Blog > What Is Level 2 and Level 3 Credit Card Processing? How Companies Can Save Up to 1% Per Transaction

What Is Level 2 and Level 3 Credit Card Processing? How Companies Can Save Up to 1% Per Transaction

If you’re processing commercial card payments (corporate cards, purchasing cards, government cards), there’s a good chance you’re paying more than you need to on every single transaction.

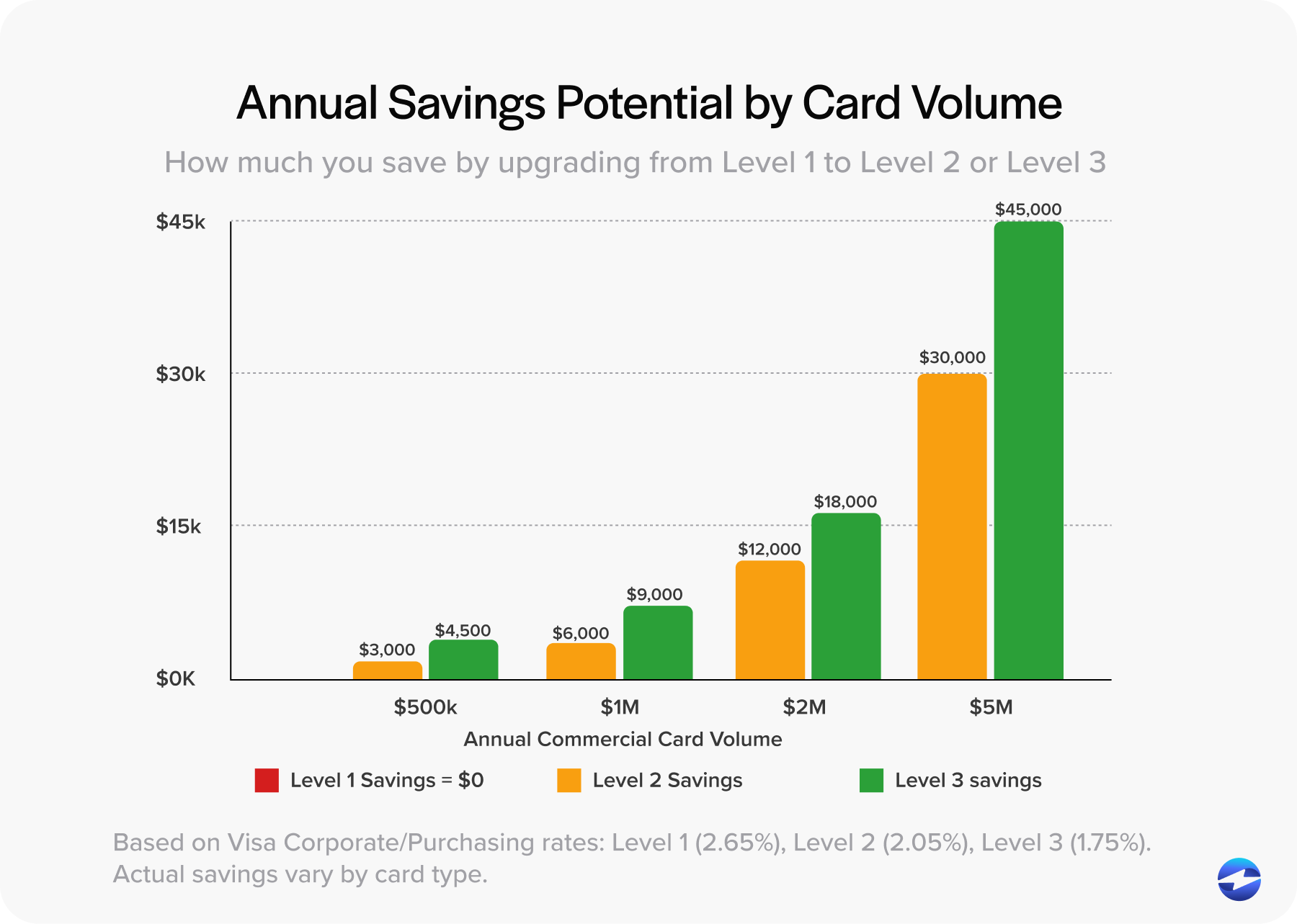

It’s not your fault. Most accounting systems and payment setups default to the most basic (and most expensive) processing tier without anyone realizing it. The difference? Somewhere between 0.6% and 0.9% per transaction. That might sound small until you do the math on your annual card volume.

