Blog > Why Manufacturers Switch from Epicor Payment Exchange

Why Manufacturers Switch from Epicor Payment Exchange

Epicor Payment Exchange has been part of many Epicor environments for years. For some manufacturers, it works well enough in the early stages. Payments are accepted, transactions go through, and finance teams can keep things moving.

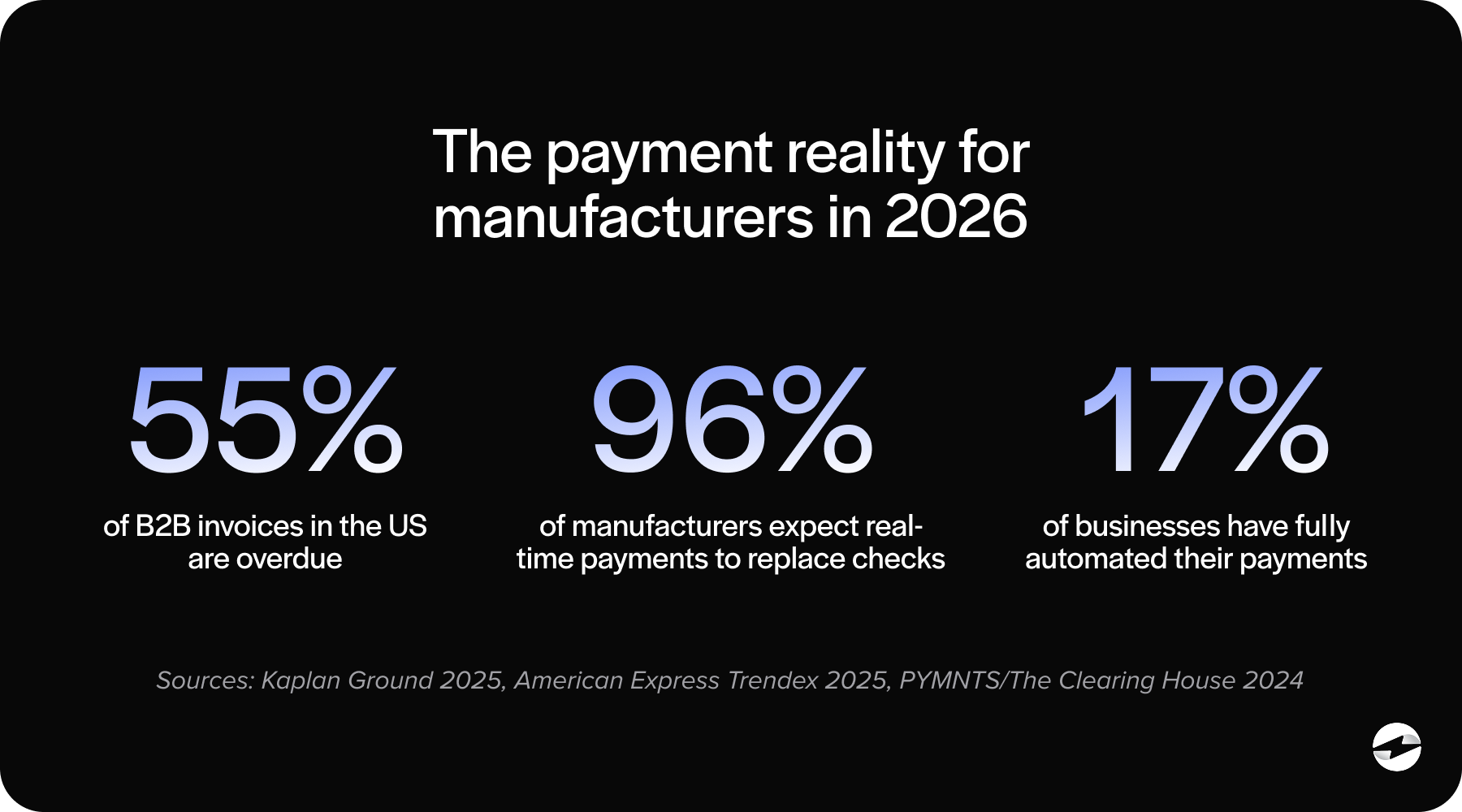

But as manufacturing operations grow, payment processing stops being a background task. It becomes a strategic concern. Invoice sizes increase, billing scenarios get more complex, and fees start to stand out on monthly statements.

