Blog > Double-Entry Accounting: Pros, Cons, and Everything You Need to Know

Double-Entry Accounting: Pros, Cons, and Everything You Need to Know

Double-entry accounting can revolutionize how businesses track their finances by unlocking a deeper understanding of their financial health.

This article will explore double-entry accounting by dissecting the basic principles of debits and credits, comparing this accounting style with single-entry accounting, and assessing its advantages and potential drawbacks.

What is double-entry accounting?

Double-entry accounting hinges on a fundamental concept: every business transaction impacts two separate accounts.

In essence, this system is a dual entry accounting method in which one account is debited, and another is credited for the same account, ensuring the accounting equation remains balanced.

The double-entry accounting equation states that a company’s assets must always equal the sum of its liabilities plus the owner’s equity.

Assets = liabilities + equity

This equation is the cornerstone of the double-entry accounting system, signifying that all of a company’s assets are financed either by borrowing money (liabilities) or by the company owner’s contributions (equity) alongside any retained earnings.

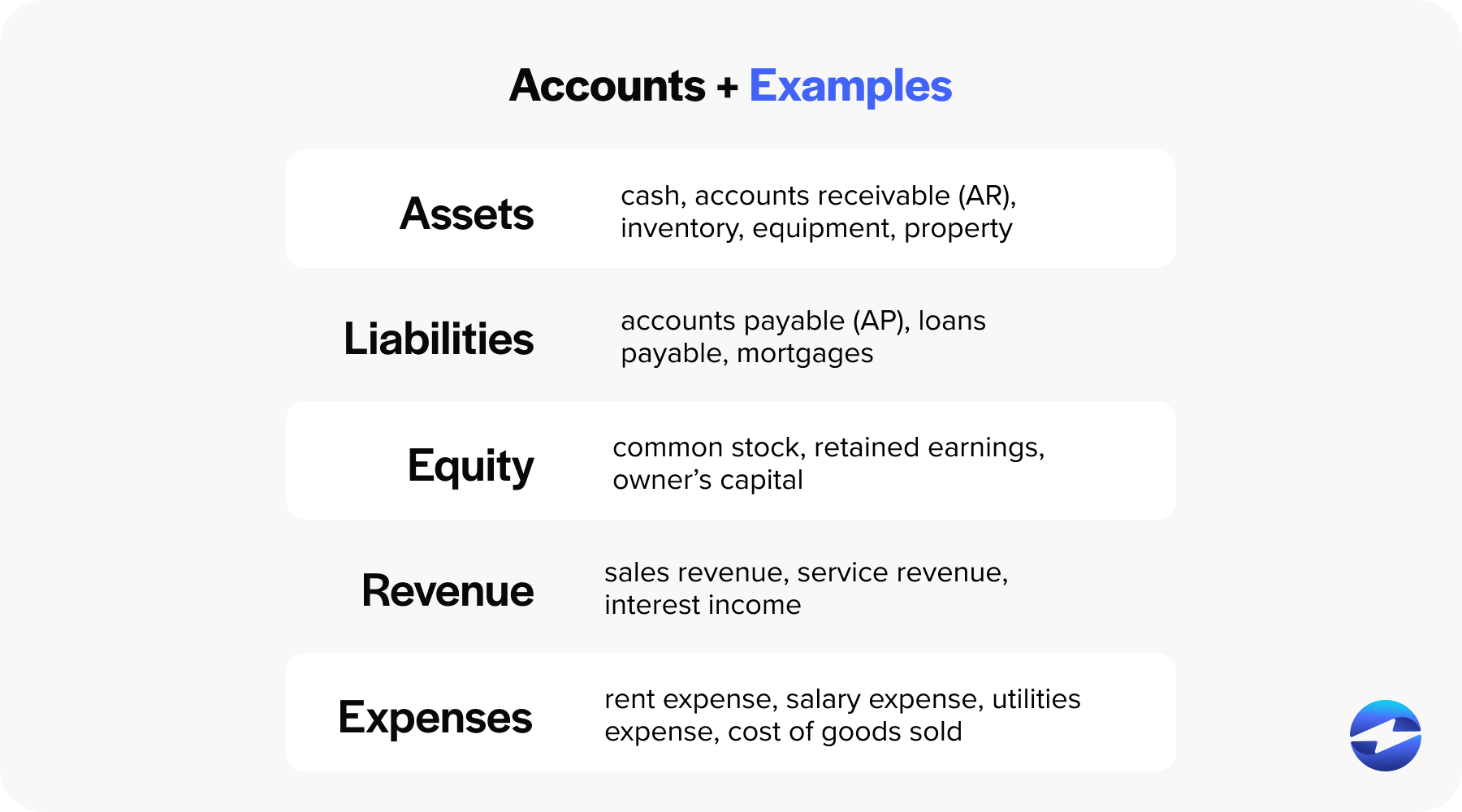

What accounts are used in double-entry accounting?

In double-entry accounting, various accounts are used to record financial transactions. These accounts fall into 5 main categories:

- Assets: Resources owned by the business that provide future economic benefits. Examples include cash, accounts receivable (AR), inventory, equipment, and property.

- Liabilities: Obligations that the business needs to pay in the future. Examples include accounts payable (AP), loans payable, and mortgages.

- Equity: The owner’s interest in the business after liabilities are subtracted from assets. Examples include common stock, retained earnings, and owner’s capital.

- Revenue: Income earned from the business’s core operations. Examples include sales revenue, service revenue, and interest income.

- Expenses: Costs incurred in the process of earning revenue. Examples include rent expense, salary expense, utilities expense, and cost of goods sold.

Now that you’re familiar with the components of double-entry accounting, here’s a quick look at how it works.

Understanding the double-entry system: Debits vs. credits

The double-entry accounting system operates through two components: debits and credits. Debits represent the left side of an account, while credits occupy the right side.

