HIPAA-Compliant Payments: Everything You Need to Know

HIPAA-Compliant Payments: Everything You Need to Know

EBizCharge is the #1 customer-rated HIPAA-compliant payment solution.

Upon your first visit to any medical facility, you’ll need to input sensitive payment information. From names and addresses to medical insurance and social security, this information must be handled with the utmost care to ensure privacy and security.

Since this data requires more protection, strict standards and regulations were created to safeguard it from outside parties.

What is HIPAA?

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) is a federal law that protects the privacy and security of individuals’ health information.

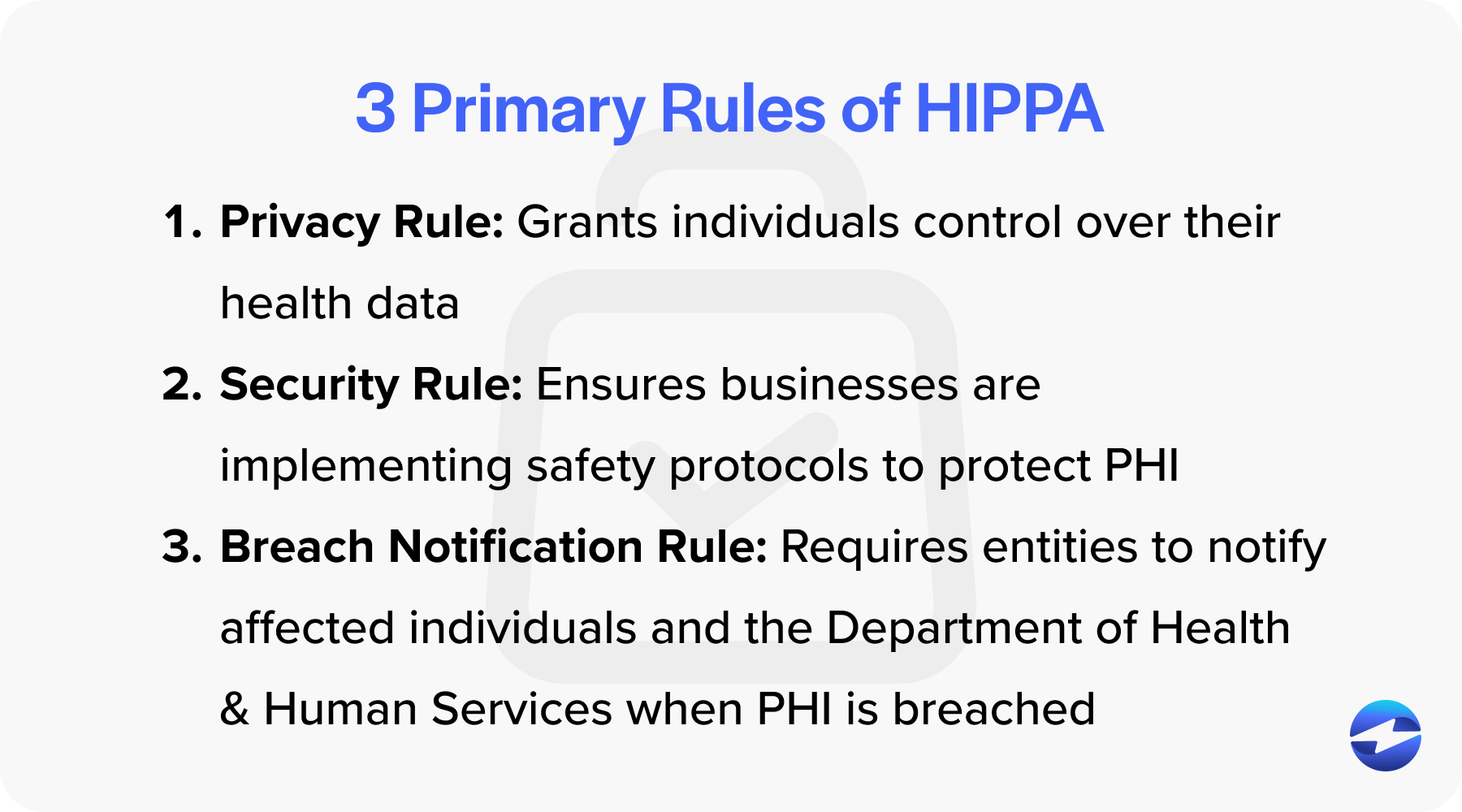

The 3 primary parts of HIPPA include:

- The privacy rule grants individuals control over their health data, including the right to access, request corrections, and control disclosures of their protected health information (PHI). Covered entities must adhere to these regulations, ensuring the confidentiality and privacy of patients’ medical records while permitting necessary disclosures for treatment, payment, and healthcare operations.

- The security rule mandates covered entities and business associates to implement administrative, physical, and technical safeguards to protect the confidentiality, integrity, and availability of e-PHI.

