Blog > Are Credit Card Surcharges Taxable?

Are Credit Card Surcharges Taxable?

Credit card surcharges are one of those things that seem simple at first but get complicated fast. If you’re a business owner thinking about passing credit card fees onto your customers you’re probably wondering: “Can I do this legally?” and more importantly “Do I have to pay tax on it?”

What Is a Credit Card Surcharge?

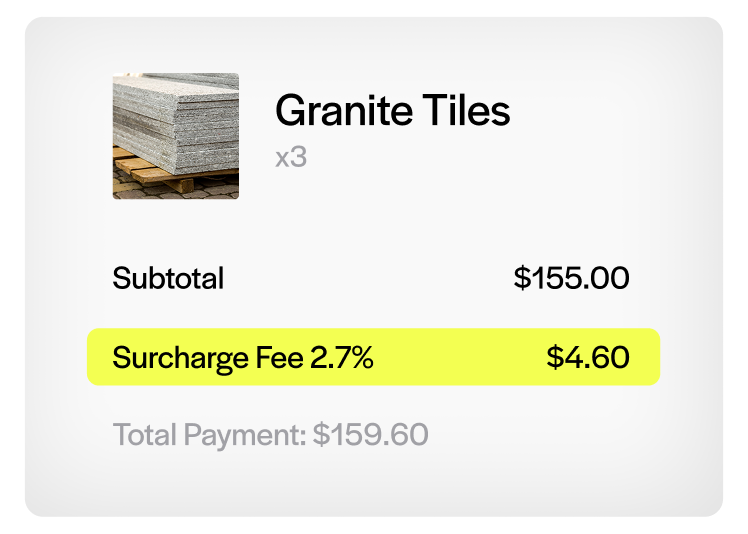

A credit card surcharge is an extra fee a business adds to a customer’s bill when they choose to pay with a credit card. It’s meant to cover the processing fees businesses get charged by card networks, typically 2-3% of the transaction.

These fees add up quickly, especially for small and midsize businesses that operate on thin margins. Instead of absorbing the cost, some businesses choose to pass it on to the customer in the form of a surcharge. It’s a way to level the playing field, especially when customers have the option to pay with cash, debit, or ACH.

You see surcharges at restaurants, gas stations, small retail shops, anywhere margins are tight, and every swipe matters. Some businesses post the surcharge on a sign near the register. Others include it on the receipt. Either way the intent is usually the same: to recover the cost of doing business with credit card companies legally.

After adding a surcharge many business owners forget how it’s treated in terms of tax laws. Not understanding those rules can lead to compliance issues and overall confusion.

Are Credit Card Surcharges Taxable?

Typically yes, credit card surcharges are taxable. Surcharges are generally treated as part of the total sale. That means they get lumped into the final amount sales tax is calculated on.

So if you sell a taxable product and add a 3% surcharge, that 3% is part of the taxable total. It’s not a separate untouchable fee. It’s just one more line item on the receipt.

Tax authorities, federal and state, generally consider the total transaction value when calculating sales tax. That includes the price of the product, shipping charges for some states, and yes surcharges.

One common mistake we see is thinking of the surcharge as something that floats outside the sale. It doesn’t. If the underlying sale is taxable the surcharge usually is too.

Are Credit Card Surcharges Subject to Sales Tax?

