Blog > A Guide to Allowance for Doubtful Accounts: Definition, Examples, and Calculation Methods

A Guide to Allowance for Doubtful Accounts: Definition, Examples, and Calculation Methods

In the complex accounting world, one critical aspect of financial management is the allowance for doubtful accounts. This provision helps businesses anticipate potential losses from uncollectible debts.

Allowance for doubtful accounts serves as a financial safety net, enabling businesses to accurately reflect their expected income and prevent the overstatement of assets. This accounting practice hinges on various calculation methods and industry benchmarks, influencing how companies assess risk and allocate resources.

Understanding allowance for doubtful accounts is vital for finance teams since it can impact financial statements, cash flow, and overall business strategy.

What is allowance for doubtful accounts?

Allowance for doubtful accounts (ADA), often found as a line item on a balance sheet, represents a reserve against which accounts receivable (AR) balances are offset to reflect a more accurate value of what the business expects to collect.

When a business extends credit to customers, there’s always a risk that some debt won’t be recoverable due to customer default or bankruptcy. The allowance for doubtful accounts ensures that receivable balances on the financial statements account for this risk.

It’s a contra-asset account that reduces the AR account on a company’s financial statements. The allowance reflects the estimated amount of credit sales expected to become bad debts.

This account is typically established through a historical analysis of previous uncollectible accounts and management’s professional judgment on current economic conditions and customer creditworthiness. Adjustments to the allowance are recorded as bad debt expense on the income statement, representing the cost associated with the risk of extending credit.

Why is allowance for doubtful accounts important to understand?

An allowance for doubtful accounts is a critical concept for finance teams to understand due to its impact on financial statements and the portrayal of a company’s financial health.

This provision anticipates that a certain percentage of AR may not be collectible. Doing so helps to project a more accurate picture of the receivable balance that will likely turn into cash, an essential aspect of cash flow management.

Understanding the allowance for doubtful accounts is essential because:

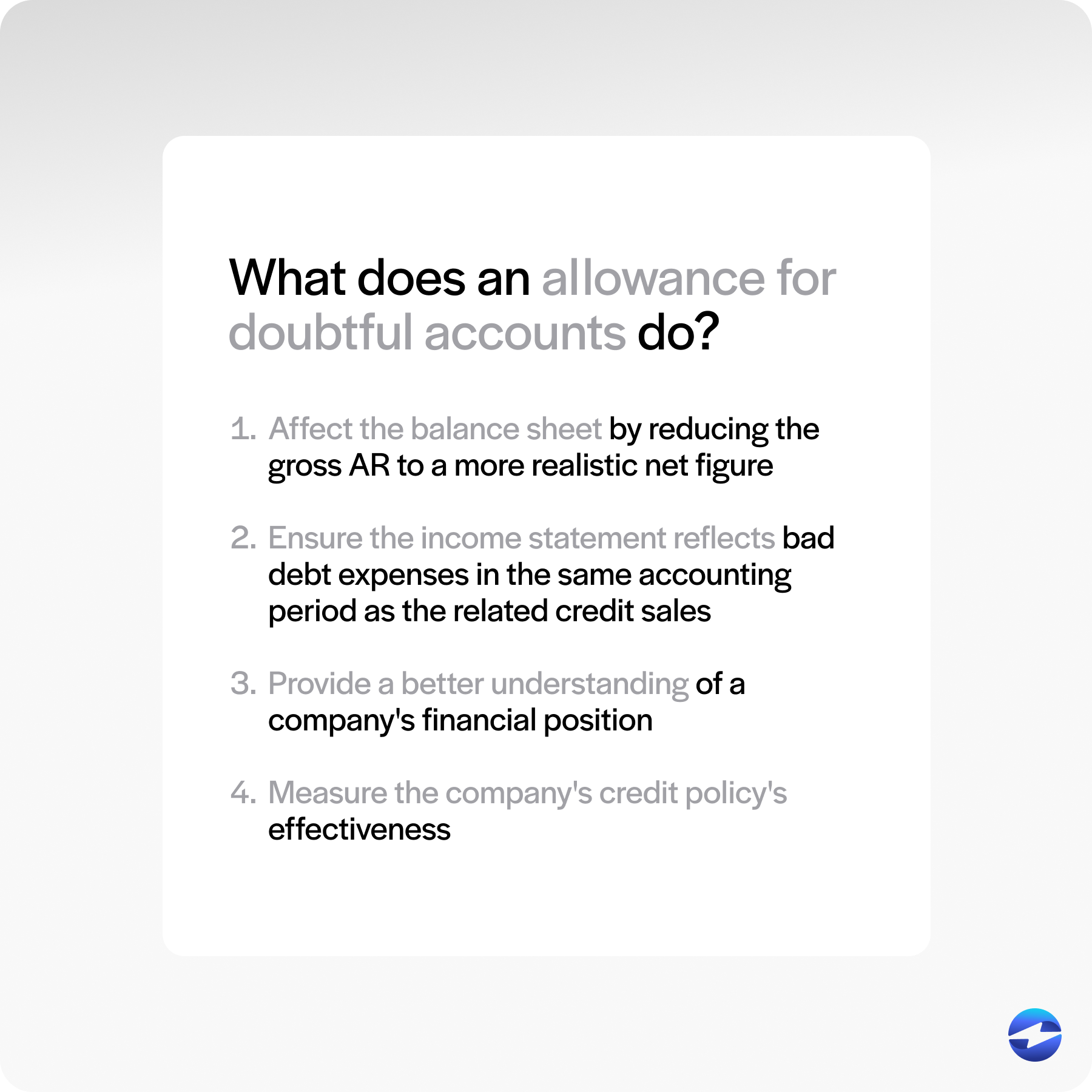

- It affects the balance sheet by reducing the gross AR to a more realistic net figure.

- It ensures the income statement reflects bad debt expenses in the same accounting period as the related credit sales, adhering to the matching accounting principles.

- It provides a better understanding of a company’s financial position, as overstatement or understatement of assets can significantly misrepresent economic realities.

- It measures the company’s credit policy’s effectiveness and helps make informed decisions about customer credit terms.

Knowing how to estimate uncollectible accounts using either the percentage of sales or the receivable method gives finance teams an edge in managing the risk associated with outstanding accounts.

How to calculate allowance for doubtful accounts

Calculating the allowance for doubtful accounts is a crucial process for businesses that sell on credit, as it helps to predict and reflect the potential losses that may result from unpaid customer invoices.

Companies typically use two primary methods to calculate the allowance for doubtful accounts: the percentage of sales method and the aging of receivables method. These methods align with accounting principles and help businesses match bad debt expense to their revenue, ensuring accurate financial statements.

Method 1: Percentage of sales method

The percentage of sales method involves applying a fixed percentage to the total credit sales of an accounting period to estimate the allowance for doubtful accounts. This method emphasizes the matching principle by correlating bad debt expense directly with the revenue recognized in the income statement.

With this method, you can calculate the doubtful account allowance by:

- Determining the total credit sales for the accounting period.

- Selecting an appropriate percentage of sales that may become uncollectible. This percentage is usually based on historical data and industry benchmarks.

- Multiplying the total credit sales by the chosen percentage to find the estimated bad debt expense for the period.

For example, if a company with $100,000 in credit sales for the year estimates based on historical data that 2% of credit sales will be uncollectible, the estimated allowance for doubtful accounts would be $2,000.

Method 2: Aging of receivables method

The aging of receivables method, another prevalent calculation method, is based on the premise that the likelihood of an account being uncollectible increases with age. This method applies different percentages to AR balances according to their outstanding length.

With this method, you can calculate doubtful allowance by:

- Preparing an aging schedule that categorizes receivable balances by the time they’ve been outstanding.

- Assigning a higher percentage of potential non-payment to older receivables based on historical percentages and risk classification.

- Multiplying the receivable balances in each category by their respective percentages to estimate the bad debt expense.

- Adding the estimated amounts to arrive at the total allowance for doubtful accounts.