When a transaction occurs, one account is debited, increasing the value of assets or expenses, or decreasing liabilities, equity, or revenue. Additionally, another account is credited, but this action has the opposite effect – increasing liabilities, equity, or revenue, or decreasing assets or expenses.

To illustrate, if a business purchases equipment with cash, the equipment account (an asset) is debited because its value increases, while the cash account (also an asset) is credited, reflecting a decrease.

This intricate dance between debits and credits enables businesses to create accurate financial statements and maintain a clear trail of their financial activities.

Single-entry vs. double-entry: What’s the difference?

When it comes to bookkeeping, understanding the distinction between single-entry and double-entry systems is crucial for maintaining accurate financial records.

A single-entry system is like a checkbook register, tracking money moving in and out of an account without matching debits and credits. It offers a rudimentary view of financial health but may lack comprehensive details for a complete financial analysis.

Conversely, a double-entry system requires every financial transaction to be recorded twice. Dual entry accounting ensures that the accounting equation always remains balanced, providing an accurate picture of a company’s financial status.

Double-entry bookkeeping demands that each entry be balanced, resulting in more exact financial statements and rendering detailed records that assist in detecting accounting errors.

Single-entry bookkeeping may be suitable for smaller businesses with straightforward financial needs. In comparison, the double-entry method is virtually universal in larger companies and organizations due to its accuracy and thoroughness in financial record-keeping.

Here’s a quick look at the differences between single-entry and double-entry systems:

| Aspect | Single-Entry | Double-Entry |

|---|---|---|

| Trackable accounts | Revenue and expenses | Assets, liabilities, equity, revenue, and expenses |

| Entries per transaction | One | Two |

| Accounts affected | One account affected | Two or more accounts affected |

| Complexity | Simple, easy to implement | Complex, requires accounting knowledge |

| Error detection | Limited error detection | High error detection |

| Fraud prevention | Minimal fraud prevention | Strong fraud prevention |

| Financial statements | Limited financial statements | Comprehensive financial statements |

| Usage | Small business, personal finance | Medium to large businesses |

| Financial insights | Limited insight | Deeper insight for a more comprehensive view of financial health |

You can review the examples below to better understand single-entry and double-entry systems.

