Blog > Does Offering More Payment Methods Increase Sales? 84% of Business Owners Say Yes. Here’s Why

Does Offering More Payment Methods Increase Sales? 84% of Business Owners Say Yes. Here’s Why

Abstract

A recent survey found that offering a variety of payment methods significantly boosts sales and enhances customer relationships, with 84% of business owners reporting positive results.

The findings showed that adopting flexible payment options caters to diverse customer preferences, improving the checkout experience and increasing conversion rates. This approach fosters customer loyalty, drives long-term revenue growth, and streamlines the purchasing journey.

The growing demand for payment flexibility

The growing demand for payment flexibility has become exponentially vital in modern markets. Companies must recognize the importance of this trend and adapt to meet consumers’ evolving expectations. Modern shoppers demand more choices when it comes to how they pay, and businesses that offer diverse payment options not only enhance customer satisfaction but also capture more sales opportunities.

Today’s customers seek simple and seamless transaction experiences. They prioritize quick checkout processes, assurance regarding payment security, and innovative payment solutions that align with their preferences. Meeting these expectations requires industries to adopt payment methods that cater to a wide range of needs, fostering customer trust and loyalty.

Global commerce trends are also transforming how businesses operate, further amplifying the need for payment flexibility. As international transactions become more common, companies must accommodate the complexities of cross-border commerce.

The following case study exemplifies these trends and the need to diversify businesses’ payment methods.

Case Study

To examine the correlation between payment flexibility and increased sales, a survey including 209 payment decision-makers was conducted. The findings demonstrate a strong link between offering diverse payment methods and driving sales growth, reinforcing the importance of payment flexibility in today’s economy.

Here’s what the survey found:

