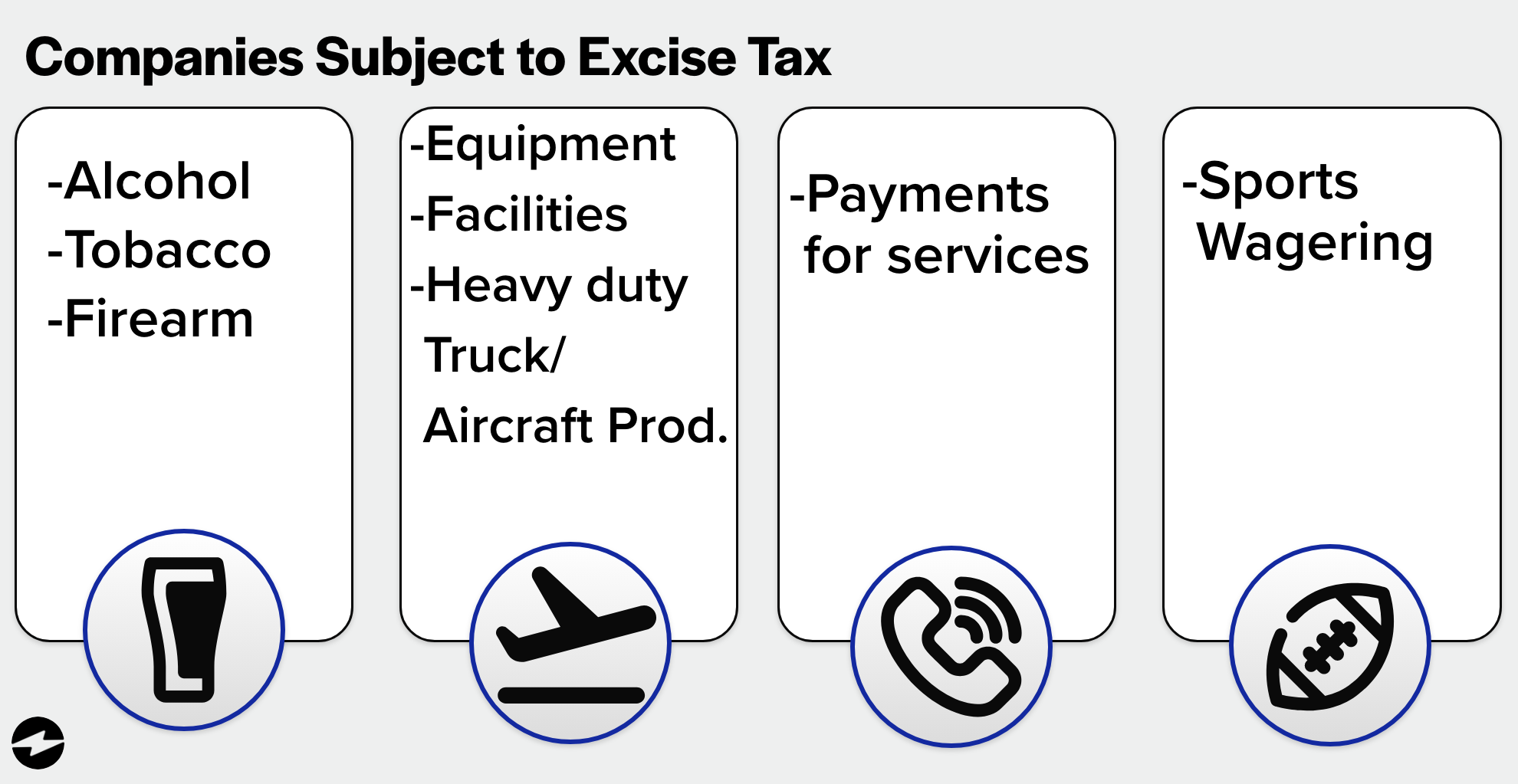

Businesses that are subject to excise taxes are:

- Companies that sell or manufacture alcohol, tobacco, or firearms.

- Companies that utilize equipment, facilities, or products such as heavy-duty trucks or aircraft.

- Companies that receive payments for services such as indoor tanning or telecommunication services.

- Companies that operate sports wagering.

Excise taxes can be paid by percentage or a flat cost per unit, so the amount of the tax varies based on the price of the product or service.

State and local taxes

State and local taxes are imposed by the state the business operates out of and, therefore, vary depending on the state.

These rates range from 2.5% in North Carolina to as high as 13.3% in California, so checking the tax rate for your business’s state is essential.

Some states, like Florida and Alaska, don’t impose a state income tax. States that don’t charge this tax may make up the lost revenue with other taxes or service fees.

Property taxes

Property taxes are taxes imposed on an individual’s or legal entity’s property, including land, buildings, vehicles, or business inventories.

Property tax rates are calculated by local governments and are considered “ad-valorem,” meaning the amount is estimated in proportion to the value of the specified property.

Paying small business taxes

Different business entities will use various forms to file their taxes. You should always check with your accountant or tax attorney to ensure you’re filing them correctly.

Listed below are business entities and their necessary forms to file their taxes:

- Small businesses categorized as C-corps, including LLCs taxed as C-corps

- S-corps and LLCs taxed as S-corps

- Form 1120-S

- Schedule K-1s are issued to each shareholder to report any profits or losses

- Businesses taxed as partnerships or LLCs with only one member

- Sole proprietors and LLCs with a single member

- Schedule C (These are filed with the owner’s individual 1040)

When should small businesses file their taxes?

Knowing when to file your taxes is a crucial part of the process, especially when dates vary depending on the entity type. Filing your taxes past their due dates can result in penalties, although it’s sometimes possible to request an extension.

Here are some due dates to keep in mind…

Corporations:

- 15th day of the 4th month after the end of the corporation’s tax year.

Partnerships:

- 15th day of the 3rd month after the end of the partnership’s tax year.

If a due date falls on a legal holiday or a weekend, it will move to the following business day.

Keeping track of your taxes

With the proper guidance and preparedness, small businesses can quickly pay their taxes with little to no stress.

In addition to this helpful article, businesses should keep track of new tax guidelines or legislation and take advantage of the IRS’s extensive resources on rates, dates, and procedures for each state and business entity. Another tip to take advantage of is that businesses can actually write off credit card processing fees. By staying up to date on tax information, you can make sure to file correctly and on time.