Blog > EBizCharge vs. Stripe for Salesforce: Which Payment Solution is Right for Your Business?

EBizCharge vs. Stripe for Salesforce: Which Payment Solution is Right for Your Business?

Choosing a payment solution that works well with Salesforce isn’t a decision to take lightly. For many organizations, Salesforce is the backbone of sales, finance, and customer management. How you accept payments—and how those payments flow into Salesforce—can either streamline your operations or create ongoing headaches. Two names come up often in this conversation: Stripe and EBizCharge. Both are capable solutions, but they take very different approaches.

This article explores the Salesforce Stripe comparison in detail, focusing on features, integration complexity, pricing, and support. Along the way, we’ll also highlight what makes a payment processing solution succeed in a Salesforce-driven business.

Feature Comparison

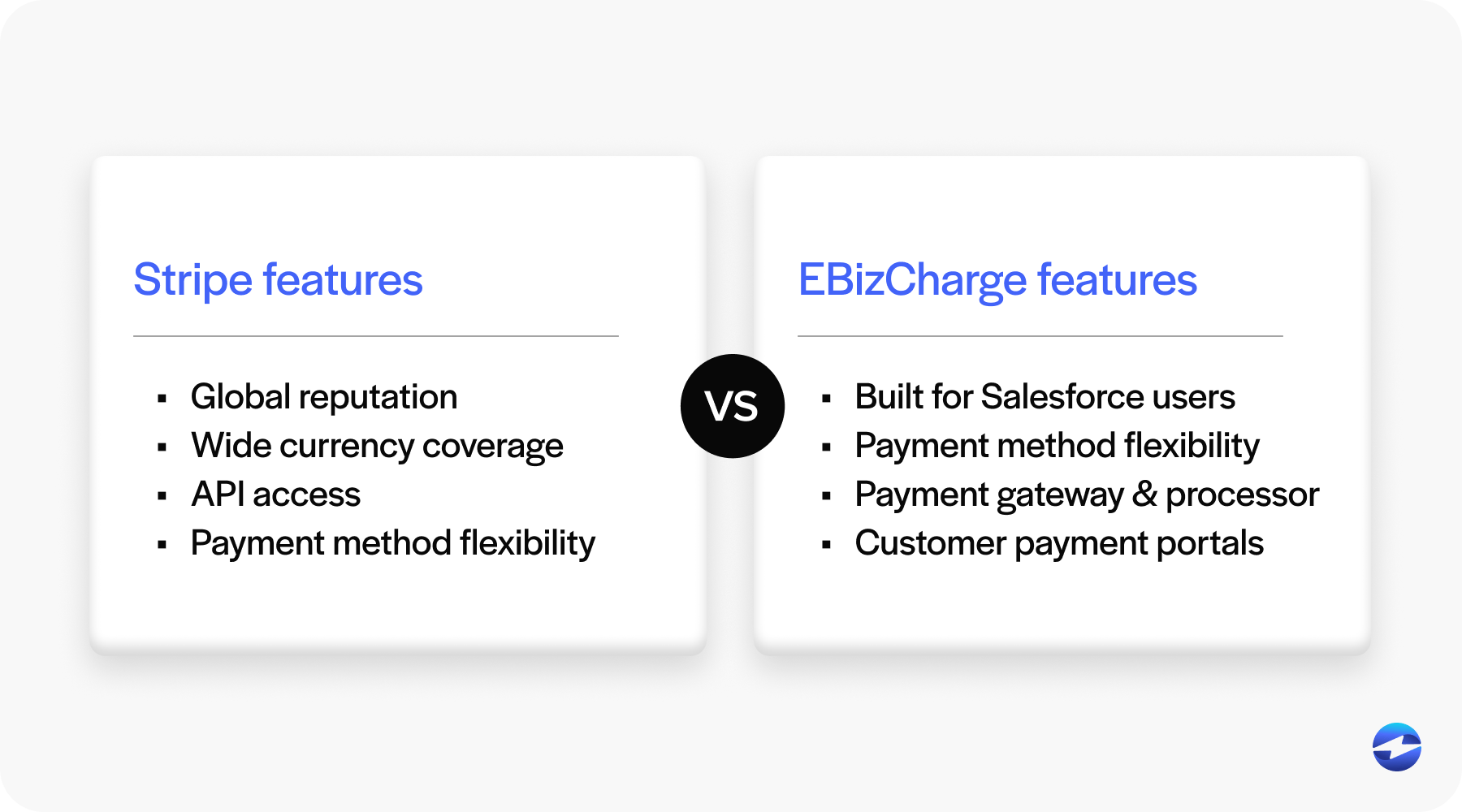

Stripe is a powerful payment processor with a strong global reputation. It shines when it comes to online transactions and offers wide coverage for different currencies and payment methods. If you’re selling internationally or need flexibility across multiple regions, Stripe has an impressive toolkit. It functions as a Salesforce payment gateway with broad application programming interface (API) access, allowing developers to extensively customize and build around it. For businesses with strong technical resources, this can be a big plus.

