Blog > An Overview of Credit Card Reconciliation

An Overview of Credit Card Reconciliation

Understanding the intricacies of credit card reconciliation can mean the difference between financial clarity and chaos for businesses and individuals. This essential process not only safeguards your finances but also enhances your overall financial health.

This article will explore the ins and outs of credit card reconciliation, detailing its significance, benefits, and the various methods to carry it out effectively.

What is credit card reconciliation?

Credit card reconciliation is the process of matching and confirming credit card transactions recorded in financial records against a credit card statement to ensure accuracy and completeness.

Reconciliation helps verify that all transactions are legitimate, appropriately accounted for, and consistent with internal records and external statements from credit card companies, which can improve financial statement accuracy and minimize fraud risks or accounting errors.

The reconciliation process should be done regularly (ideally on a monthly basis) to keep financial records up-to-date and to identify any discrepancies quickly. Regular reconciliation helps finance and accounting teams quickly spot human errors, unauthorized transactions, or signs of fraud. It also aids in making informed decisions about financial management by ensuring that data is reliable and current.

Frequent reconciliation is particularly important for companies using corporate credit cards or handling a large volume of credit card transactions. This is because multiple employees often use corporate credit cards across various departments, making it more challenging to track expenses and match them with financial records.

To further enhance the credit card reconciliation process, businesses can automate data entry, create accurate financial reports, and maintain reliable expense records, all of which can reduce human error and improve efficiency.

Regular reconciliation provides numerous benefits for businesses.

The benefits of credit card reconciliation

Understanding the benefits of credit card reconciliations is crucial for managing financial health. It not only ensures accurate reporting but also helps identify any inaccuracies, manage cash flow, and prepare for audits.

Here are four benefits of credit card reconciliation:

- Financial record accuracy: Credit card reconciliations ensure that all transactions are accurately recorded in financial records. By comparing credit card statements against internal records, businesses can confirm that each transaction is correctly documented. This accuracy is vital for generating reliable financial reports and maintaining accountability.

- Fraud detection: Early fraud detection is one of the key benefits of credit card reconciliation. Regular reconciliation enables companies to quickly identify unauthorized transactions or anomalies. By catching fraud early, businesses can take immediate action to mitigate any financial damage.

- Cash flow management: Effective cash flow management is another benefit of credit card reconciliation. By tracking all transactions and matching them with bank statements, companies can better manage their liquidity. This helps maintain an accurate view of available funds, aiding in strategic financial planning and expense control.

- Audit readiness: Credit card reconciliation enhances audit readiness by ensuring all financial records are current and reflect actual transactions. Routine reconciliation simplifies the audit process, as auditors require precise documentation. This practice helps merchants maintain compliance and demonstrate financial transparency.

Now that you know the benefits of credit card reconciliation, you should familiarize yourself with the different types.

3 types of credit card reconciliation

Understanding the different types of reconciliation is crucial for maintaining accurate financial records.

While each type serves a specific purpose, the overall reconciliation process enables businesses to detect errors, maintain transparency, identify fraud, and make more informed decisions with precise financial insights.

The three main types of reconciliation include bank reconciliation, credit card reconciliation, and account reconciliation.

1. Bank reconciliation

Bank reconciliation matches a company’s internal financial records against its bank statements to verify that all transactions are accurately recorded while explaining differences between the ledger’s and the bank’s figures.

The bank reconciliation process helps detect discrepancies such as bank errors, overlooked transactions, or human error, offering confidence in the financial statements.

2. Credit card reconciliation

Credit card reconciliation involves comparing transactions in the company’s internal records with those reported on credit card statements to confirm all expenses are authorized and correctly recorded to mitigate discrepancies or fraud.

The credit card reconciliation process is especially vital for businesses using corporate credit cards, allowing their accounting teams to improve expense management and maintain financial clarity.

3. Account reconciliation

Account reconciliation confirms that the balance of an account matches its company’s internal records.

The account reconciliation process reconciles various accounts, such as accounts payable (AP) and accounts receivable (AR), to guarantee accurate and complete financial statements.

This type of reconciliation helps maintain credibility with stakeholders and supports the integrity of the accounting systems.

Whether it’s bank reconciliation to align cash balances, credit card reconciliation to manage expenses, or account reconciliation to verify overall financial integrity, each type addresses specific aspects of financial management.

With these types of reconciliation in mind, the following section can explain more about the technical steps involved in this process.

How does credit card reconciliation work?

A well-executed credit card reconciliation process not only prevents errors and fraud but also strengthens financial management, enabling businesses to operate with confidence and precision.

Here are the eight steps involved in the reconciliation process:

- Gather necessary documents: Credit card reconciliation requires documentation, which includes corporate credit card statements, bank statements, expense reports, and any relevant transaction records. Preparing these documents can streamline the reconciliation process and pinpoint discrepancies.

