Blog > Credit Card Surcharging for Online vs. In-Person Payments

Credit Card Surcharging for Online vs. In-Person Payments

If you’ve ever thought about adding a fee to offset credit card processing fees, you’re not alone. Many businesses—both brick-and-mortar and online—are turning to credit card surcharging as a way to manage the rising cost of accepting credit card payments. However, how you apply a credit card surcharge fee depends a lot on how you accept payments.

There’s a big difference between surcharging in person versus online. Understanding those differences can help you avoid compliance headaches, improve the customer experience, and recover more of what you’re losing to payment processing costs. This guide is here to help you understand how credit card surcharging works in both settings—and what you need to consider before you move forward.

What is credit card surcharging?

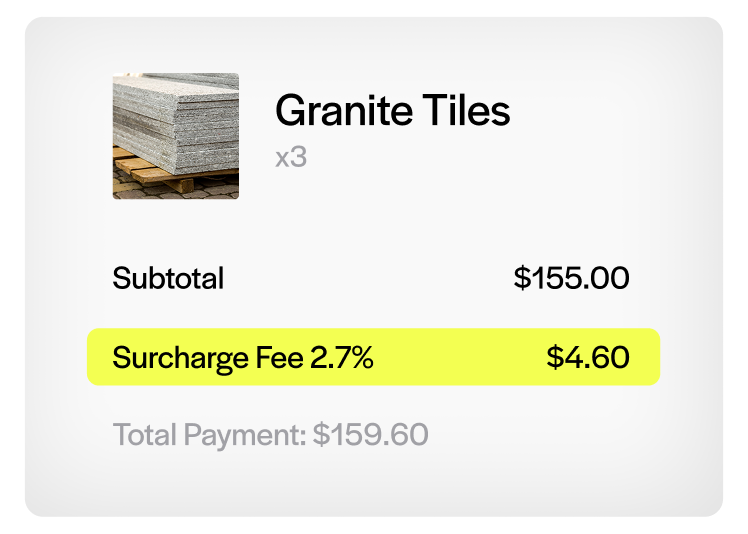