The percentage of sales and aging of receivables methods are commonly used and recognized for their distinct approaches to evaluating the credit risk associated with AR.

While the percentage of sales method is more straightforward and based on sales, the aging of receivables method offers a more intricate estimation that accounts for the time-sensitivity of outstanding accounts.

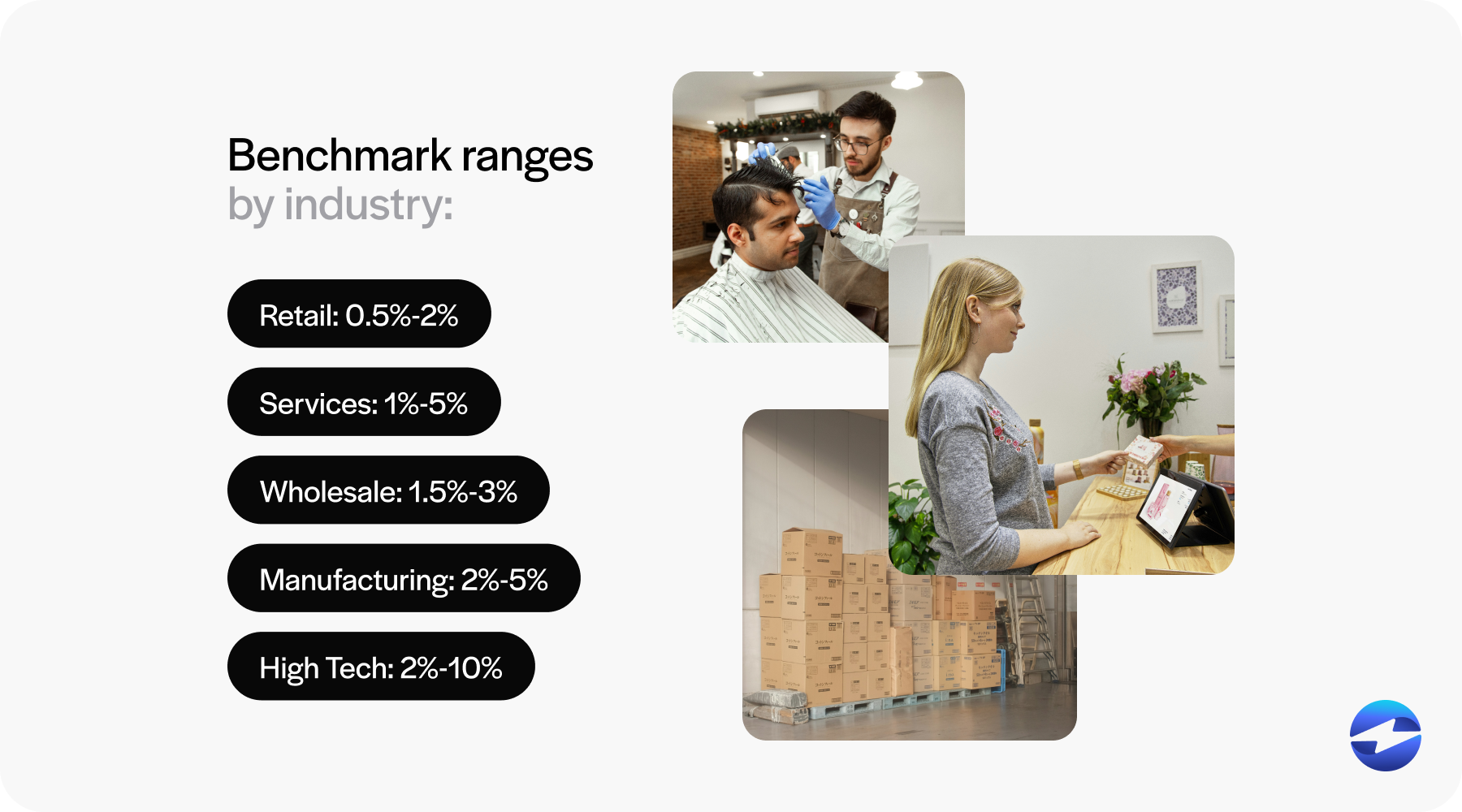

What are the industry benchmarks for allowance for doubtful accounts?

