Blog > How long do pending transactions take to clear?

How long do pending transactions take to clear?

Have you ever checked your bank or credit card statement to find mysterious pending transactions that leave you wondering where they came from?

The world of pending transactions can be confusing and significantly affect your financial planning. Understanding this aspect of personal finance is essential for effective budgeting and managing your funds.

What is a pending transaction?

A pending transaction is a card transaction that’s been authorized but has yet to be fully processed by your bank or credit card company.

Pending transactions occur when a merchant processes a payment, but the funds haven’t officially moved from your account yet. These transactions can result from various reasons, including holds placed by banks or merchants. Navigating through the timeline and potential delays of these transactions will help you manage your expectations and spending habits.

While pending transactions temporarily reduce your available balance, they don’t affect your current balance until they clear. During this pending period, the transaction details are being processed and are awaiting final confirmation by the credit card issuer or payment processor.

How long do pending transactions take to refund?

The time it takes for pending transactions to clear may vary depending on the type of transaction and the policies of the merchant or credit card company. Typically, transactions clear within 1-5 business days.

Credit card purchases and direct deposits often clear within this timeframe, although some may take longer due to delays in processing times.

Factors such as the transaction type, merchant’s banking process, and weekends or holidays can influence processing times.

How do you cancel pending transactions?

Pending transactions can be canceled by contacting the merchant directly, especially if the payment hasn’t been fully processed. However, some factors may affect this cancellation.

For example, specific purchase categories (restaurants, gas stations, travel agents, etc.) often place holds that may last several days or even up to 30 days, where waiting may be more optimal than canceling.

In cases where a pending charge is due to a delayed shipment, contacting the seller to cancel the transaction until the shipment is complete can help.

Pending payments during bank holidays or outside regular banking hours (between 9 a.m. and 5 p.m. on Monday through Friday) often clear on the next business day, making it difficult to initiate a cancellation.

While it’s possible to cancel pending transactions, it’s important to look at the common reasons pending charges may occur.

Common reasons for pending charges

Pending charges on financial accounts occur for various reasons, typically relating to processing times and transaction types.

One common reason is when credit card transactions are authorized but still need to be finalized by the issuer. This period allows the merchant and payment network to confirm details and ensure sufficient funds are available.

Another reason behind pending charges is the nature of certain card transactions, such as those at gas stations or for hotel room bookings. These businesses often request a preauthorization hold, which temporarily affects your current balance but isn’t posted immediately. This hold will cover potential overdraft fees or additional charges until the final amount is confirmed.

Pending charges may also result from direct or check deposits that require time for the Automated Clearing House (ACH) or the payment processor to verify and complete the transaction. Additionally, cash deposits or debit card transactions might show as pending until all parties involved in the transaction history process the payment.

For more insights into pending periods and how they impact overall credit scores and limits, businesses can access mobile banking and banking apps that provide transaction details and updates.