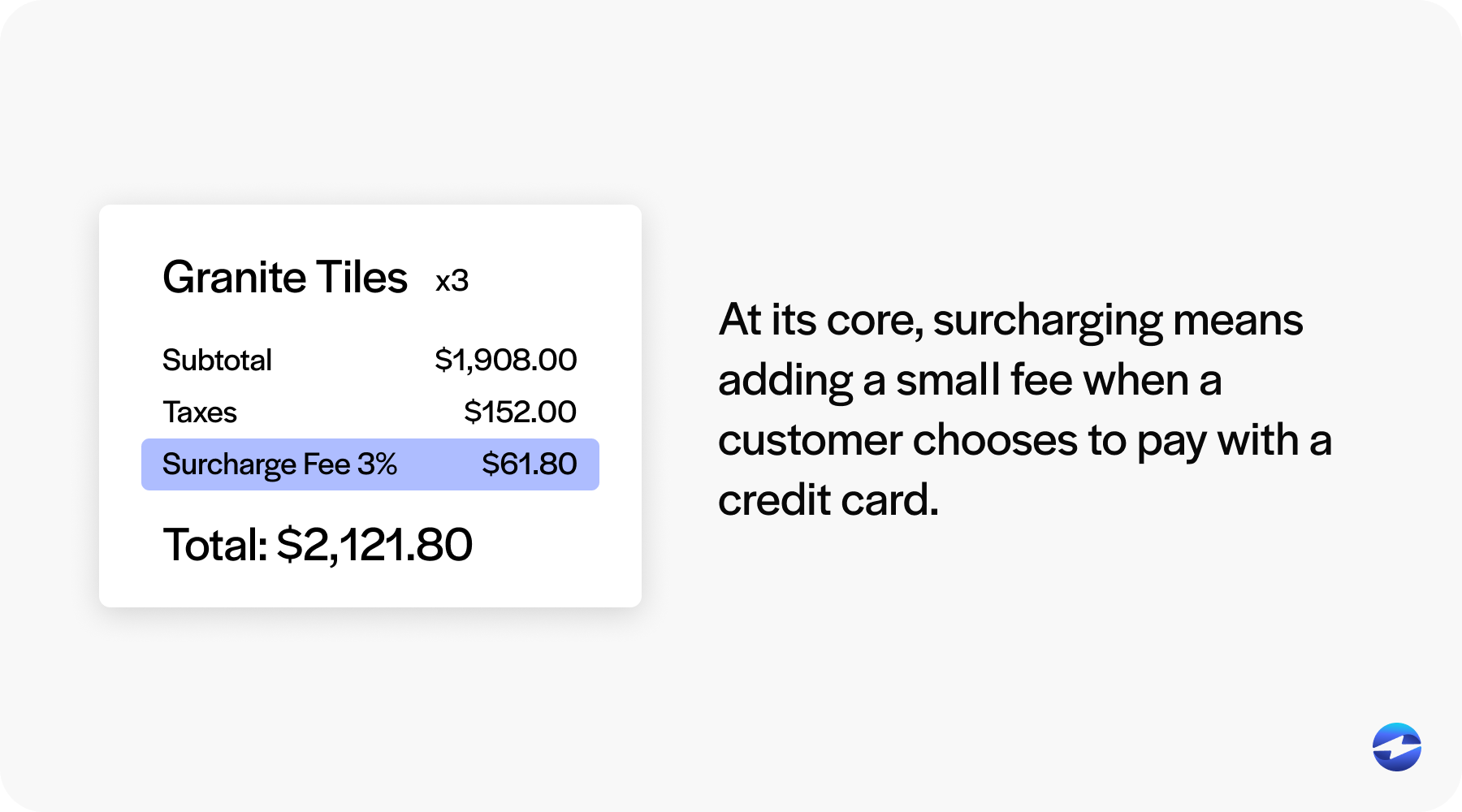

At its core, surcharging means adding a small fee when a customer chooses to pay with a credit card. The credit card surcharge fee is meant to help cover the credit card processing fees that merchants normally absorb.

It’s important not to confuse this with a convenience fee. The difference between a credit card surcharge vs. convenience fee comes down to why and when the fee is applied. A surcharge is only applied to credit card transactions. A convenience fee, on the other hand, is charged when a customer uses an alternative method of payment (like paying online instead of in person) and can apply regardless of the card type.

Businesses choose to implement credit card surcharging to reduce overhead, stay profitable, and avoid raising prices across the board. However, because adding a surcharge for credit card payments is regulated by card networks and by local laws, it’s essential to know the rules.