If you’re responsible for finance, AR, or operations, you’ve probably reached the point where you’re questioning whether it still makes sense to stay put or switch from Epicor payments to something more flexible. This article looks at why manufacturers reach that moment, what usually drives the decision, and what they’re really looking for when they replace Epicor Payment Exchange with an alternative.

Understanding Epicor Payment Exchange in Manufacturing Environments

Epicor Payment Exchange, often referred to as EPX, is designed to provide basic payment functionality within Epicor ERP. For manufacturers with straightforward billing needs, EPX can handle simple card transactions and basic posting back to the ERP.

In early stages, this is often enough. Smaller transaction volumes, limited payment methods, and simple invoicing don’t put much strain on the system. Teams can process payments without much friction.

Problems tend to surface as operations mature. Manufacturing environments rarely stay simple. Once deposits, partial payments, milestone billing, or larger invoices become common, EPX can start to feel restrictive.

How Manufacturing Payment Needs Evolve Over Time

Manufacturing payment needs usually change gradually, until they don’t.

What may start as a manageable increase in volume turns into larger invoices and more complex terms. Customers begin asking for flexibility. Sales teams negotiate payment schedules that no longer fit neatly into a simple, one-step payment process.

Before long, deposits become standard. Partial payments need to be tracked carefully. Milestones trigger billing events that have to be applied correctly. Finance teams need a clear, up-to-date picture of what’s been paid and what’s still open.

At that point, the limit of basic payment setups becomes hard to ignore. Processes that once worked start to rely on workarounds, manual checks, and extra reconciliation just to keep things moving.

Limitations Manufacturers Encounter with Epicor Payment Exchange

One of the most common frustrations manufacturers raise with Epicor Payment Exchange is how little room there is to adjust it to real-world workflows.

Customization options are limited, which makes it hard to align EPX with manufacturing billing scenarios that involve deposits, partial payments, or nonstandard terms. Instead of the tool adapting to the business, teams often find themselves adjusting their internal processes just to make payments fit.

Visibility can also be a challenge. Many manufacturers struggle to get a clear, timely view of payment status, posting timing, and transaction-level details. When something doesn’t line up, tracing the issue back to its source can take longer than it should.

As billing complexity grows, these pain points become more noticeable. What once felt manageable starts to slow collections, add manual work, and pull attention away from higher-value tasks.

Payment Processing Fees and Cost Control Concerns

Fees are often the tipping point. As transaction volumes and invoice sizes grow, Epicor payment fees become more noticeable. Manufacturers begin to see how much card processing costs are affecting margins.

Within EPX, options for optimizing fees are limited. Advanced strategies like Level 3 data, routing transactions by payment type, or balancing cards with ACH aren’t always easy to implement.

As payment volume increases, fee transparency becomes more important. Finance teams want to understand exactly what they’re paying and why.

Payment Processing Options for Epicor ERP Users

Manufacturers using Epicor ERP typically find themselves choosing between a few different payment processing approaches as their needs grow.

Some stick with EPX and learn to work within its limits. Others add standalone payment tools outside Epicor, which can solve one problem but often creates another by introducing manual posting and reconciliation.