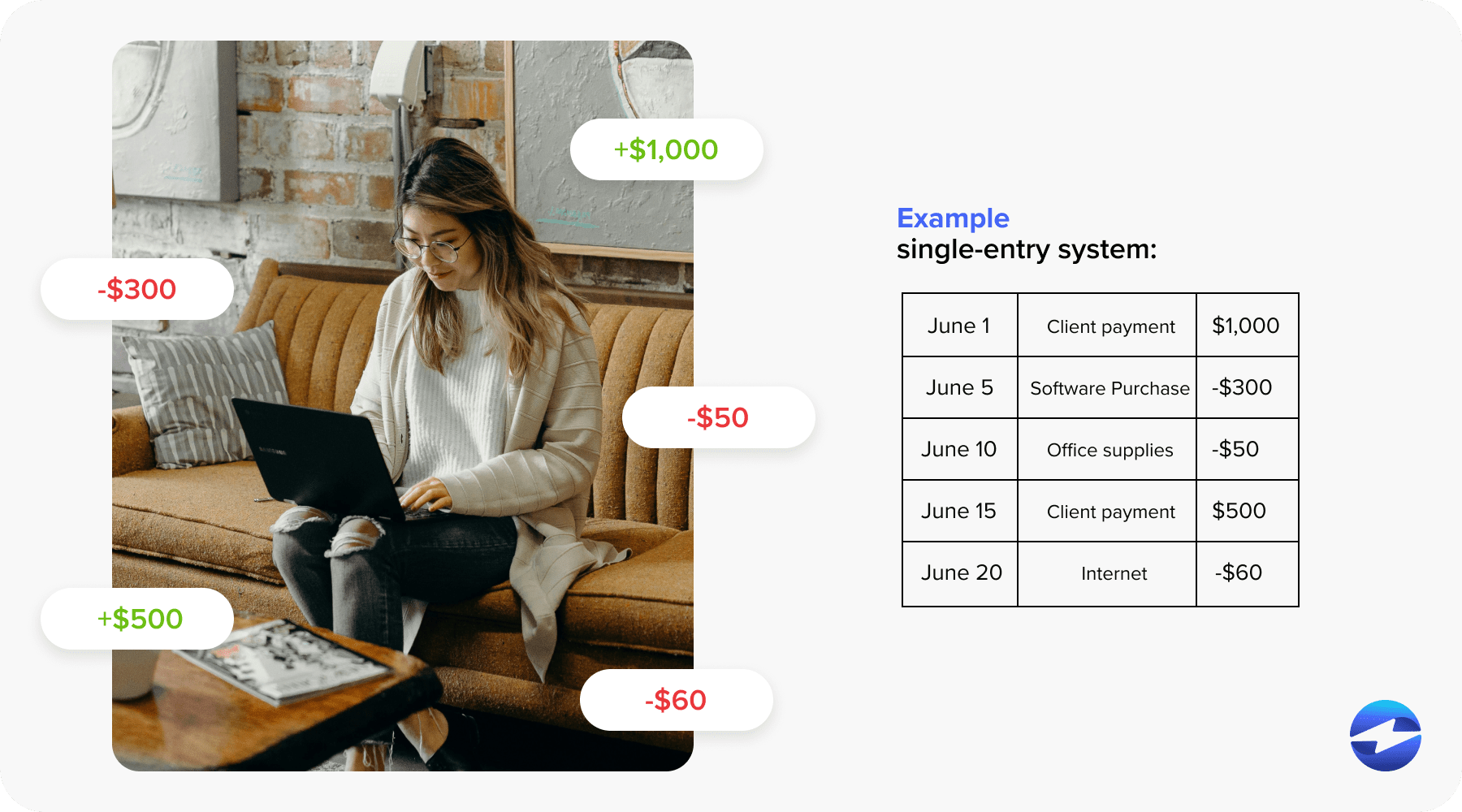

Single-entry system example

Sarah, a freelance graphic designer, maintains a simple cash book to record her financial transactions.