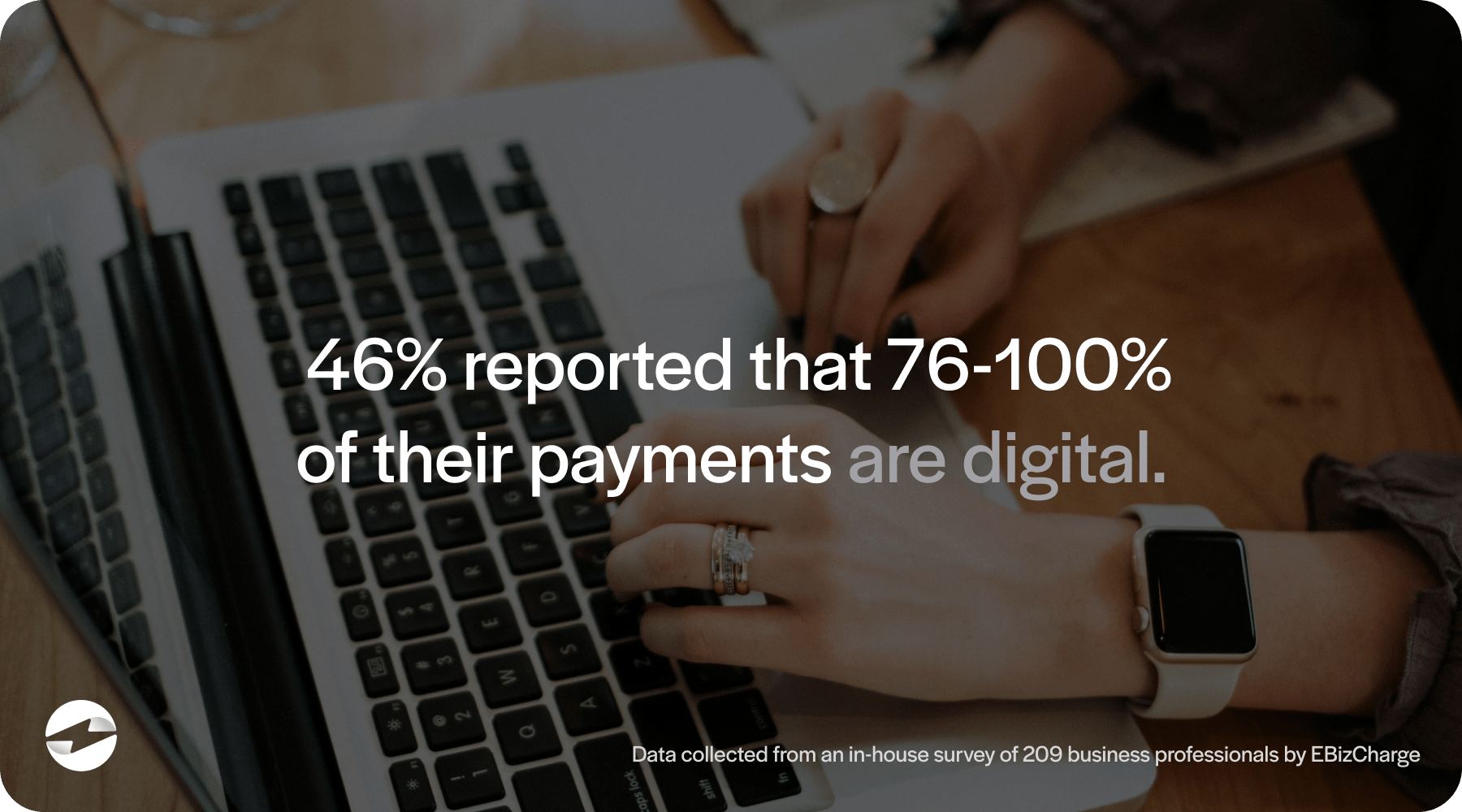

The frequency of digital transactions

The survey revealed that many businesses rely heavily on digital payments. When asked about the percentage of digital payments in their transactions, 46% reported that 76-100% of their payments are digital. An additional 21% stated that 51-75% of their payments are digital.

The impact of offering multiple payment options on sales volume

When asked if offering more payment options increases sales, 84% of respondents agreed, with only 4% of the sample size in disagreement and the remaining 12% impartial.

The most popular payment methods

The survey also explored which payment methods customers prefer. The findings indicate a clear hierarchy, with 54% of participants identifying credit and debit as the most preferred option. 27% listed eChecks or ACH payments as their preferred payment option, while digital wallets and bank transfers each accounted for only 6%. Emerging methods like Buy Now Pay Later (BNPL) accounted for only 2% and the remaining 5% stated that their preferred payment method was not listed.

