Blog > GAAP vs. Non-GAAP Accounting: What You Need to Know

GAAP vs. Non-GAAP Accounting: What You Need to Know

Crunching numbers is pivotal in determining your business’s financial success. Therefore, it’s important to familiarize yourself with general accounting terms when calculating finances.

How financial success is communicated in business hinges on the frameworks used. Thankfully, there are generally accepted accounting principles or GAAP that are the foundation of financial success. Investors, analysts, and accountants navigate these rules to establish the baseline for financial operations.

What is GAAP?

Generally accepted accounting principles (GAAP) are a collection of commonly followed accounting rules and standards for financial reporting. The standards are established by the Financial Accounting Standards Board (FASB) and form the backbone of accounting practices for public companies in the U.S.

GAAP is designed to ensure consistency, clarity, and comparability of financial statements, such as income statements, balance sheets, and statements of cash flows.

The fundamental principles of GAAP include:

- Relevance: Financial information should be relevant to the decision-making needs of users.

- Reliability: Financial reporting should be accurate and verifiable.

- Consistency: Companies should use the same accounting methods from year to year.

- Comparability: Information should be presented to allow users to identify similarities and differences between organizations.

Compliance with GAAP provides a standardized method of describing a company’s financial performance, enabling investors, regulators, and other stakeholders to analyze and compare financial statements confidently. The Securities and Exchange Commission (SEC) requires GAAP compliance for all U.S. public companies for financial reporting.

However, not all financial measures are captured by GAAP, leading to the emergence of non-GAAP metrics, which offer additional insights into a company’s performance.

What is non-GAAP?

Non-GAAP accounting refers to presenting financial statements and results that don’t adhere to GAAP. The intention behind non-GAAP figures is to provide a clearer picture of a business’s financial performance related to its core operations.

These non-GAAP measures may exclude certain expenses or income management outside a company’s typical operations, such as non-recurring expenses, one-time expenses, restructuring charges, or non-cash expenses like stock-based compensation.

Non-GAAP adjustments can help investors and analysts understand a company’s ongoing financial health by eliminating fluctuations caused by irregular or one-time events.

Companies often present non-GAAP earnings and GAAP-compliant financial reporting to highlight earnings per share (EPS) or income statements that may differ from GAAP figures. However, these non-GAAP results have come under scrutiny, as no industry standard exists for determining what constitutes a non-GAAP measure. Therefore, the SEC requires public companies to reconcile non-GAAP financial measures with their GAAP counterparts, ensuring fuller transparency in financial reporting.

Critics argue that these measures can potentially mislead stakeholders, so disclosures and clear explanations of non-GAAP numbers are essential and regulated by the SEC.

Amidst the debate over GAAP and non-GAAP measures, revenue recognition remains a critical aspect of financial reporting, ensuring that revenue is recorded accurately and promptly.

Importance of revenue recognition

Revenue recognition is a cornerstone of financial reporting that determines when and how income is recorded.

Adherence to predesignated guidelines for recognizing revenue ensures consistency within financial statements, which is essential for investors, creditors, and other stakeholders when assessing a company’s financial health and performance.

According to accounting principles, revenue is recognized when it’s realized and earned. This means businesses record revenue when goods or services are delivered or performed, not when the payment is received.

Proper revenue recognition is significant beyond regulatory compliance. It provides a clearer picture of a company’s sales effectiveness, customer satisfaction, and overall stability. By reflecting true sales activity, these figures allow stakeholders to make better-informed decisions regarding investment and credit lending.

Despite their differences, GAAP and non-GAAP measures share common goals of enhancing the clarity and usefulness of financial information for stakeholders.

How are GAAP and non-GAAP similar?

GAAP and non-GAAP accounting methods deliver insights into a company’s financial performance. Both measures offer valuable financial data that stakeholders can use to evaluate businesses’ past, present, and potential future success.

While GAAP and non-GAAP accounting have fundamental differences, they share some common ground since they’re both essential accounting measures examined by the SEC.

GAAP and non-GAAP are both accounting measures

At their core, both GAAP and non-GAAP are accounting measures used to present information through financial statements. These frameworks quantify a company’s operations, financial health, and managerial effectiveness in controlling expenses and generating revenue.

Regardless of the method, the objective remains to provide stakeholders with data to make informed decisions regarding a company’s economic affairs.