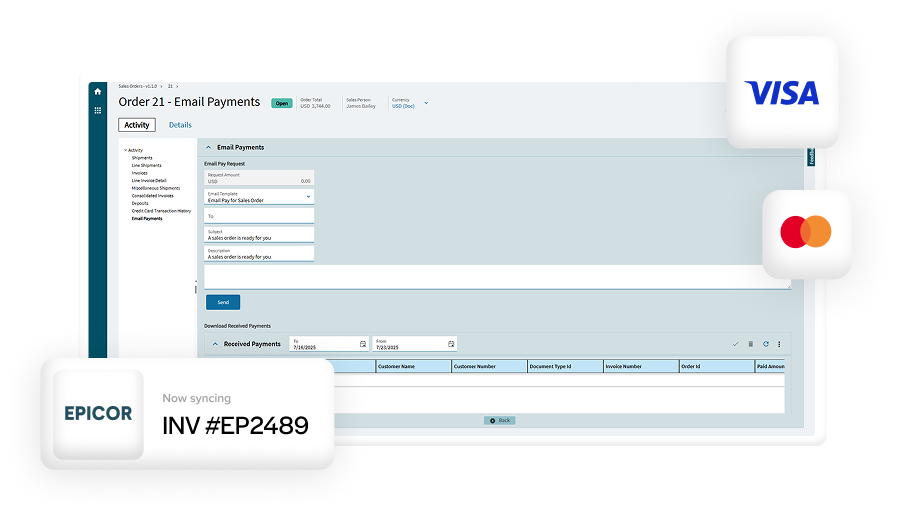

The third option is moving to a fully integrated third-party payment processing solution built specifically for Epicor. Instead of treating payments as something separate, these solutions embed payment activity directly into Epicor workflows.

When manufacturers explore this route, they’re usually looking for a true Epicor payment alternative that simplifies day-to-day work and reduces friction, rather than shifting the burden to another system.