Surcharging for in-person payments

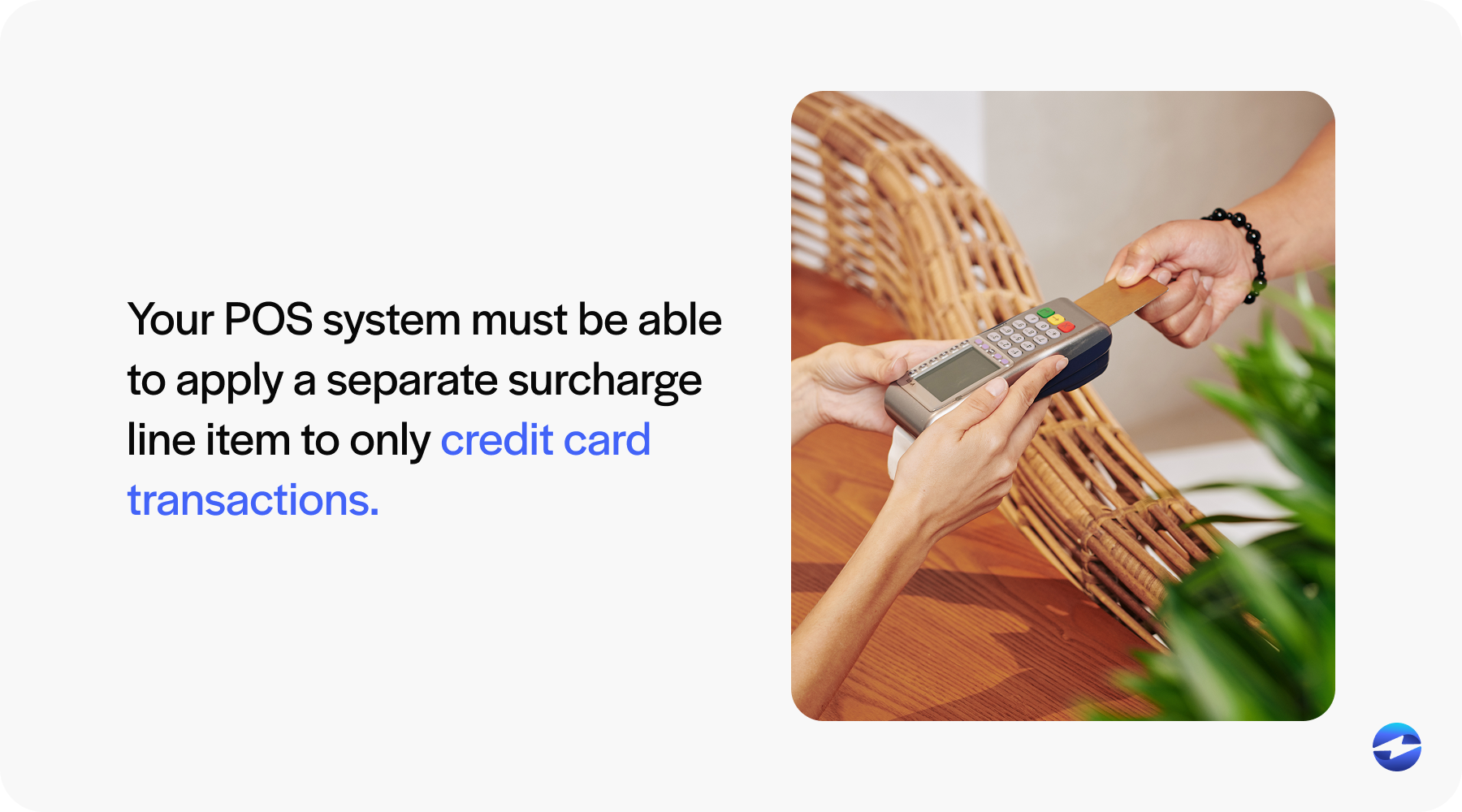

In a brick-and-mortar setting, credit card surcharging typically happens at the register. When a customer swipes, dips, or taps their card, the credit card surcharge fee is added at checkout. But to do this correctly, a few things need to be in place.

First, your point-of-sale (POS) system must be able to apply a separate surcharge line item only to credit card transactions. You’ll also need to ensure your hardware can support this setup without applying the fee to debit cards or other non-credit payments.

Second, clear signage is key. You must inform customers before they enter a transaction that adding a surcharge for credit card payments is your policy. Signs near the entrance and at the payment terminal help with this—and they’re often required.

There are some advantages to in-person surcharging: you can explain the fee in real-time and answer questions. However, you’ll also want to train your team so they can handle those conversations professionally.

The challenge? Many POS systems don’t handle credit card surcharging out of the box. You may need to update your setup or work with a payment processor that offers compliant payment solutions for retail environments.

Surcharging for online payments

If you run an eCommerce store or take payments remotely, surcharging looks a little different.