- The breach notification rule requires entities to notify affected individuals and the Department of Health and Human Services (HSS) following a breach of unsecured PHI. It mandates prompt disclosure of breaches to affected parties, enabling them to take necessary steps to mitigate potential harm, such as identity theft or fraud.

HIPAA establishes national standards for protecting PHI and ensures that this information is only accessed and disclosed when necessary and with the individual’s consent.

Now that you understand what HIPPA entails, you can explore what information is included in PHI.

What is PHI?

PHI, or protected health information, refers to any information about a person’s health status, healthcare provision, or payment for healthcare that can be linked to that individual.

PHI consists of 18 sensitive data identifiers, including names, addresses, relevant dates, phone numbers, Social Security numbers, and more. PHI can include medical records, lab records, lab results, health insurance information, and other data used to identify a patient.

Unauthorized access to this sensitive information can lead to privacy breaches, identity theft, and medical fraud. Therefore, healthcare organizations and professionals are obligated to safeguard PHI using HIPAA-compliant payment methods that incorporate secure storage, transmission, and disposal practices.

What are HIPAA-compliant payment methods?

HIPAA-compliant payment methods refer to payment processing systems and practices that adhere to the security and privacy requirements outlined in HIPAA. These methods ensure the protection of patients’ PHI when processing payments for healthcare services.

Therefore, any payment method that adheres to HIPAA guidelines, including the privacy, security, and breach notification rules, is considered HIPAA-compliant.

Examples of common HIPPA-compliant payment methods

1. Credit and Debit Card Payments

Accepting credit and debit cards is standard in most industries, but in healthcare, it requires extra security measures. HIPAA-compliant payment processors use encryption, tokenization, and secure data storage to keep patient information safe.

2. ACH and eCheck Payments

For patients who prefer paying directly from their bank account, ACH and eCheck payments offer a secure, digital alternative to paper checks. These transactions go through encrypted gateways that meet HIPAA and PCI compliance standards.

3. Patient Payment Portals

A growing number of healthcare providers are turning to secure online portals that allow patients to pay bills, set up payment plans, and manage their accounts from home. These portals use encryption and other security measures to protect sensitive patient information, ensuring compliance with HIPAA regulations when handling PHI.

4. Mobile and Contactless Payments

With more patients expecting modern payment options, mobile payments, text-to-pay, and contactless payments have become popular. These methods use secure encryption to protect transaction data, making them both HIPAA and PCI-compliant.

5. Recurring Billing and Card-on-File Payments

For practices that offer payment plans or subscription-based billing, securely storing a patient’s payment information on file can make transactions seamless. HIPAA-compliant solutions ensure that this data is encrypted and protected from unauthorized access.

Not all payment processors are built for the healthcare industry, so it’s important to choose one that meets HIPAA and PCI compliance standards