Epicor Payment Exchange vs. Third-Party Payment Solutions

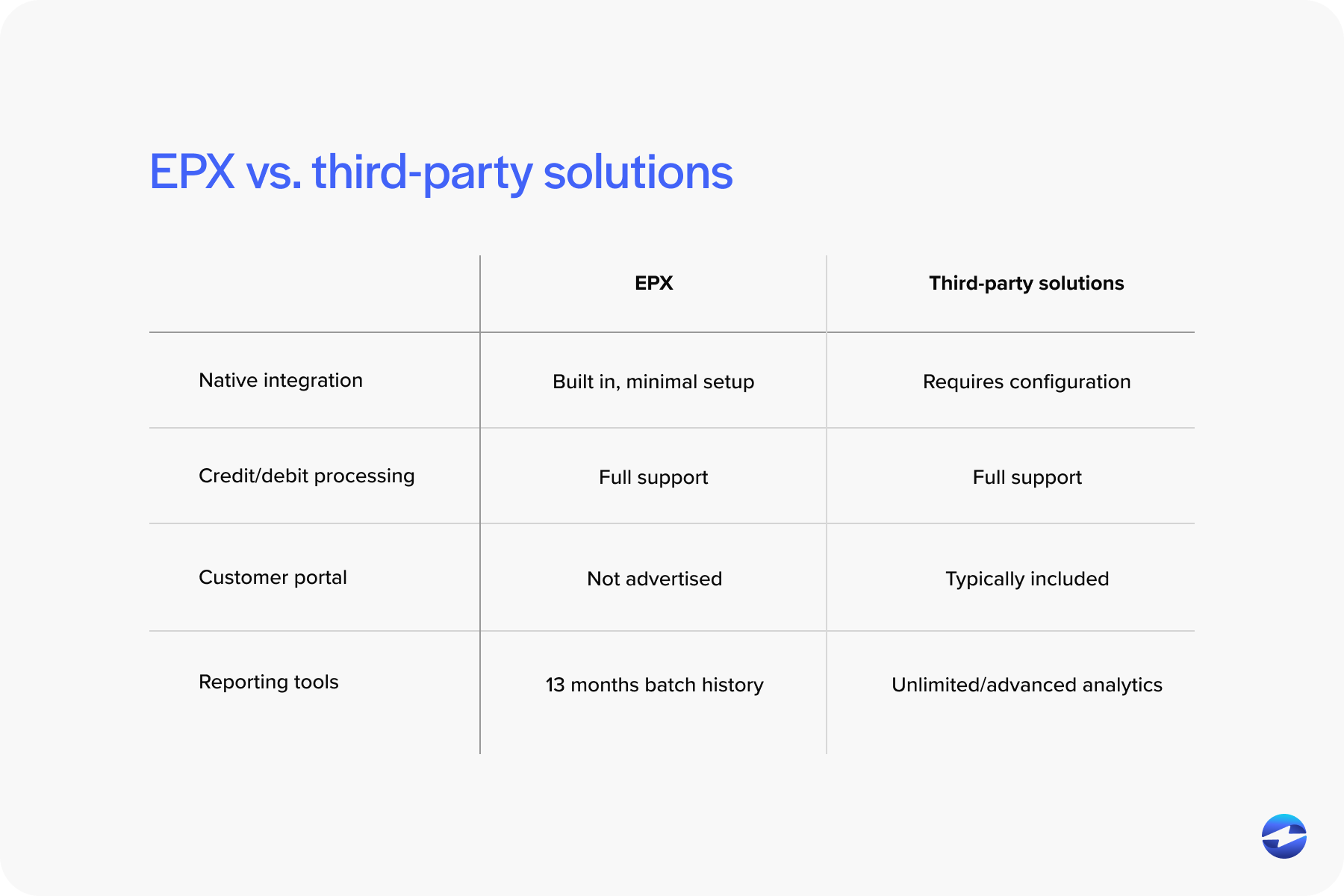

When manufacturers compare Epicor Payment Exchange to third-party solutions, the difference usually comes down to how much each option can actually support day-to-day manufacturing work.

EPX provides basic connectivity, which can be enough early on. Third-party solutions tend to offer deeper integration, more flexibility, and clearer visibility into payment data as requirements grow.

For manufacturers, workflow fit matters. Support for deposits, partial payments, and more complex billing scenarios quickly becomes essential rather than optional.

This is often the point where teams decide it makes more sense to replace Epicor Payment Exchange than to keep building workarounds around a tool that was never designed for that level of complexity.

Operational Impact of Switching Away from EPX

Switching payment systems is rarely just a technical decision. It affects how work gets done every day.

Manufacturers that move away from EPX often notice fewer manual steps almost immediately. Payments post more consistently, delays are reduced, and reconciliation becomes a simpler, more predictable process instead of a recurring cleanup task.

Accuracy tends to improve as well. Finance teams spend less time tracking down errors or connecting postings and more time focused on managing cash flow and supporting the business.

Over time, these operational improvements make it much easier to justify the choice to switch from Epicor payments to a solution that better supports growing manufacturing needs.