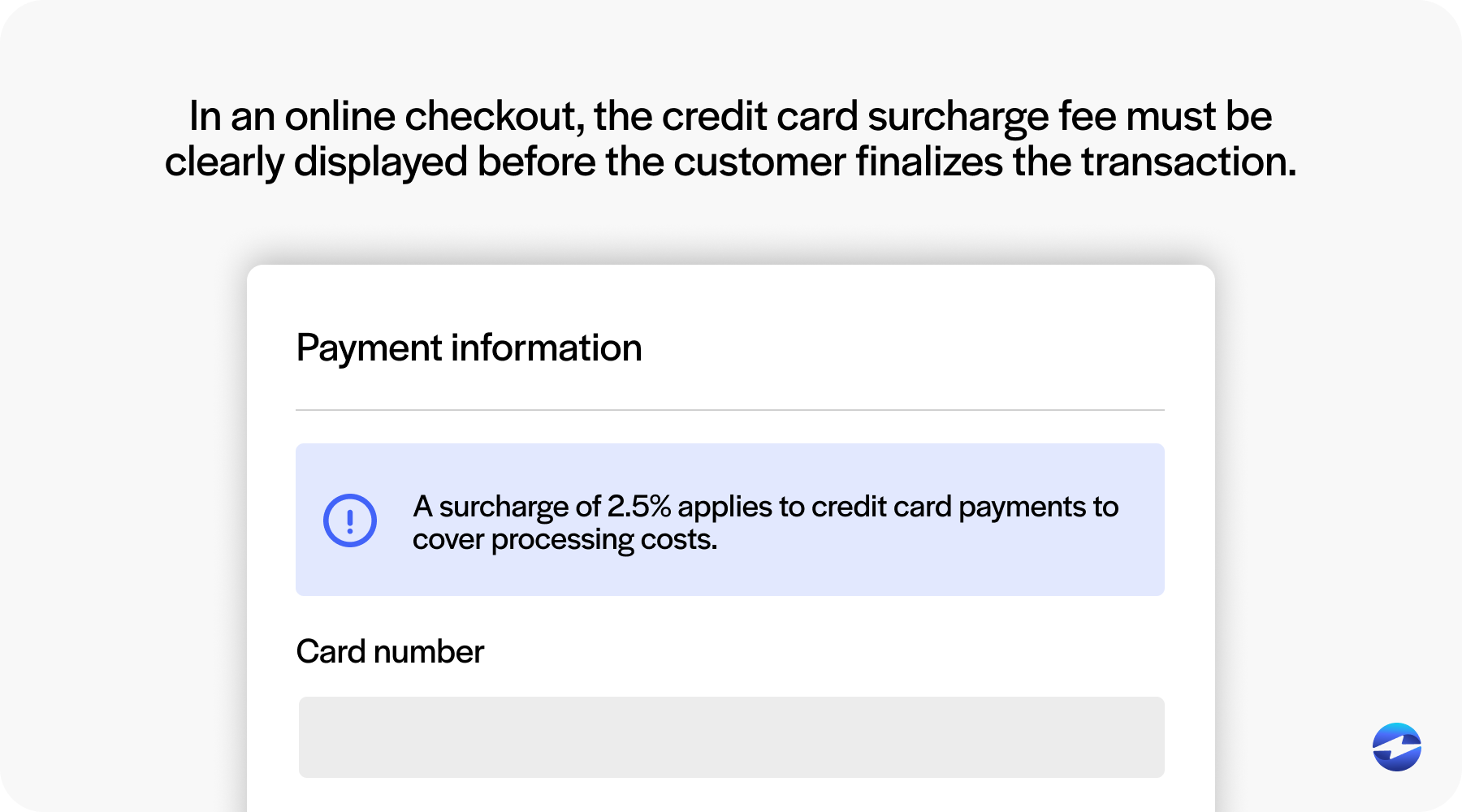

In an online checkout, the credit card surcharge fee must be clearly displayed before the customer finalizes the transaction. That means it should show up on the payment page—not just after they’ve paid. Transparency is critical here, both for compliance and customer trust.

Your payment processor or gateway must support configurable surcharges and distinguish between card types. If your system can’t isolate credit card transactions from debit or prepaid cards, you risk applying the fee incorrectly—which could lead to chargebacks or policy violations.