How to start using HIPAA-compliant payment processing

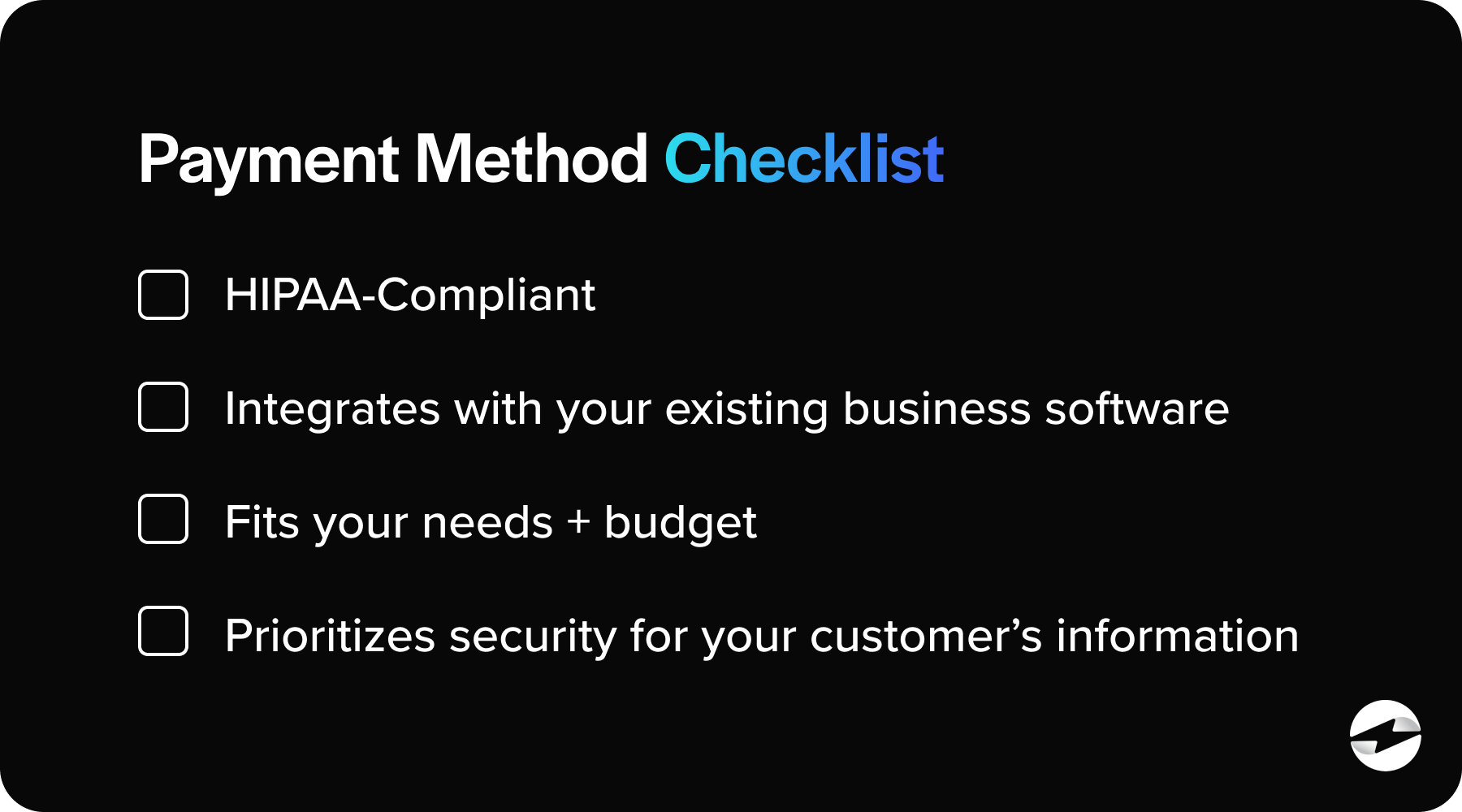

The simplest way to begin accepting HIPAA-compliant payments is to research and identify payment providers that use HIPAA-compliant payment software. Evaluate their features, services, and pricing to choose the best fit for your needs and budget.

Once you’ve selected a reliable payment processor, you can sign up for an account and set up your payment processing settings. The best providers will also offer integrated payment options into your existing systems, such as your HIPAA-compliant billing software or patient portal.

HIPPA-compliant billing software

The right HIPAA-compliant billing software is essential for healthcare providers handling sensitive patient payment data. These payment processing solutions meet HIPAA regulations, keeping patient information secure while providing a seamless billing experience. Below are some of the top HIPAA-compliant payment processors:

EBizCharge

EBizCharge

EBizCharge offers a secure HIPAA-compliant payment processing solution that integrates with various healthcare software systems, including Electronic Medical Records (EMRs), Enterprise Resource Planning (ERP) platforms, and accounting systems. It provides tokenization, encryption, and off-site data storage to ensure compliance. With features like automated invoicing, patient payment portals, email pay, and recurring billing, EBizCharge streamlines healthcare payment collection while reducing processing fees.

Rectangle Health

Rectangle Health specializes in healthcare payment solutions, offering secure patient payment processing with compliance tools designed for HIPAA and PCI DSS. It includes features such as text-to-pay, card-on-file storage, and flexible payment plans to improve revenue cycle management for medical practices.

Paysafe

Paysafe provides HIPAA and PCI-compliant payment solutions tailored for the healthcare industry. It supports omnichannel payments, recurring billing, and fraud prevention tools, allowing providers to accept payments in-person, online, or via mobile devices while maintaining compliance.

Square for Healthcare

Square offers a HIPAA-compliant payment processing solution for medical providers, integrating seamlessly with practice management systems. With features like contactless payments, invoicing, and online payment portals, Square helps streamline patient billing and reduce administrative workload.

Not all businesses will require HIPAA-compliant payment methods, but for those that do, it’s imperative to use reliable payment software.

Businesses that require HIPAA-compliance

HIPAA compliance is primarily required for businesses and organizations that handle sensitive health data. Some examples include:

- Healthcare providers (hospitals, clinics, doctors’ offices, etc.)

- Health plan providers (insurance companies, Medicaid, and other government healthcare programs)

- Healthcare clearinghouses

- Business associates (billing companies, IT providers, etc.)

- Pharmacies

- Healthcare IT providers

- Medical laboratories

- Medical equipment suppliers

- Telemedic providers

- Medical research organizations

- Employer-sponsored health programs

These are just a few industries that must adhere to HIPAA regulations and utilize HIPAA-compliant billing software. One payment solution that makes collecting payments easier is EBizCharge, a highly rated option for HIPAA-compliant credit card processing designed for accounts receivable management.

HIPAA-compliant credit card processing with EBizCharge

EBizCharge offers a seamless integration process, allowing businesses to incorporate HIPAA-compliant payment options into their existing business software effortlessly.

With its secure processing solutions, EBizCharge encrypts transactions and implements robust security measures, safeguarding patients’ confidentiality and health data for each transaction.

Additionally, EBizCharge provides comprehensive support and guidance, enabling healthcare entities to navigate HIPAA regulations and maintain compliance.