Blog > 5 Ways Accepting Credit Cards Can Help Small Businesses

5 Ways Accepting Credit Cards Can Help Small Businesses

If your business accepts credit cards, you’ve probably wondered how to choose a good payment processor. Without a doubt, choosing the right payment processor can greatly contribute to your business’ success.

As a merchant, it is your responsibility to create a smooth and efficient transaction experience for your customer. A proficient payment processor can facilitate customer satisfaction, which ultimately leads to more money in your wallet. However, not all payment processors are created equal.

When choosing a payment processor, always do your research. Here are some tips to help you choose a payment processor that best suits your business needs:

- Security/Fraud Protection

- Integrated Payments

- PCI Compliance

- Customer Service

- Rates and Fees

- Payment Gateway

- Do Your Research

Let’s get into it!

Security/Fraud Protection

40% of all financial fraud is related to credit cards. With enhanced payment technology, businesses can now accept payments from any location. However, this privilege carries serious liabilities. To help protect sensitive credit card information, choose a payment processor that implements tokenization.

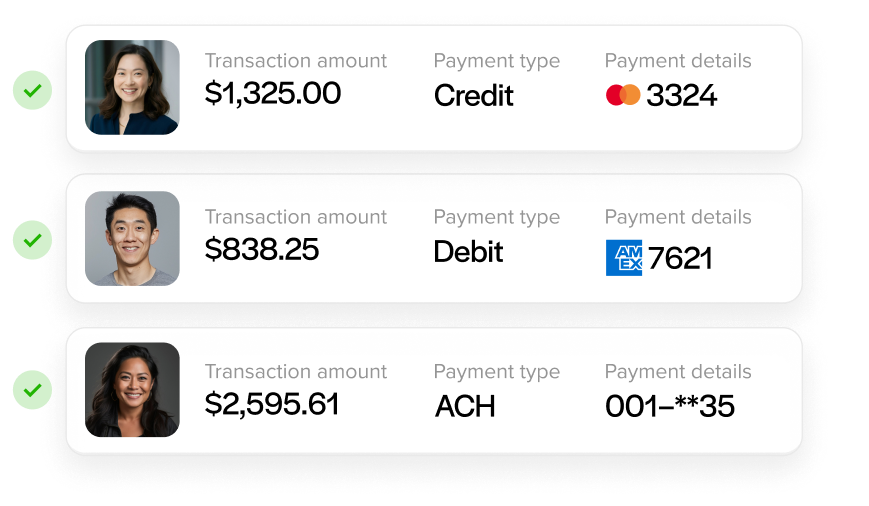

Tokenization takes credit card information and replaces it with a unique token. This token acts as a key for all future transactions and is only decipherable with the proper payment card tokenization system. Hackers cannot access your credit card data without this key. Even if they did, they would find the information useless.

Integrated Payments

Make sure the payment processor is compatible with your current software. Having the ability to integrate payments with your accounting, CRM or ERP software can help reduce operating costs, processing time, and human errors. Integrated payments can automate your acceptance process and provide you with more time to focus on building relationships with customers and enhancing other areas of business.

PCI Compliance

In order to accept payments, businesses must maintain PCI compliance, which ensures the secure processing and storage of credit card information. In order to become PCI compliant, merchants must complete a Self-Assessment Questionnaire. A PCI compliant payment processor will help safeguard credit card data and make sure business information is guarded at the highest security levels possible.

Customer Service

Customer relationships lie at the heart of a successful business. In fact, 75% of customers believe it takes too long to reach a live agent. Look for a processor that offers 24/7, in-house customer support specialists. Reliable, easily reachable support will keep your payment systems running smoothly and allow for more time to manage important business affairs.

Rates and Fees

Be wary of hidden fees. Many payment processors will charge higher rates based on the type of cards you accept. To avoid financial surprises, find a processor that charges a flat rate. In addition, avoid payment processors that try to lock you into a contract. When doing business with a payment processor, you should not feel deceived or kept in the dark. A good payment processor will tell you exactly what you need to pay without adding any hidden charges.

Payment Gateway

A payment gateway authorizes credit card transactions for your business, and can reduce processing costs, save time and increase efficiency, and allow your business to accept payments online. Choose a processor with a feature-rich payment gateway that integrates with your ERP or accounting software and allows for unlimited transaction history, custom reports, and secure data tokenization.

Do Your Research

Review these factors carefully, and make sure you know exactly what a payment processor can provide your business before entering into a relationship. By doing proper research, you will benefit from increased security, lower fees, and a PCI-compliant payment gateway that will help ensure lasting success for your business.

Learning how to choose a payment processor doesn’t have to be a hassle. By following these simple tips, you’ll be able to choose the payment processor that is right for your business.