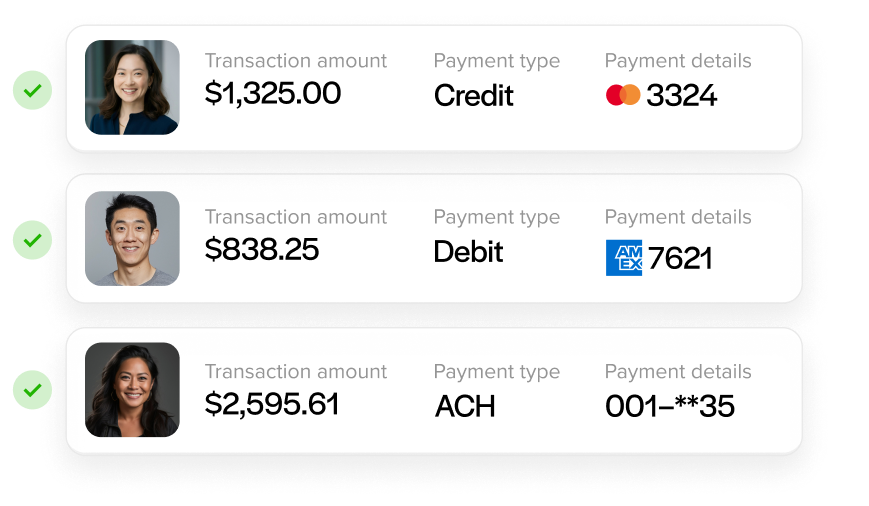

- Compare transactions: Once documents are collected, you should compare transactions listed in credit card statements with those in your company’s accounting records to verify that all credit card transactions are accurately recorded, minimizing the chance of discrepancies due to human error.

- Identify discrepancies: During the comparison process, it’s crucial to identify any differences between documents and actual expenses. Discrepancies can arise for numerous reasons, such as duplicate entries, forgotten transactions, or incorrect amounts.

- Investigate and resolve discrepancies: After identifying discrepancies, the next step is to investigate their causes. This may involve checking with the credit card company, reviewing transactions with the credit card processor, or probing individual expense management software entries. Prompt resolution of these discrepancies is necessary to maintain the integrity of financial records.

- Update financial records: Next, it’s essential to update financial records accordingly, which can involve adjusting accounting entries or reconciling internal records with corrected data. Updated records ensure that financial statements are accurate and reflect the actual state of the company’s finances.

- Verify ending balance: After updating records, you should verify the ending balance on the credit card statement with your updated accounting records. This verification ensures that all transactions are accounted for and that the ending balance aligns with financial records. This is crucial to maintain consistency across different financial records.

- Finalize and save records: The final step of the credit card reconciliation process is to finalize and save all relevant records, storing them securely for future reference and auditing purposes. Keeping a consistent routine contributes to a robust financial system and supports future decision-making.

This process is typically performed regularly, such as monthly, to keep records current and ensure financial accuracy. Many businesses use specialized software to streamline the reconciliation process, enabling automated matching and error detection, reducing manual effort, and minimizing the risk of oversight.

With a disciplined reconciliation routine, businesses can safeguard their finances and uphold robust financial management practices. That said, this process isn’t without its challenges.

Challenges in reconciling credit cards

Credit card reconciliation can be challenging, primarily due to the high volume of transactions recorded daily, especially for businesses using corporate credit cards. This increases the likelihood of errors and discrepancies between credit card statements and internal records.

More human error can lead to financial mismanagement if not caught during routine reconciliation.

Another challenge is matching credit card transactions to the respective financial records accurately. This process can be cumbersome and time-consuming, especially when multiple cards are involved. The data from credit card statements and bank statements may not align perfectly with what’s recorded in the company’s accounting software, complicating the reconciliation process.

Fraud can also present a significant challenge since detecting unauthorized transactions amidst numerous legitimate entries requires diligence and can be easily overlooked.

Inconsistencies arising from differences in transaction recording by credit card processors and merchants add to the complexity, often necessitating manual checks by accounting and finance teams to ensure accurate financial reports and journal entries.

With these challenges in mind, following best practices for reconciling credit cards is vital.

5 best practices for credit card reconciliation

Merchants would be wise to adopt best practices to streamline the credit card reconciliation process and promote efficiency, accuracy, and compliance.

To ensure effective reconciliation, businesses should adopt the following best practices:

- Perform routine reconciliations: Reconciliation should be conducted on a monthly basis. Accounting software can streamline the process, minimizing human error and improving overall efficiency.

- Establish clear policies for corporate card use: A clear policy for corporate card use simplifies reconciliation. Employees should provide detailed expense reports supported by receipts, allowing easy transaction matching. Expense management software further enhances this process by offering real-time data and reducing administrative workload.

- Keep accounting systems up-to-date: Regularly updating accounting systems ensures they integrate seamlessly with payment processors and credit card issuers. This integration reduces manual entry errors and supports a smoother reconciliation process, especially for businesses handling large transaction volumes.

- Train accounting teams: Well-trained accounting teams are critical for efficient reconciliation. Teams should be educated on different credit card types and transaction categories. With proper training, teams can better manage reconciliation scenarios.

- Maintain open communication with credit card providers: Frequent communication with credit card companies or merchant service providers keeps businesses informed about any changes in fees, policies, or procedures that may affect reconciliation. Staying up to date helps you avoid unexpected complications and enhance financial operations.

In addition to these best practices, merchants can work with a reliable payment processor to optimize the reconciliation process.

Optimizing the reconciliation process with EBizCharge

EBizCharge significantly enhances and accelerates the credit card reconciliation process by seamlessly integrating with accounting systems and efficiently matching credit card transactions with internal records to ensure payments are precise.

EBizCharge automates reconciling credit cards through real-time data syncing from credit card processors, ensuring that all financial reports reflect the most current information. This not only enhances the efficiency of accounting teams but also reduces the possibility of variations between bank statements and internal records.

The top-rated EBizCharge platform allows merchants to facilitate regular reconciliation to maintain up-to-date records, prevent fraud, and improve strategic initiatives.

By effortlessly consolidating data, EBizCharge helps card users and companies improve their expense management, maximize productivity, and maintain precise financial records.