Allowance for doubtful accounts varies significantly across industries and is influenced by credit policies, customer base, and historical experience with bad debts.

Industry benchmarks for this allowance are typically expressed as a percentage of total accounts receivable.

While there is no one-size-fits-all benchmark, certain industries tend to have higher averages due to the nature of their credit sales. For instance, industries with long-term receivables, such as machinery manufacturing, may have a higher allowance benchmark due to the increased uncertainty over time.

Conversely, industries like retail may have lower allowances owing to shorter-term transactions and a more immediate exchange of goods for payment.

The following list represents benchmark ranges for the allowance for doubtful accounts in various industries:

- Retail: 0.5% – 2%

- Services: 1% – 5%

- Wholesale: 1.5% – 3%

- Manufacturing: 2% – 5%

- High Tech: 2% – 10%

It’s important for businesses to continuously monitor their actual bad debt experience against these benchmarks and adjust their allowance for doubtful accounts to reflect their unique risk profile and financial position.

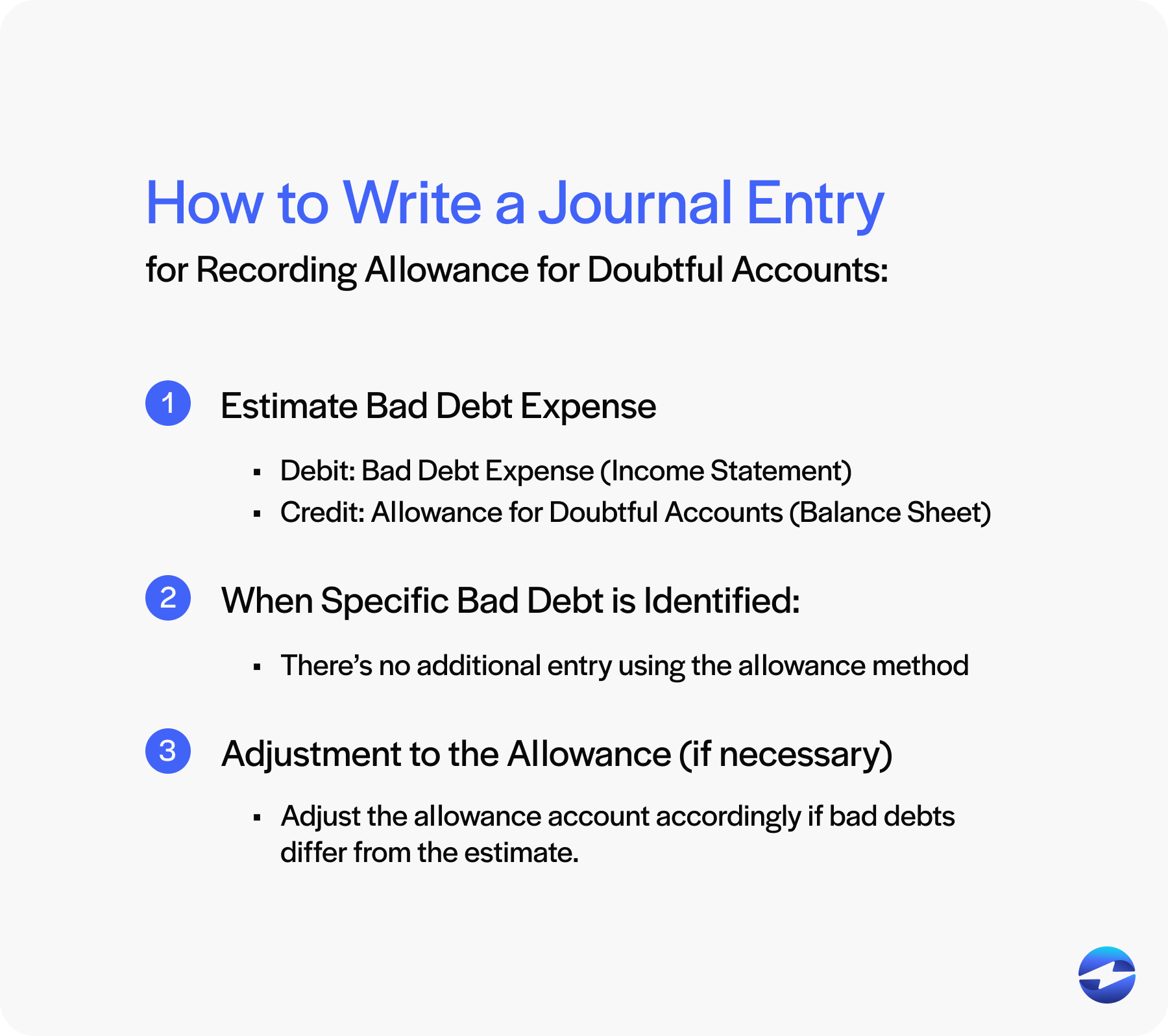

How to record allowance for doubtful accounts journal entries

Businesses use journal entries to record the allowance for doubtful accounts on financial statements.

The allowance represents an estimate of the receivable balance that may not be collected and serves as a contra-asset account on the balance sheet, reducing the total AR.

Journal Entry for Recording Allowance for Doubtful Accounts:

- Estimate Bad Debt Expense:

- Debit: Bad Debt Expense (Income Statement)

- Credit: Allowance for Doubtful Accounts (Balance Sheet)

- When Specific Bad Debt is Identified:

- There’s no additional entry using the allowance method, as the bad debt is already estimated.

- Adjustment to the Allowance (if necessary):

- Adjust the allowance account accordingly if bad debts differ from the estimate.

Example:

A company estimates that 2% of its $100,000 credit sales will be uncollectible.

- Bad Debt Expense: $2,000 (Debit)

- Allowance for Doubtful Accounts: $2,000 (Credit)

Recording in Journal Entries:

| Date | Account Title | Debit | Credit |

|---|---|---|---|

| [Date] | Bad Debt Expense | $2,000 | |

| Allowance for Doubtful Accounts | $2,000 |

The above entry adheres to the matching principle, ensuring expenses are recognized in the same accounting period as the related revenues.