What Are Credit Card Processing Levels?

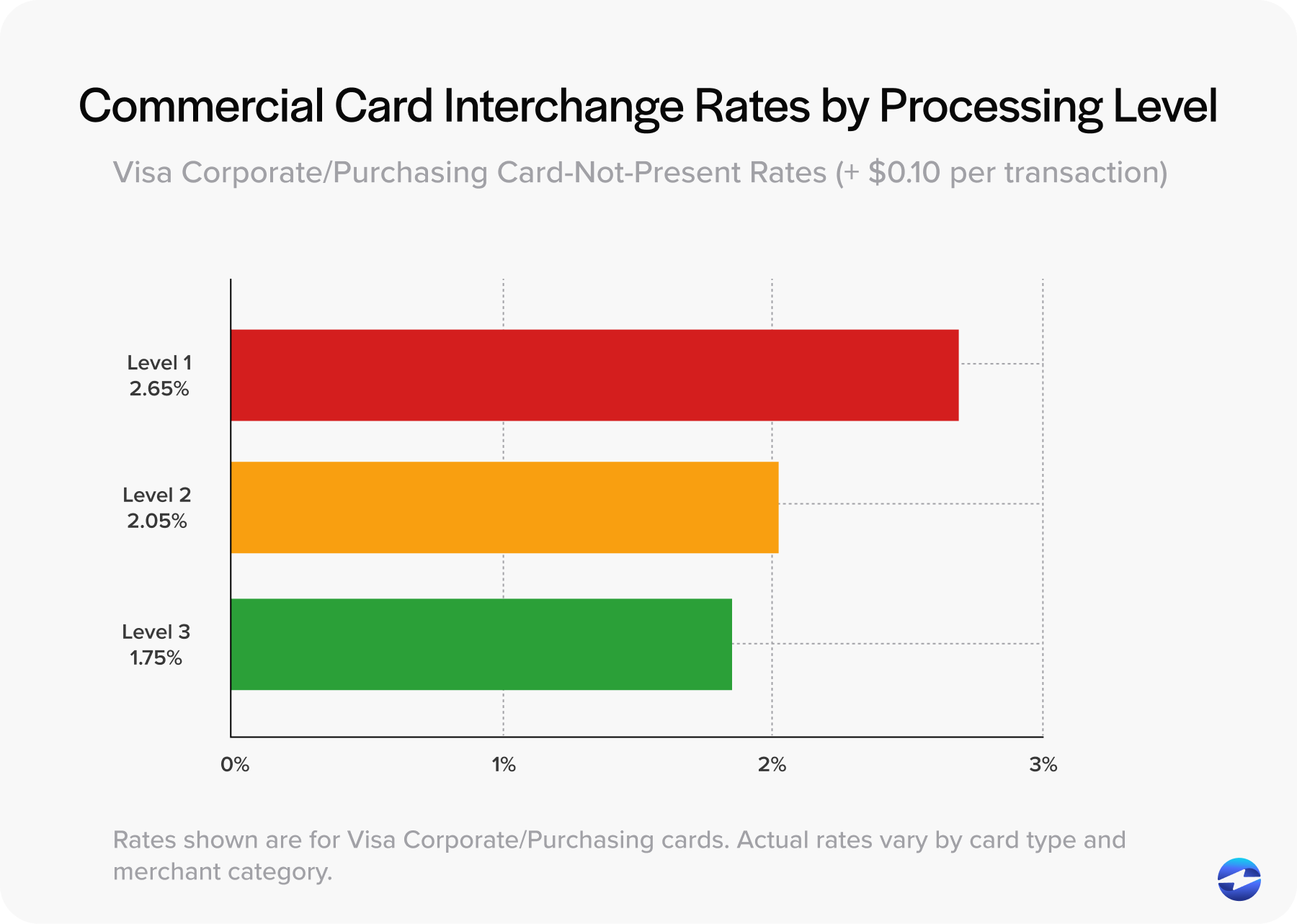

Processing levels refer to how much data gets passed along with a credit card transaction. The more detailed information you include, the lower the risk looks to the card networks, and the lower your interchange fees.

There are three levels:

- Level 1 is the bare minimum. Just the basics.

- Level 2 adds tax and customer information.