One of the advantages of credit card surcharging online is automation. Once it’s set up properly, the system can handle the calculations, disclosures, and receipts with minimal manual effort. But the downside is that you lose the opportunity to explain the fee personally—so the way you present it on your site matters a lot.

Key differences between online and in-person surcharging

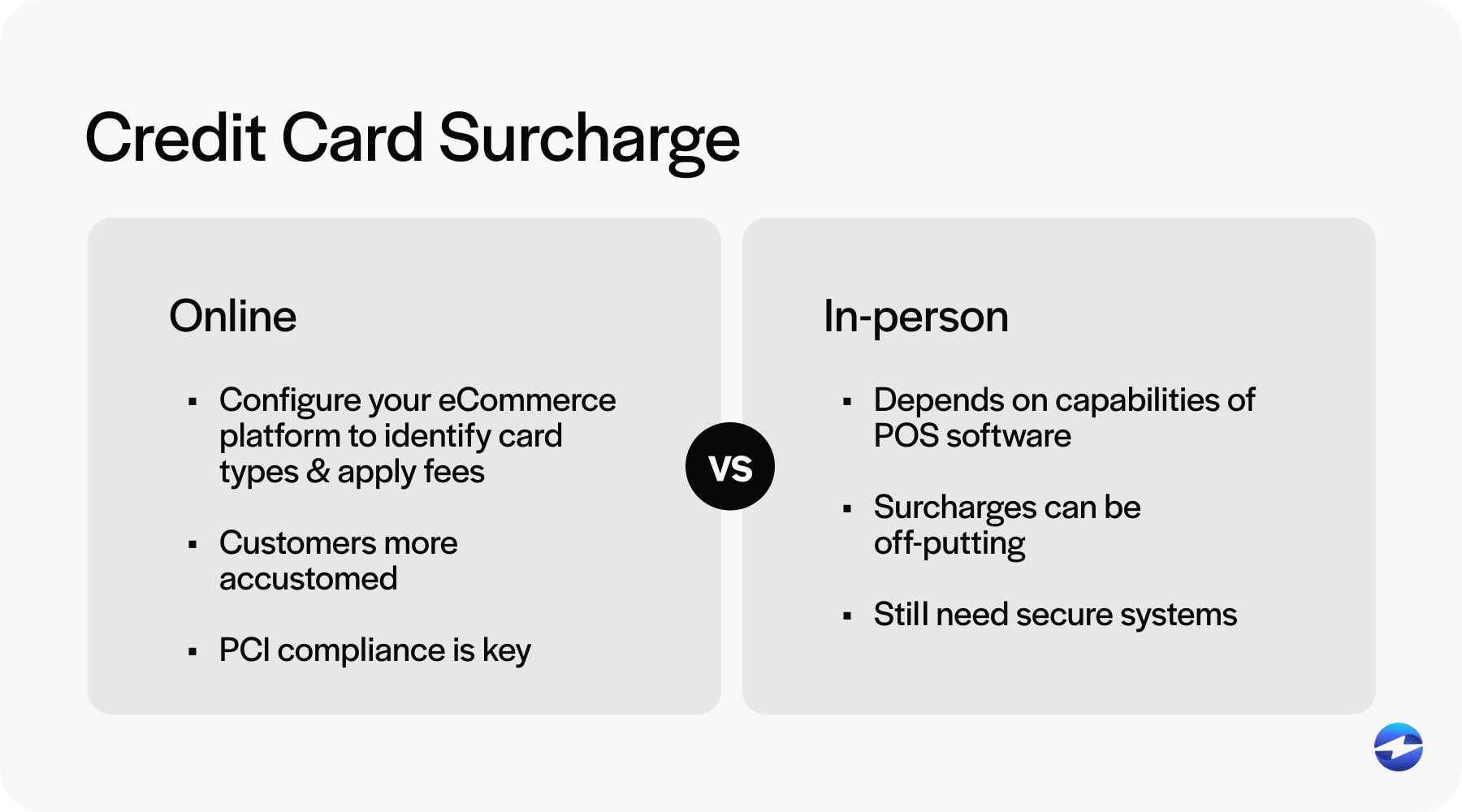

The goal is consistent—helping businesses recover credit card processing costs—but the way you handle credit card surcharging can vary significantly depending on whether the payment happens online or in person.

