Blog > Debit Card Surcharging: Is It Legal?

Debit Card Surcharging: Is It Legal?

If you’ve ever wondered whether it’s legal to add a surcharge when someone pays with a debit card, you’re not alone. It’s a common question – especially for business owners looking for ways to manage rising processing fees.

The short answer? No, debit card surcharging isn’t legal in the U.S. But that’s just the tip of the iceberg. The rules behind it come from a mix of card network policies, federal law, and state regulations.

This article will break it all down, explain where the restrictions come from, and help you make sense of what’s allowed – and what’s not.

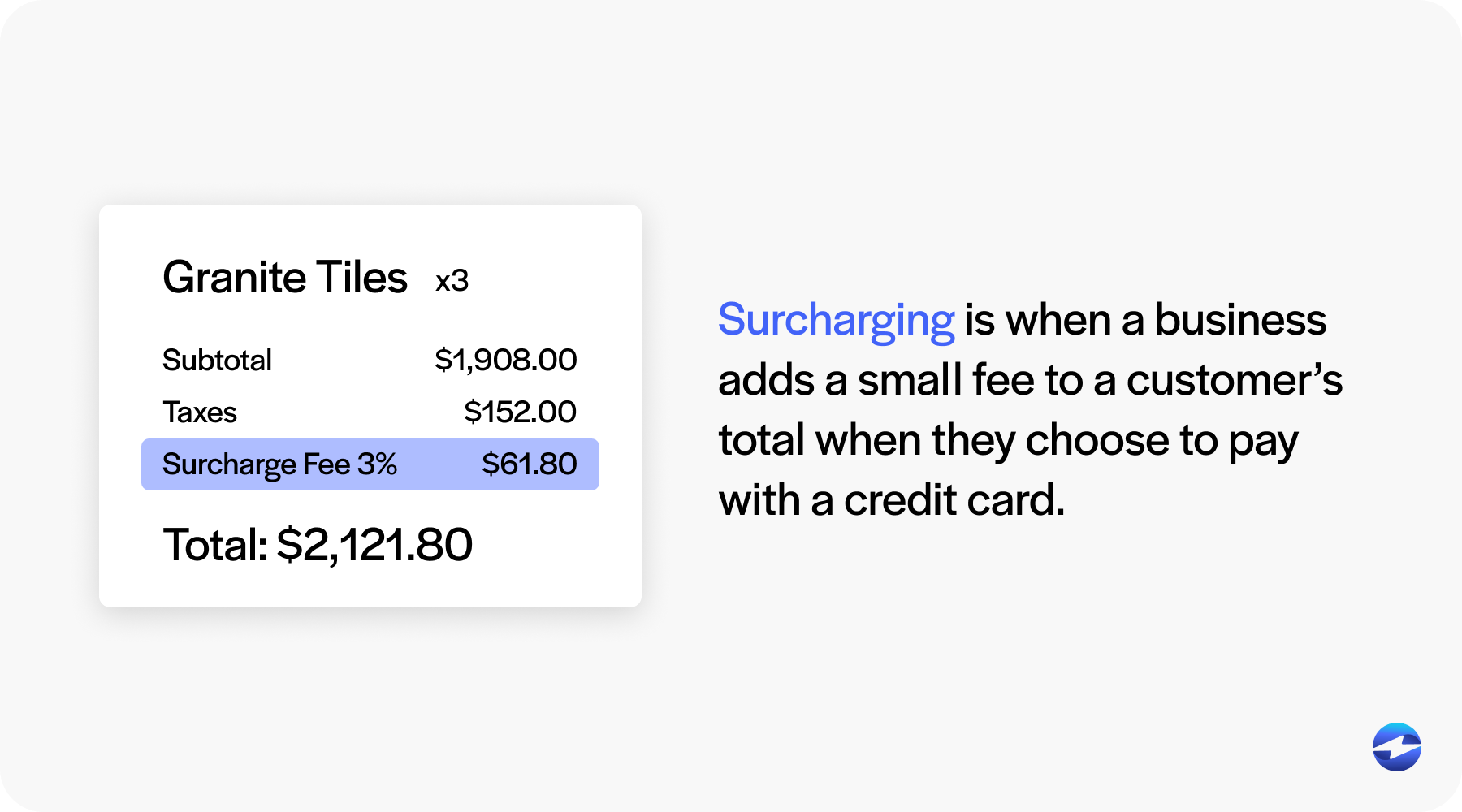

What is a surcharge?

Surcharging is when a business adds a small fee to a customer’s total when they choose to pay with a credit card. It’s usually meant to cover the cost of credit card processing – the fees that businesses pay every time someone swipes, dips, or taps their card.

The idea is pretty straightforward: passing along the cost of accepting credit cards instead of absorbing it. For small businesses, especially those with tight margins, even a 2% or 3% fee per transaction can add up over time. Surcharging is one way to make those costs more visible – and to shift it, at least partially, to the person choosing the more expensive payment method.

Let’s say you buy a $50 item, and the store has a 3% surcharge for credit card use. You’d end up paying $51.50 if you used your credit card instead of cash or a check. That $1.50 goes toward offsetting what the business must pay the processor or card networks, like Visa or Mastercard.

The regulations surrounding surcharging can be a bit confusing, and non-compliance has consequences. So, it’s important to understand these rules and regulations in their entirety.

Can you surcharge a debit card?

No, you cannot surcharge a debit card in the United States. All major card networks, including Visa, Mastercard, American Express, and Discover, prohibit merchants from adding surcharges to debit card transactions, even when the card is processed as credit. This restriction is reinforced by the Durbin Amendment, a federal law that regulates debit card fees. Credit card surcharging, however, is permitted in most states when disclosed properly.