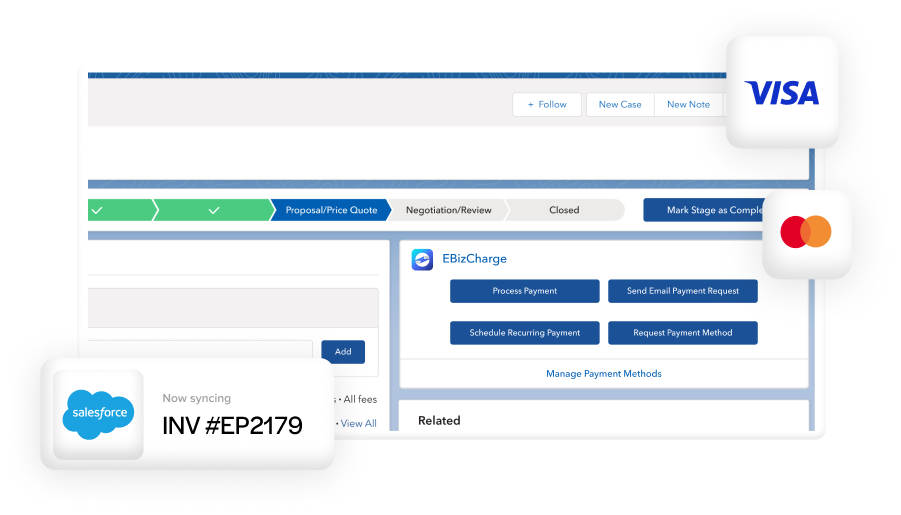

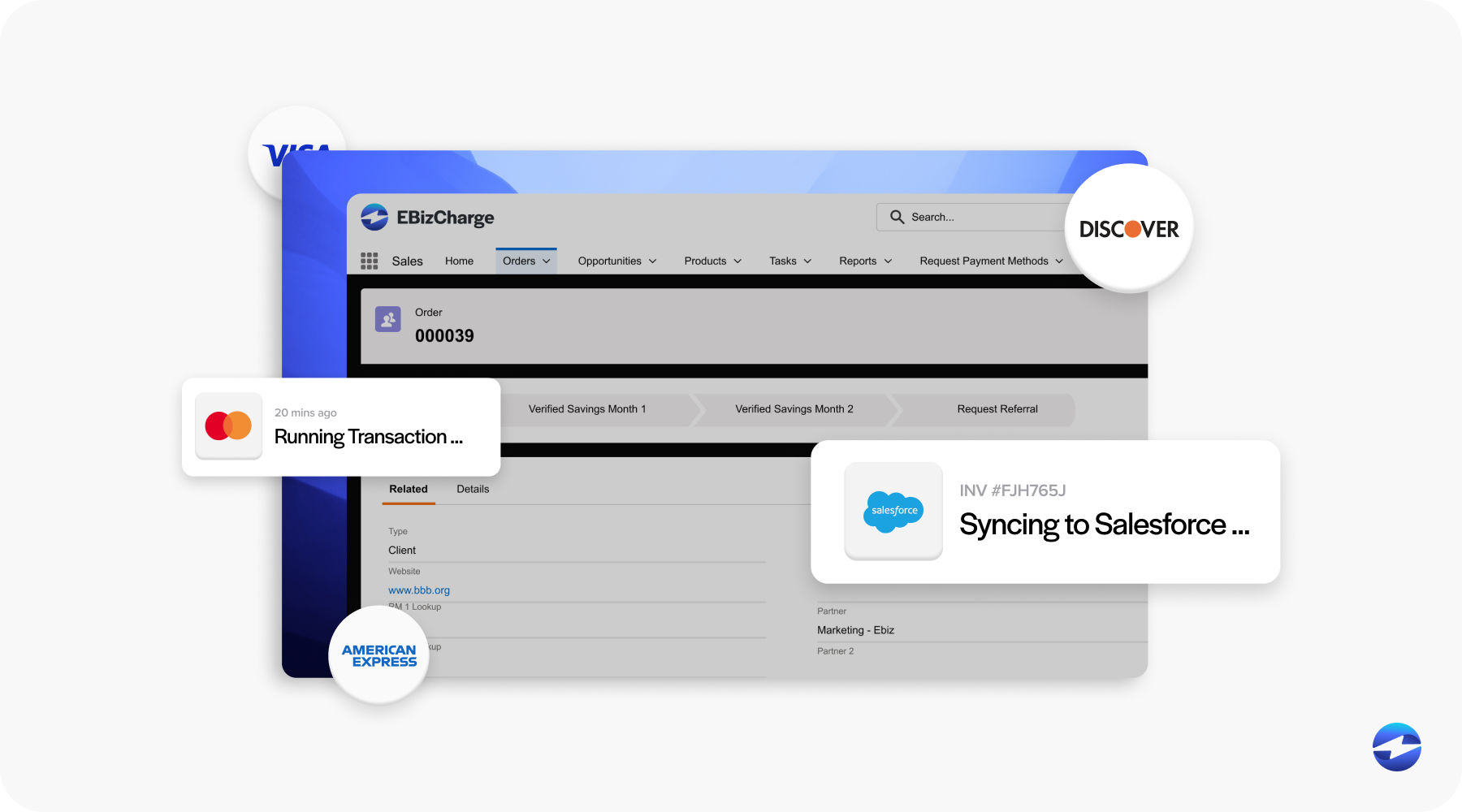

EBizCharge, by contrast, was built with Salesforce users in mind. Instead of focusing on being a one-size-fits-all gateway, it works directly inside Salesforce. Payments are tied to invoices, accounts, and opportunities right out of the box. Whether it’s ACH transfers, credit cards, digital wallets, or even customer self-service portals, these Salesforce payment options flow directly into your records. It acts as both a payment gateway and processor, which means you don’t have to patch together multiple services.

When comparing features, Stripe is highly flexible and developer-friendly, while EBizCharge is designed to minimize customization and work seamlessly with the Salesforce billing platform from day one. For businesses deeply invested in Salesforce, that difference can matter more than the raw feature list.

Integration Complexity

Integration is often where payment solutions rise or fall. Many businesses start by trying to integrate Stripe with Salesforce, but quickly realize it’s not plug-and-play. Stripe doesn’t offer a native Salesforce integration, so you’ll need a connector, middleware, or custom development to make it work the way you want. This adds complexity and creates more opportunities for sync errors. For IT teams, that can mean additional time spent maintaining integrations rather than focusing on more strategic projects.