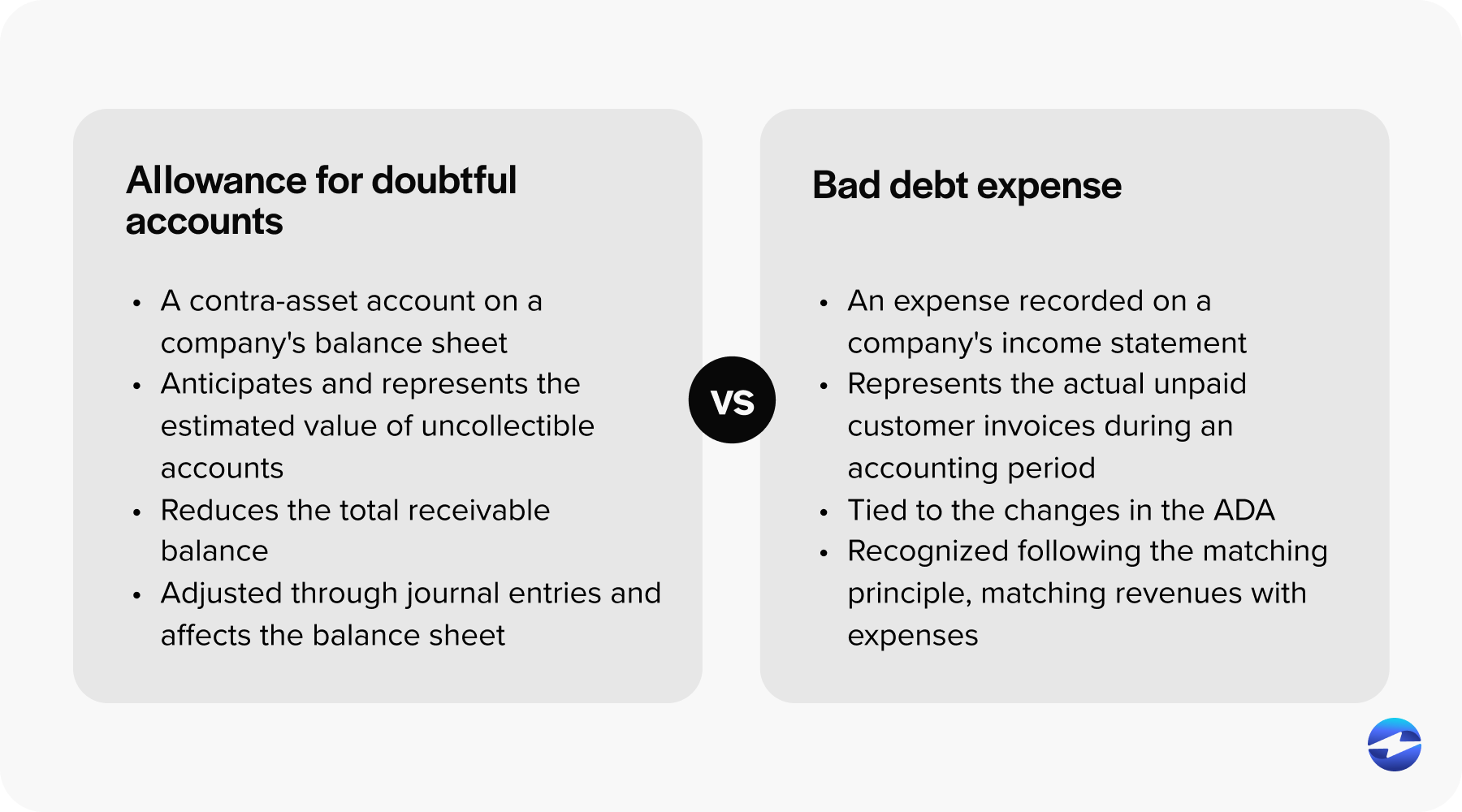

Allowance for doubtful accounts vs. bad debt expense

Distinguishing between allowance for doubtful accounts and bad debt expense is crucial for accurately representing a company’s financial health. ADA and bad debt expenses serve different purposes yet work in tandem to manage and report uncollectible accounts.

While ADA is a contra-asset account on the balance sheet estimating future losses from uncollected receivables, bad debt expense records the actual losses incurred within an accounting period on the income statement.

Understanding how each function and its calculation methods allows businesses to maintain accurate financial reporting and prepare for potential revenue losses.

Allowance for doubtful accounts vs. bad debt expense

- Allowance for Doubtful Accounts (ADA)

- Definition: A contra-asset account on a company’s balance sheet.

- Purpose: Anticipates and represents the estimated value of uncollectible accounts.

- Impact: Reduces the total receivable balance, reflecting a more accurate financial position.

- Accounting treatment: ADA is adjusted through journal entries and affects the balance sheet.

- Bad debt expense

- Definition: An expense recorded on a company’s income statement.

- Purpose: Represents the actual unpaid customer invoices during an accounting period.

- Relationship to ADA: Tied to the changes in the ADA.

- Accounting treatment: Recognized following the matching principle, matching revenues with expenses.

Bad debt expense reflects the realization of loss, while ADA is a proactive approach to account for potential losses in AR. Both are essential in conveying the financial health of a business on their respective financial statements.

What are bad debt expenses?

Bad debt expenses are financial losses that a company incurs due to its customers’ non-payment of credit sales, rendering the AR balance uncollectible.

The matching accounting principle recognizes these expenses in the financial statements.

There are two primary methods to account for bad debt expenses:

Recording bad debt expense affects the income statement (where the expense is reported) and balance sheet (where the receivable balance is reduced). Understanding these expenses is critical to reflecting a more accurate financial position for the company.

How to calculate bad debt expense

Calculating bad debt expense is essential for businesses that sell goods or services on credit, as it directly impacts the balance sheet and the income statement.