If you run a business – or are someone who pays attention to the line items on your receipts – it helps to know how surcharging rules work. If you’re a merchant trying to stay compliant or a consumer just trying to make sense of what you’re being charged, it’s worth understanding where these rules come from and what they mean.

The thing is, those rules aren’t all in one place. Some come from card networks. Others are embedded into federal laws. And then there are state laws, which can change everything depending on where you do business.

Here’s how the main layers of regulation break down:

Card network rules

Most of the guidelines around surcharging don’t come from lawmakers – they come from the card networks themselves. These networks set the terms for how their cards can be used, and if you want to accept their payments, you agree to play by their rules.

Most networks do allow credit card surcharging – but they don’t leave it wide open. Usually, there’s a cap: you can’t charge more than 4% of the transaction amount. You must clearly disclose the surcharge before the customer pays. That means signage at the register, notices on receipts, and online alerts if you’re an eCommerce business.

Debit cards are a different story. Even if a debit card is run “as credit” – something customers often do to avoid entering a PIN – the networks still classify it as a debit transaction. And surcharges on debit cards are a no-go across all the major card brands.

Federal law

In addition to card network rules, there are federal laws that govern how surcharging works in the U.S. One of the most significant is the Durbin Amendment – part of the Dodd-Frank Act, which was passed after the 2008 financial crisis.

The Durbin Amendment mainly deals with debit card fees. It limits how much banks can charge businesses to process debit card transactions, especially when the bank has more than $10 billion in assets. This was intended to reduce costs for merchants – and in many cases, it did.

But here’s where it gets tricky: the law doesn’t say much about surcharges directly. It doesn’t ban them, but it doesn’t give businesses a free pass either. Instead, it creates a framework that requires businesses to follow card network rules and local laws. So federal law gives a foundation, but real enforcement power often lies elsewhere.

State-level laws

This is where things get complicated. Some states are totally fine with surcharges as long as you disclose them properly. Others, like California or New York, have had surcharging laws that either ban surcharging outright or impose strict conditions.

That means a business operating legally in one state might be breaking the rules just by doing the same thing across state lines. In places where surcharges are allowed, you might be required to display the cash price and card price side by side. In others, any extra charge could be considered deceptive – or even illegal.

These laws are also constantly evolving. Court challenges have overturned some of the older bans, and new legislation pops up regularly. Compliance with surcharge laws requires constant monitoring of relevant rules and regulations.

Why debit surcharging is generally prohibited

If you’re wondering why you rarely – if ever – see a debit card surcharge at checkout, there’s a reason for that. In most cases, adding a fee to a debit card transaction just isn’t allowed. It’s something that’s generally off the table for U.S. merchants.

This restriction primarily stems from the Durbin Amendment. But the law also led to a stricter line around debit card surcharges. Unlike credit cards, which can incur additional fees under certain conditions, debit cards fall into a different category. They’re typically cheaper to process, and they pull funds directly from a bank account. So, there’s no need for an extra charge.

Why is this rule in place?

There are a few reasons behind the restriction:

- Consumer protection comes first. Lawmakers didn’t want people to face extra costs just for using a debit card, which is often the most straightforward and debt-free way to pay.

- Debit is safer for the average person. It doesn’t rack up interest. It’s tied to money the customer already has. By keeping it surcharge-free, there’s an incentive to use it over credit.

- It keeps things simple across the board. While states can still make their own rules, this restriction from the federal level sets a basic, consistent standard. It helps avoid confusion for both merchants and customers.

If you’re unsure about how these rules apply to your business, it’s worth taking the time to research.

Consequences of non-compliance

Non-compliance with surcharging rules and regulations can cause serious problems. If you apply a surcharge when you’re not supposed to – especially on a debit card – you could face fines, lawsuits, or even lose your ability to accept card payments.

Breaking those rules can result in higher processing fees or having your merchant account shut down entirely. On top of that, there’s your reputation to think about. Customers notice extra fees, and if they feel they’ve been charged unfairly, they may not come back – or worse, they may spread the word.

Different states have different penalties. For example, California and New York can impose civil fines or even take legal action against businesses that surcharge illegally. In Florida, you might be exposed to class-action lawsuits. That’s why staying up to date on both local laws and network rules is important. It’s not just about compliance – it’s about protecting your business and maintaining trust with your customers.

Simplifying surcharging with EBizCharge

For businesses seeking a compliant and streamlined way to implement credit card surcharging, EBizCharge provides a reliable and effective solution. Designed to help merchants recover the cost of credit card processing, EBizCharge’s surcharging feature automates the process while ensuring adherence to card network rules and applicable state laws.

One of the key advantages of EBizCharge is its intuitive interface, which allows merchants to easily configure surcharge settings and apply them automatically to qualifying credit card transactions. This automation not only reduces the risk of manual errors but also helps ensure that surcharges are applied consistently and within the bounds of legal and regulatory requirements.

Additionally, EBizCharge integrates seamlessly with a wide range of payment systems and ERP software, including QuickBooks payment processing, NetSuite credit card integration, and Acumatica payment gateway solutions. This makes it a practical option for businesses of all sizes that want compliant surcharging built directly into their existing workflows. Dedicated support is also available to assist with implementation, configuration, and ongoing use.

EBizCharge takes the guesswork out of surcharging by giving businesses in the U.S and Canada a simple, compliant way to manage costs without the headache.