- Compliance setup: Online surcharging often requires you to configure your eCommerce platform or payment gateway to identify card types and apply the fee only to eligible credit card transactions. It also involves showing the fee transparently before payment is completed. In contrast, in-person surcharging depends heavily on the capabilities of your POS hardware and whether it can cleanly add a separate surcharge line and distinguish credit from debit cards. You’ll also need to consider where and how to display customer-facing signage to comply with card brand rules.

- Customer expectations: Customers are more accustomed to seeing service or processing fees during online checkouts. However, when shopping in a physical store, an unexpected surcharge at the terminal can feel off-putting. Managing that perception is important—clear signage and friendly, informed staff can make a big difference.

- Security and fraud: Online transactions carry additional risks related to fraud and chargebacks. This makes it even more important that your payment solution supports PCI compliance and offers secure transaction processing. While fraud is less common in-store, you still need secure systems and employee protocols to protect sensitive data.

- Examples: Let’s say you run a boutique clothing shop. In-store, you might use updated POS software and post signage near the door and checkout counter. For your online store, you could install a payment plugin that automatically detects credit card payments and adds the appropriate fee, with clear disclosure before the customer clicks “Pay.”

By understanding how these factors differ across environments, you’ll be better prepared to implement credit card surcharging in a way that’s both compliant and customer-friendly.

