Blog > 4 Reasons to Ditch Your Physical Credit Card Terminal

4 Reasons to Ditch Your Physical Credit Card Terminal

For many business owners, using a physical credit card terminal is a hassle. If you take credit card payments over the phone, you have to manually key in the information. At the end of the day, you have to print out a batch receipt and reconcile it with your accounts receivable records. It’s inefficient, costly, and annoying.

Is there a better way?

Fortunately, yes. Merchants can migrate to a virtual terminal. There are many reasons why this is a smart move for your business, but we’ve compiled the 4 most compelling reasons here.

But first, let’s talk about what a virtual terminal is.

A virtual terminal is an online alternative to a physical terminal. Instead of swiping a card, merchants log in to a web page and type in the payment information. In terms of function, virtual terminals are identical to physical terminals (minus the paper receipts and button mashing), allowing merchants to run and accept credit card payments.

So why should you ditch your physical terminal in favor of a virtual terminal?

- Cost

- Data Storage

- Reports

- Flexibility

Let’s get into it!

Cost

Physical terminals are expensive. Each machine can cost hundreds of dollars. If the machine breaks, merchants have to call someone in to repair it. Repairs not only halt business operations, they also usually carry a hefty price tag. And as the EMV chip card update has proven, the need to replace terminals can also be a source of frustration. With a virtual terminal system, on the other hand, merchants don’t have to worry about fixing or replacing machines. Their system is always up and accessible from multiple devices.

Data Storage

One of the joys of using a physical credit card processing terminal is waiting until the end of the day when the machine spits out a batch report. The merchant then gets to take this slip of paper, reconcile it with their records in their accounting system, and then carefully file it away in a special folder. Thrilling, right?

What if you didn’t have to do any of that? A virtual terminal eliminates the need for storing scraps of paper in a file cabinet. No more punching in 16-digit numbers, no more clumsy mistakes, and no more filing.

Reports

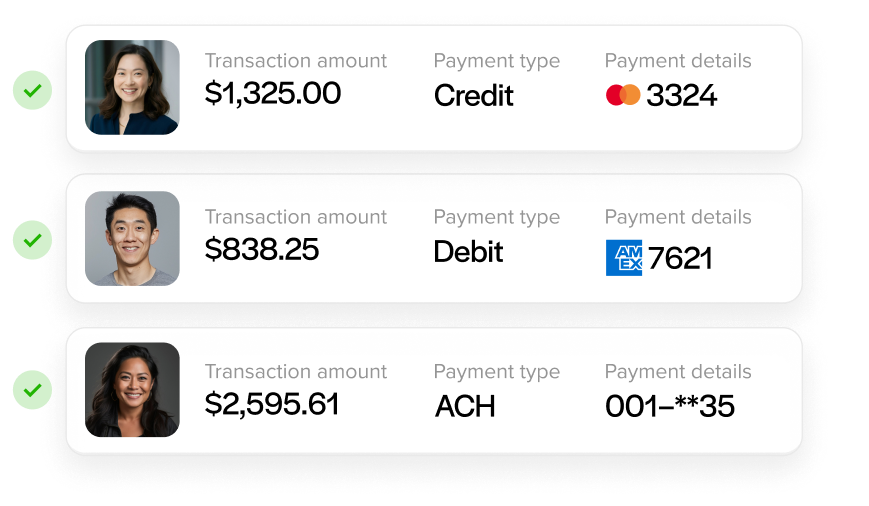

Unlike a physical terminal, virtual terminals provide incredible reporting tools. These allow merchants to drill down and gather useful data about the number and types of credit card transactions over a period of time. Merchants can also issue voids and credits, view details on transactions, email receipts, and monitor their batches in real-time.

Flexibility

With a physical terminal, merchants are restricted to accepting payments within their brick and mortar store or location. A virtual terminal, on the other hand, can be accessed from any mobile device with an internet connection, meaning that merchants can accept payments on the go — at trade shows, events, or in the field. This capability expands its reach and increases their profits.

So there you go. It’s time to ditch your clunky physical credit card terminal. Embrace the brave new world of virtual terminals, and say hello to increased efficiency and profits.