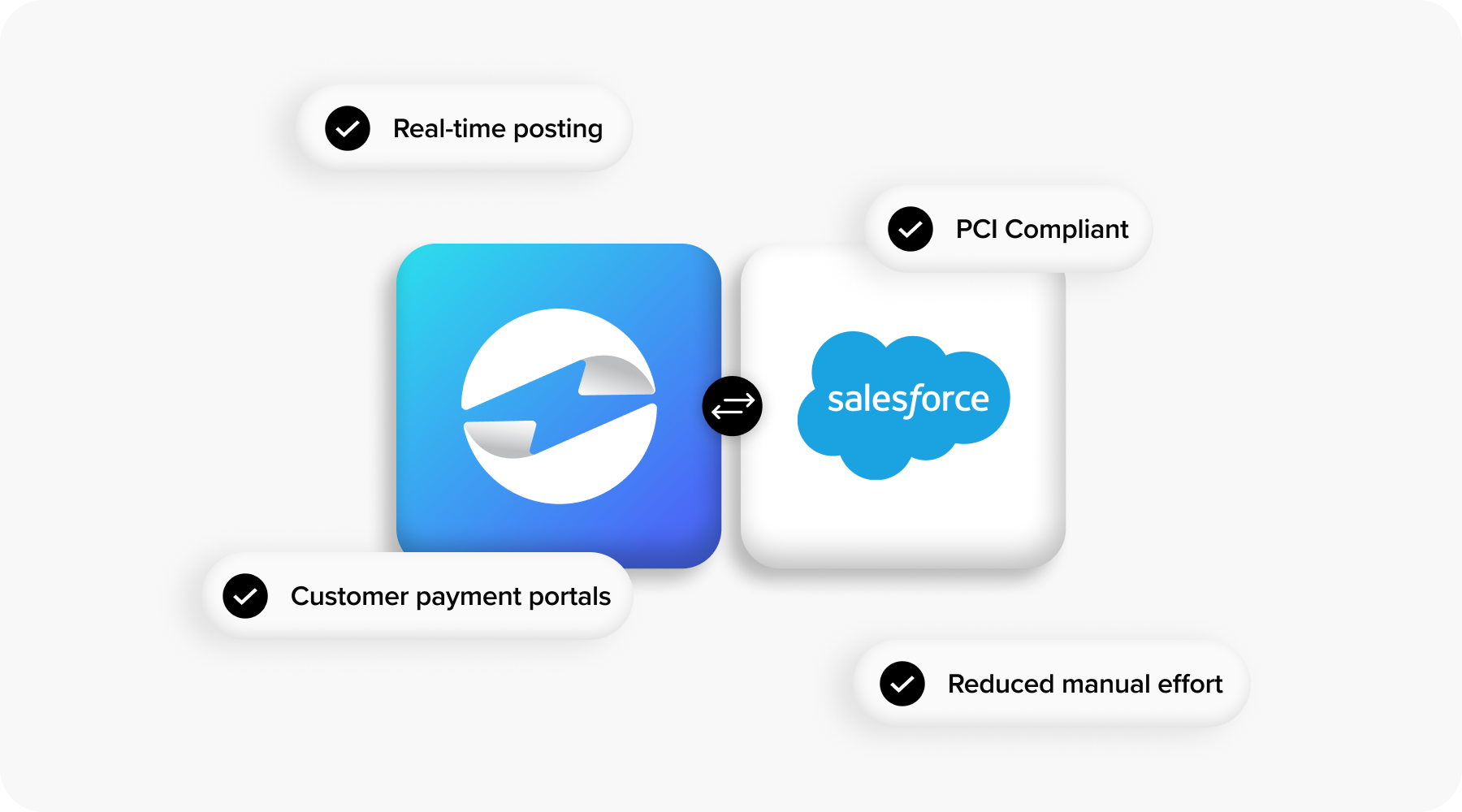

EBizCharge takes a different approach with a native Salesforce integration. Payments are posted directly to Salesforce records in real time. Invoices, accounts, and contracts are updated automatically, so finance teams don’t have to reconcile between systems. The reduced IT overhead is significant, and fewer sync issues mean greater trust in the data inside Salesforce. For many businesses, especially those without large technical teams, this difference alone tips the scale.

Pricing

Stripe is transparent about its transaction fees, and for many online businesses, its costs are easy to understand. However, when you look closer, certain advanced features—like fraud detection, recurring billing, and multi-currency support—may come with additional costs. For businesses that want a full set of tools, Stripe’s final bill can be higher than expected.

EBizCharge offers a different pricing model. It also emphasizes transparency, but more importantly, many advanced tools are bundled into the core offering. Fraud monitoring, tokenization, and customer portals don’t require extra add-ons. Depending on your volume and payment mix, EBizCharge can end up being more cost-effective, especially if Salesforce billing is already central to your operations. For finance teams that need predictable costs, this bundled approach can make budgeting easier.

Support Differences

Support is another area worth examining in a Salesforce Stripe comparison. Stripe has extensive developer documentation and resources, which is great for technical teams. However, when it comes to specialized Salesforce workflows, its support can feel generic. Most businesses work through ticket-based systems, and the help you receive may not always be Salesforce-specific.

EBizCharge, on the other hand, positions its support team around Salesforce users. The onboarding process is designed to get payments flowing inside Salesforce quickly, and troubleshooting is handled by people familiar with Salesforce data structures. For finance and IT managers who need quick, Salesforce-aware answers, this kind of specialized support makes a real difference. It’s not just about solving issues—it’s about understanding the Salesforce billing platform and ensuring payments enhance rather than disrupt daily operations.