The SEC examines both GAAP and non-GAAP

Despite offering an alternative view of financial performance, non-GAAP measures are still subject to scrutiny by regulatory bodies such as the SEC. The SEC recognizes that non-GAAP measures can complement GAAP reporting, particularly by isolating non-recurring, irregular, and one-time expense items to better understand ongoing performance.

However, the SEC closely oversees how public companies apply non-GAAP measures to ensure that these presentations are accurate and are reconciled with GAAP figures.

Consequently, companies must provide transparent reconciliations from non-GAAP to GAAP numbers, ensuring investors have a comprehensive view of a company’s finances.

Both GAAP and non-GAAP enhance transparency in financial reporting

GAAP and non-GAAP enhance transparency in financial reporting by offering different perspectives on a company’s financial health.

GAAP provides a standardized framework, ensuring consistency, comparability, and reliability across financial statements. This uniformity allows stakeholders to confidently analyze and compare the financial performance of different companies.

On the other hand, non-GAAP measures offer additional insights by excluding irregular or non-recurring items, helping to present a clearer picture of a company’s core operational performance.

When used together, these metrics provide a more comprehensive view of a company’s financial situation, aiding stakeholders in making well-informed decisions.

Critical differences between GAAP and non-GAAP

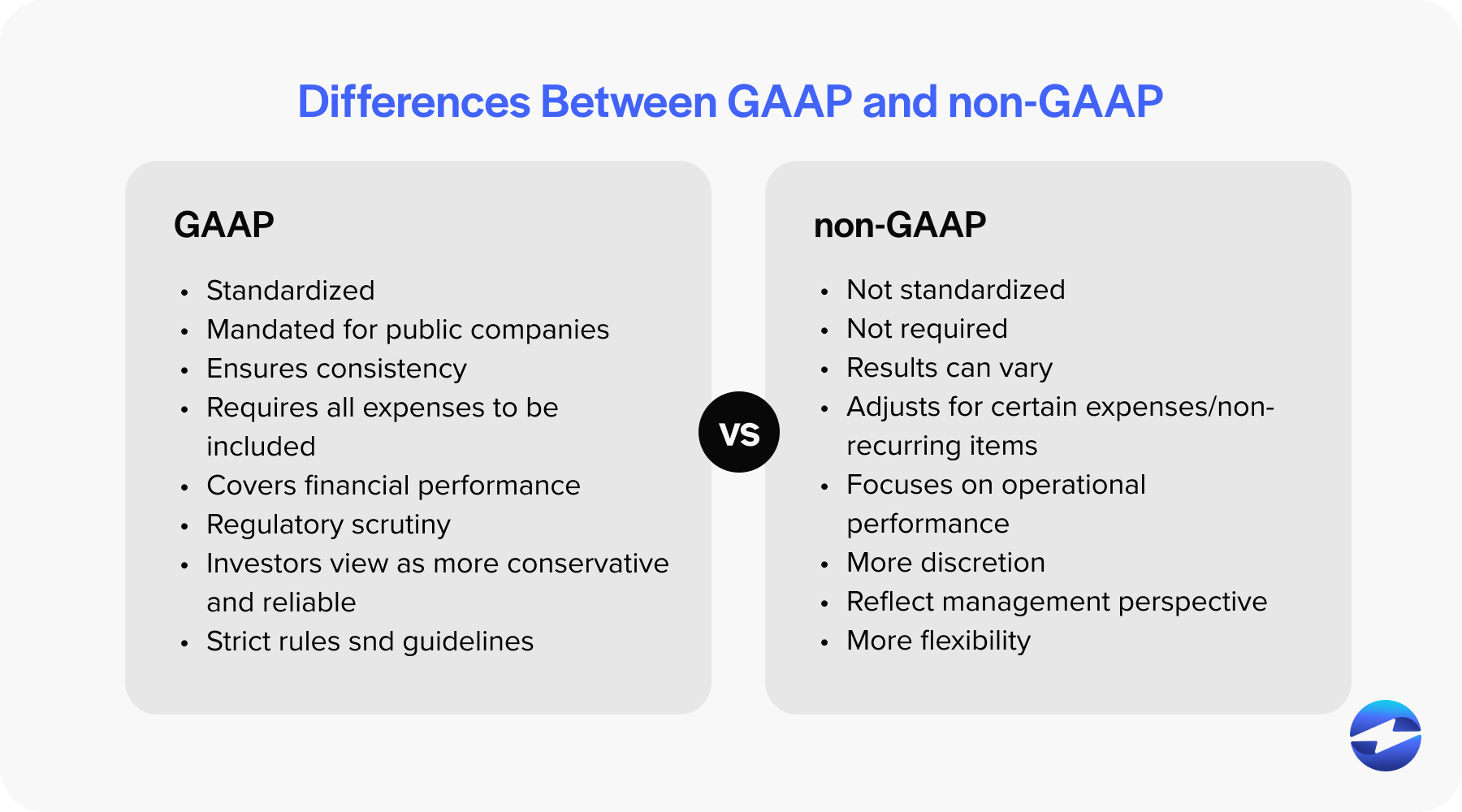

Understanding the financial reporting landscape also involves grasping the critical differences between GAAP and non-GAAP measures.