On June 1, she receives $1,000 from Client A for a design project, which she records as income. On June 5, she purchases design software for $300, recording it as an expense. On June 10, she buys office supplies for $50, another expense entry. On June 15, she receives $500 from Client B for a logo design, adding to her income. Lastly, on June 20 she pays $60 for internet service, marking it as an expense.

| Date | Description | Amount |

|---|---|---|

| June 1 | Received payment from Client A for design project | $1,000 |

| June 5 | Purchased design software | -$300 |

| June 10 | Paid for office supplies | -$50 |

| June 15 | Received payment from Client B for logo design | $500 |

| June 20 | Paid for internet service | -$60 |

Sarah uses a single-entry system to track her cash flow. She can easily see her total income and expenses by listing each transaction once in the cash book. However, this system lacks the detailed financial insights the double-entry method provides.

In the following example, you’ll see the difference in Sarah’s reporting using a double-entry system.

Double-entry system example

Sarah receives $1,000 from Client A on June 1 and records it by debiting Cash, which increases her cash on hand, and crediting Revenue, recognizing the income earned. On June 5, Sarah buys design software for $300, debiting Software Expense to reflect the cost incurred and crediting Cash to reduce her cash on hand. On June 10, Sarah pays $50 for office supplies, recording the transaction by debiting Office Supplies Expense and credit Cash. On June 15, Sarah receives $500 from Client B, recording the transaction by debiting Cash and crediting Revenue. Finally, on June 20, Sarah pays $60 for internet service, recorded by debiting Internet Expenses and credit Cash.

Sarah records all these transactions using a double-entry system, which breaks down credits and debits below:

| Date | Description | Debit | Credit | Account |

|---|---|---|---|---|

| June 1 | Received payment from Client A for design project | $1,000 | $0 | Cash |

| June 1 | Received payment from Client A for design project | $0 | $1,000 | Revenue |

| June 5 | Purchased design software | $300 | $0 | Software Expense |

| June 5 | Purchased design software | $0 | $300 | Cash |

| June 10 | Paid for office supplies | $50 | $0 | Office Supplies Expense |

| June 10 | Paid for office supplies | $0 | $50 | Cash |

| June 15 | Received payment from Client B for logo design | $500 | $0 | Cash |

| June 15 | Received payment from Client B for logo design | $0 | $500 | Revenue |

| June 20 | Paid for internet services | $60 | $0 | Internet Expense |

| June 20 | Paid for internet services | $0 | $60 | Cash |

Double-entry accounting has its benefits, but it’s also important to understand its limitations.