Which Should You Choose?

So how do you decide? Both Stripe and EBizCharge are strong contenders, but they serve different priorities.

Choose Stripe if you need global reach and advanced developer customization. If your business relies heavily on a technical team that can build around Stripe’s APIs and maintain a third-party Salesforce integration, Stripe is a reliable payment processor. It’s especially strong if Salesforce isn’t the only system you rely on.

Choose EBizCharge if Salesforce is the center of your business. If you want a payment processing solution that’s native, requires less overhead, and works seamlessly with Salesforce billing, EBizCharge is the better fit. Its ability to act as both a Salesforce payment gateway and processor, paired with Salesforce-focused support, makes it well-suited for businesses that want efficiency over constant integration maintenance.

For most Salesforce-driven organizations, EBizCharge feels like the more natural choice. It reduces manual work, ensures clean data, and allows finance teams to focus on strategy instead of reconciliation.

Finding the Best Fit for Your Salesforce Workflow

At the end of the day, the choice between Stripe and EBizCharge comes down to priorities. Stripe offers flexibility and reach, but often requires more customization to integrate Stripe with Salesforce effectively. EBizCharge narrows its focus on the Salesforce ecosystem and delivers a native experience that reduces friction.

In a world where Salesforce billing and customer records drive business decisions, the payment processor you choose should support—not complicate—that reality. Whether you value developer freedom or Salesforce-native efficiency, the right Salesforce payment gateway will shape your team’s productivity and your customers’ experience.

For businesses where Salesforce integration is the top priority, EBizCharge stands out as the payment processing solution that best aligns with the Salesforce billing platform and Salesforce payment options. It’s not just about collecting payments. It’s about building a unified system that works the way your business does.