GAAP is the industry standard for financial statements among public companies in the U.S., mandated by the SEC. It provides a uniform set of guidelines for financial reporting, ensuring comparability and consistency across companies.

On the other hand, non-GAAP measures provide an alternative view of financial performance by excluding certain items that companies believe are not indicative of their core operations. These may include non-recurring expenses, restructuring charges, stock-based compensation, and other one-time costs. Non-GAAP reporting often presents a clearer picture of a company’s ongoing profitability and cash flows.

Some of the key differences between GAAP and non-GAAP include:

- Standardization: GAAP is standardized, and non-GAAP is not.

- Mandate: The SEC requires GAAP for public companies, whereas non-GAAP is optional.

- Consistency: GAAP ensures consistency across financial statements, but non-GAAP results can vary.

- Items excluded: Non-GAAP measures adjust for certain non-cash expenses and non-recurring items. GAAP requires these to be included.

- Focus: Non-GAAP measures often focus on operational performance. GAAP covers financial performance, including non-operational aspects.

- Regulatory scrutiny: GAAP is subject to strict regulatory scrutiny and oversight, while non-GAAP measures, though monitored, allow companies more discretion in their reporting.

- Investor perception: GAAP figures are generally considered more conservative and reliable by investors, while non-GAAP figures are seen as more reflective of management’s perspective on ongoing operations.

- Flexibility: Non-GAAP allows more flexibility when presenting financial information, while GAAP follows strict guidelines and rules.

Nonetheless, GAAP and non-GAAP measures are valuable and aid stakeholders in comprehensively understanding a company’s financial standing.

Common misconceptions about GAAP and Non-GAAP

GAAP and non-GAAP accounting practices are commonly misunderstood.

One widespread misconception is that non-GAAP measures are unreliable or misleading. Yet, these figures can provide valuable insight into a company’s operational performance by excluding non-recurring expenses and other specific items such as restructuring charges, stock-based compensation, and one-time expenses.

Another misconception is that GAAP is the only legitimate method of financial reporting. While GAAP figures are standardized and mandated by the SEC for public companies in the U.S., non-GAAP financial measures can complement GAAP figures by offering additional performance insights, especially for private companies that aren’t required to follow GAAP.

Some believe non-GAAP results allow companies to artificially inflate earnings per share or other financial metrics. However, these adjustments often provide a transparent operational picture, especially when GAAP figures include significant non-cash expenses and other accounting noise.

Lastly, there’s a myth that GAAP earnings are all-inclusive. However, due to the accrual basis of accounting principles, even GAAP financial statements can omit essential data on cash flows and may not always reflect the ongoing sustainability of a company’s profits.