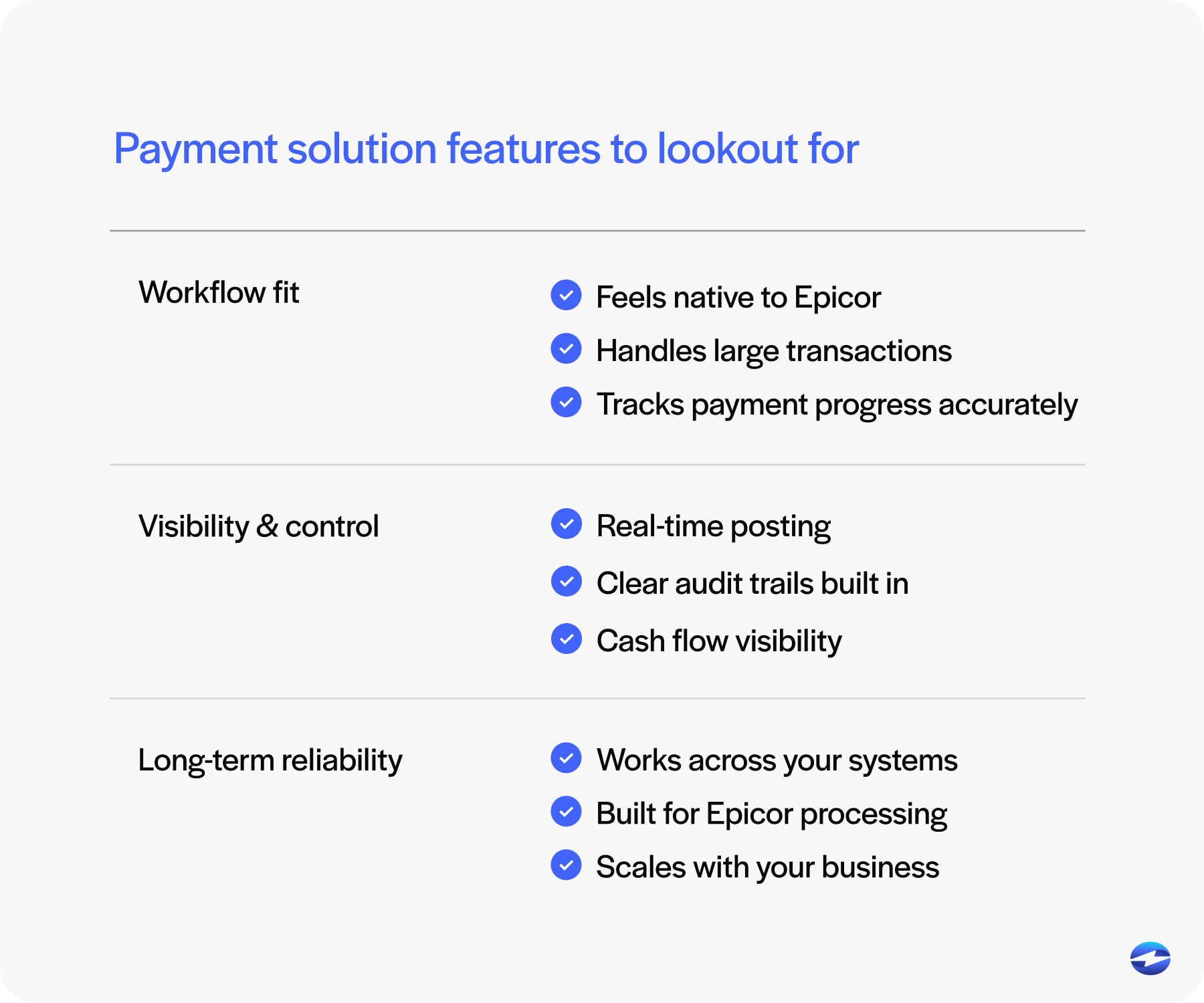

What Manufacturers Look for After EPX

Once manufacturers decide to move on, their priorities are usually clear.

They want strong Epicor integration that keeps payments tied to invoices, customers, and jobs. They want flexibility to support real-world billing scenarios and better insight into fees and payment status.

Scalability matters as well. The solution should grow alongside the business without forcing another switch a few years down the road.

This is why choosing the right payment processor is such an important part of this decision. Epicor experience matters, especially during upgrades and changes.