When customers fail to pay what they owe, the unpaid customer invoices become bad debts that businesses must account for to maintain accurate financial records.

Two primary methods for calculating bad debt expenses that align with specific accounting principles and financial reporting requirements include direct write-off and allowance methods.

Method 1: Direct write-off method

The direct write-off method involves identifying specific AR deemed uncollectible and directly writing them off as bad debt expenses.

The direct write-off calculation for bad debt expense is straightforward:

Bad Debt Expense = Actual Amount of Uncollectible Accounts

A journal entry is then made to debit the bad debt expense account and credit the AR account to reflect the write-off. This direct approach only affects the financial statements when a receivable is identified as uncollectible, which can be at any point and not necessarily in the same accounting period as the sale.

Here’s an example of how the journal entry would look like:

| Account Debited | Accounted Credited |

|---|---|

| Bad Debt Expenses | Accounts Receivable |

| $X (amount uncollectible) | $X (mount uncollectible) |

Although the direct write-off method is simple, it doesn’t comply with the matching principle, which states that expenses should be recognized in the same period as the related revenues.

Method 2: Allowance method

The allowance method is more sophisticated and aligns with the accrual basis of accounting and the matching principle. It involves estimating the amount of bad debt expense at the end of each accounting period based on historical data and current economic conditions.

The steps to calculate bad debt expense under the allowance method include:

- Determining the total AR balance at the end of the accounting period.

- Estimating the percentage of receivables that may become uncollectible based on historical data (percentage of sales method) or analyzing the age of outstanding accounts (aging of receivables method).

- Recording an adjusting journal entry to debit bad debt expense and credit allowance for doubtful accounts by the estimated amount.

The allowance method is preferred for larger companies or those with significant sales on credit, as it provides a better estimation of future cash flows and a clearer financial picture.

Now that you understand the various calculations and methods that go into the allowance for doubtful accounts, you can look for tips to manage these accounts better.