- Level 3 includes full line-item detail.

Here’s the thing most people don’t realize: these levels exist specifically for B2B and B2G (business-to-government) transactions. Consumer purchases almost always process at Level 1, which is fine for everyday retail. Corporate and purchasing cards are different. These cards can qualify for significantly lower interchange rates if your payment system captures the right data.

Visa, Mastercard, and American Express all have different names for these categories, but the concept is generally the same. More data equals lower fees.

Level 1 Credit Card Processing: The Default Setting (and the Most Expensive)

Level 1 processing is what happens when a transaction goes through with only the essential information: card number, expiration date, transaction amount, and basic merchant details.

This is standard for most retail and e-commerce purchases. It works fine for a $50 purchase at a coffee shop, but for a $15,000 invoice payment from a corporate purchasing card? You’re getting charged premium rates for no reason.

The problem is that many B2B companies end up processing at Level 1 by default. Their ERP or accounting software isn’t set up to pass enhanced data, so every commercial card transaction gets treated like a consumer swipe at a gas station.

Card networks see Level 1 transactions as higher risk because there’s less verification. Higher risk means higher interchange fees and interchange fees make up 70-90% of what you pay to accept credit cards. For B2B credit card processing, this adds up fast.

Level 2 Credit Card Processing: The Standard

Level 2 processing was designed with business transactions in mind. It includes everything from Level 1, plus additional fields that help verify the purchase.

Typical Level 2 credit card data requirements include:

- Sales tax amount and indicator

- Customer code (especially for purchasing and government cards)

- Merchant postal code

- Invoice or order number

When you provide this information, you’re essentially giving the card network more confidence that the transaction is legitimate. A real business made a real purchase, and here’s the documentation to prove it.

The result? Lower interchange rates. We’re talking roughly 0.6% savings compared to Level 1 on qualifying transactions. That’s a meaningful reduction in B2B payment processing fees for companies with any real card volume.

Note: American Express only supports up to Level 2. They don’t have a Level 3 program, so if you process a lot of Amex corporate cards, Level 2 is as good as it gets.

For most B2B companies, Level 2 should be the minimum standard. If your current setup isn’t capturing at least this much data, you’re definitely overpaying.

Level 3 Credit Card Processing: Maximum Savings for Distributors, Manufacturers, and Government Contractors

Level 3 is where the real savings kick in. This tier requires the most detailed transaction data, including full line-item information for every purchase.

On top of Level 2 data requirements, Level 3 credit card data adds:

- Product codes and descriptions

- Quantities and unit prices

- Ship-to and ship-from ZIP codes

- Freight and duty amounts

- Extended line-item totals

Think of it like attaching a detailed invoice to every transaction. The card networks can see exactly what was purchased, where it’s going, and how the totals break down.

Level 3 credit card processing is particularly valuable if you’re selling to large corporations or government agencies. These buyers often use purchasing cards specifically because they want that level of detail for their own accounting and compliance purposes. You’re already creating invoices with this information. Level 3 just passes it through with the payment.

The Level 3 processing savings potential is significant. Depending on the card type and network, you could see interchange rates drop by as much as 0.9% compared to Level 1.

Let’s put that in perspective. If your company processes $2 million in commercial card payments annually, the difference between Level 1 and Level 3 rates could be $18,000 per year. That’s real money going straight to your bottom line.

Why Most Companies Don’t Get These Rates

If Level 2 and Level 3 processing saves so much money, why isn’t everyone doing it? The short answer: their payment systems aren’t set up for it.