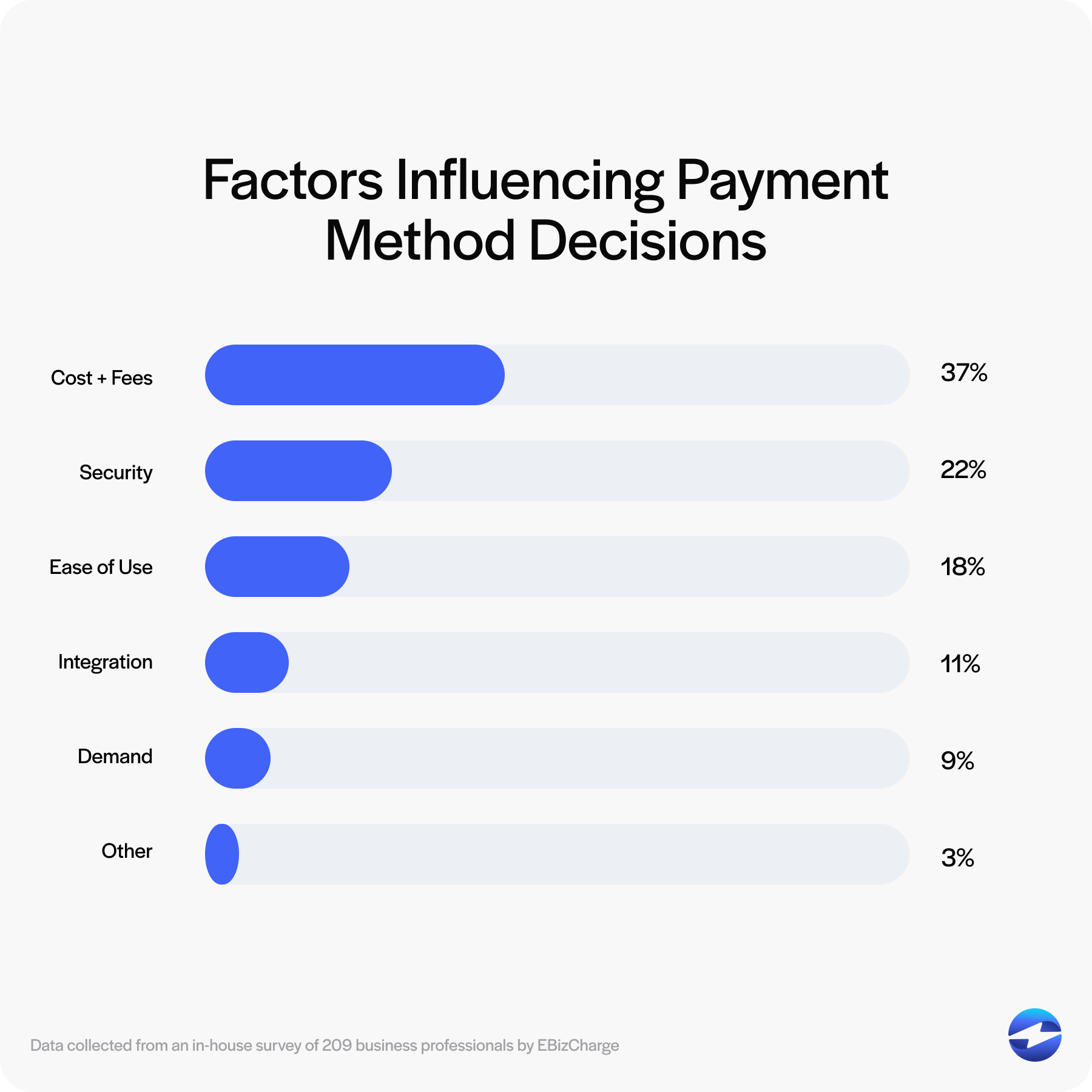

Factors influencing payment method decisions

When selecting payment types to offer, 37% of respondents stated that cost and fees were the most critical factor. 22% stated that security was their biggest concern while 18% stated ease of use. 11% stated integration with existing systems as their biggest concern, 9% stated customer demand, and the remaining 3% stated other reasons.

The findings of this study concluded that offering more payment methods effectively boosts sales. The next section will explain how.

How offering more payment methods boost sales

Adding different payment methods plays a vital role in customer acquisition and retention. This improves conversion rates, customer trust, and the overall customer experience.

Increased conversion rates

Providing a variety of payment methods leads to higher conversion rates. When customers can choose their preferred payment method, they’re more likely to complete their purchase. This increases the company’s click-through rates and, in turn, boosts annual revenue. Many customers abandon their carts when their preferred payment methods are unavailable. With multiple gateways, businesses see fewer abandoned carts and more successful transactions.

Broader customer reach

A wide variety of payment methods helps reach more potential customers. For instance, accepting credit cards and other payment methods like PayPal can make your business attractive to more shoppers. American Express users, for example, feel more included if they see their card accepted. This approach to payment flexibility ensures you don’t miss out on any potential sales. By broadening your payment options, your sales team can appeal to a diverse audience.

Enhanced customer trust

Customer trust is crucial for long-term growth. Offering flexible payment options can enhance trust in your business. Customers feel confident when they know their payment details are secure. A reliable payment service provider can ensure transaction security, boosting customer loyalty. Customers who trust your payment process are more likely to return, becoming loyal customers. Regular follow-up emails and positive customer feedback further strengthen these customer relations.

While understanding how offering more payment methods boosts sales, it’s important to note that this avenue comes with challenges.