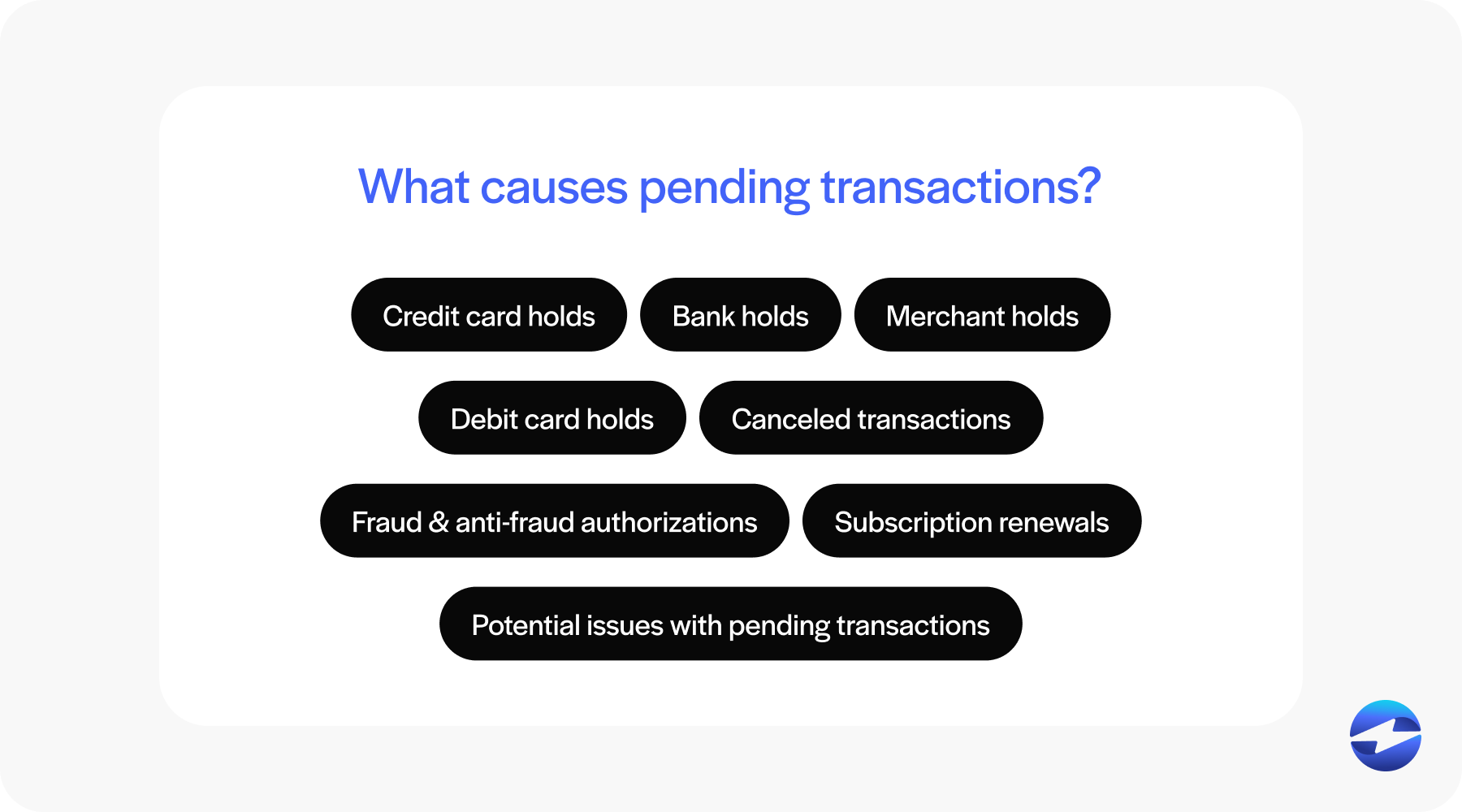

What causes pending transactions?

Pending transactions can result from numerous situations, from credit card or bank holds to fraud or subscription renewals.

The below sections will detail the various causes of pending transactions.

Credit card holds

Credit card holds occur when a transaction is authorized but not yet posted. These holds are common for purchases where the payment network needs to validate the transaction to ensure your credit card company holds the necessary amount.

The pending period varies, depending on the credit card issuer, and can last from a few hours to several business days until the transaction clears.

Bank holds

Bank holds occur when funds are temporarily inaccessible, typically after check deposits, and last until the bank clears the check from the payer’s account.

Bank hold times are influenced by the type of transaction and payment processor. These holds can last anywhere from one to five business days, affecting your current balance and available funds.

Merchant holds

Merchants may place temporary holds on your account to ensure you have sufficient funds for anticipated transactions. Gas stations and hotels commonly use this practice.

Merchant holds remain in effect until a business finalizes the transaction details, often clearing within two to three business days.

Debit card holds

Debit card holds apply to authorized debit card transactions that have yet to be posted to bank accounts.

Similar to credit cards, debit card holds affect your current balance and ensure you don’t overdraft. These holds generally last up to three business days, depending on the merchant’s processing times and your bank’s mobile banking policies.

Canceled transactions

Canceled transactions may still appear as pending on your transaction history, causing confusion. This typically happens when an authorization is placed but later voided.

While funds may appear unavailable, they usually return to your available balance after the banking app updates, typically within a few business days.

Fraud and anti-fraud authorizations

Banks and credit card companies implement fraud and anti-fraud authorizations to prevent unauthorized transactions, which can place a hold on transactions to investigate suspicious activity.