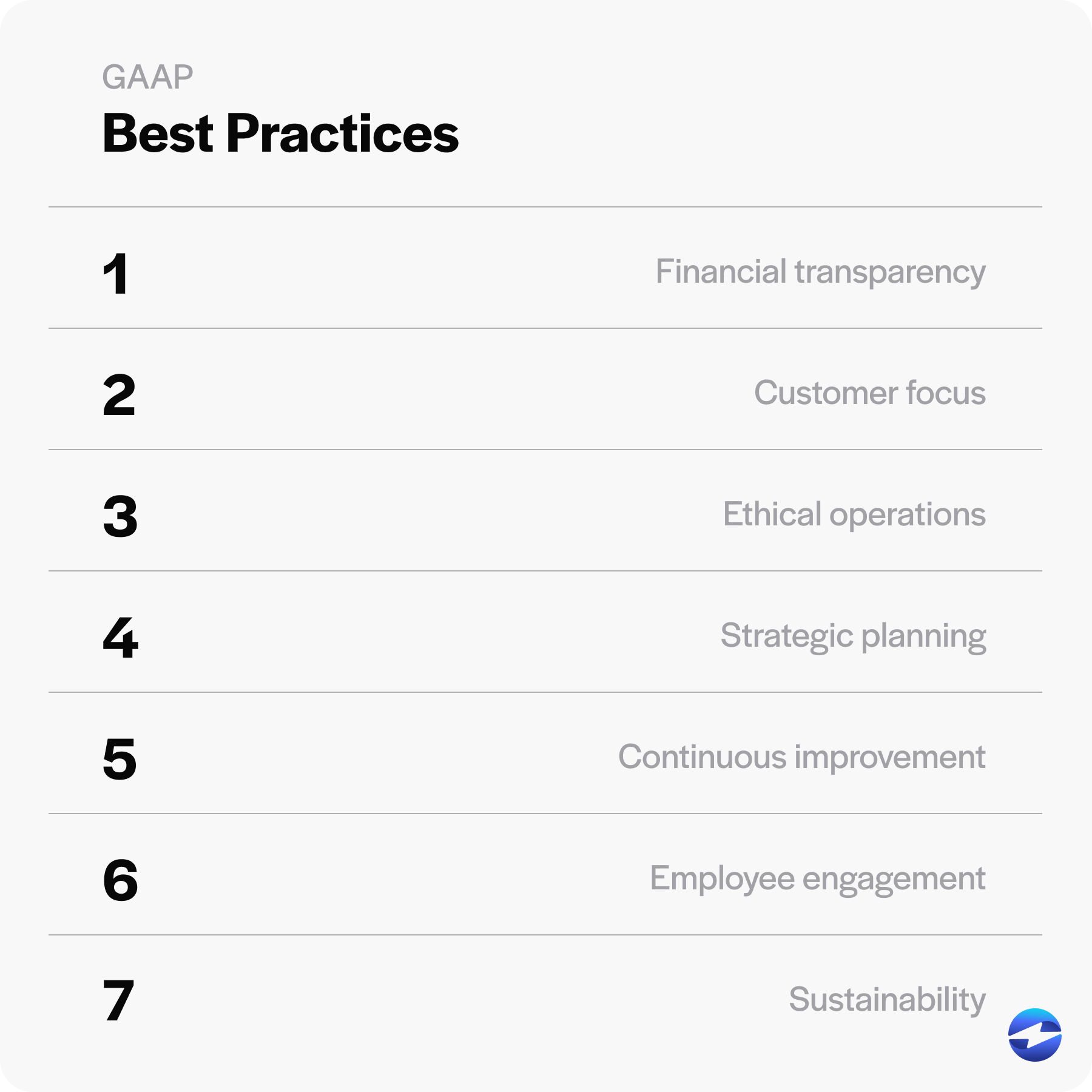

7 GAAP best practices for businesses

To thrive in today’s competitive environment, businesses must adhere to best practices that promote efficiency, ethical behavior, and sustainable growth.

Some of the practices include:

- Financial transparency: Maintain clear and accurate financial records. Public companies should ensure compliance with GAAP for financial statements, providing a standard framework for financial reporting.

- Customer focus: Prioritize customer satisfaction by delivering high-quality products and services. Listening to customer feedback and addressing concerns is vital for long-term success.

- Ethical operations: Establish a code of ethics and conduct to guide all business operations and ensure compliance with laws and industry standards.

- Strategic planning: Develop a robust business plan with well-defined goals and strategies. This requires regular review and adjustments to adapt to market dynamics.

- Continuous improvement: Embrace innovation and encourage continuous learning. Implementing processes can optimize efficiency and quality.

- Employee engagement: Invest in employees through professional development. Valuing their contributions leads to motivated personnel and lower turnover rates.

- Sustainability: Incorporate eco-friendly practices and corporate social responsibility into business strategy, reflecting commitment to environmental stewardship and community development.

Adopting these best practices enhances a company’s reputation and contributes to long-term profitability and success.

Yield long-term success with GAAP and non-GAAP

Understanding the nuances between GAAP and non-GAAP accounting is crucial for evaluating a company’s financial health.

GAAP provides a solid foundation of standardized, consistent, and reliable reporting, ensuring regulatory compliance and fostering trust among investors and stakeholders. Non-GAAP measures complement this by offering additional insights into a company’s operational performance, highlighting current and potential business trends.

By transparently reconciling and presenting GAAP and non-GAAP figures, companies can provide a comprehensive and accurate picture of their financial health, enabling better decision-making and long-term success.

Is you business PCI compliant? Take this 1-min quiz to find out.

Is you business PCI compliant? Take this 1-min quiz to find out.