Best practices for both channels

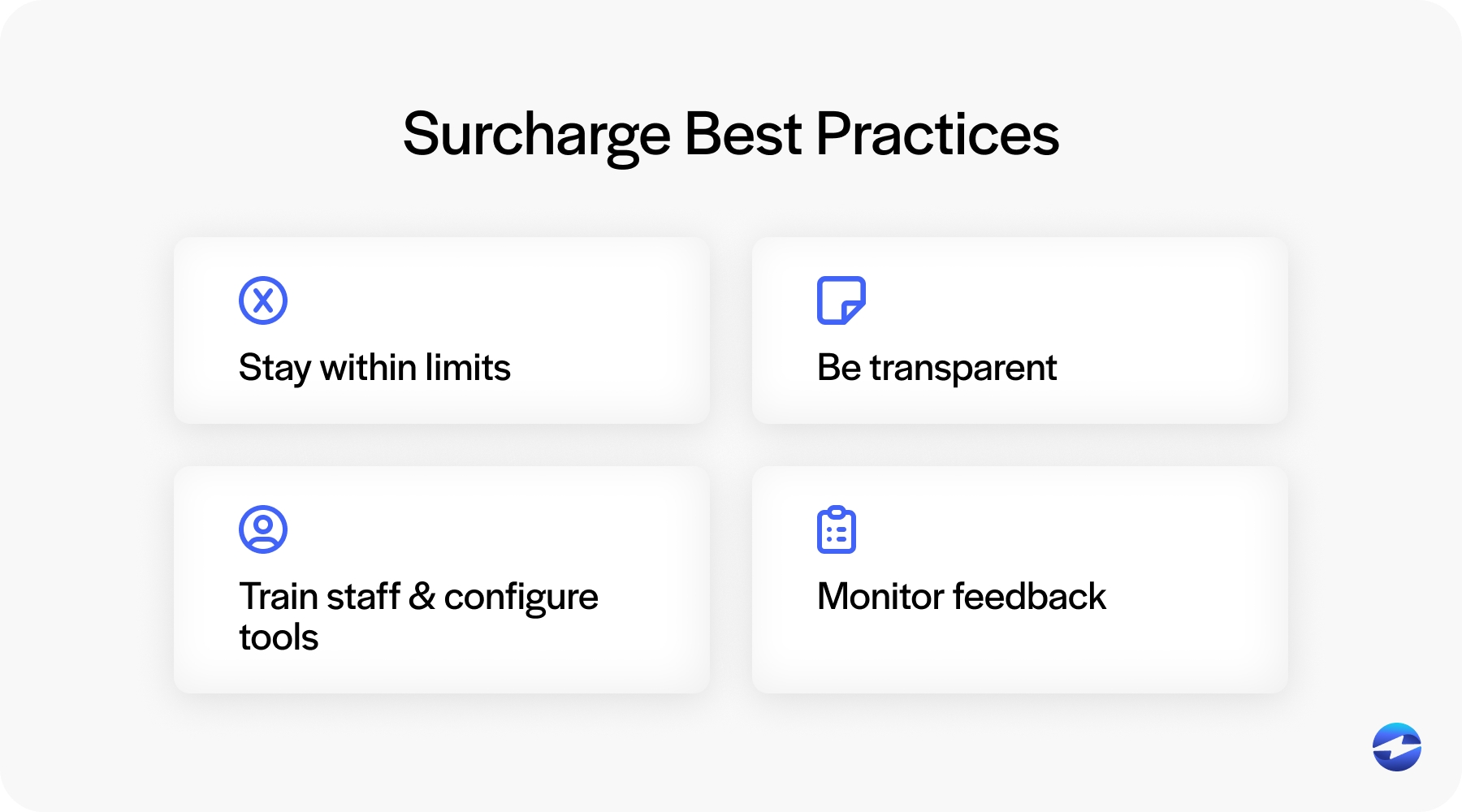

No matter how you apply a credit card surcharge fee, a few best practices apply across the board—and taking time to get these right can save you from compliance issues and unhappy customers.

- Stay within limits. Most card networks cap surcharges at 3% (or less in some regions), and you should never exceed your actual credit card processing fees. Going above the cap can result in fines or the loss of your merchant account.

- Be transparent. Transparency is the foundation of any successful surcharging strategy. Whether you’re using in-store signage or pre-checkout notifications online, your customers should know what to expect before they complete the transaction. Clear and early disclosure helps set expectations and avoid disputes.

- Train staff and configure tools. In physical stores, make sure your employees are trained to explain why the credit card surcharge fee is being applied and how it helps control rising payment processing costs. Online, it’s about making sure your payment processor provides the flexibility to apply surcharges only when appropriate—and to the correct card types.

- Monitor feedback. Even if you’ve implemented everything by the book, customers may still have concerns or questions. Monitor their feedback regularly, especially in the early days after implementing credit card surcharging. Their input can help you fine-tune your language, policies, or tech settings.

Choosing a flexible payment solution that supports both online and in-person surcharging not only simplifies your setup but ensures you’re equipped to stay compliant as rules evolve and customer expectations shift. A proactive approach today can help you avoid costly changes later.

How EBizCharge makes surcharging easy

Credit card surcharging can be a smart way to recover credit card processing fees—but applying it correctly, whether in-store or online, requires the right tools and support.

EBizCharge simplifies this process for merchants by offering a fully integrated payment solution that supports compliant credit card surcharging in both environments. For in-person payments, EBizCharge enables point-of-sale systems to automatically apply the appropriate credit card surcharge fee, ensuring it only triggers on eligible transactions. The system also handles line-item displays and helps merchants meet signage and disclosure requirements.

For online payments, EBizCharge allows businesses to configure surcharges within their checkout flows, ensuring customers are aware of and understand the fee before completing a transaction. It also supports dynamic card-type detection to prevent errors like surcharging a debit card.

Across both channels, EBizCharge gives merchants the confidence that they’re staying within network rules, local laws, and customer expectations. From automated compliance safeguards to seamless integration with accounting platforms, EBizCharge helps businesses manage payment processing with ease.

In short, the right payment processor can turn credit card surcharging from a hassle into a practical, compliant strategy for offsetting costs—while keeping the customer experience intact.