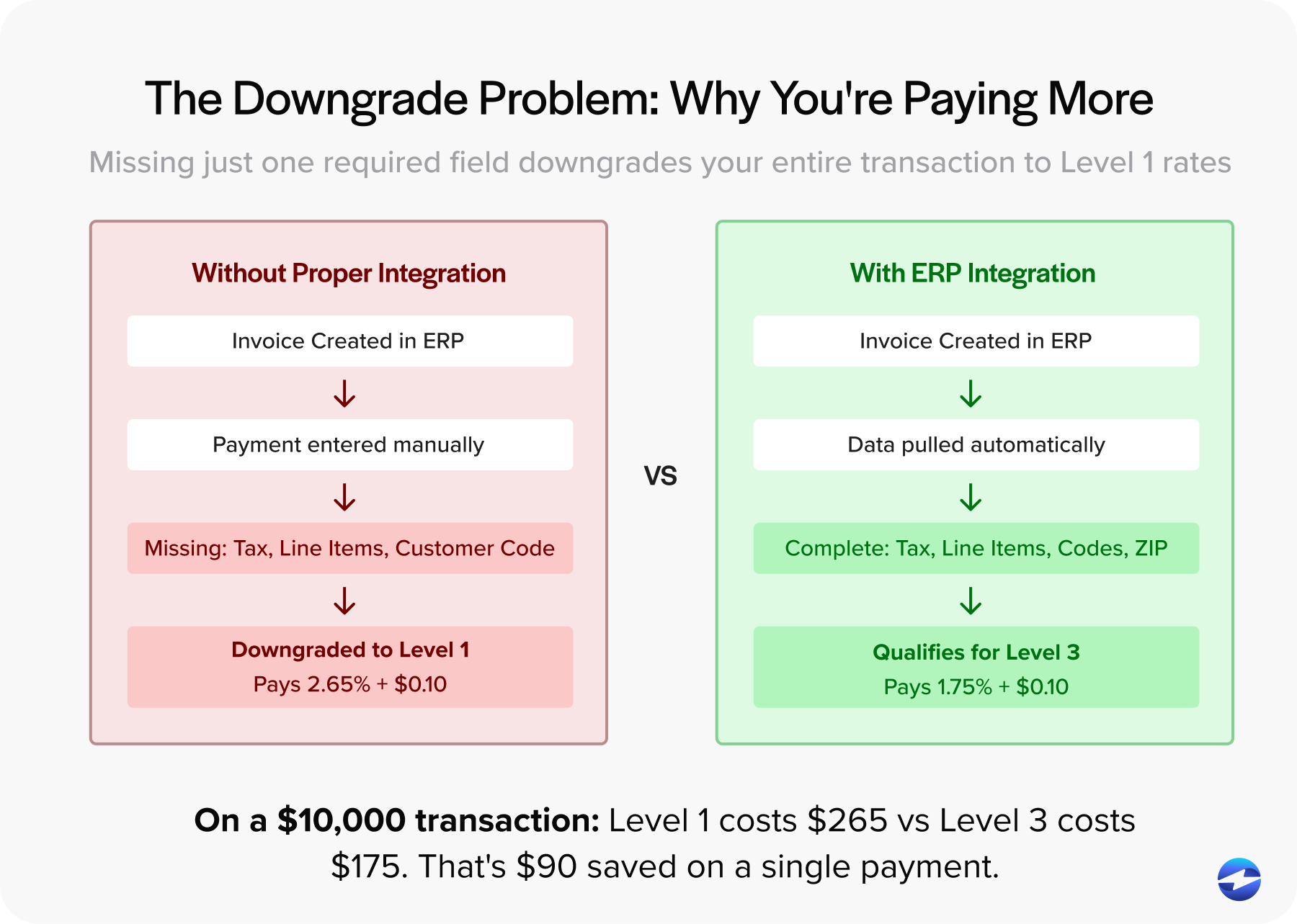

Here’s the catch with enhanced data processing. You have to actually capture and transmit all the required fields. Miss even one piece of required information, and the entire transaction gets “downgraded” to Level 1 rates. The card networks don’t give partial credit.

Most standalone payment terminals and basic online gateways don’t collect this data automatically. Someone would have to manually enter tax amounts, customer codes, line-item details, and shipping information for every single transaction. That’s not realistic for any business processing more than a handful of payments.

Even companies using accounting software or ERP systems often run into this problem. The payment module might not be pulling invoice data correctly, or it might not be configured to pass enhanced fields to the processor. Everything looks fine on the surface, but behind the scenes, every transaction is processing at the highest rate.

The frustrating part? Most businesses have no idea this is happening. Your processing statement doesn’t show a line item that says “you could have saved $500 this month if your data was complete.” It just shows the rates you paid.

How to Qualify for Level 2 and Level 3 Processing

Getting these lower rates comes down to two things: having the right payment setup and making sure your data flows correctly.

First, check if your processor even supports Level 2 and Level 3. Not all of them do, and some that claim to support it don’t actually optimize for it. Ask directly: “What percentage of my commercial card transactions are qualifying for Level 2 or Level 3 interchange rates?” If they can’t answer that question, you have a problem.