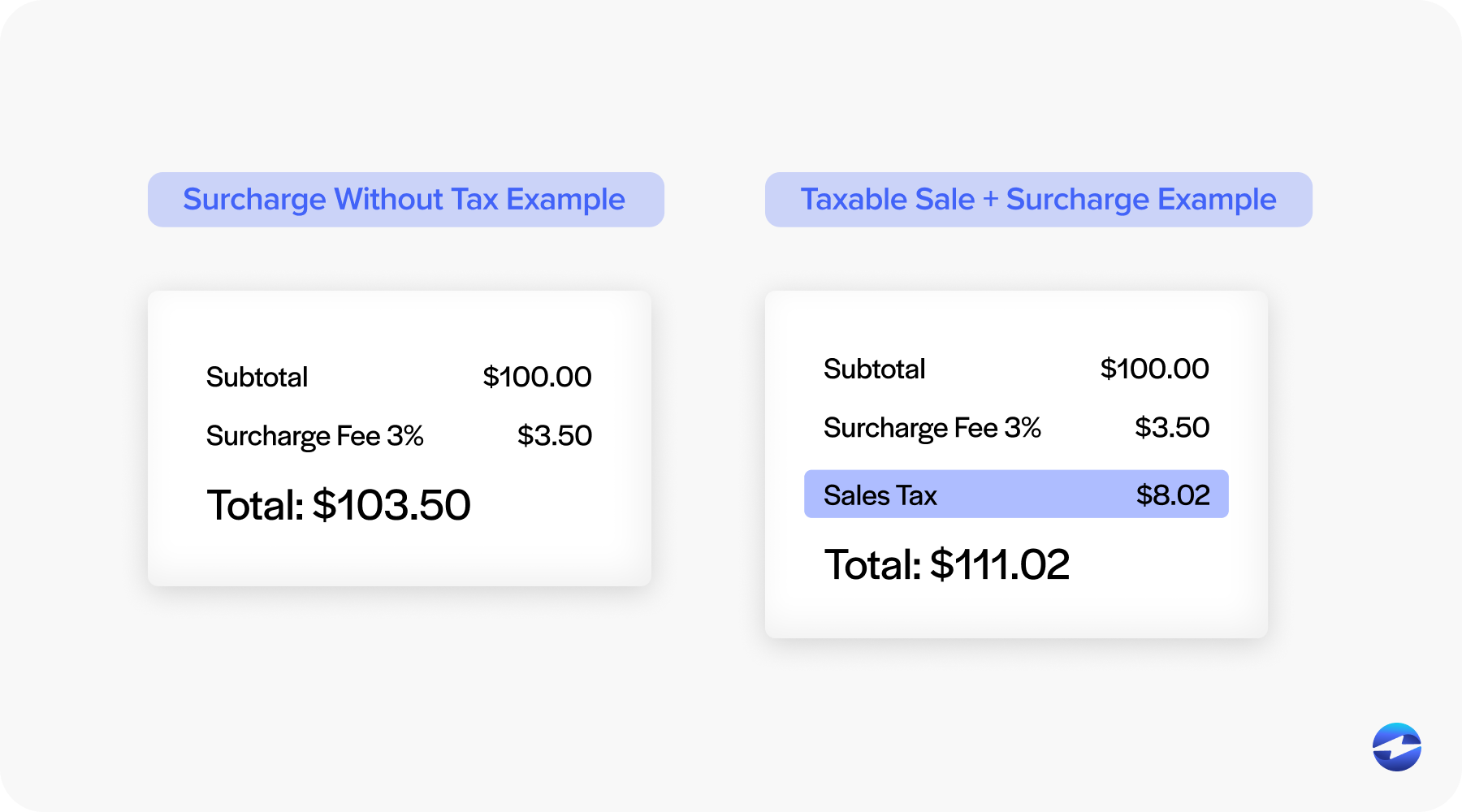

This is where wording matters. Being subject to sales tax means the surcharge is included when calculating sales tax. Let’s walk through a couple of examples:

- Taxable sale + surcharge: You sell a $100 taxable item and add a $3 surcharge. In most cases sales tax is applied to the full $103.

- Non-taxable sale + surcharge: If you’re selling something that’s not subject to sales tax like certain groceries or services depending on the state, then the surcharge generally isn’t taxed either.

State rules vary. For example:

- California treats surcharges the same as the sale. If the sale is taxable, the surcharge is too.

- Texas includes surcharges in the taxable amount.

Always check your state’s Department of Revenue for guidance or talk to a tax professional. The details change fast.

Is a Surcharge a Tax?

This trips up a lot of people. A surcharge feels like a tax because it’s an extra fee tacked onto the total, but it’s not a government-imposed tax. It’s a merchant-imposed fee to cover the cost of accepting credit cards. That legal distinction matters. If customers think you’re charging them an extra tax, they might get upset or think you’re doing something shady. That’s why it’s important to label and explain it clearly.

Saying “credit card surcharge” or “processing fee” is more accurate than calling it a “credit card tax” because the government doesn’t impose a surcharge. The business sets it. However even though a surcharge isn’t classified as a tax, authorities still often include it as part of the total amount that is subject to sales tax. In other words, the surcharge doesn’t get a free pass; it still plays a role in determining how the transaction is taxed. As we mentioned earlier, it is still often taxed just like the rest of the sale.

State-Level Tax Variations and Compliance Tips

Not every state has the same rules for credit card surcharges. Some states allow them with clear disclosure while others have heavy restrictions, and a few outright ban them. That means what works in one state might get you in trouble in another.

Take Connecticut and Massachusetts for example; they have strict laws that limit or ban surcharges altogether. Texas and Florida allow them as long as you’re transparent with customers. Then there are states with gray areas where the rules aren’t entirely clear or are still evolving based on court decisions and regulatory updates.

Adding to the complexity are card networks like Visa and Mastercard that have their own guidelines. These include caps on the surcharge amount and requirements for advance notice if you’re going to implement one. You’re not just juggling state law; you’re navigating multiple layers of compliance.

To stay on the safe side here are a few practical steps you can take:

- Check your state’s laws. Some states like Connecticut and Massachusetts restrict or ban surcharges. Others have no specific rules, but you still need to follow general tax and consumer protection laws.

- Post clear notices. Most states and all card brands require you to tell customers about the surcharge before the transaction. This includes signage at the point of entry and at the point of sale, both in-store and online.

- Train your staff. Make sure your team knows how to explain the surcharge and when it applies. Miscommunication at checkout can lead to unhappy customers or even chargebacks.

- Double-check tax settings. Make sure your POS system or invoicing software is set up to properly apply and tax the surcharge depending on the nature of the sale and your state’s rules.

- This is the part of surcharging that often gets overlooked. The rules can shift, and non-compliance can lead to fines, legal headaches, or customer trust issues. It’s easy to unintentionally overcharge or undercharge when things aren’t clearly defined in your system.

That’s why staying informed and proactive is important. Whether you’re just considering adding a surcharge or you already have one in place regularly, reviewing your approach can help keep you on solid ground. Navigating state laws, card brand rules, customer communication and tax compliance can be overwhelming to do alone. That’s where having the right payment processor can make all the difference.

How EBizCharge Helps Businesses Implement Surcharges

Manual surcharging can be a headache for many businesses. From calculating taxes to signage to point-of-sale system configuration, there are many moving parts and many opportunities for errors.

To simplify the process EBizCharge has built-in tools that remove much of the guesswork. The platform automatically applies surcharges where applicable, factors them into sales tax calculations and displays all details on the receipt.

This kind of automation ensures compliance, keeps financial records accurate, and reduces the operational load on staff. EBizCharge also has comprehensive reporting features that allow businesses to track surcharge revenue independently and make informed pricing and policy decisions moving forward.

Understanding the Tax Impact of Credit Card Surcharges

In most cases surcharges are taxable when the main product or service is. They’re not a separate tax, but they do count as part of the sale. Surcharging can be a smart way to offset credit card processing fees, but only if done correctly. If you’re adding surcharges, check your state laws, train your staff, and make sure your system is set up correctly.

If you’d like to skip the guesswork, talk to us at EBizCharge. We’ve helped thousands of businesses implement surcharges correctly, and we can help you too.