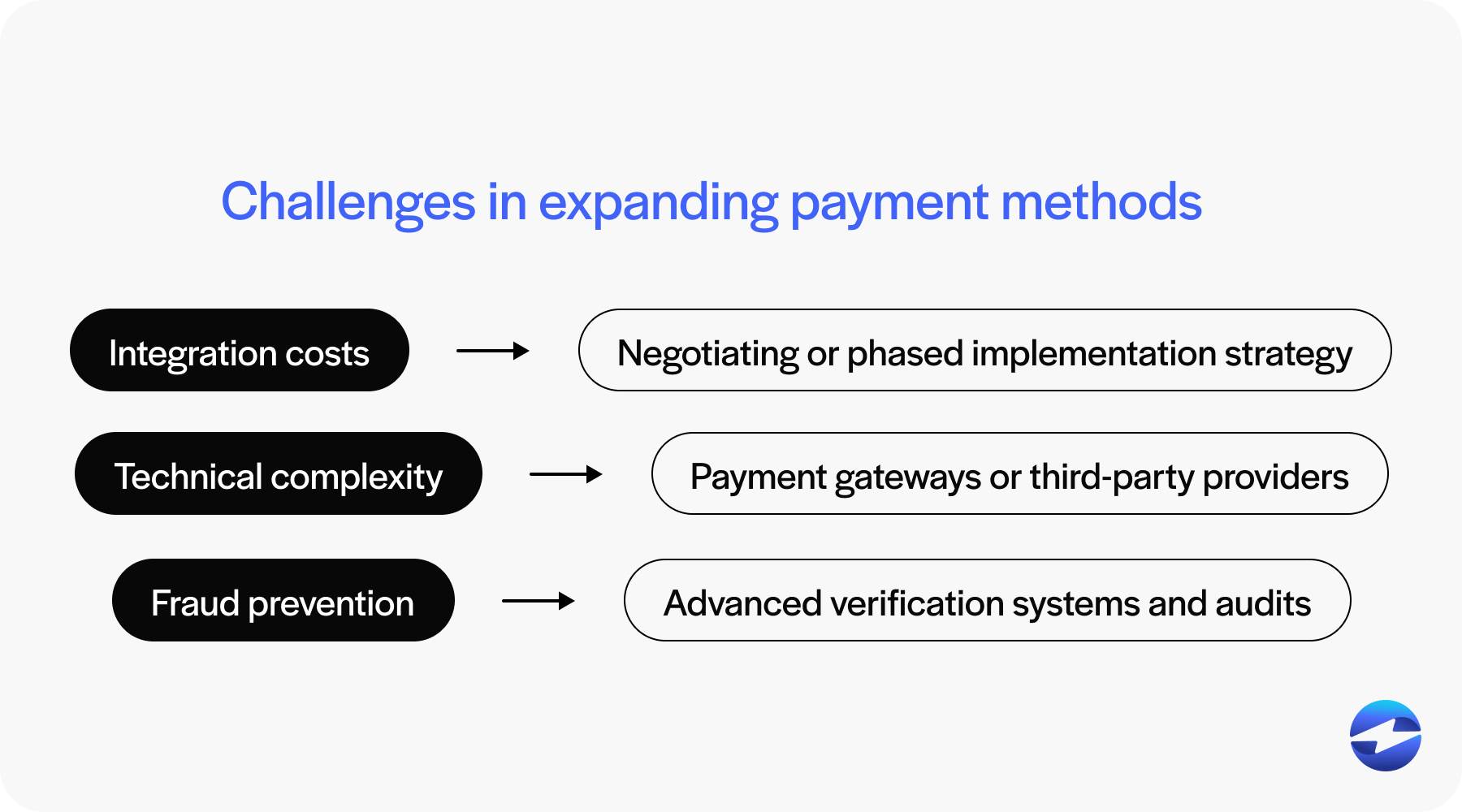

Overcoming challenges in expanding payment methods

While expanding payment options can help increase sales by attracting more potential customers, it does come with challenges. By addressing these hurdles, businesses can offer flexible payment options and enhance the checkout experience.

Here’s how they can tackle common issues:

Integration costs

Businesses can mitigate these expenses through careful budget planning, allocating funds based on annual revenue. Negotiating with payment service providers for better terms and potential discounts can also reduce costs. Another effective approach is a phased implementation strategy, starting with the most requested payment options and gradually expanding as the business grows.