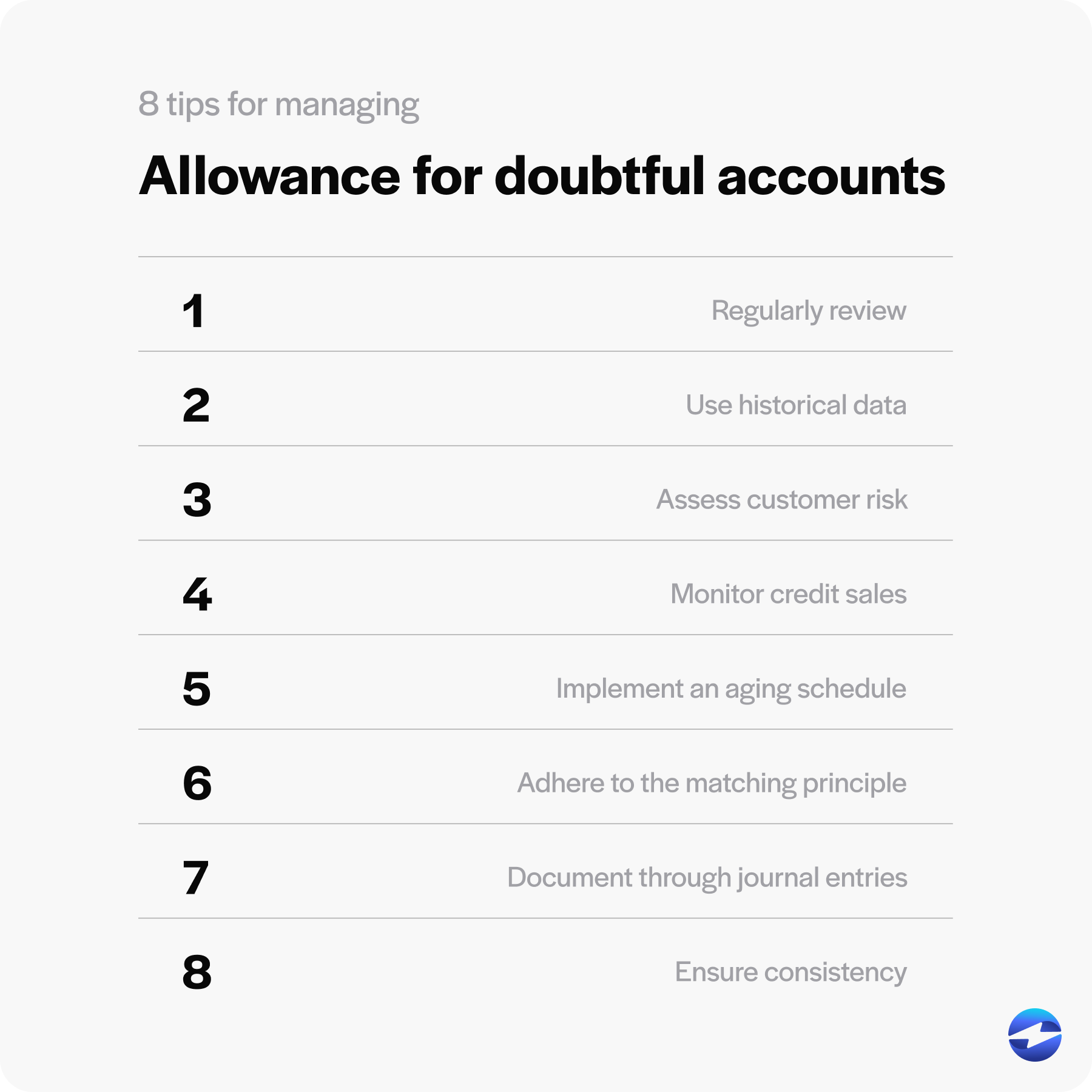

8 tips for managing allowance for doubtful accounts

When managing the allowance for doubtful accounts, businesses should proactively assess and predict the credit risk associated with their AR.

Here are eight tips to help your business manage its allowance for doubtful accounts:

- Regular review: Update the allowance frequently, ideally during each accounting period, to reflect changes in customer creditworthiness and economic conditions.

- Historical data: Use historical percentage of bad debts to inform allowance levels, considering changes in customer base or credit policies.

- Customer risk assessment: Analyze customer payment patterns and classify them by risk levels. Higher risk classifications should have a higher percentage of allowance.

- Credit sales monitoring: Track credit sales and unpaid customer invoices. Allowance should typically be a percentage of total credit sales.

- Aging schedule: Implement an aging schedule for receivables to identify older, potentially uncollectible accounts.

- Matching principle: Adhere to accounting principles such as the matching principle, which dictates that bad debt expense should be matched with the revenue of the same accounting period.

- Journal entries: Document adjustments through journal entries, credit the allowance for doubtful accounts and debit bad debt expense on the income statement.

- Consistency: Ensure consistency in the calculation methods, whether percentage of sales, receivable balance, or risk classification method.

Businesses can maintain more robust and accurate financial statements by carefully monitoring and managing the allowance for doubtful accounts.

Leverage allowance for doubtful accounts for a more realistic financial outlook

The allowance for doubtful accounts is an essential component of financial accounting that provides a more accurate representation of a company’s financial position.

By estimating and recording potential losses from uncollectible receivables, businesses can prevent sudden financial surprises and make better strategic decisions. This proactive approach helps companies anticipate and mitigate risks, ensuring reported assets are closer to realizable values.

Effectively managing the allowance for doubtful accounts gives businesses a more precise and realistic financial outlook for more informed planning and sustainable growth.

FAQs

FAQs

- What is allowance for doubtful accounts?

- How to calculate allowance for doubtful accounts

- What are the industry benchmarks for allowance for doubtful accounts?

- How to record allowance for doubtful accounts journal entries

- Allowance for doubtful accounts vs. bad debt expense

- What are bad debt expenses?

- How to calculate bad debt expense

- 8 tips for managing allowance for doubtful accounts

- Leverage allowance for doubtful accounts for a more realistic financial outlook

- FAQs