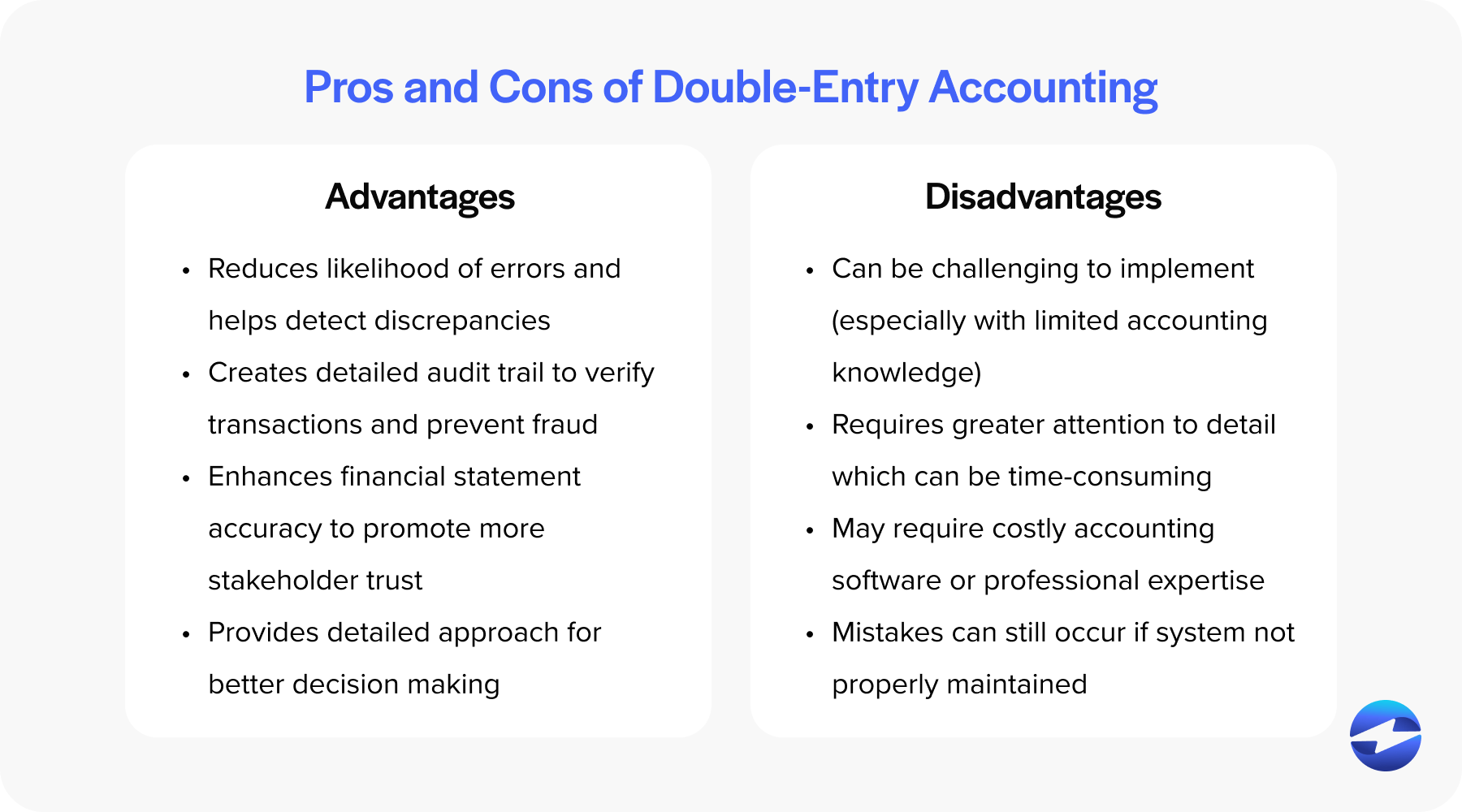

The pros and cons of double-entry accounting

The double-entry accounting method offers a mix of advantages and shortcomings that reflect its complexity and necessity.

Advantages of double-entry accounting

Double-entry accounting offers several significant advantages that enhance financial management and reporting.

One of the primary benefits of double-entry accounting is its ability to provide a comprehensive and balanced view of an organization’s financial transactions, ensuring accuracy and reducing the likelihood of errors.

By recording each transaction in two separate accounts, this system helps maintain the fundamental accounting equation, making it easier to detect discrepancies and rectify mistakes promptly. This method also creates a detailed audit trail, which is invaluable for verifying the legitimacy of transactions and preventing fraudulent activities.

Moreover, the detailed records generated through double-entry accounting facilitate the preparation of accurate financial statements, offering stakeholders a precise and reliable picture of the company’s financial health. This comprehensive approach supports better decision-making by providing detailed financial performance and position insights.

Disadvantages of double-entry accounting

Double-entry accounting has its drawbacks, particularly in terms of complexity and resource requirements.

The double-entry system can be intricate and challenging to implement, especially for small businesses or individuals with limited accounting knowledge. Recording every transaction in two accounts requires meticulous attention to detail. It can be time-consuming, demanding more effort than simpler accounting methods like single-entry accounting. This complexity often necessitates specialized accounting software or professional expertise, which can be costly and may not be feasible for all companies.

Additionally, while double-entry accounting reduces the risk of errors, it doesn’t eliminate them entirely, and mistakes can still occur, especially if the system isn’t properly maintained.

Despite these challenges, double-entry accounting’s accuracy, fraud prevention, and detailed financial reporting benefits often outweigh the drawbacks, making it the preferred method for many businesses.

Double-entry accounting is the gold standard for financial accuracy

Double-entry accounting is unrivaled in its ability to provide a detailed and accurate picture of a company’s financial health, making it the industry standard for financial reporting.

While single-entry accounting may suffice for smaller entities with straightforward financial activities, the detailed insights and reliability offered by double-entry accounting support better decision-making and financial stewardship, cementing its role as the preferred method in the industry.