Technical complexity

Businesses can simplify this process by using payment gateways, which provide all-in-one solutions and minimize the need for custom development. Third-party providers are also an excellent choice, as they handle multiple payment methods and streamline implementation. Additionally, designing simplified and user-friendly checkout systems reduces technical challenges and enhances the customer journey.

Fraud prevention

Expanding payment options may also increase the risk of fraud, making robust security measures essential. Businesses can protect themselves by employing advanced verification systems, such as requiring the CVV for credit card transactions. Ensuring all payment details are encrypted adds another layer of security. Regular security audits can help detect and address vulnerabilities early, preventing potential issues.

By effectively addressing these challenges, businesses can boost conversion rates, strengthen customer relationships, and build a more efficient payment system.

With these challenges in mind, it’s beneficial to adhere to best practices when expanding payment options.

Best practices for expanding payment options

While offering diverse payment methods provides numerous benefits, implementing them requires a thoughtful approach that considers customer preferences, market trends, security, and technological advancements. Following best practices for implementation will promote a seamless transition for your business and its customers.

When expanding payment options, businesses should:

- Analyze customer preferences and market trends.

- Partner with reputable payment processors or platforms.

- Start with widely used methods and gradually expand.

- Educate customers on the security and benefits of new payment options.

- Continuously monitor and adapt to payment technology advancements.

1. Analyze customer preferences and market trends. Understanding what your customers want is crucial. Analyzing customer preferences and market trends helps you offer payment methods they are likely to use. This analysis can guide your sales team in choosing the most popular method. It helps anticipate customer needs and adapt to their buying journey. It ensures that your payment flexibility aligns with current trends, which can lead to higher annual revenue.

2. Partner with reputable payment processors or platforms. Choosing a reputable payment service provider ensures security and efficiency. These providers offer secure payment gateways, enhancing the customer experience. Such partnerships are key to maintaining customer relations and ensuring smooth transactions. It also reduces risks related to payment fraud, thus protecting your business and your loyal customers.

3. Start with widely used methods and gradually expand. Begin by offering payment options like credit and debit cards. Businesses should avoid overwhelming systems by starting small. As you grow comfortable, expand to less common methods. This gradual approach helps manage costs and adapt to new technologies efficiently. It allows sales reps to master each method, improving the overall payment process and customer satisfaction.

4. Educate customers on the security and benefits of new payment options. When introducing new payment methods, educate your customers about their safety and benefits. Use email marketing and follow-up emails to communicate these points. Clear information builds trust and encourages customers to try new options. Highlight how these methods streamline their checkout experience and enhance the security around their payment details. Education fosters confidence, leading to better customer acquisition and retention.

5. Continuously monitor and adapt to payment technology advancements. Stay informed on the latest in payment technology. This enables adaptation to advancements that can increase sales. Regular updates ensure your payment options remain competitive. By keeping up with changes, your business can offer solutions that meet customer expectations and maintain high conversion rates. This adaptability is essential for long-term revenue growth and sustaining a strong customer lifetime value.

By following these steps, business owners can effectively expand payment options, cater to a wide variety of customer needs, and drive significant revenue growth.

To facilitate transactions with multiple payment options, look for comprehensive payment solutions that allow you to accept your desired payment methods.

Diversify your payment options with EBizCharge

For businesses seeking to expand their payment options, platforms like EBizCharge provide an excellent solution.

EBizCharge offers tools that streamline the sales process and enhance the checkout experience through features such as payment flexibility, seamless integration with existing gateways, secure transactions, and customer convenience. These capabilities allow businesses to accept various payment methods, simplify the customer journey, and protect payment details efficiently. By delivering flexible payment options, businesses not only improve conversion rates but also drive annual revenue growth and attract new customers.

Leveraging platforms like EBizCharge aligns with smart marketing strategies, ensuring smoother customer relationships and fostering loyalty. As sales teams utilize these tools, businesses can expect increased positive feedback, higher click-through rates, and greater overall success. Ultimately, EBizCharge supports a seamless transaction experience for businesses and their customers, paving the way for sustained growth and customer satisfaction.