Fraud and anti-fraud authorizations may temporarily impact your credit score and current balance until the issue is resolved, often within a few days.

Subscription renewals

Recurring payments for subscription renewals often result in pending transactions. This automated process ensures that your payment processor can securely manage withdrawals at scheduled intervals.

The pending period may last a few days, depending on the transaction type and the procedures of the parties involved.

Despite the type of pending transaction, some potential issues can result from pending transactions.

Potential issues with pending transactions

Pending transactions can cause several issues for consumers and businesses since they require a temporary hold of funds.

One primary concern is the delay in the availability of funds, as these transactions can take several business days to clear. This delay may impact the current balance visible in your banking app or mobile banking, leading to potential overdraft fees if funds aren’t available for other transactions.

Another issue arises from the uncertainty affecting credit card transactions. The amount deducted for services like gas station holds during the pending period may differ from the initial amount. This can temporarily affect your credit limit and impact your credit score if not managed carefully. Since pending transactions don’t reflect in your transaction history immediately, it can be difficult to track spending accurately.

Businesses using QuickBooks can reduce this uncertainty by connecting a QuickBooks payment gateway that posts completed transactions directly to their books. This gives finance teams a clearer picture of what has actually settled versus what is still pending.

Pending check deposits or direct deposits can also affect cash flow, leading to budgeting challenges for merchants.

Overall, understanding the transaction details and processing times associated with each type of transaction, whether credit or debit cards, is crucial to manage your finances effectively and avoid potential pitfalls.

6 tips to prevent pending transaction setbacks

Preventing issues with pending transactions begins with understanding the type of transaction you’re making.

Here are six tips to help you prevent pending transaction problems or discrepancies:

- Track credit, debit, and direct deposit transactions via your mobile banking app to stay informed about your current balance and avoid overdraft fees.

- Ensure sufficient funds are in your account before initiating transactions to prevent declines and minimize pending periods.

- Avoid making large purchases close to the end of a billing cycle, especially with credit card accounts, to protect your credit limit and score.

- Familiarize yourself with your credit card issuer or debit card policies regarding pending transactions, as processing times vary by payment network and financial institution.

- Regularly check your transaction history to identify and address any errors or discrepancies quickly.

- Contact your credit card company or bank for any issues or delays beyond the standard pending period.

Following these tips can minimize the hassle and potential problems of pending transactions. Businesses can also avoid issues with pending transactions by working with a reliable provider like EBizCharge to better manage these transactions.

For businesses running Sage Intacct, a Sage Intacct credit card integration can help by automatically syncing payment data into your ERP in real time. This makes it easier to reconcile pending and cleared transactions without manually cross-referencing bank statements.

Gain complete control of your payments with EBizCharge

EBizCharge is a comprehensive payment processing solution that transforms financial operations by giving merchants complete visibility into their transactions.

EBizCharge offers real-time tracking and detailed insights into every transaction detail, allowing businesses to monitor their financial activities closely.

With EBizCharge, merchants can view transaction types, current balances, and transaction histories using an intuitive interface. This solution integrates seamlessly with payment networks and processors to provide full transparency into available transaction funds, thus reducing the risk of overdraft fees.

Offering compatibility with numerous platforms, EBizCharge enables businesses to stay informed about pending periods and processing times. This transparency is crucial for managing credit card accounts and ensuring timely credit card transactions and check deposits.

Businesses can leverage the powerful tools that EBizCharge provides to generate more informed financial decisions, better financial health and credit, and more cash flow.

Frequently asked questions

Can pending transactions be declined?

Pending transactions can be declined if there are insufficient funds or the credit limit is exceeded at the point of final transaction processing.

Credit card issuers and banks may also decline pending charges if they suspect fraud on the account.

Have pending transactions already been deducted from my account?

Pending transactions aren’t fully deducted from your account but can temporarily affect your available balance. The amount remains a hold on your current balance until it’s finalized.

While they have yet to be officially processed, they can limit your spending ability and potentially impact your credit score if appropriately managed.

How long do pending transactions last?

Pending transactions generally last between 1 to 5 business days. The exact time depends on the transaction type and the payment processor’s efficiency.