A Practical Path Forward for Epicor Manufacturers

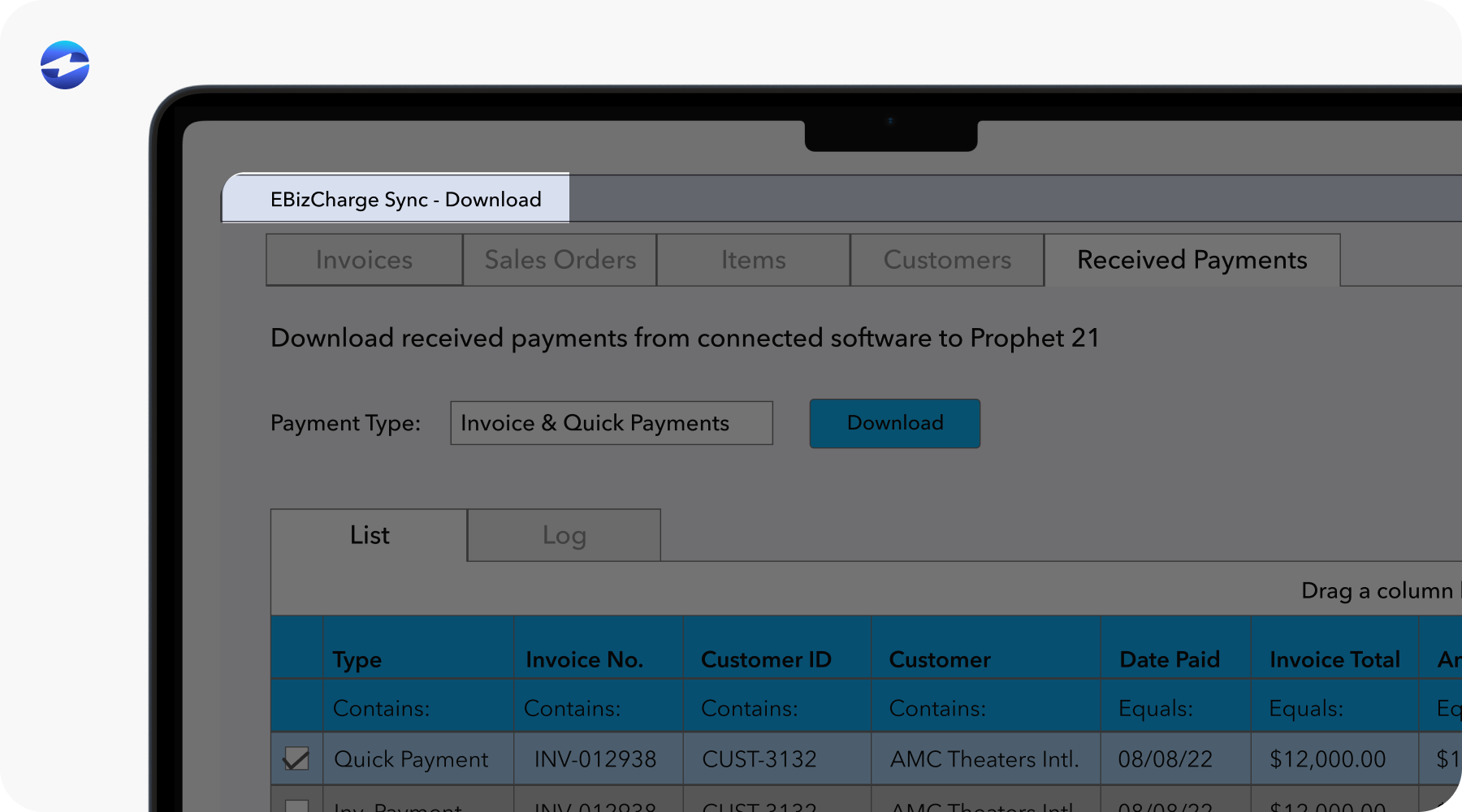

EBizCharge is designed for manufacturers who have outgrown EPX’s limitations.

It works directly within Epicor software, embedding payments into AR, invoices, and job workflows, which creates deeper Epicor integration and reduces the need for manual steps.

EBizCharge helps manufacturers gain better visibility into payment status and Epicor payment fees. Flexible payment options and automation support more complex billing without adding overhead.

As a true Epicor payment alternative, EBizCharge enables manufacturers to replace EPX with a solution that better aligns with how manufacturing actually works. For teams ready to modernize payment operations, it provides a clear path forward built around Epicor, not around workarounds.