Second, your payment system needs to automatically capture enhanced data. This is where ERP and accounting integrations matter. When your payment solution connects directly to your invoicing and order management, it can pull tax amounts, line items, shipping details, and customer codes without anyone typing anything extra. This is the key to interchange optimization.

At EBizCharge, this is exactly what we built our platform to do. Our integrations with systems like Sage, NetSuite, QuickBooks, Microsoft Dynamics, and SAP automatically extract Level 2 and Level 3 data from your existing invoices and sales orders. The information is already in your system. We just make sure it gets passed through with the payment.

No manual data entry. No missing fields. No downgrades.

Is Your Business a Good Fit for Level 2 and Level 3 Processing?

Not every business needs to worry about this. If you’re primarily selling to consumers using personal credit cards, processing levels won’t make much difference. Consumer cards don’t qualify for enhanced data rates regardless of what information you provide.

But if a meaningful portion of your payments come from:

- Corporate credit cards

- Purchasing cards (P-cards)

- Government cards (GSA SmartPay, state purchasing programs)

- Fleet cards

Then you absolutely should be optimizing for Level 2 and Level 3. These are the card types where enhanced data makes a real difference in your commercial card interchange fees.

Industries where this tends to have the biggest impact include distribution, manufacturing, wholesale, professional services, and any business that contracts with government agencies. High transaction values and commercial card volume are the recipe for serious savings.

What to Do Next

If you’re a CFO, controller, or billing manager reading this, here’s the honest reality: you probably don’t know whether your current transactions are qualifying for optimal rates. Most businesses don’t, because the information isn’t easy to find on a standard processing statement.

Start by asking your processor or payment provider for a breakdown of your interchange qualification rates. Specifically, you want to know what percentage of your commercial card transactions are hitting Level 2 or Level 3 versus getting downgraded to Level 1.

If you’re not happy with the answer, or if you can’t get a clear answer at all, it might be time to look at a solution that’s actually built for B2B payments.

The Bottom Line

Level 2 and Level 3 processing exist specifically to reduce interchange fees for B2B transactions. The card networks want this data because it reduces their risk, and they’re willing to give you better rates in exchange for providing it.

The only reason more businesses don’t take advantage is that their payment systems aren’t capturing the right information. That’s a solvable problem.

If you’re processing commercial cards and you’re not sure whether you’re getting Level 2 or Level 3 rates, it’s worth finding out. The savings add up faster than you’d think.

FAQs

Is Level 2 and Level 3 processing only for B2B companies?

Yes. Level 2 and Level 3 interchange rates only apply to commercial card transactions, which means corporate cards, purchasing cards, government cards, and fleet cards. If a customer pays with a personal consumer credit card, it processes at Level 1 rates regardless of how much data you submit. These programs were designed specifically for business-to-business and business-to-government transactions.

Do all payment processors support Level 2 and Level 3?

No. Many processors technically accept the data but don’t optimize for it. Some don’t support it at all. Ask your processor directly what percentage of your commercial card transactions are qualifying for Level 2 or Level 3 rates. If they can’t give you a clear answer, that’s not a good sign.

What happens if I’m missing a required data field?

The transaction gets downgraded to Level 1 rates. Card networks don’t give partial credit. Even if you submit 90% of the required fields, missing one means you pay the highest interchange rate on that transaction.

Does American Express offer Level 3 processing?

No. American Express only supports Level 2. If you process a high volume of Amex corporate cards, Level 2 is the best rate you can qualify for with that network.

How do I know if I’m currently getting Level 2 or Level 3 rates?

It’s not easy to tell from a standard processing statement. You’ll need to ask your processor for an interchange qualification report that breaks down what percentage of transactions are hitting each level. Most businesses are surprised to learn they’re paying Level 1 rates on commercial cards.

What industries benefit most from Level 2 and Level 3 processing?

Any business that accepts a significant volume of commercial cards. This includes distributors, manufacturers, wholesalers, government contractors, professional services firms, and B2B SaaS companies. The higher your average transaction value and commercial card volume, the bigger the savings.

Can I qualify for Level 3 rates on all transactions?

Only transactions made with commercial, purchasing, corporate, or government cards can qualify. Consumer credit cards are not eligible. And you need a payment system that automatically captures and transmits all required data fields. If any field is missing, the transaction downgrades to Level 1.

Get a free cost-comparison of your current payment processing costs vs. EBizCharge

Get a free cost-comparison of your current payment processing costs vs. EBizCharge